You absolutely can sell a car with a lien, but it requires careful planning and coordination with your lender. The key is ensuring the loan is paid off before or during the sale, so the title can be transferred cleanly. With the right steps, you can avoid legal issues, protect your credit, and get a fair price for your vehicle.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Can You Sell a Car with a Lien? The Short Answer

- 4 Understanding What a Lien Means for Your Car

- 5 Step-by-Step Guide to Selling a Car with a Lien

- 6 Common Challenges and How to Avoid Them

- 7 Legal and Financial Considerations

- 8 Tips for a Smooth and Successful Sale

- 9 Conclusion

- 10 Frequently Asked Questions

- 10.1 Can I sell my car if I still owe money on it?

- 10.2 What happens if I sell a car with a lien and don’t pay it off?

- 10.3 How long does it take to get a lien release after paying off the loan?

- 10.4 Can a buyer finance a car that has a lien?

- 10.5 What if my car is worth less than what I owe?

- 10.6 Do I need a lawyer to sell a car with a lien?

Key Takeaways

- Yes, you can sell a car with a lien: It’s legal and common, but the lien must be resolved before or at the time of sale.

- Contact your lender first: They’ll provide the payoff amount and guide you through the process of releasing the lien.

- Use the sale proceeds to pay off the loan: Most sales involve the buyer paying the lender directly or you using the money to settle the debt.

- Get a lien release document: This proves the loan is paid and the car is free to transfer—don’t skip this step.

- Choose the right selling method: Private sales, trade-ins, or selling to a dealer each have pros and cons when a lien is involved.

- Protect yourself legally: Always use a bill of sale and ensure the title transfer happens correctly to avoid future liability.

- Act quickly after payoff: Lenders may take days or weeks to process the lien release—plan accordingly to avoid delays.

📑 Table of Contents

Can You Sell a Car with a Lien? The Short Answer

If you’re wondering, “Can you sell a car with a lien?” the quick answer is yes—but it’s not as simple as handing over the keys and walking away. A lien means someone else (usually a bank or credit union) has a legal claim on your vehicle until the loan is paid off. That doesn’t stop you from selling, but it does mean you need to handle the lien properly to avoid headaches, legal trouble, or even losing money.

Think of a lien like a mortgage on a house. You can sell a house with a mortgage, but the buyer’s payment typically goes toward paying off that debt first. The same logic applies to cars. The sale can happen, but the loan must be settled before the title—the legal proof of ownership—can be transferred to the new owner.

Many people assume that having a lien means they’re stuck with the car until the loan is paid in full. That’s a common misconception. In reality, selling a car with a lien is not only possible, it’s done every day. Whether you’re upgrading to a newer model, downsizing, or just need cash, understanding how to navigate the lien process is key to a smooth and successful sale.

Understanding What a Lien Means for Your Car

Visual guide about Can You Sell a Car with a Lien

Image source: lihpao.com

Before diving into the selling process, it’s important to understand exactly what a lien is and how it affects your vehicle. A lien is a legal right or interest that a lender has in your property—in this case, your car—until you’ve repaid the loan used to purchase it. This means the lender technically holds a claim on the car, even though you’re the one driving it.

There are two main types of liens on vehicles: voluntary and involuntary. A voluntary lien is one you agree to when you take out an auto loan. The lender files the lien with your state’s Department of Motor Vehicles (DMV), and it stays on record until the loan is paid in full. An involuntary lien, on the other hand, is usually placed due to unpaid taxes, repairs, or legal judgments—but these are far less common in car sales.

When a lien is active, the lender is listed as the “lienholder” on your car’s title. This doesn’t mean they own the car, but they do have the right to repossess it if you default on payments. Because of this, you can’t transfer full ownership to a buyer until the lien is removed.

The good news? Removing a lien is straightforward—once the loan is paid off. The lender will issue a lien release document, which you (or the buyer) can submit to the DMV to clear the title. Until that happens, the car technically can’t be sold in the traditional sense, because the buyer wouldn’t receive a clean title.

Why the Lien Must Be Resolved Before Sale

You might be thinking, “Can’t I just sell the car and let the buyer deal with the lien?” Technically, yes—but it’s risky and often impractical. Most buyers want a car with a clear title, meaning no outstanding debts or claims. If you sell a car with an active lien and don’t resolve it, the buyer could face serious problems.

For example, if the buyer registers the car in their name but the lien remains, the lender could still repossess the vehicle—even if the new owner has no idea about the debt. That’s not only unfair, it could lead to legal disputes. Plus, many states won’t allow a title transfer if a lien is still on record.

Another issue is financing. Most buyers need a loan to purchase a used car. Lenders won’t approve a loan for a vehicle with an existing lien because it complicates the ownership chain. So even if a buyer is interested, they may not be able to complete the purchase without the lien being cleared first.

How Liens Appear on Your Title and Registration

If you’re unsure whether your car has a lien, check your title certificate. It will list the lienholder’s name and address if one exists. You can also check your registration or contact your state’s DMV. Some states even allow you to look up lien information online using your vehicle identification number (VIN).

Keep in mind that just because you’re making payments doesn’t always mean the lien is active. If you’ve paid off the loan but haven’t received a lien release, the title may still show the lender as the lienholder. This is a common oversight that can delay a sale. Always confirm the lien status before listing your car.

Step-by-Step Guide to Selling a Car with a Lien

Visual guide about Can You Sell a Car with a Lien

Image source: lh4.googleusercontent.com

Selling a car with a lien doesn’t have to be complicated—if you follow the right steps. The process involves coordinating with your lender, preparing the necessary documents, and ensuring the loan is paid off during or before the sale. Here’s a clear, step-by-step guide to help you navigate the process smoothly.

Step 1: Contact Your Lender

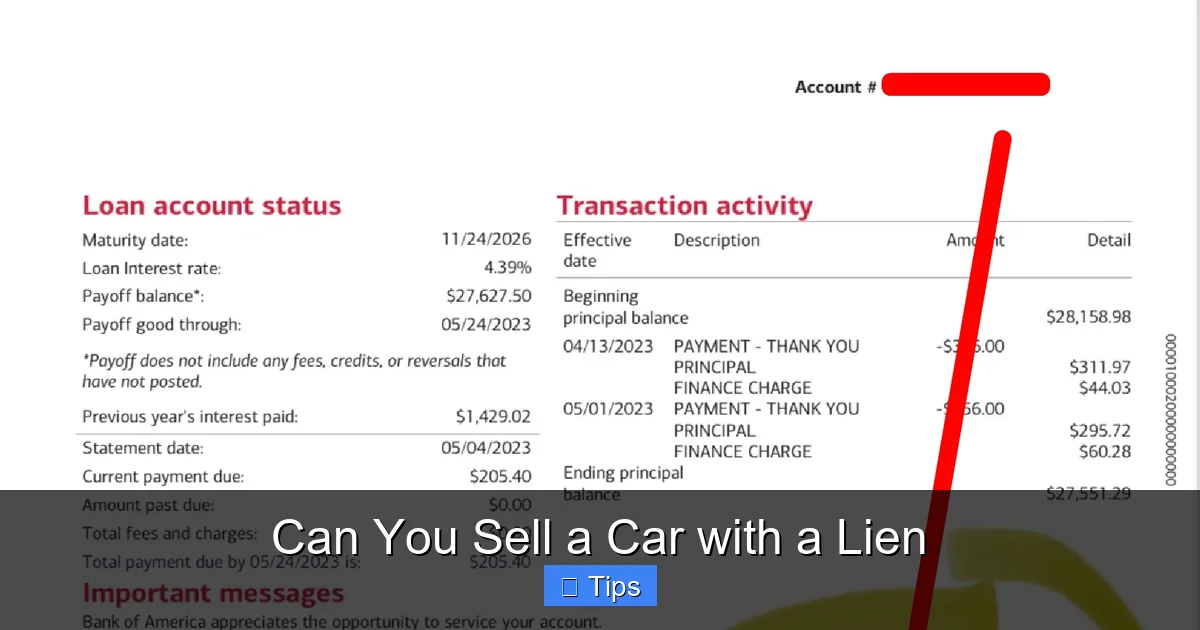

The first and most important step is to call your lender. Let them know you’re planning to sell the car and ask for the current payoff amount. This is the total amount needed to pay off the loan in full, including any interest or fees that have accrued since your last payment.

The payoff amount is usually higher than your remaining balance because it includes interest up to the payoff date. Lenders typically provide this amount valid for 10 to 30 days, so plan your sale within that window. Some lenders even offer online portals where you can request a payoff quote instantly.

While you’re on the phone, ask about their process for releasing the lien. Some lenders will send the lien release directly to you, while others may send it to the DMV or the buyer. Knowing this ahead of time helps avoid confusion later.

Step 2: Determine Your Car’s Market Value

Before listing your car, research its fair market value. Use tools like Kelley Blue Book (KBB), Edmunds, or NADA Guides to get an estimate based on your car’s make, model, year, mileage, and condition. Be honest about any wear and tear—overpricing can scare off buyers.

Keep in mind that if your car is worth less than the payoff amount (known as being “upside-down” or “underwater”), you’ll need to cover the difference out of pocket. For example, if your loan balance is $15,000 but the car is only worth $12,000, you’ll need to pay $3,000 at the time of sale.

On the flip side, if your car is worth more than the loan, you’ll walk away with cash after the lien is paid. This is called having “equity” in the vehicle. Knowing your equity (or deficit) helps you set a realistic asking price and negotiate confidently.

Step 3: Choose How to Sell the Car

There are three main ways to sell a car with a lien: private sale, trade-in at a dealership, or selling directly to a car-buying service. Each option has its pros and cons, especially when a lien is involved.

A private sale usually gets you the highest price, but it requires more effort. You’ll need to advertise the car, meet with potential buyers, and handle the paperwork. However, because the lien must be resolved, you’ll need to coordinate with the buyer and your lender to ensure the payoff happens smoothly.

Trading in your car at a dealership is often the easiest option. The dealer will pay off the lien directly and apply any equity toward your new vehicle purchase. If you’re upside-down, they may roll the negative equity into your new loan—though this increases your debt. Dealers handle all the paperwork, including the lien release and title transfer, which saves you time and stress.

Selling to a car-buying service like CarMax, Carvana, or Vroom is another convenient choice. These companies will inspect your car, make an offer, and pay off the lien if you accept. They handle the title transfer and lien release, making the process quick and hassle-free. However, their offers are often lower than what you’d get in a private sale.

Step 4: Coordinate the Payoff with the Buyer or Dealer

Once you’ve found a buyer or dealer, it’s time to settle the lien. There are two common ways this happens:

1. **Buyer pays the lender directly:** In a private sale, the buyer can write a check to your lender for the payoff amount. This is often done at a bank branch with both parties present. Once the lender receives the payment, they’ll release the lien and send the title to the buyer (or to you, depending on the state).

2. **Seller uses sale proceeds to pay off the loan:** You can also use the money from the sale to pay off the loan yourself. For example, if the buyer pays you $14,000 and your payoff is $13,500, you’d send $13,500 to the lender and keep the $500 difference. Then, you’d forward the lien release and title to the buyer.

In both cases, it’s crucial to get a receipt or confirmation from the lender that the loan is paid in full. Without this, you can’t prove the lien is released.

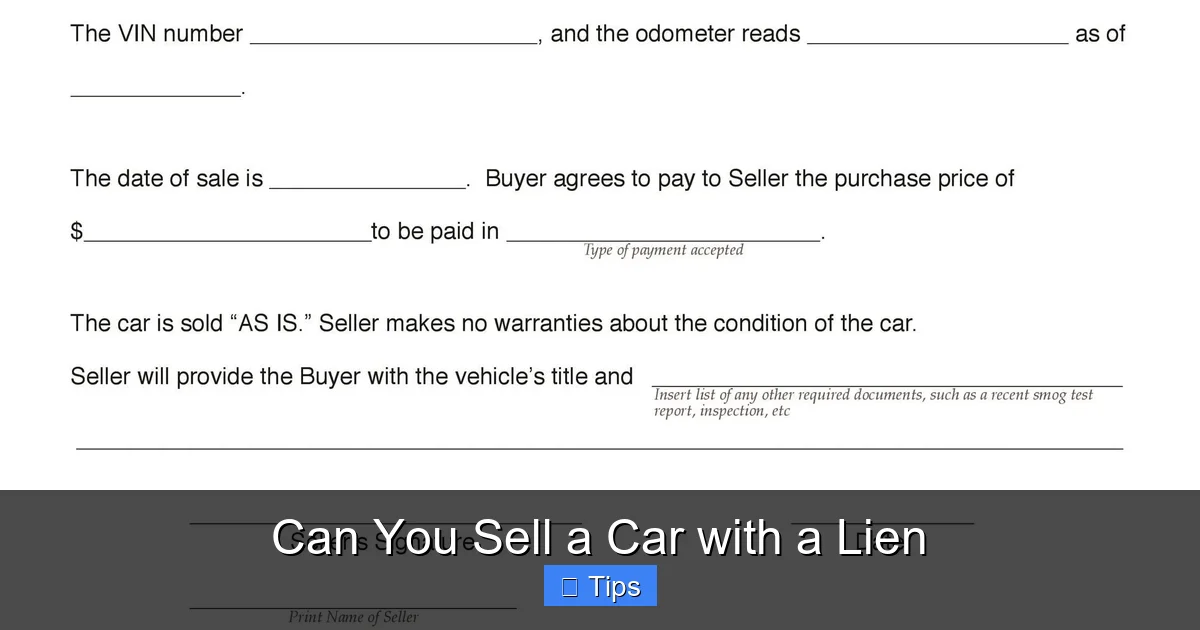

Step 5: Complete the Title Transfer and Bill of Sale

After the lien is paid, the title can be transferred to the new owner. The exact process varies by state, but generally, you’ll need to sign the title over to the buyer and provide a bill of sale.

A bill of sale is a legal document that records the transaction, including the sale price, date, and both parties’ information. Some states require it for registration, and it protects both buyer and seller in case of disputes.

Make sure the lien release document is included with the title. The buyer will need to submit both to the DMV to register the car in their name. If the lender sends the lien release directly to the DMV, the buyer may receive a new title automatically.

Common Challenges and How to Avoid Them

Visual guide about Can You Sell a Car with a Lien

Image source: images.squarespace-cdn.com

Selling a car with a lien can come with hurdles, but most are avoidable with preparation. Here are some common challenges and practical tips to overcome them.

Challenge 1: The Lien Release Is Delayed

After paying off the loan, some lenders take days or even weeks to process the lien release. This can delay the title transfer and frustrate buyers. To avoid this, ask your lender how long it typically takes and request expedited processing if possible.

Some lenders offer electronic lien releases, which are faster than paper documents. If available, opt for this method. You can also follow up with the lender and the DMV to ensure the release is processed promptly.

Challenge 2: Negative Equity (Being “Upside-Down”)

If you owe more than the car is worth, you’ll need to cover the difference. This can be tough, especially if you’re on a tight budget. One option is to save up the extra amount before selling. Alternatively, you can roll the negative equity into a new car loan—but this increases your debt and monthly payments.

Another strategy is to sell the car privately and use the proceeds plus your own funds to pay off the loan. While it requires more effort, a private sale often yields a higher price than a trade-in.

Challenge 3: Buyer Backing Out After Payoff

In rare cases, a buyer may back out after you’ve paid off the lien, leaving you without a sale and a paid-off car. To prevent this, consider using an escrow service or meeting at a bank where the transaction can be completed on the spot.

You can also ask for a deposit or partial payment upfront to show the buyer’s commitment. Just be sure to document everything in writing.

Legal and Financial Considerations

Selling a car with a lien involves legal and financial responsibilities. Failing to handle them correctly can lead to liability, fines, or even lawsuits.

Liability After the Sale

Even after you sell the car, you could still be liable for accidents or tickets if the title isn’t transferred properly. That’s why it’s essential to complete the sale correctly and notify the DMV. Some states allow you to file a “notice of sale” form, which releases you from liability once the buyer registers the vehicle.

Tax Implications

In most cases, selling a personal vehicle doesn’t trigger taxes. However, if you sell the car for more than you paid and it’s considered a business asset, you may owe capital gains tax. Consult a tax professional if you’re unsure.

Impact on Your Credit

Paying off your auto loan can actually improve your credit score, as it reduces your debt-to-income ratio and shows responsible credit management. Just make sure the lender reports the payoff to the credit bureaus.

Tips for a Smooth and Successful Sale

To make the process as smooth as possible, follow these practical tips:

- Get everything in writing: Use a bill of sale and keep copies of all documents, including the lien release and payoff confirmation.

- Meet in a safe, public place: If selling privately, meet at a bank or police station for security.

- Be transparent with buyers: Let them know about the lien upfront. Honesty builds trust and prevents last-minute surprises.

- Check your state’s DMV requirements: Each state has different rules for title transfers and lien releases. Visit your DMV website for specifics.

- Consider a pre-sale inspection: A clean bill of health from a mechanic can increase buyer confidence and justify your asking price.

Conclusion

So, can you sell a car with a lien? Absolutely. While it requires extra steps compared to selling a car with a clear title, it’s entirely doable—and often necessary—when you’re ready to move on from your current vehicle. The key is planning ahead, communicating with your lender, and ensuring the lien is resolved before or during the sale.

Whether you choose a private sale, trade-in, or selling to a dealer, the process can be smooth and stress-free with the right preparation. By understanding your responsibilities, protecting yourself legally, and guiding the buyer through the lien release, you can sell your car confidently and walk away with peace of mind.

Remember, a lien doesn’t have to be a roadblock. With the right knowledge and a little patience, you can turn your financed car into cash—or trade it in for your next ride—without any legal or financial hiccups.

Frequently Asked Questions

Can I sell my car if I still owe money on it?

Yes, you can sell a car even if you still owe money on it, as long as the lien is resolved during or before the sale. The buyer’s payment must cover the loan payoff, and the title must be transferred cleanly.

What happens if I sell a car with a lien and don’t pay it off?

If you sell a car with an active lien and don’t pay it off, the lender can still repossess the vehicle. The buyer may also sue you for fraud or misrepresentation, and you could face legal and financial consequences.

How long does it take to get a lien release after paying off the loan?

Most lenders process lien releases within 7 to 14 business days, but it can take longer. Contact your lender to confirm their timeline and request expedited processing if needed.

Can a buyer finance a car that has a lien?

Yes, but the buyer’s lender will require the existing lien to be paid off first. The new loan will typically cover the payoff amount, and the title will be transferred directly to the buyer.

What if my car is worth less than what I owe?

If your car is worth less than your loan balance (negative equity), you’ll need to pay the difference out of pocket at the time of sale. Some buyers may be willing to cover part of the gap, but it’s not guaranteed.

Do I need a lawyer to sell a car with a lien?

No, you don’t need a lawyer, but it’s wise to understand your state’s laws and use proper documentation. A bill of sale and lien release are usually sufficient to protect both parties.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.