Gap insurance covers the difference between what you owe on your car loan and the car’s actual cash value if it’s totaled or stolen. While not always necessary for used cars, it can be a smart financial safety net—especially if you have a long loan term, low down payment, or drive a depreciating vehicle.

Buying a used car can be a smart financial move. You avoid the steepest part of depreciation, save on sales tax, and often get a reliable vehicle at a lower price. But once you drive off the lot, a new kind of risk emerges—one that isn’t always obvious: the risk of owing more on your car loan than the car is actually worth.

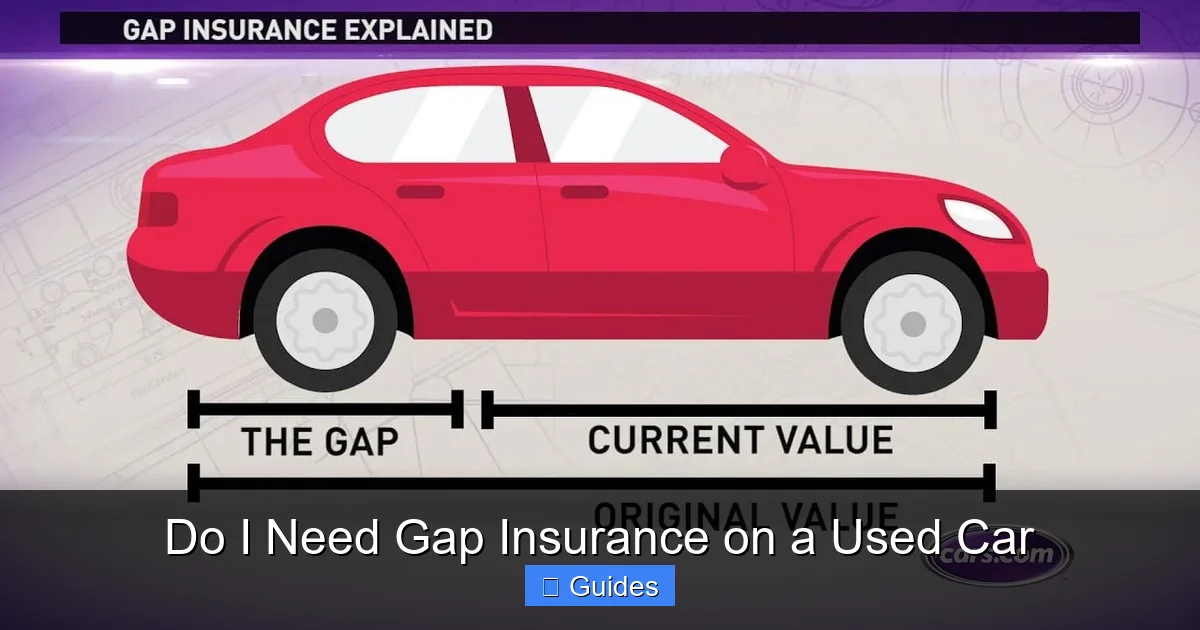

This is where gap insurance comes into play. If your used car is totaled in an accident or stolen, your standard auto insurance will only pay out the car’s current market value—what it’s worth today, not what you paid for it or what you still owe. If there’s a difference between that payout and your remaining loan balance, you’re stuck paying the “gap” out of pocket. That’s where gap insurance steps in to cover that difference, protecting you from a potentially huge financial hit.

So, do you need gap insurance on a used car? The answer isn’t always simple. It depends on several factors: how much you financed, how long your loan term is, how quickly the car loses value, and your personal risk tolerance. In this guide, we’ll walk you through everything you need to know to make an informed decision—without the sales pressure or confusing jargon.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Is Gap Insurance and How Does It Work?

- 4 When Is Gap Insurance Worth It for a Used Car?

- 5 When You Probably Don’t Need Gap Insurance

- 6 How Much Does Gap Insurance Cost?

- 7 How to Get Gap Insurance (and Save Money)

- 8 Real-Life Examples: When Gap Insurance Saved the Day

- 9 Alternatives to Gap Insurance

- 10 Final Thoughts: Should You Buy Gap Insurance on a Used Car?

- 11 Frequently Asked Questions

Key Takeaways

- Gap insurance protects against negative equity: If your used car is totaled, your auto insurer pays only its current market value—not what you still owe. Gap insurance covers that gap.

- It’s most useful with long loan terms: Loans over 60 months increase the risk of owing more than the car is worth, making gap coverage more valuable.

- Down payments matter: Putting less than 20% down on a used car increases the chance of being upside-down on your loan, raising the need for gap insurance.

- Not all used cars need it: If you have a short loan term, large down payment, or own the car outright, gap insurance may not be necessary.

- Gap insurance isn’t free: It typically costs $500–$800 added to your loan or $30–$60 per month if purchased separately—weigh the cost against the risk.

- You can often cancel it later: Once your loan balance drops below the car’s value, you may be able to cancel gap coverage and stop paying for it.

- Check your existing coverage: Some credit cards, auto insurers, or lenders already include gap protection—review your policy before buying more.

📑 Table of Contents

- What Is Gap Insurance and How Does It Work?

- When Is Gap Insurance Worth It for a Used Car?

- When You Probably Don’t Need Gap Insurance

- How Much Does Gap Insurance Cost?

- How to Get Gap Insurance (and Save Money)

- Real-Life Examples: When Gap Insurance Saved the Day

- Alternatives to Gap Insurance

- Final Thoughts: Should You Buy Gap Insurance on a Used Car?

What Is Gap Insurance and How Does It Work?

Gap insurance—short for “guaranteed asset protection” insurance—is a type of coverage designed to protect car owners from financial loss if their vehicle is declared a total loss. It doesn’t replace your regular auto insurance. Instead, it works alongside it to fill a specific financial gap.

Here’s how it works in practice: Let’s say you buy a used car for $20,000 and finance $18,000 of it with a 72-month loan. After two years, you’ve paid down the loan to $14,000. But because cars lose value quickly—especially in the first few years—your car might now be worth only $12,000 on the market. If the car is totaled in an accident, your auto insurance company will pay you $12,000 (the actual cash value). But you still owe $14,000 on the loan. That leaves you with a $2,000 gap.

Without gap insurance, you’d have to pay that $2,000 yourself—even though you no longer have the car. With gap insurance, that $2,000 is covered, and your lender gets paid in full. You walk away debt-free.

Types of Gap Insurance

There are two main types of gap insurance:

1. **Loan/Lease Gap Coverage:** This is the most common type. It covers the difference between your car’s actual cash value and the remaining balance on your auto loan or lease. It’s typically offered by dealerships, banks, or credit unions when you finance a vehicle.

2. **Return-to-Value (RTV) or Disappearing Deductible Gap Insurance:** This newer type of gap coverage goes a step further. Instead of just covering the loan gap, it may also cover your deductible and, in some cases, pay you the original purchase price of the car—even if it’s worth less now. These policies are less common and usually more expensive, but they offer greater protection.

It’s important to note that gap insurance only applies if your car is declared a total loss. It doesn’t cover repairs, medical bills, or other damages. It also doesn’t apply if you voluntarily surrender the car or default on your loan.

Who Sells Gap Insurance?

You can get gap insurance from several sources:

– **Car dealerships:** Often offer it as an add-on during financing. Convenient, but can be more expensive.

– **Banks and credit unions:** May include it in auto loan packages or sell it separately.

– **Auto insurance companies:** Some insurers offer gap coverage as an endorsement to your policy.

– **Third-party providers:** Independent companies that specialize in gap protection.

Prices vary widely. Dealerships may charge $500–$800 rolled into your loan, while insurers might offer it for $30–$60 per month. Always compare options and read the fine print.

When Is Gap Insurance Worth It for a Used Car?

Visual guide about Do I Need Gap Insurance on a Used Car

Image source: moneyabcs.uta.edu

Not every used car buyer needs gap insurance. But in certain situations, it can be a financial lifesaver. Let’s break down the scenarios where it makes the most sense.

You Have a Long Loan Term (60+ Months)

The longer your loan term, the more time your car has to depreciate—and the more likely you are to owe more than it’s worth. For example, a 72-month (6-year) loan on a used car means you’re still making payments long after the car has lost a significant portion of its value.

Let’s say you buy a 3-year-old SUV for $25,000 with a 72-month loan and $3,000 down. After 18 months, you’ve paid about $6,000, but the car is now worth only $18,000. You still owe $19,000. That’s a $1,000 gap. After 3 years, the gap could be even larger.

In this case, gap insurance is a smart hedge against depreciation.

You Made a Small or No Down Payment

Putting little or nothing down on a used car increases your loan amount and reduces your equity from day one. Even if the car holds its value well, you’re starting in a vulnerable position.

For instance, financing $22,000 on a $22,000 used car with zero down means you’re immediately upside-down if the car loses just 10% of its value in the first month—which is common. Gap insurance protects you during that risky early period.

You’re Leasing the Used Car

Leased vehicles often come with gap insurance included, but if you’re leasing a used car privately or through a non-traditional lender, you may need to buy it separately. Since lease payments are based on depreciation, you’re especially vulnerable to value drops.

If your leased used car is totaled, the insurer pays its current value—but you may still owe lease-end fees, excess mileage charges, or other costs. Some gap policies cover these extras, so read the details carefully.

You Drive a Car That Depreciates Quickly

Not all used cars lose value at the same rate. Luxury brands, high-end trims, and vehicles with high mileage tend to depreciate faster. Even some popular models can lose 20–30% of their value in the first year.

If you’re buying a used BMW, Mercedes, or a high-mileage pickup truck, gap insurance can be a wise investment. On the other hand, if you’re buying a reliable, low-depreciation model like a Toyota Corolla or Honda Civic with low miles, the risk is lower.

You Can’t Afford an Unexpected $2,000–$5,000 Bill

This might be the most important factor: your personal financial situation. If you’re living paycheck to paycheck or don’t have an emergency fund, a $3,000 gap payment could be devastating.

Gap insurance acts like a safety net. For a few hundred dollars, you can avoid a potentially crippling debt. It’s not about the car—it’s about protecting your financial stability.

When You Probably Don’t Need Gap Insurance

Visual guide about Do I Need Gap Insurance on a Used Car

Image source: thumbor.forbes.com

Just as there are situations where gap insurance is valuable, there are times when it’s unnecessary—or even a waste of money.

You Have a Short Loan Term (36–48 Months)

If you’re financing a used car over 3 or 4 years, you’re likely to pay down the loan faster than the car depreciates—especially if you make regular payments and avoid rolling over negative equity from a previous loan.

For example, a $15,000 used car with a 48-month loan and $3,000 down means you’re paying about $250 per month. After 2 years, you’ve paid $6,000, and the car might be worth $10,000. You owe $9,000. No gap. In fact, you may even have a little equity.

In this case, gap insurance offers little benefit.

You Made a Large Down Payment (20% or More)

Putting 20% or more down on a used car significantly reduces your loan amount and builds instant equity. You’re less likely to be upside-down, even if the car loses value.

For instance, buying a $20,000 used car with a $5,000 down payment means you only finance $15,000. Even if the car drops to $16,000 in value after a year, you’re still in positive territory.

You Own the Car Outright

If you paid cash for your used car or have already paid off your loan, you don’t need gap insurance. There’s no loan to protect, so there’s no gap to cover.

Your Car Holds Its Value Well

Some used cars depreciate slowly. Brands like Toyota, Honda, Subaru, and certain trucks (like the Ford F-150) tend to retain value better than average. If you’re buying a well-maintained, low-mileage model from one of these brands, the risk of a large gap is lower.

You Already Have Gap Coverage

Check your existing policies. Some auto insurers include gap protection in comprehensive coverage. Certain credit cards offer gap insurance as a benefit when you use them to buy a car. And some lenders automatically include it in loan packages.

Before buying additional coverage, review your current benefits. You might already be protected.

How Much Does Gap Insurance Cost?

Visual guide about Do I Need Gap Insurance on a Used Car

Image source: money.madenginer.com

The cost of gap insurance varies depending on where you buy it, the type of coverage, and your loan details. Here’s what to expect:

– **Dealerships:** Typically charge $500–$800, often rolled into your loan. This increases your monthly payment and adds interest over time.

– **Banks/Credit Unions:** May offer it for $400–$600 as a standalone product.

– **Auto Insurers:** Usually charge $30–$60 per month as an endorsement to your policy.

– **Third-Party Providers:** Prices range from $300–$700, depending on coverage limits.

While $500 might seem steep, consider the alternative: paying a $3,000 gap out of pocket. For many, the peace of mind is worth the cost.

Is It Worth the Price?

To decide if gap insurance is worth it, ask yourself:

– How much could the gap be if my car is totaled in the next 12–24 months?

– Can I afford to pay that amount if it happens?

– How long will it take for my loan balance to drop below the car’s value?

Use online tools like Kelley Blue Book or Edmunds to estimate your car’s current and future value. Compare that to your loan amortization schedule. If the gap is likely to be $1,000 or more in the first few years, gap insurance may be a smart buy.

How to Get Gap Insurance (and Save Money)

If you decide gap insurance is right for you, here’s how to get it—and avoid overpaying.

Shop Around

Don’t just accept the first offer from the dealership. Compare prices from your bank, credit union, and auto insurer. Online providers like Endurance or Protect My Car may offer competitive rates.

Ask About Cancellation Policies

Many gap policies allow you to cancel once your loan balance drops below the car’s value. This usually happens after 2–3 years, depending on your loan. Ask if you’ll get a refund for unused coverage.

Read the Fine Print

Not all gap policies are created equal. Some exclude certain types of losses, have caps on payouts, or require you to use OEM parts. Make sure the policy covers:

– Total loss due to accident or theft

– Your deductible (up to a limit)

– Loan balance, including interest

– No exclusions for high-mileage or older vehicles

Consider Bundling

Some insurers offer discounts if you bundle gap insurance with comprehensive and collision coverage. Ask about package deals.

Time It Right

You usually have 30–60 days after buying the car to add gap insurance. Don’t wait until the last minute. The sooner you’re covered, the better.

Real-Life Examples: When Gap Insurance Saved the Day

Let’s look at two real-world scenarios to see how gap insurance plays out.

Example 1: The Upside-Down Buyer

Maria buys a used 2019 Honda Accord for $18,000. She puts $2,000 down and finances $16,000 over 6 years. After 18 months, she’s in a minor accident. The car is totaled. Her insurer pays $13,500—the car’s current value. But she still owes $14,200 on the loan.

Without gap insurance, Maria owes $700. With it, the gap is covered. She walks away with no debt and can use the insurance payout toward a new car.

Example 2: The Smart Saver

James buys a used 2020 Toyota Camry for $20,000 with a $5,000 down payment and a 4-year loan. After 2 years, the car is worth $14,000, and he owes $10,000. No gap. He skips gap insurance and saves $600.

In this case, James made a smart financial decision. His large down payment and short loan term minimized risk.

These examples show that gap insurance isn’t one-size-fits-all. It depends on your loan structure, down payment, and vehicle choice.

Alternatives to Gap Insurance

If gap insurance doesn’t fit your budget or situation, consider these alternatives:

Make a Larger Down Payment

Putting more money down reduces your loan amount and builds equity faster. Aim for at least 20% down on a used car.

Choose a Shorter Loan Term

A 36- or 48-month loan reduces the time you’re exposed to depreciation risk. Your monthly payment will be higher, but you’ll pay less interest and build equity faster.

Buy a Car That Holds Its Value

Research depreciation rates before buying. Brands like Toyota, Honda, and Subaru tend to retain value better than luxury or niche vehicles.

Build an Emergency Fund

If you can’t afford gap insurance, focus on saving. Even $1,000 in savings can help cover a small gap. Aim for 3–6 months of expenses over time.

Pay Extra on Your Loan

Making extra payments reduces your principal faster, helping you get out of negative equity sooner. Even $50 extra per month can make a big difference.

Final Thoughts: Should You Buy Gap Insurance on a Used Car?

So, do you need gap insurance on a used car? The short answer: it depends.

If you have a long loan term, small down payment, or are driving a car that depreciates quickly, gap insurance can be a smart financial move. It protects you from a potentially large out-of-pocket expense if your car is totaled or stolen.

But if you have a short loan, large down payment, or own a vehicle that holds its value well, you may not need it. And if you already have coverage through your insurer or credit card, buying more could be redundant.

The key is to assess your personal risk. Look at your loan balance, your car’s value, and your ability to handle an unexpected bill. Use online tools to estimate depreciation and run the numbers.

Remember, gap insurance isn’t about the car—it’s about protecting your financial future. For a few hundred dollars, you can avoid a debt that could take months or years to pay off.

Take the time to compare options, read the fine print, and make a decision that fits your budget and peace of mind. Because when it comes to car ownership, being prepared is always better than being surprised.

Frequently Asked Questions

Is gap insurance required for used cars?

No, gap insurance is not legally required for used cars. However, some lenders may require it if you have a high loan-to-value ratio or long loan term. Always check your loan agreement.

Can I buy gap insurance after purchasing a used car?

Yes, in most cases. You typically have 30 to 60 days after buying the car to add gap insurance. Some insurers and lenders allow it even later, but coverage may be limited.

Does gap insurance cover theft?

Yes, most gap insurance policies cover theft if your car is declared a total loss. The insurer pays the actual cash value, and gap insurance covers the difference between that and your loan balance.

Can I cancel gap insurance?

Yes, many gap policies allow cancellation once your loan balance drops below the car’s value. Ask your provider about refund policies and cancellation procedures.

Does gap insurance cover my deductible?

Some policies do, up to a certain limit (e.g., $500–$1,000). Check your policy details to see if your deductible is included in the coverage.

Is gap insurance worth it for a 5-year-old car?

It depends. Older cars with high mileage may have slower depreciation, reducing the risk of a large gap. But if you have a long loan or small down payment, it could still be worth considering.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.