Yes, you can lease a car for 6 months—but it’s not as common as standard 24- or 36-month leases. Short-term leases offer flexibility and lower long-term commitment, ideal for temporary needs like job relocations or travel. However, they often come with higher monthly payments and stricter terms, so it’s important to weigh your options carefully.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Can You Lease a Car for 6 Months?

- 4 What Is a Car Lease, and How Does a 6-Month Lease Work?

- 5 Pros and Cons of a 6-Month Car Lease

- 6 Who Should Consider a 6-Month Car Lease?

- 7 How to Find and Secure a 6-Month Car Lease

- 8 Alternatives to a 6-Month Car Lease

- 9 Tips for Getting the Best 6-Month Lease Deal

- 10 Final Thoughts: Is a 6-Month Car Lease Right for You?

- 11 Frequently Asked Questions

Key Takeaways

- Short-term leases (like 6 months) are possible but less common: Most traditional leases last 24 to 36 months, but some dealers and specialty programs offer 6-month options.

- Higher monthly payments are typical: Because the lease term is shorter, you’re paying off depreciation faster, which increases your monthly cost.

- Mileage limits still apply: Even on a 6-month lease, you’ll face mileage restrictions—usually prorated from annual limits—so plan your driving accordingly.

- Early termination fees may apply: Ending a lease early can trigger penalties, so read the fine print before signing.

- Insurance and maintenance are still your responsibility: Just like any lease, you’ll need full coverage insurance and must keep the car in good condition.

- Look into specialty leasing companies or dealer promotions: Some brands run short-term lease deals, especially for new models or during slow sales periods.

- Consider alternatives like car subscriptions or rentals: If a 6-month lease isn’t available, services like Zipcar, Fair, or Flexdrive may offer similar flexibility.

📑 Table of Contents

- Can You Lease a Car for 6 Months?

- What Is a Car Lease, and How Does a 6-Month Lease Work?

- Pros and Cons of a 6-Month Car Lease

- Who Should Consider a 6-Month Car Lease?

- How to Find and Secure a 6-Month Car Lease

- Alternatives to a 6-Month Car Lease

- Tips for Getting the Best 6-Month Lease Deal

- Final Thoughts: Is a 6-Month Car Lease Right for You?

Can You Lease a Car for 6 Months?

Let’s get straight to the point: yes, you *can* lease a car for 6 months—but it’s not the norm. Most people think of leasing as a long-term commitment, typically 24, 30, or 36 months. And while that’s true for the majority of leases, the automotive world has evolved. With more people working remotely, moving frequently, or needing temporary transportation, the demand for shorter lease terms has grown.

So, if you’re wondering whether a 6-month car lease is a realistic option, the answer is a cautious “maybe.” It depends on where you live, what kind of vehicle you want, and which leasing companies or dealerships you’re willing to work with. In this guide, we’ll walk you through everything you need to know about short-term car leasing—what it is, how it works, the pros and cons, and whether it’s the right move for your situation.

Whether you’re relocating for a summer job, waiting for your new car to arrive, or just want to test out a model before committing long-term, a 6-month lease could be a smart, flexible solution. But like any financial decision, it comes with trade-offs. Let’s dive in and explore your options.

What Is a Car Lease, and How Does a 6-Month Lease Work?

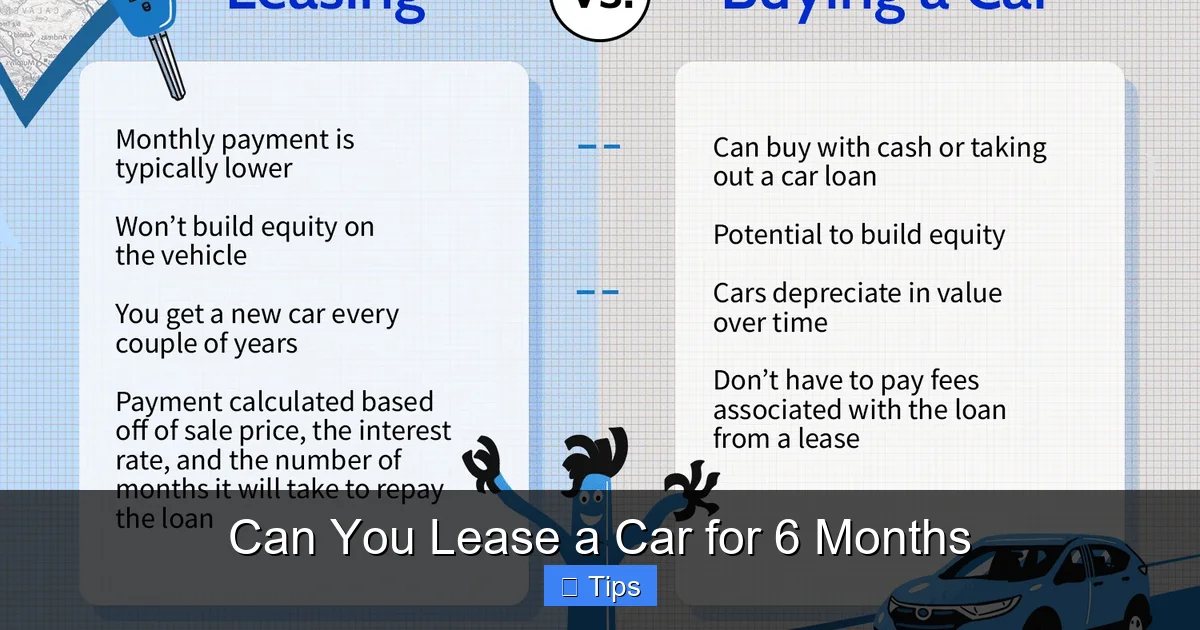

Visual guide about Can You Lease a Car for 6 Months

Image source: investopedia.com

At its core, a car lease is essentially a long-term rental. Instead of buying the vehicle, you’re paying to use it for a set period—usually 2 to 3 years. During that time, you make monthly payments that cover the car’s depreciation (the drop in value), plus interest and fees. At the end of the lease, you return the car (assuming you’ve met all the terms), and walk away—unless you choose to buy it.

Now, a 6-month lease follows the same basic principles, but compressed into a much shorter timeframe. Instead of spreading depreciation over 24 or 36 months, you’re covering a larger chunk of it in just half a year. That means your monthly payments will likely be higher than they would be on a longer lease.

For example, let’s say a new sedan depreciates $12,000 over 36 months. On a standard lease, that’s about $333 per month just for depreciation (not including interest or fees). But on a 6-month lease, you’d be covering roughly $2,000 per month in depreciation alone—assuming linear depreciation, which isn’t always accurate, but gives you an idea of the cost jump.

How 6-Month Leases Are Structured

Most 6-month leases are structured similarly to traditional leases, with a few key differences:

– **Lease Term:** Exactly 6 months (180 days), sometimes with an option to extend.

– **Monthly Payments:** Higher than longer leases due to accelerated depreciation.

– **Mileage Limits:** Usually prorated. If a 36-month lease allows 12,000 miles per year (36,000 total), a 6-month lease might cap you at 6,000 miles.

– **Down Payment:** Some 6-month leases require a larger upfront payment to offset the higher risk for the lessor.

– **Early Termination:** Ending the lease early may result in penalties, so flexibility is limited.

It’s also worth noting that 6-month leases are often offered as “lease assumptions” or “lease takeovers.” This means you’re stepping into an existing lease that someone else started. These can be great deals because the original lessee may have already paid a large down payment, and you’re just covering the remaining months. Websites like Swapalease.com and LeaseTrader.com specialize in these types of arrangements.

Who Offers 6-Month Car Leases?

Traditional dealerships and major leasing companies (like Ally, Mercedes Financial, or Toyota Financial) rarely advertise 6-month leases. They prefer longer terms because they’re more profitable and predictable. However, some dealerships may offer short-term leases under special circumstances:

– **New Model Launches:** Dealers sometimes offer 6-month leases to generate buzz around a new vehicle.

– **Inventory Clearance:** If a dealership is overstocked, they might offer short leases to move cars quickly.

– **Corporate or Fleet Programs:** Some companies lease vehicles for employees on short-term assignments.

– **Specialty Leasing Companies:** A growing number of startups and online platforms now offer flexible, short-term leases.

Additionally, luxury brands like BMW, Audi, and Porsche have experimented with short-term leasing programs in urban areas, especially in cities with high demand for premium vehicles.

Pros and Cons of a 6-Month Car Lease

Visual guide about Can You Lease a Car for 6 Months

Image source: images.cars.com

Like any financial decision, a 6-month car lease has its upsides and downsides. Let’s break them down so you can decide if it’s the right fit for your lifestyle and budget.

Advantages of a 6-Month Lease

1. Flexibility

This is the biggest benefit. If you know you’ll only need a car for six months—say, for a summer internship, a temporary job, or while your own car is in the shop—a short lease lets you avoid a long-term commitment. You’re not tied down for years, and you can walk away (or upgrade) at the end of the term.

2. Lower Total Cost Than Buying

If you only need a car for half a year, leasing is almost always cheaper than buying. You avoid the large down payment, sales tax on the full value, and long-term maintenance costs. Plus, you’re not responsible for the car’s resale value.

3. Drive a Newer, Safer Vehicle

Leasing gives you access to the latest models with modern safety features, infotainment systems, and fuel-efficient engines. For six months, you can enjoy a premium ride without the long-term cost.

4. Minimal Maintenance Worries

Most leased cars are under warranty, so repairs are typically covered. You also avoid the hassle of selling the car later—just return it and move on.

5. Potential for Lower Upfront Costs

Some 6-month leases, especially lease takeovers, require little or no down payment. If the original lessee already paid a security deposit or cap cost reduction, you might only need to cover the first month’s payment.

Disadvantages of a 6-Month Lease

1. Higher Monthly Payments

As mentioned earlier, you’re paying off depreciation faster, so your monthly cost will be significantly higher than a longer lease. For example, a $300/month 36-month lease might jump to $600–$800/month for 6 months.

2. Limited Availability

Finding a 6-month lease can be challenging. Most dealerships don’t offer them, and you may need to search online or work with a broker.

3. Mileage Restrictions Still Apply

Even on a short lease, you’ll face mileage caps. If you drive a lot, you could exceed the limit and face hefty per-mile charges (often $0.15–$0.25 per mile over).

4. Early Termination Fees

If your plans change and you need to return the car early, you may be hit with penalties. Unlike month-to-month rentals, leases are contracts—breaking them can cost you.

5. No Equity Build-Up

With leasing, you’re not building ownership. At the end of six months, you return the car and get nothing back (unless you buy it). If you’re someone who prefers to own assets, this might feel like “throwing money away.”

6. Insurance Costs

Leased vehicles require full coverage insurance (comprehensive and collision), which can be expensive—especially for newer or luxury models. This adds to your monthly expenses.

Who Should Consider a 6-Month Car Lease?

Visual guide about Can You Lease a Car for 6 Months

Image source: rentalregime.com

A 6-month lease isn’t for everyone, but it can be a smart choice for certain situations. Here are some scenarios where it makes sense:

Short-Term Job Assignments or Relocations

If you’re moving to a new city for a 6-month project or internship, a short lease lets you have reliable transportation without the hassle of buying and selling a car. You can focus on your work, not your wheels.

Waiting for a New Car Delivery

Sometimes, there are long wait times for new vehicles—especially EVs or high-demand models. If your current car is about to die and your new one won’t arrive for months, a 6-month lease can bridge the gap.

Testing a New Vehicle Before Committing

Thinking about leasing or buying a luxury SUV or electric car? A 6-month lease lets you “try before you buy.” You can test the driving experience, tech features, and real-world costs without a long-term commitment.

Seasonal Needs

If you live in a snowy area and only need a 4WD for winter, or you’re a snowbird heading south for the season, a short lease can provide the right vehicle for the right time.

College Students or Recent Graduates

Students doing summer internships or recent grads starting their first job might benefit from a short-term lease. It’s a way to drive a reliable car without the burden of ownership.

People with Changing Financial Situations

If you’re between jobs, recovering from a financial setback, or waiting for a bonus, a 6-month lease can give you time to stabilize before making a bigger commitment.

How to Find and Secure a 6-Month Car Lease

Now that you know the pros and cons, let’s talk about how to actually find one. It takes a bit of legwork, but it’s doable.

1. Search Online Lease Marketplaces

Websites like Swapalease.com, LeaseTrader.com, and LeaseFetcher.com specialize in lease takeovers. You can filter by location, vehicle type, and lease term. Many listings include 6-month or shorter remaining terms. These platforms often show the monthly payment, mileage used, and transfer fees.

Tip: Look for leases with low mileage and a clean history. Avoid cars with excessive wear or past accidents.

2. Contact Local Dealerships

Call or visit dealerships in your area and ask if they offer short-term leases. Some may be willing to create a custom 6-month agreement, especially if they have excess inventory. Be prepared to negotiate.

Tip: Mention that you’re flexible on the vehicle model. You might get a better deal on a less popular car.

3. Check with Luxury or Premium Brands

Brands like BMW, Mercedes-Benz, and Audi sometimes run short-term lease promotions in major cities. These are often marketed as “flex leases” or “urban mobility programs.”

Example: BMW’s “BMW Financial Services Flex” program offers leases as short as 6 months in select markets.

4. Consider Car Subscription Services

If a traditional lease isn’t available, look into car subscription services like:

– **Fair:** Offers month-to-month subscriptions with insurance and maintenance included.

– **Flexdrive:** Similar to Fair, with flexible terms and no long-term commitment.

– **Zipcar for Long-Term:** While Zipcar is usually hourly, they offer weekly and monthly plans in some cities.

These aren’t technically leases, but they provide similar flexibility—often with lower upfront costs and no mileage penalties.

5. Work with a Lease Broker

Lease brokers specialize in finding hard-to-get lease deals. They have relationships with dealerships and can often secure a 6-month lease for a fee (usually $200–$500). This is a good option if you’re short on time or want a specific vehicle.

6. Read the Fine Print

Before signing anything, make sure you understand:

– The total cost (monthly payment × 6 + fees)

– Mileage allowance and overage charges

– Early termination penalties

– Required insurance coverage

– Maintenance and wear-and-tear guidelines

– Option to buy or extend at the end

Tip: Take photos of the car before you drive it off the lot. This protects you from being charged for pre-existing damage.

Alternatives to a 6-Month Car Lease

If you can’t find a 6-month lease, don’t worry—there are other ways to get a car for half a year.

Long-Term Car Rental

Companies like Hertz, Avis, and Enterprise offer long-term rentals (30+ days) at discounted rates. While not as cheap as leasing, they’re more flexible and often include maintenance and roadside assistance.

Example: A 6-month rental might cost $1,200–$1,800 per month, depending on the vehicle.

Peer-to-Peer Car Sharing

Platforms like Turo and Getaround let you rent cars directly from owners. You can often find great deals, especially for economy or used vehicles. Just make sure the owner allows long-term rentals.

Buying and Selling

In some cases, buying a used car and selling it after 6 months might be cheaper than leasing—especially if you choose a reliable, low-depreciation model like a Toyota Corolla or Honda Civic. Just factor in sales tax, registration, and potential repair costs.

Public Transit, Biking, or Ride-Sharing

If you live in a city with good public transportation, consider going car-free for six months. Use buses, trains, bikes, or apps like Uber and Lyft. You could save thousands.

Tips for Getting the Best 6-Month Lease Deal

If you decide to move forward with a 6-month lease, here are some tips to get the best value:

– **Shop in the Off-Season:** Dealers are more likely to offer deals in winter or late summer.

– **Negotiate the Capitalized Cost:** Even on a short lease, you can negotiate the car’s price (cap cost). Lower cap cost = lower monthly payments.

– **Avoid Extras:** Skip add-ons like extended warranties, paint protection, or VIN etching. They’re rarely worth it.

– **Check Your Credit:** A higher credit score can get you better lease terms. Aim for 700+.

– **Compare Multiple Offers:** Get quotes from at least 3 sources before deciding.

– **Ask About Transfer Fees:** If you’re taking over a lease, find out who pays the transfer fee—you or the original lessee.

Final Thoughts: Is a 6-Month Car Lease Right for You?

So, can you lease a car for 6 months? Absolutely—but it’s not always easy, and it’s not always the cheapest option. A 6-month lease offers unmatched flexibility and lets you drive a newer car without a long-term commitment. It’s ideal for temporary needs, testing a vehicle, or bridging a gap between cars.

However, the higher monthly payments, limited availability, and mileage restrictions mean it’s not for everyone. If you drive a lot, prefer ownership, or can’t find a good deal, alternatives like long-term rentals, car subscriptions, or even buying might serve you better.

The key is to do your research, compare your options, and understand the full cost—not just the monthly payment. Talk to dealers, check online marketplaces, and read the contract carefully.

In the end, a 6-month car lease can be a smart, practical solution—if it fits your lifestyle and budget. With the right approach, you can enjoy the benefits of a new car for half a year, stress-free.

Frequently Asked Questions

Can you lease a car for 6 months?

Yes, it’s possible to lease a car for 6 months, though it’s less common than traditional 24- or 36-month leases. Some dealerships, specialty leasing companies, and lease takeover platforms offer short-term options.

Are 6-month car leases more expensive?

Generally, yes. Because you’re paying off depreciation faster, monthly payments are higher than on longer leases. You may also face higher upfront costs or fees.

What happens if I need to return the car early?

Early termination usually triggers penalties, which can be costly. Always check the lease agreement for early exit clauses before signing.

Do I still have to pay for maintenance and insurance?

Yes. Just like any lease, you’re responsible for full coverage insurance, regular maintenance, and keeping the car in good condition.

Can I extend a 6-month lease?

Some leases allow extensions, but it depends on the terms. You may need to renegotiate or switch to a new lease agreement.

Are there mileage limits on a 6-month lease?

Yes, mileage limits still apply and are usually prorated from the annual allowance. Exceeding the limit results in per-mile charges.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.