Leasing a car can help build credit if the leasing company reports your payments to the major credit bureaus. However, not all leases are reported, so it’s important to confirm this before signing. Consistent, on-time payments are key to boosting your credit score over time.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Does Leasing a Car Build Credit? A Complete Guide

- 4 How Credit Scores Work: The Basics You Need to Know

- 5 Does Leasing a Car Appear on Your Credit Report?

- 6 How Leasing Builds Credit: The Positive Impact

- 7 When Leasing Hurts Your Credit: The Risks to Avoid

- 8 Leasing vs. Buying: Which Builds Credit Better?

- 9 Tips to Maximize Credit Building While Leasing

- 10 Common Misconceptions About Leasing and Credit

- 11 Final Thoughts: Should You Lease to Build Credit?

- 12 Frequently Asked Questions

- 12.1 Does leasing a car build credit if the payments aren’t reported?

- 12.2 How long does it take for leasing to improve my credit score?

- 12.3 Can I build credit with a lease if I have bad credit?

- 12.4 What happens to my credit when my lease ends?

- 12.5 Will leasing a car lower my credit score initially?

- 12.6 Is it better to lease or buy a car to build credit?

Key Takeaways

- Leasing can build credit if payments are reported: Only leases reported to Equifax, Experian, or TransUnion will impact your credit score.

- On-time payments matter most: Paying your lease on time each month helps establish a positive payment history, the biggest factor in your credit score.

- Not all leasing companies report: Some smaller or regional leasing companies don’t report to credit bureaus, so your payments won’t help your credit.

- Late payments hurt your score: Missing or late lease payments can damage your credit, just like with loans or credit cards.

- Lease end behavior counts: Returning the car in good condition and fulfilling end-of-lease terms avoids negative marks.

- Leasing vs. buying for credit: Both can build credit, but buying may offer longer-term credit benefits due to longer loan terms.

- Check your credit report regularly: Monitor your reports to ensure lease payments are being reported accurately.

📑 Table of Contents

- Does Leasing a Car Build Credit? A Complete Guide

- How Credit Scores Work: The Basics You Need to Know

- Does Leasing a Car Appear on Your Credit Report?

- How Leasing Builds Credit: The Positive Impact

- When Leasing Hurts Your Credit: The Risks to Avoid

- Leasing vs. Buying: Which Builds Credit Better?

- Tips to Maximize Credit Building While Leasing

- Common Misconceptions About Leasing and Credit

- Final Thoughts: Should You Lease to Build Credit?

Does Leasing a Car Build Credit? A Complete Guide

So you’re thinking about leasing a car—maybe you love driving a new vehicle every few years, or you want lower monthly payments compared to buying. But here’s a question that often gets overlooked: *Does leasing a car build credit?*

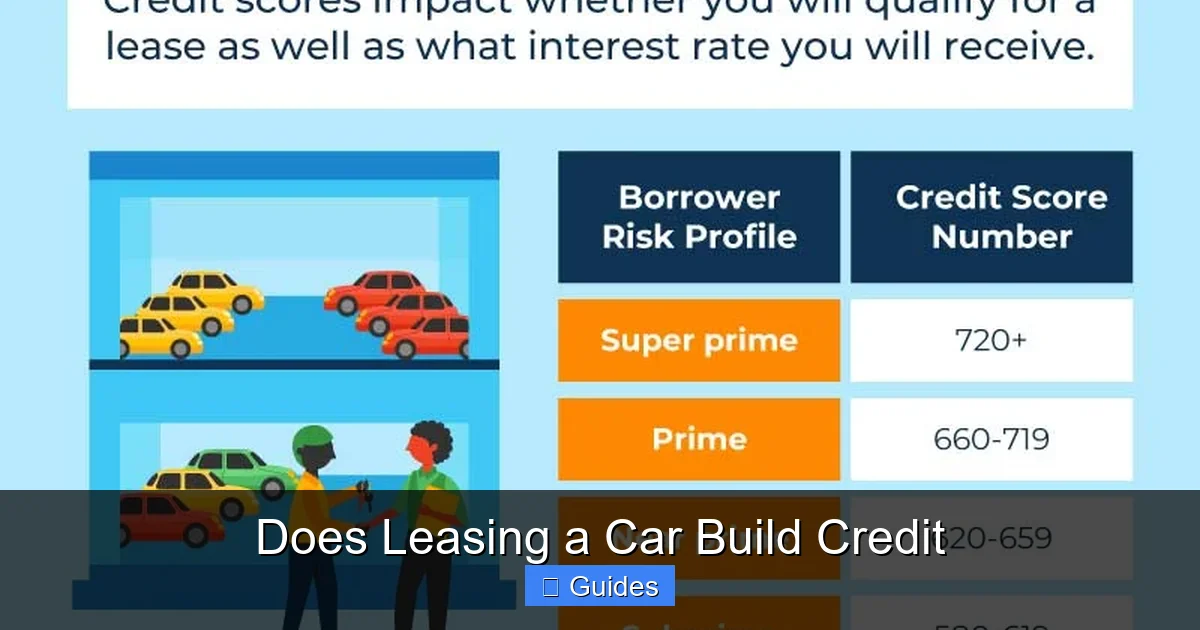

It’s a smart question, especially if you’re trying to improve your credit score or establish a solid credit history. After all, your credit score affects everything from loan approvals to interest rates on mortgages and credit cards. And while most people know that paying off a car loan can help build credit, leasing is a bit more mysterious.

The short answer? Yes, leasing a car *can* build credit—but only under the right conditions. It’s not automatic, and it depends heavily on whether the leasing company reports your payments to the major credit bureaus. In this guide, we’ll break down exactly how car leasing affects your credit, what you need to know before signing a lease, and how to make sure your lease works in your favor.

Whether you’re a first-time lessee or just curious about credit-building strategies, this article will give you the clarity you need to make informed decisions. Let’s dive in.

How Credit Scores Work: The Basics You Need to Know

Visual guide about Does Leasing a Car Build Credit

Image source: experian.com

Before we get into how leasing impacts your credit, let’s quickly go over how credit scores are calculated. Understanding this will help you see why certain lease behaviors matter—and why others don’t.

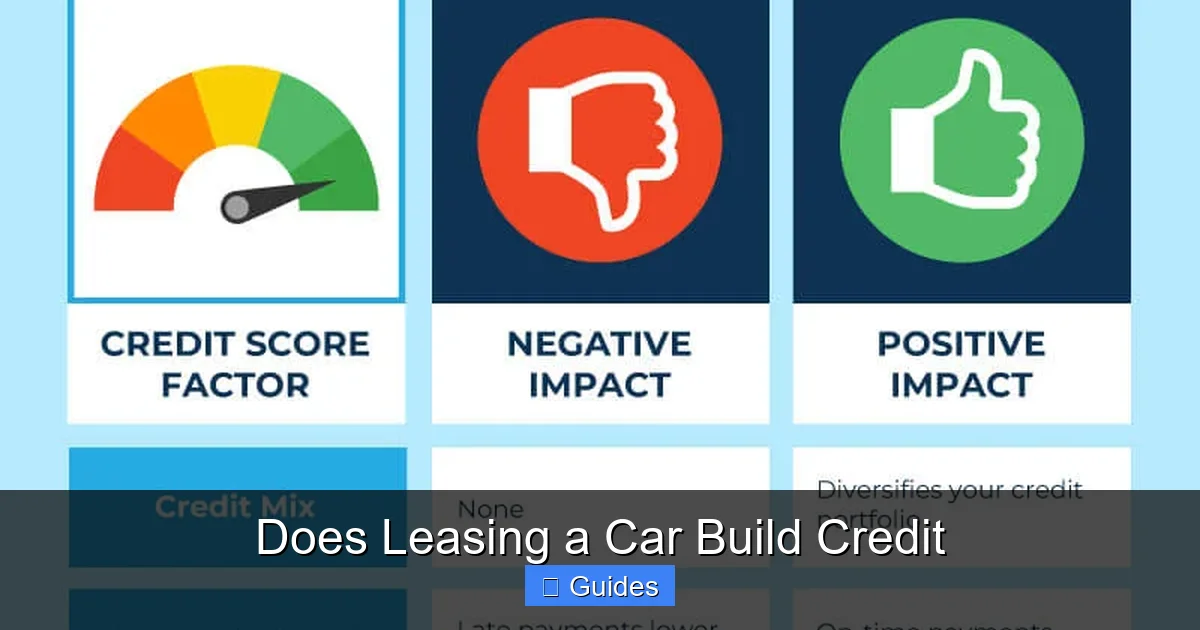

Your credit score is a three-digit number, typically ranging from 300 to 850, that reflects your creditworthiness. The most common scoring model is FICO, used by about 90% of top lenders. FICO scores are based on five key factors:

- Payment history (35%): This is the biggest factor. It tracks whether you’ve paid your bills on time.

- Amounts owed (30%): Also known as credit utilization, this looks at how much debt you have compared to your credit limits.

- Length of credit history (15%): How long you’ve had credit accounts open.

- Credit mix (10%): The variety of credit types you use, like credit cards, loans, and mortgages.

- New credit (10%): How many new accounts you’ve opened recently.

Now, here’s the key takeaway: **Only accounts that are reported to the credit bureaus affect your score.** If a lender or leasing company doesn’t report your payments, your on-time payments won’t help—and your late payments won’t hurt (at least not directly).

That’s why it’s crucial to know whether your lease will be reported. More on that in a moment.

Does Leasing a Car Appear on Your Credit Report?

Visual guide about Does Leasing a Car Build Credit

Image source: images.ctfassets.net

This is the million-dollar question: *Will my car lease show up on my credit report?*

The answer is: **It depends.**

Most major leasing companies—like those affiliated with big automakers such as Toyota, Honda, Ford, or BMW—do report lease payments to the three major credit bureaus: Equifax, Experian, and TransUnion. When they do, your lease will appear as an installment account on your credit report, similar to a car loan.

But not all leasing companies report. Smaller, independent leasing firms or regional dealerships may not report to the bureaus at all. In those cases, your lease payments won’t impact your credit score—positively or negatively.

So how can you tell if your lease will be reported?

Ask the Dealer or Leasing Company

The easiest way is to simply ask. Before you sign the lease agreement, ask the dealer or leasing representative: *“Do you report lease payments to the credit bureaus?”* If they say yes, that’s a good sign. If they’re unsure or say no, your payments likely won’t help your credit.

You can also check your credit report after a few months of payments. If the lease appears as an active account, it’s being reported. If not, it probably isn’t.

Look for Clues in the Lease Agreement

Sometimes, the lease agreement will mention credit reporting. While it’s not always explicit, phrases like “credit reporting may occur” or “account activity may be reported” are hints that your payments could show up on your report.

Keep in mind: even if the lease isn’t reported initially, some companies may start reporting later, especially if you miss a payment. But for building credit, you want consistent, positive reporting from the start.

How Leasing Builds Credit: The Positive Impact

Visual guide about Does Leasing a Car Build Credit

Image source: images.ctfassets.net

If your lease is reported to the credit bureaus, it can be a powerful tool for building credit—especially if you’re new to credit or trying to recover from past mistakes.

Here’s how leasing helps:

1. Establishes a Positive Payment History

Payment history is the most important factor in your credit score, making up 35% of your FICO score. When you make on-time lease payments month after month, you’re building a track record of reliability.

For example, let’s say you lease a car for 36 months and pay $350 every month on time. That’s 36 consecutive on-time payments added to your credit history. Over time, this can significantly boost your score, especially if you don’t have many other credit accounts.

2. Adds to Your Credit Mix

Credit mix accounts for 10% of your score. Having a variety of credit types—like credit cards, student loans, mortgages, and installment loans—can improve your score.

A car lease counts as an installment loan, which is different from revolving credit (like credit cards). If your credit history is mostly made up of credit cards, adding a lease can diversify your credit mix and give your score a small but meaningful lift.

3. Helps Build Credit Length (Over Time)

While the length of your credit history is only 15% of your score, it still matters. A longer history of responsible credit use looks good to lenders.

Even though a lease typically lasts 2–4 years, it still contributes to your overall credit timeline. And if you lease multiple cars over the years, each lease adds to your credit history.

Real-Life Example: Sarah’s Credit Journey

Let’s look at a real-world scenario. Sarah, 24, has a thin credit file—she has one credit card and no loans. She decides to lease a Honda Civic for three years. The leasing company reports to all three bureaus.

For the first six months, Sarah pays her $320 lease payment on time every month. After six months, she checks her credit score and sees it has increased by 40 points. Why? Her on-time payments are now showing up, and she’s building a positive payment history.

By the end of her lease, Sarah’s score has climbed another 30 points. She’s now in a much better position to qualify for a mortgage or auto loan with lower interest rates.

This is how leasing can build credit—when done right.

When Leasing Hurts Your Credit: The Risks to Avoid

While leasing can help build credit, it can also hurt it—especially if you’re not careful.

Here’s what can go wrong:

1. Late or Missed Payments

Just like with any loan, late lease payments can damage your credit. If you’re more than 30 days late, the leasing company may report it to the credit bureaus. A single late payment can drop your score by 50–100 points, depending on your current score and credit history.

For example, if your score is 720 and you miss a lease payment, it could drop to 650 or lower. That’s a big hit—and it can stay on your report for up to seven years.

2. Defaulting on the Lease

If you stop making payments altogether, the leasing company may repossess the car. A repossession is a major negative mark on your credit report and can drop your score dramatically. It also makes it harder to get approved for future loans or leases.

3. Excessive Wear and Tear Fees

At the end of your lease, you’re responsible for returning the car in good condition. If there’s excessive wear and tear—like deep scratches, dents, or interior damage—you may be charged fees.

If you don’t pay those fees, the leasing company might send the debt to collections. And yes, collections accounts appear on your credit report and can severely damage your score.

4. Early Termination Fees

Ending your lease early usually comes with penalties. If you can’t pay those fees, the leasing company may report the delinquency to the credit bureaus.

How to Avoid These Pitfalls

The best way to protect your credit while leasing is simple: **Stay current on payments and read your lease agreement carefully.**

Set up automatic payments so you never miss a due date. Budget for potential end-of-lease charges. And if you’re struggling to make payments, contact the leasing company early—many offer hardship programs or payment extensions.

Leasing vs. Buying: Which Builds Credit Better?

Now that we’ve covered how leasing affects credit, you might be wondering: *Is leasing better than buying for building credit?*

The answer isn’t black and white—it depends on your situation.

Similarities in Credit Impact

Both leasing and buying a car can build credit if the payments are reported to the credit bureaus. In both cases, on-time payments help your score, while late payments hurt it.

For example, if you finance a $25,000 car with a 60-month loan and make on-time payments, you’re building credit just like you would with a lease.

Key Differences

There are a few important differences:

- Loan term length: Car loans typically last 5–7 years, while leases are usually 2–4 years. A longer loan term means more time to build credit history.

- Ownership: When you buy, you own the car at the end. With a lease, you return it. This doesn’t directly affect credit, but it changes your financial picture.

- Credit mix: Both count as installment loans, so they contribute similarly to credit mix.

- End-of-term impact: With a lease, you may face fees for wear and tear or mileage overages. With a loan, you just pay it off and own the car.

Which Is Better for Building Credit?

If your goal is purely to build credit, **buying may have a slight edge** because of the longer loan term. More months of on-time payments mean more data for your credit history.

But if you prefer lower monthly payments, newer cars, and the flexibility to upgrade every few years, leasing can still be a great option—especially if it’s reported to the credit bureaus.

The key is consistency. Whether you lease or buy, making on-time payments is what really builds credit.

Tips to Maximize Credit Building While Leasing

If you’re leasing a car and want to use it as a credit-building tool, here are some practical tips to get the most out of it:

1. Confirm Reporting Before You Sign

As mentioned earlier, ask the leasing company if they report to Equifax, Experian, and TransUnion. If they don’t, consider choosing a different lender or negotiating with the dealer to use a reporting finance company.

2. Set Up Automatic Payments

Autopay ensures you never miss a payment. Even one late payment can hurt your score, so automation is your best friend.

3. Monitor Your Credit Report

Check your credit report every few months (you can get free reports at AnnualCreditReport.com). Make sure your lease appears and that payments are marked as “on time.” If there’s an error, dispute it immediately.

4. Avoid Excessive Mileage or Damage

Stay within your lease’s mileage limit and take care of the car. This prevents surprise fees at the end that could lead to collections if unpaid.

5. Consider a Lease Buyout (Optional)

At the end of your lease, you may have the option to buy the car. If you do, the buyout amount could be financed, giving you another installment loan to build credit with. This only makes sense if the car is worth buying, though.

6. Use a Co-Signer if Needed

If your credit is poor, a co-signer with good credit can help you qualify for a lease. Just remember: the co-signer is equally responsible for payments, and their credit will also be affected.

Common Misconceptions About Leasing and Credit

There are a lot of myths floating around about leasing and credit. Let’s clear up a few:

“Leasing doesn’t affect credit at all.”

False. If the lease is reported, it absolutely affects your credit—both positively and negatively.

“Only car loans build credit.”

Not true. Any reported installment account, including leases, can build credit.

“You can’t build credit with a lease because you don’t own the car.”

Ownership doesn’t matter for credit scoring. What matters is payment behavior and reporting.

“Leasing hurts your credit because it’s not a real loan.”

Leasing is a form of financing and is treated similarly to a loan by credit bureaus when reported.

“I can skip payments if I’m struggling—no one will know.”

If the lease is reported, skipped payments will show up and hurt your score. Always communicate with the lender if you’re having trouble.

Final Thoughts: Should You Lease to Build Credit?

So, does leasing a car build credit? The answer is: **Yes, but only if the leasing company reports your payments to the credit bureaus and you make on-time payments consistently.**

Leasing can be a smart way to build credit, especially if you’re new to credit or trying to improve your score. It adds to your payment history, diversifies your credit mix, and gives you a chance to prove financial responsibility.

But it’s not a magic fix. You still need to manage your lease wisely—pay on time, avoid excessive fees, and monitor your credit report.

If you’re deciding between leasing and buying, consider your financial goals, driving habits, and credit needs. Both can build credit, but leasing offers lower monthly payments and newer vehicles, while buying gives you ownership and potentially longer credit-building terms.

Ultimately, the best credit-building strategy is responsible financial behavior—no matter how you finance your car.

Frequently Asked Questions

Does leasing a car build credit if the payments aren’t reported?

No, if the leasing company doesn’t report your payments to the credit bureaus, your lease won’t affect your credit score. Only reported accounts influence your credit history.

How long does it take for leasing to improve my credit score?

You may see improvements in as little as 3–6 months of on-time payments, but significant score increases usually take 12–24 months of consistent, responsible behavior.

Can I build credit with a lease if I have bad credit?

Yes, leasing can help rebuild credit, especially if you make all payments on time. Some leasing companies offer programs for people with lower credit scores.

What happens to my credit when my lease ends?

If you’ve made all payments on time and returned the car in good condition, your credit should remain strong. The account will show as “closed” but still contribute positively to your history.

Will leasing a car lower my credit score initially?

Applying for a lease may cause a small, temporary dip due to a hard credit inquiry. But once you start making on-time payments, your score should improve over time.

Is it better to lease or buy a car to build credit?

Both can build credit, but buying may offer longer-term benefits due to longer loan terms. Choose based on your financial goals, not just credit building.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.