Leasing a car can be an affordable way to drive a new vehicle every few years, but it’s important to understand all the costs involved. From monthly payments and down payments to mileage fees and wear-and-tear charges, knowing what you’re paying for helps you make smarter financial decisions.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Is Car Leasing and How Does It Work?

- 4 Breaking Down the Upfront Costs of Leasing a Car

- 5 Understanding Monthly Lease Payments

- 6 Hidden and Ongoing Costs You Might Not Expect

- 7 End-of-Lease Options and Associated Costs

- 8 Is Leasing Cheaper Than Buying?

- 9 Tips to Minimize the Cost of Leasing a Car

- 10 Final Thoughts on the Cost of Leasing a Car

- 11 Frequently Asked Questions

Key Takeaways

- Monthly lease payments are typically lower than loan payments: Because you’re only paying for the vehicle’s depreciation during the lease term, not the full value.

- Upfront costs include a down payment, security deposit, and fees: Expect to pay several thousand dollars at signing, depending on the deal.

- Mileage limits affect your total cost: Most leases allow 10,000–15,000 miles per year; exceeding this results in per-mile charges.

- Wear and tear charges can add up: Excessive damage beyond “normal use” may lead to repair fees at lease end.

- Early termination is expensive: Breaking a lease early often incurs penalties equal to several months of payments.

- Gap insurance is usually included: This protects you if the car is totaled or stolen, covering the difference between its value and what you owe.

- Leasing isn’t always cheaper long-term: If you prefer to own your vehicle or drive high mileage, buying may be more cost-effective.

📑 Table of Contents

- What Is Car Leasing and How Does It Work?

- Breaking Down the Upfront Costs of Leasing a Car

- Understanding Monthly Lease Payments

- Hidden and Ongoing Costs You Might Not Expect

- End-of-Lease Options and Associated Costs

- Is Leasing Cheaper Than Buying?

- Tips to Minimize the Cost of Leasing a Car

- Final Thoughts on the Cost of Leasing a Car

What Is Car Leasing and How Does It Work?

If you’ve ever wondered whether leasing a car is right for you, start with the basics. Car leasing is essentially renting a vehicle for a fixed period—usually 24 to 36 months—while making monthly payments based on how much the car depreciates during that time. Unlike buying, you don’t own the car at the end of the lease. Instead, you return it to the dealership (or buy it outright if you choose).

Think of it like leasing an apartment: you pay to use it for a set time, follow certain rules (like no pets or painting the walls), and move out when the term ends. With cars, those “rules” include mileage limits, maintenance requirements, and care standards. At the end of the lease, the car goes back to the dealer, often to be resold as a certified pre-owned vehicle.

One big appeal? Lower monthly payments. Since you’re only covering the car’s loss in value—not paying off the entire purchase price—your monthly outlay is usually significantly less than a loan payment for the same model. That means you could drive a luxury SUV or a brand-new electric vehicle for less than you’d pay to finance it over five or six years.

But here’s the catch: leasing isn’t free. There are upfront costs, ongoing fees, and potential penalties. And if you’re someone who loves driving, modifies their car, or plans to keep a vehicle for a decade, leasing might not align with your lifestyle or budget goals.

Breaking Down the Upfront Costs of Leasing a Car

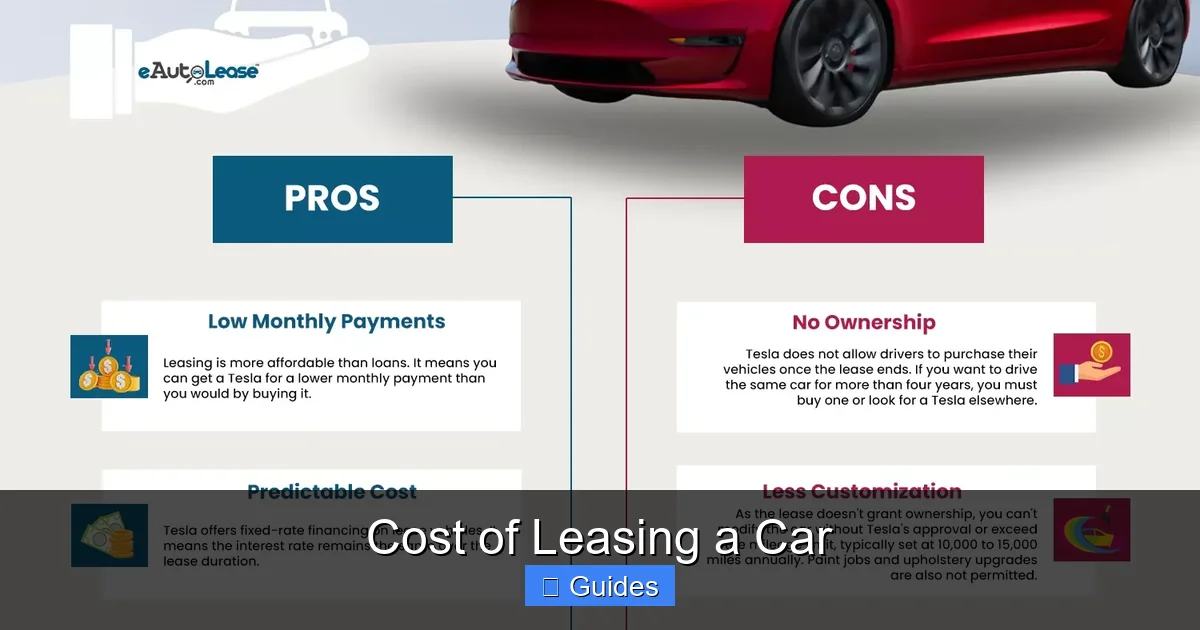

Visual guide about Cost of Leasing a Car

Image source: eautolease.com

When you sign a lease, you’ll likely face several initial expenses—sometimes called the “drive-off fees.” These can add up quickly, so it’s crucial to understand what you’re paying for before handing over your keys.

Down Payment (Cap Cost Reduction)

Many lessees choose to make a down payment, also known as a capitalized cost reduction. This reduces the amount you’re financing (i.e., the depreciation), which lowers your monthly payments. For example, putting $3,000 down on a $40,000 car might drop your monthly payment by $80–$100.

However, dealers often advertise “$0 down” leases to attract customers. While tempting, these deals usually result in higher monthly payments because you’re financing more of the car’s value. Only skip the down payment if you’re comfortable with the long-term cost and have emergency savings intact.

Security Deposit

Some states or dealers require a refundable security deposit—typically one month’s payment or a few hundred dollars. This protects the lessor (usually the finance company) against default or excessive wear. If you return the car in good condition and make all payments, you’ll get this money back.

Not all leases require a security deposit, especially if you have strong credit. Always ask whether it’s mandatory or negotiable.

Acquisition Fee

This is a non-refundable administrative fee charged by the leasing company—often $500 to $1,000. It covers paperwork, credit checks, and setting up your account. Some dealers roll this into your monthly payments instead of charging it upfront, which spreads out the cost but increases total interest.

First Month’s Payment

Almost every lease requires your first month’s payment at signing. So if your monthly payment is $350, that’s due right away—along with any other fees.

Taxes, Registration, and Title Fees

You’ll also pay state and local taxes, registration, and title fees. In some states, sales tax is applied to each monthly payment (called “monthly tax”), while others tax the total lease amount upfront. Check your state’s rules to avoid surprises.

Example: Total Drive-Off Cost

Let’s say you’re leasing a 2024 Honda CR-V with a $399 monthly payment:

– Down payment: $2,000

– First month’s payment: $399

– Acquisition fee: $695

– Security deposit: $399

– Taxes and registration: $450

Total upfront cost: ~$3,943

That’s nearly $4,000 before you even drive off the lot—so budget accordingly.

Understanding Monthly Lease Payments

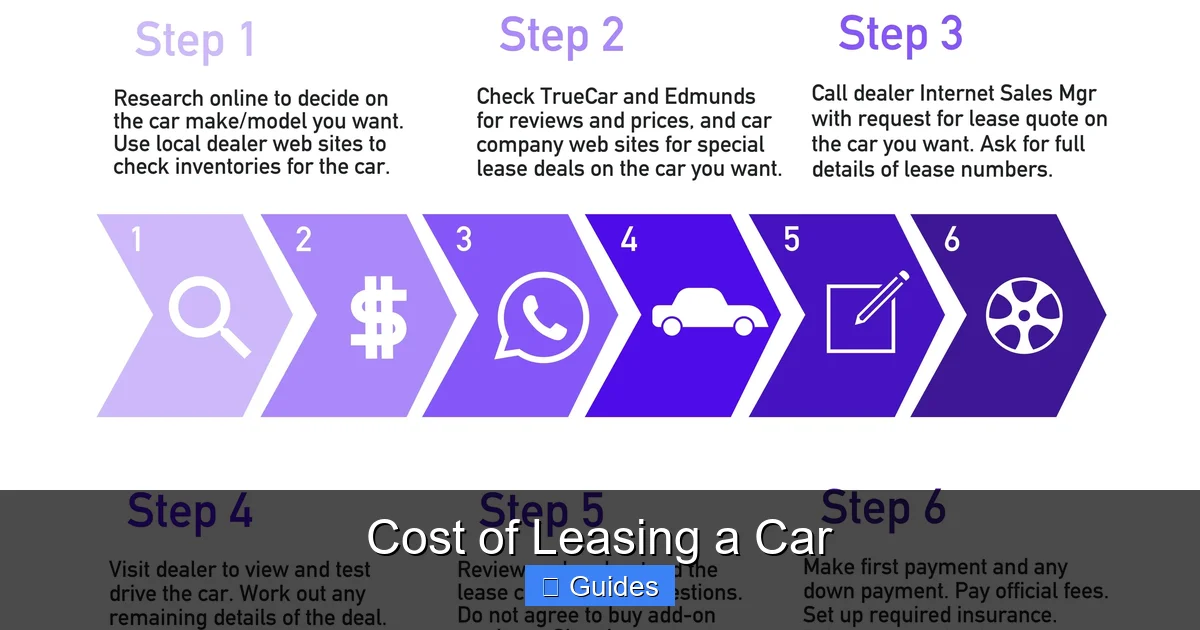

Visual guide about Cost of Leasing a Car

Image source: i.pinimg.com

Your monthly lease payment isn’t just a random number. It’s calculated using three key factors: the car’s negotiated price, its residual value, and the money factor (similar to an interest rate).

Negotiated Capitalized Cost

This is the price you agree to pay for the car—just like when buying. The lower this number, the lower your payments. Always negotiate the capitalized cost, not just the monthly payment. A savvy dealer might offer a low monthly rate but inflate the car’s price to compensate.

Tip: Use tools like Edmunds’ True Market Value or Kelley Blue Book to research fair pricing before negotiating.

Residual Value

The residual value is the car’s estimated worth at the end of the lease. For example, a $40,000 car with a 60% residual after 36 months is expected to be worth $24,000. You only pay for the $16,000 in depreciation—plus fees and interest.

Cars with strong resale values (like Toyota, Honda, or Subaru) often have better lease terms because their residuals are higher.

Money Factor

This is the lease equivalent of an APR. It’s usually a tiny decimal like 0.00250. To convert it to an approximate APR, multiply by 2,400:

0.00250 × 2,400 = 6% APR

A lower money factor means lower financing costs. If your credit score is excellent (720+), you’ll likely qualify for the best rates. Poor credit? Expect higher money factors or stricter terms.

Putting It All Together

Using the earlier CR-V example:

– Negotiated price: $36,000

– Residual (60% of $40,000 MSRP): $24,000

– Depreciation: $12,000

– Money factor: 0.00200 (~4.8% APR)

– Monthly payment (before tax): ~$350

Add taxes and fees, and you land near that $399 figure. Remember: small changes in any of these variables can significantly impact your payment.

Hidden and Ongoing Costs You Might Not Expect

Visual guide about Cost of Leasing a Car

Image source: certifiedmastertech.com

Beyond the sticker price and monthly payment, leasing comes with several ongoing and end-of-lease expenses that can catch unprepared drivers off guard.

Mileage Overages

Most leases include an annual mileage limit—typically 10,000, 12,000, or 15,000 miles. If you exceed it, you’ll pay a per-mile fee, usually $0.10 to $0.25. That adds up fast:

– Driving 18,000 miles/year on a 12,000-mile lease = 6,000 extra miles

– At $0.15/mile = $900 per year, or $2,700 over three years

Solution: Choose a higher mileage allowance upfront (for a slightly higher payment) or track your odometer monthly. If you’re close to the limit, consider buying extra miles in bulk at lease start—it’s often cheaper than paying overage fees later.

Wear and Tear Charges

At lease end, the dealer will inspect your car for damage beyond “normal use.” Scratches, dents, torn upholstery, or excessive tire wear may result in repair charges. What counts as “normal” varies, but generally:

– Small paint chips or door dings: OK

– Large dents, cracked windshield, or stained seats: not OK

Tip: Take photos of the car at pickup and keep maintenance records. Consider purchasing a wear-and-tear protection plan (for a fee) to cover minor damages.

Disposition Fee

When you return the car, most leases charge a disposition fee—around $300–$500—to cover cleaning, reconditioning, and resale prep. This is non-negotiable in most cases, so factor it into your total cost.

Excess Mileage Buyout Option

Some leases let you buy extra miles at signing for a reduced rate (e.g., $0.08/mile instead of $0.20). If you think you’ll drive more than average, this can save money long-term.

Maintenance and Repairs

While many new cars come with free maintenance (e.g., Hyundai’s 3-year/36,000-mile plan), you’re still responsible for oil changes, tire rotations, and repairs not covered under warranty. Skipping maintenance can void your lease agreement and lead to penalties.

End-of-Lease Options and Associated Costs

When your lease term ends, you have three choices—each with financial implications.

Return the Car

This is the most common option. After a final inspection, you pay any outstanding fees (mileage, wear, disposition) and walk away. No equity, no hassle—but also no asset.

Buy the Car

You can purchase the vehicle at its residual value. For example, if the residual is $24,000 and the car’s market value is $26,000, you’re getting a $2,000 discount. However, if the market value is lower (say, $22,000), you’d overpay by $2,000.

Tip: Get an independent appraisal before deciding. If it’s a good deal, financing the purchase through your bank (not the dealer) may offer better rates.

Lease a New Car

Many lessees simply move into a new lease—sometimes with the same brand for loyalty incentives. This keeps payments low and lets you drive the latest models. But remember: you’ll face new drive-off fees and start the cycle again.

Is Leasing Cheaper Than Buying?

This is the million-dollar question—and the answer depends on your priorities.

Short-Term Affordability

Yes, leasing is usually cheaper month-to-month. You avoid large down payments, enjoy lower monthly costs, and benefit from full manufacturer warranties. Ideal for people who want a new car every few years without long-term commitment.

Long-Term Cost

No, leasing isn’t cheaper over time. You’re always making payments and never build equity. After 10 years of leasing, you own nothing. With buying, even if payments are higher initially, you eventually own a paid-off asset you can sell or keep.

Lifestyle Fit

– Leasing suits: Tech lovers, low-mileage drivers, those who dislike repairs, or people who want predictable costs.

– Buying suits: High-mileage drivers, DIYers, customizers, or anyone planning to keep a car 7+ years.

Rule of thumb: If you drive under 12,000 miles/year and prefer driving new cars, leasing makes sense. Otherwise, buying may save you thousands.

Tips to Minimize the Cost of Leasing a Car

Smart leasing starts with preparation. Use these strategies to keep costs down:

– **Negotiate the capitalized cost**, not just the monthly payment.

– **Put money down only if it lowers your total cost**—don’t deplete savings.

– **Choose a car with a high residual value** (Toyota, Lexus, Honda).

– **Opt for a 36-month lease**—shorter terms have higher monthly payments; longer terms risk mechanical issues out of warranty.

– **Read the fine print** on mileage, wear, and termination clauses.

– **Avoid unnecessary add-ons** like VIN etching or fabric protection—they inflate your cap cost.

– **Check for incentives**—manufacturers often offer lease cash or reduced money factors.

Final Thoughts on the Cost of Leasing a Car

Leasing a car offers convenience, lower payments, and the thrill of driving something new—but it’s not a one-size-fits-all solution. The true cost of leasing a car goes far beyond the monthly payment. Upfront fees, mileage limits, wear-and-tear charges, and end-of-lease expenses all add up.

Before signing, ask yourself: How many miles do I drive? Do I want to own my car someday? Can I afford the drive-off fees? If you answered “low mileage,” “no,” and “yes,” leasing could be a smart financial move.

But if you’re looking for long-term value, enjoy modifying your ride, or simply hate monthly car payments, buying might serve you better. Either way, understanding the full cost of leasing a car empowers you to choose confidently—and avoid costly surprises down the road.

Frequently Asked Questions

Is leasing a car cheaper than buying?

Leasing usually has lower monthly payments than buying, but it’s not cheaper long-term. You never build equity, and you’ll always have car payments if you keep leasing.

Can I negotiate a car lease?

Yes! You can negotiate the capitalized cost (price of the car), money factor, and sometimes fees. Focus on the total cost, not just the monthly payment.

What happens if I go over my mileage limit?

You’ll be charged a per-mile fee—typically $0.10 to $0.25—at lease end. To avoid this, choose a higher mileage allowance upfront or track your driving closely.

Do I need gap insurance when leasing?

Most leases include gap insurance automatically. It covers the difference between what you owe and the car’s value if it’s totaled or stolen.

Can I end my car lease early?

Yes, but it’s expensive. Early termination fees often equal several months of payments. Some dealers offer lease transfer programs to reduce costs.

What counts as excessive wear and tear?

Damage beyond normal use—like large dents, cracked glass, or stained interiors—may result in repair charges. Small scratches and minor dings are usually acceptable.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.