When financing a car, lenders typically require full coverage insurance to protect their financial interest until the loan is paid off. This means you’ll need more than just liability—comprehensive and collision coverage are usually mandatory. While it may cost more upfront, full coverage safeguards both you and the lender in case of accidents, theft, or damage.

Buying a car is exciting—but it comes with responsibilities, especially when you’re financing it. One of the biggest questions new car buyers face is whether they need full coverage insurance. The short answer? Almost always, yes. But let’s dig deeper.

When you finance a car, you’re not the sole owner—at least not yet. The lender holds a financial interest in the vehicle until you’ve paid off the loan. That means if something happens to the car—like an accident, theft, or storm damage—the lender wants to be sure they can recover their investment. Full coverage insurance, which includes both comprehensive and collision protection, helps ensure that the car can be repaired or replaced if damaged. Without it, the lender’s collateral is at risk, and they won’t take that chance.

Now, you might be thinking, “But my state only requires liability insurance.” That’s true—most states mandate minimum liability coverage to cover damages you cause to others. However, liability doesn’t protect your own vehicle. If you crash into a tree or your car gets stolen, liability won’t help you at all. That’s where full coverage steps in. It’s not just a suggestion from your lender—it’s a requirement to protect everyone involved.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Is Full Coverage Insurance?

- 4 What Happens If You Don’t Have Full Coverage?

- 5 How Much Does Full Coverage Cost?

- 6 Gap Insurance: A Crucial Add-On

- 7 Can You Drop Full Coverage After Paying Off the Loan?

- 8 Full Coverage for Leased Vehicles

- 9 Common Misconceptions About Full Coverage

- 10 Final Thoughts: Is Full Coverage Worth It?

- 11 Frequently Asked Questions

- 11.1 Do I need full coverage if I’m financing a used car?

- 11.2 Can I switch insurers while financing a car?

- 11.3 What happens if I cancel full coverage during the loan term?

- 11.4 Is full coverage required for leased cars?

- 11.5 How long do I need to keep full coverage?

- 11.6 Does full coverage include roadside assistance?

Key Takeaways

- Lenders require full coverage: Most auto lenders mandate comprehensive and collision insurance to protect the vehicle, which serves as collateral for your loan.

- It’s not just about legal compliance: Full coverage goes beyond state minimums and shields you from major out-of-pocket expenses after an accident or theft.

- Gap insurance is a smart add-on: If your car is totaled early in the loan, gap coverage pays the difference between what you owe and the car’s actual cash value.

- Shop around for the best rates: Comparing quotes from multiple insurers can help you find affordable full coverage without sacrificing protection.

- You can drop it after paying off the loan: Once your car is fully owned, you’re free to adjust your coverage—though keeping full coverage is often wise.

- Leased vehicles also require full coverage: Just like financed cars, leased vehicles typically require comprehensive and collision coverage for the duration of the lease.

- Non-compliance can lead to forced placement: If you let your coverage lapse, lenders may buy expensive insurance on your behalf and charge you.

📑 Table of Contents

- What Is Full Coverage Insurance?

- What Happens If You Don’t Have Full Coverage?

- How Much Does Full Coverage Cost?

- Gap Insurance: A Crucial Add-On

- Can You Drop Full Coverage After Paying Off the Loan?

- Full Coverage for Leased Vehicles

- Common Misconceptions About Full Coverage

- Final Thoughts: Is Full Coverage Worth It?

What Is Full Coverage Insurance?

Full coverage isn’t a specific type of policy—it’s a term used to describe a combination of insurance coverages that go beyond the legal minimum. Typically, it includes:

– **Liability insurance**: Covers bodily injury and property damage you cause to others.

– **Collision coverage**: Pays for damage to your car from a collision, regardless of fault.

– **Comprehensive coverage**: Covers non-collision events like theft, vandalism, fire, hail, or hitting an animal.

Some policies may also include uninsured/underinsured motorist coverage, medical payments, and rental reimbursement, depending on your needs and insurer.

Think of full coverage as a safety net. If you’re in a fender bender, your collision coverage kicks in to fix your car. If a tree falls on it during a storm, comprehensive coverage handles the repairs. Without these, you’d be paying out of pocket—possibly thousands of dollars.

Why Lenders Require It

Lenders require full coverage because the car is collateral. Just like a mortgage protects a bank’s interest in your home, auto insurance protects the lender’s stake in your vehicle. If the car is totaled and you only have liability, the insurance payout might not cover what you still owe on the loan. That leaves you on the hook for the difference—and the lender out of luck.

For example, imagine you owe $25,000 on a car that’s worth $20,000. If it’s totaled in an accident, your insurer (with full coverage) will pay the actual cash value—$20,000. You’d still owe $5,000. Without full coverage, you might get nothing, and the lender loses their security.

What Happens If You Don’t Have Full Coverage?

Visual guide about Do You Need Full Coverage When Financing a Car

Image source: watcher.guru

Skipping full coverage might seem like a way to save money, but it can backfire fast. Most loan agreements explicitly require comprehensive and collision coverage. If you fail to maintain it, the lender can take action.

Forced Placement Insurance

If your insurance lapses or doesn’t meet the lender’s requirements, they may purchase a policy on your behalf—called force-placed insurance. This coverage is often much more expensive than what you could get on your own. Worse, it usually only protects the lender, not you. So if you’re in an accident, you might not be covered for repairs or medical bills.

Force-placed insurance can also lead to higher monthly payments and damage your credit if you fall behind. It’s a costly consequence of cutting corners.

Risk of Financial Loss

Without full coverage, you’re exposed to significant financial risk. A single accident could leave you with repair bills in the thousands. If your car is stolen or destroyed by a natural disaster, you’d lose the vehicle and still owe money on the loan. That’s a double blow—no car, but still paying for it.

Even minor incidents can add up. A cracked windshield, a dented door from a shopping cart, or a broken side mirror can cost hundreds to fix. Full coverage helps absorb these costs, so you’re not draining your savings.

How Much Does Full Coverage Cost?

Visual guide about Do You Need Full Coverage When Financing a Car

Image source: thechupitosbar.com

The cost of full coverage varies widely based on several factors:

– **Your driving record**: Clean records usually mean lower premiums.

– **Location**: Urban areas with higher traffic and crime rates tend to have higher rates.

– **Vehicle type**: Newer, more expensive, or high-performance cars cost more to insure.

– **Deductible amount**: Higher deductibles lower your premium but increase out-of-pocket costs when you file a claim.

– **Credit score**: In most states, insurers use credit-based insurance scores to determine rates.

On average, full coverage costs about $1,500 to $2,000 per year, or $125 to $165 per month. That’s significantly more than liability-only insurance, which might run $500 to $800 annually. But when you’re financing a car, the extra cost is often worth it for the protection it provides.

Tips to Save on Full Coverage

You don’t have to overpay for full coverage. Here are some smart ways to reduce your premiums:

– **Shop around**: Get quotes from at least three insurers. Rates can vary by hundreds of dollars.

– **Bundle policies**: Many insurers offer discounts if you combine auto and home or renters insurance.

– **Maintain a good driving record**: Avoid tickets and accidents to keep your rates low.

– **Increase your deductible**: Raising it from $500 to $1,000 can lower your premium—just make sure you can afford the higher out-of-pocket cost if needed.

– **Ask about discounts**: Good student, safe driver, low mileage, and anti-theft device discounts can add up.

– **Pay annually**: Some insurers offer a discount if you pay your premium in full instead of monthly.

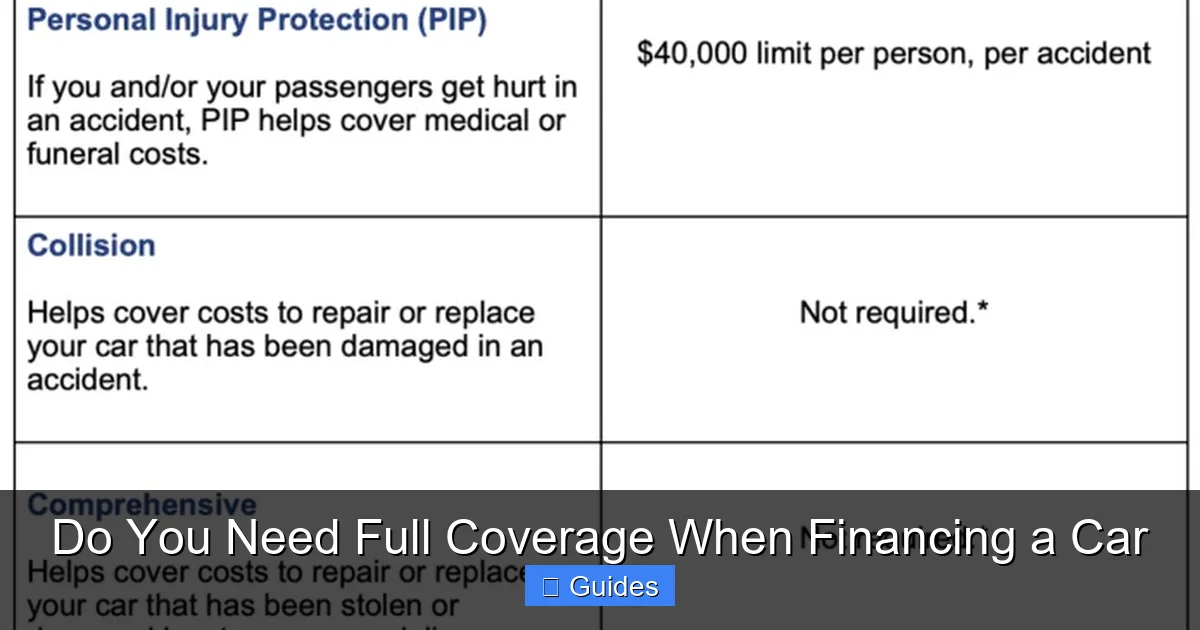

Gap Insurance: A Crucial Add-On

Visual guide about Do You Need Full Coverage When Financing a Car

Image source: atimn.com

When you finance a new car, it starts losing value the moment you drive it off the lot. In the first year, a car can depreciate 20% or more. That means if you’re in an accident early in your loan, the insurance payout might not cover what you still owe.

That’s where gap insurance comes in. Short for “guaranteed asset protection,” gap insurance covers the difference between your car’s actual cash value and the remaining loan balance. For example, if you owe $22,000 but your car is only worth $18,000 when it’s totaled, gap insurance pays the $4,000 gap.

When Is Gap Insurance Worth It?

Gap insurance is especially valuable if:

– You made a small down payment (less than 20%).

– You have a long loan term (60 months or more).

– You’re leasing the vehicle.

– You’re financing a car that depreciates quickly.

Many lenders offer gap insurance at the time of purchase, but it’s often cheaper to buy it through your auto insurer. A typical gap policy costs $200 to $500 over the life of the loan—a small price for major peace of mind.

Can You Drop Full Coverage After Paying Off the Loan?

Yes—once you own your car outright, the lender no longer has a say in your insurance. You’re free to adjust your coverage as you see fit. However, dropping full coverage isn’t always the best move.

Weighing the Pros and Cons

If your car is older and has low market value, you might consider dropping collision and comprehensive. For example, if your 10-year-old sedan is worth $3,000, paying $1,200 a year to insure it might not make sense. In that case, liability-only could be sufficient.

But if your car still has significant value—or if you rely on it heavily—keeping full coverage protects your investment. A single accident could cost more than years of premiums. Also, if you have savings you’d rather not tap into for repairs, full coverage is a smart choice.

Consider Your Financial Situation

Ask yourself: Can I afford to replace my car if it’s totaled? If the answer is no, keep full coverage. Even older cars can be expensive to repair after an accident. And if you’re on a tight budget, unexpected costs can derail your finances.

Full Coverage for Leased Vehicles

Leasing a car? You’ll also need full coverage. Just like with financing, the leasing company owns the vehicle and requires protection. Most lease agreements mandate comprehensive and collision coverage, often with lower deductibles (like $500 or less).

Leased cars are typically newer and more valuable, so the cost of full coverage is justified. Plus, lease terms often include gap insurance, so you’re covered if the car is totaled.

Don’t Skimp on Lease Insurance

Some lessees try to cut costs by reducing coverage, but that’s risky. If you’re in an accident and can’t afford repairs, you could face fees or even early termination of the lease. Stick to the required coverage to avoid headaches.

Common Misconceptions About Full Coverage

There’s a lot of confusion around full coverage. Let’s clear up some myths:

Myth: Full coverage means everything is covered.

Not true. Full coverage doesn’t include things like mechanical breakdowns, regular maintenance, or wear and tear. It also won’t cover personal items stolen from your car unless you have additional personal property coverage.

Myth: It’s only for new cars.

While new cars depreciate fast and benefit greatly from full coverage, used cars can also be worth protecting—especially if they’re still under warranty or have high repair costs.

Myth: I can drop it as soon as I drive off the lot.

No—lenders require it for the entire loan term. Dropping it early can trigger penalties or forced placement.

Myth: It’s too expensive to be worth it.

While full coverage costs more, the financial protection it offers often outweighs the premium. One major claim can pay for years of coverage.

Final Thoughts: Is Full Coverage Worth It?

When financing a car, full coverage isn’t just recommended—it’s usually required. It protects the lender’s investment and shields you from costly out-of-pocket expenses. While the monthly premium may seem high, the peace of mind and financial security it provides are invaluable.

Think of it this way: You’re already committing to monthly car payments. Adding a few hundred dollars a year for insurance is a small price to pay to avoid a financial disaster. Plus, with smart shopping and discounts, you can find affordable full coverage that fits your budget.

In the end, full coverage when financing a car is about responsibility—not just to your lender, but to yourself. It ensures that if the unexpected happens, you’re not left stranded with a car you can’t drive and a loan you still have to pay.

So before you sign that loan agreement, make sure your insurance is up to par. Talk to your lender, compare quotes, and choose a policy that offers the right balance of protection and value. Your future self will thank you.

Frequently Asked Questions

Do I need full coverage if I’m financing a used car?

Yes, most lenders require full coverage regardless of whether the car is new or used. The vehicle serves as collateral, so the lender wants it protected until the loan is paid off.

Can I switch insurers while financing a car?

Absolutely. You can switch insurers at any time, but make sure your new policy meets the lender’s requirements and that there’s no lapse in coverage. Notify your lender of the change to avoid issues.

What happens if I cancel full coverage during the loan term?

Your lender may force-place expensive insurance on your vehicle and charge you for it. This can increase your monthly payments and potentially damage your credit if you fall behind.

Is full coverage required for leased cars?

Yes, leased vehicles typically require comprehensive and collision coverage, just like financed cars. The leasing company owns the car and needs protection against damage or loss.

How long do I need to keep full coverage?

You must maintain full coverage for as long as the lender has a financial interest in the vehicle—usually until the loan is fully paid off. Once you own the car outright, you can adjust your coverage.

Does full coverage include roadside assistance?

Not automatically. Roadside assistance is usually an optional add-on. Check with your insurer to see if it’s included or available for an extra fee.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.