Leasing a car is like renting it long-term, with lower monthly payments than buying—but you don’t own it. You pay for the vehicle’s depreciation during the lease term, plus fees and interest, and return it at the end unless you choose to buy it.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Is a Car Lease?

- 4 How Car Leasing Works: The Basics

- 5 Pros and Cons of Leasing a Car

- 6 Mileage Limits and Wear-and-Tear Rules

- 7 End-of-Lease Options: What Happens When Your Lease Ends?

- 8 Tips for Getting the Best Car Lease Deal

- 9 Leasing vs. Buying: Which Is Right for You?

- 10 Final Thoughts: Is Leasing Right for You?

- 11 Frequently Asked Questions

Key Takeaways

- Lower monthly payments: Lease payments are typically 20–40% lower than loan payments for the same car because you’re only paying for the vehicle’s depreciation during the lease term, not the full value.

- Mileage limits apply: Most leases include an annual mileage cap (usually 10,000–15,000 miles). Exceeding it results in per-mile fees, so choose a limit that matches your driving habits.

- Wear and tear matters: You’re responsible for excess wear and damage beyond “normal use.” Keep the car clean, maintain it well, and document its condition to avoid surprise charges.

- No equity buildup: Unlike buying, leasing doesn’t build ownership or equity. Once the lease ends, you walk away (or buy the car) with no financial stake unless you purchase it.

- Early termination is costly: Ending a lease early usually triggers steep penalties, including remaining payments and fees—so only lease if you’re confident in your timeline.

- End-of-lease options: At the end, you can return the car, lease a new one, or buy the vehicle at its predetermined residual value.

- Gap insurance is often included: Most leases include gap coverage, which pays the difference if the car is totaled and insurance doesn’t cover the full lease balance.

📑 Table of Contents

- What Is a Car Lease?

- How Car Leasing Works: The Basics

- Pros and Cons of Leasing a Car

- Mileage Limits and Wear-and-Tear Rules

- End-of-Lease Options: What Happens When Your Lease Ends?

- Tips for Getting the Best Car Lease Deal

- Leasing vs. Buying: Which Is Right for You?

- Final Thoughts: Is Leasing Right for You?

What Is a Car Lease?

Imagine renting a car—but for two, three, or even four years. That’s essentially what a car lease is: a long-term rental agreement where you pay to use a vehicle without ever owning it. Instead of financing the entire cost of the car like you would with a loan, you’re only paying for the portion of the car’s value that it loses during your lease period—this is called depreciation.

Car leasing has become increasingly popular, especially among drivers who want lower monthly payments, enjoy driving new vehicles every few years, or don’t want the hassle of selling a car down the line. It’s common for people leasing luxury cars, tech-heavy models, or vehicles with strong resale value. But while leasing offers flexibility and affordability upfront, it comes with rules, restrictions, and long-term costs that aren’t always obvious at first glance.

So how does a car lease work, exactly? In simple terms, you agree to use the car for a set period (usually 24 to 36 months), drive within a mileage limit, keep it in good condition, and return it in acceptable shape at the end. In return, you make monthly payments that cover the car’s depreciation, plus interest (called the “money factor”), taxes, and fees. At the end of the lease, you can walk away, lease a new car, or buy the vehicle at a pre-agreed price.

How Car Leasing Works: The Basics

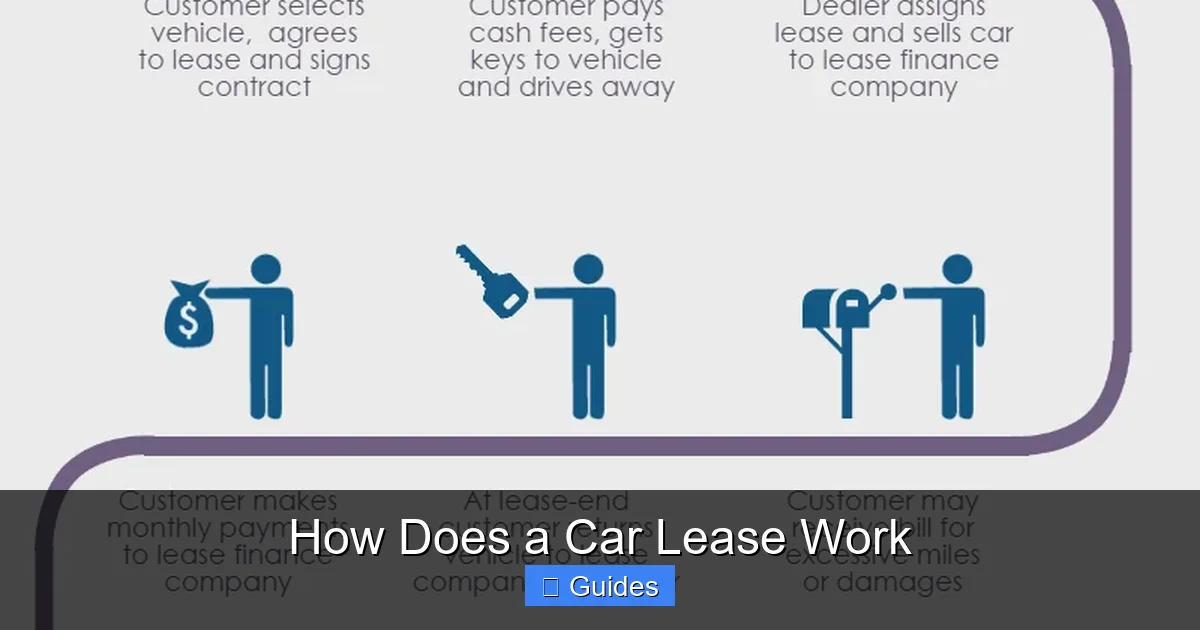

To understand how a car lease works, think of it as a three-act play: the beginning (signing the lease), the middle (driving and maintaining the car), and the end (returning or buying the vehicle). Each stage has its own rules and responsibilities.

Visual guide about How Does a Car Lease Work

Image source: moneydigest.com

The Lease Agreement

When you sign a lease, you’re entering a legal contract with the leasing company (often the car manufacturer’s finance arm, like Toyota Financial Services or Ford Credit). This agreement outlines everything: the lease term, monthly payment, mileage allowance, fees, and what happens at the end. It’s crucial to read every detail—don’t just skim and sign.

Key Components of a Lease

Several factors determine your monthly payment and overall cost:

- Capitalized Cost: This is the negotiated price of the car—similar to the purchase price if you were buying. The lower this number, the lower your payments. Always negotiate this just like you would when buying.

- Residual Value: This is the car’s estimated worth at the end of the lease, expressed as a percentage of its original MSRP. For example, a $30,000 car with a 60% residual value will be worth $18,000 after three years. Higher residuals mean lower depreciation and lower payments.

- Money Factor: This is the lease’s interest rate, written as a decimal (e.g., 0.00250). To convert it to an approximate APR, multiply by 2,400. So 0.00250 × 2,400 = 6% APR. A lower money factor means lower finance charges.

- Lease Term: Most leases last 24, 36, or 48 months. Shorter terms mean higher monthly payments but less total interest. Longer terms spread out costs but may result in higher overall fees.

- Down Payment (Cap Cost Reduction): Some lessees put money down to lower monthly payments. However, this is risky—if the car is totaled early, you may not get that money back unless you have gap insurance.

Example: Breaking Down a Lease Payment

Let’s say you’re leasing a $35,000 car with a 36-month term, a 60% residual value ($21,000), and a money factor of 0.00200 (about 4.8% APR). You negotiate the capitalized cost down to $32,000.

- Depreciation: $32,000 – $21,000 = $11,000

- Monthly depreciation: $11,000 ÷ 36 = $305.56

- Finance charge: ($32,000 + $21,000) × 0.00200 = $106

- Estimated monthly payment (before taxes/fees): ~$411.56

This simplified example shows how your payment is calculated. Real-world payments also include taxes, acquisition fees, and other charges.

Pros and Cons of Leasing a Car

Leasing isn’t for everyone—but for the right person, it can be a smart financial move. Let’s look at the advantages and drawbacks so you can decide if it fits your lifestyle and budget.

Visual guide about How Does a Car Lease Work

Image source: assets.carpages.ca

Advantages of Leasing

- Lower Monthly Payments: Because you’re only paying for depreciation—not the full value of the car—your monthly payments are significantly lower than a loan payment for the same vehicle. This frees up cash for other expenses or investments.

- Drive a New Car More Often: Most leases last 2–3 years, so you can upgrade to the latest model with updated safety features, tech, and styling every few years without the hassle of selling your old car.

- Lower Repair Costs: Leased cars are typically under the manufacturer’s warranty for the entire lease term. That means major repairs are covered, and you avoid unexpected out-of-pocket expenses.

- No Resale Hassle: When the lease ends, you simply return the car. No need to worry about market value, private sales, or trade-in negotiations.

- Tax Benefits for Business Use: If you use the car for work, you may be able to deduct a portion of lease payments as a business expense (consult a tax professional).

Disadvantages of Leasing

- No Ownership: You don’t build equity. Once the lease ends, you have nothing to show for your payments unless you buy the car.

- Mileage Restrictions: Most leases limit you to 10,000–15,000 miles per year. Go over, and you’ll pay 10–25 cents per extra mile—which adds up fast.

- Fees for Wear and Tear: Scratches, dents, stained upholstery, or damaged tires beyond “normal use” can result in hefty charges at lease-end.

- Early Termination Penalties: Need to end the lease early? You’ll likely pay a large fee—often equivalent to several months of payments—plus administrative costs.

- Customization Limits: You can’t modify a leased car (like adding a spoiler or tinting windows) without risking damage charges or violating the lease terms.

- Long-Term Cost: While monthly payments are lower, leasing repeatedly can cost more over time than buying and keeping a car for 5–10 years.

Who Should Lease?

Leasing makes the most sense for people who:

- Drive fewer than 12,000 miles per year

- Want lower monthly payments

- Enjoy having a new car every few years

- Don’t want to deal with long-term maintenance or resale

- Can afford to pay for a car indefinitely (since you never own it)

Mileage Limits and Wear-and-Tear Rules

Two of the biggest “gotchas” in car leasing are mileage limits and wear-and-tear charges. Understanding these can save you hundreds—or even thousands—of dollars.

Visual guide about How Does a Car Lease Work

Image source: leaseguide.com

Mileage Limits Explained

Every lease includes an annual mileage allowance, typically between 10,000 and 15,000 miles. If you exceed this limit, you’ll be charged a per-mile fee—usually 15 to 25 cents. For example, driving 18,000 miles in a year on a 12,000-mile lease means 6,000 extra miles. At 20 cents per mile, that’s a $1,200 penalty.

Tip: If you know you’ll drive more than average, consider a higher mileage lease upfront. It’s almost always cheaper than paying overage fees later. Some dealers offer 18,000- or 20,000-mile leases for a slightly higher monthly payment.

What Counts as “Excess Wear and Tear”?

Leasing companies define “normal wear and tear” loosely, but they’re strict about what’s acceptable. Here’s what you might be charged for:

- Paint damage beyond minor scratches (e.g., deep gouges, rust)

- Tire tread below legal limits or uneven wear

- Stains, burns, or tears in upholstery

- Cracked or chipped windshield

- Damaged wheels or hubcaps

- Odors (smoke, pets, etc.)

Pro Tip: Take photos of the car before you drive it off the lot and keep maintenance records. At lease-end, consider a professional detailing service to minimize charges. Some lessees even hire third-party inspectors to assess the car before return.

How to Avoid Fees

- Stay within your mileage limit—track your odometer monthly.

- Follow the manufacturer’s maintenance schedule (oil changes, tire rotations, etc.).

- Use seat covers, floor mats, and paint protection film to preserve interior and exterior.

- Avoid smoking or transporting pets without protective covers.

- Repair minor damage (like small dents or chips) before returning the car.

End-of-Lease Options: What Happens When Your Lease Ends?

When your lease term is up, you have three main choices: return the car, lease a new one, or buy the vehicle. Each option has pros, cons, and financial implications.

Option 1: Return the Car

This is the most common choice. You bring the car back to the dealership, undergo an inspection, and pay any fees for excess mileage or wear. If everything checks out, you walk away—no further obligations.

Tip: Schedule your return a few weeks early to avoid last-minute stress. Some dealers offer “lease-end packages” that include inspection, detailing, and paperwork for a flat fee.

Option 2: Lease a New Car

Many lessees roll directly into a new lease. Dealers often offer incentives—like waived acquisition fees or reduced down payments—to keep you in their brand. This is convenient if you love driving new cars and don’t want ownership responsibilities.

Watch Out: Be careful not to get trapped in a cycle of perpetual payments. If you lease forever, you’ll always have a car payment and never build equity.

Option 3: Buy the Car

You can purchase the vehicle at its residual value—the price set at the beginning of the lease. This can be a great deal if the car has held its value well or if you’ve grown attached to it.

Example: Your lease started with a $30,000 car and a 60% residual value ($18,000). If the market value today is $20,000, you’re getting a $2,000 discount by buying it.

Tip: Have the car appraised by a third party before deciding. If the market value is lower than the residual, it may be better to walk away and buy a similar used car elsewhere.

Can You Sell the Car Yourself?

Technically, no—you don’t own it. But you can arrange a “lease buyout” where a third party (like a dealership or private buyer) pays the residual value to the leasing company and takes ownership. This is rare and complicated, so buying it yourself is usually simpler.

Tips for Getting the Best Car Lease Deal

Leasing can be a great value—if you do it right. Here’s how to maximize savings and avoid common pitfalls.

Negotiate the Capitalized Cost

Just like buying, the capitalized cost is negotiable. Research the car’s invoice price (what the dealer paid) and aim to lease it at or below that number. Use online tools like Edmunds or Kelley Blue Book to find fair market values.

Watch Out for Fees

Leases come with many fees: acquisition fee ($500–$1,000), disposition fee ($300–$500 if you return the car), title and registration, and more. Ask for a full breakdown before signing. Some dealers roll fees into the capitalized cost to hide them—don’t let them.

Consider a $0 Down Lease

While putting money down lowers your monthly payment, it’s risky. If the car is stolen or totaled early, you lose that money unless you have gap insurance. Instead, look for leases with low or no down payment and use that cash as a safety net.

Check the Residual Value

Cars with high residual values (like Toyotas, Hondas, and Subarus) cost less to lease because they depreciate slowly. Avoid leasing cars with poor resale value—they’ll cost more per month.

Time Your Lease Right

End-of-year sales, holiday promotions, and new model-year launches often bring the best lease deals. Dealers want to move inventory, so they offer lower money factors and higher residuals.

Read the Fine Print

Don’t skip the details. Look for clauses about early termination, transferability, and insurance requirements. Make sure gap insurance is included—most leases require it.

Leasing vs. Buying: Which Is Right for You?

The age-old debate: lease or buy? There’s no one-size-fits-all answer—it depends on your financial goals, driving habits, and lifestyle.

Leasing Is Better If You…

- Want lower monthly payments

- Drive less than 12,000 miles per year

- Enjoy having a new car every 2–3 years

- Don’t want to worry about long-term repairs or resale

- Can afford to pay for a car indefinitely

Buying Is Better If You…

- Drive a lot (over 15,000 miles per year)

- Want to build equity and own your car outright

- Plan to keep the car for 5+ years

- Like to customize or modify your vehicle

- Want to minimize long-term transportation costs

Bottom Line: Leasing offers short-term savings and convenience, while buying builds long-term value. Run the numbers for your situation—sometimes the difference is smaller than you think.

Final Thoughts: Is Leasing Right for You?

So, how does a car lease work? It’s a flexible, lower-cost way to drive a new vehicle without the commitment of ownership. You pay for depreciation, stay within mileage and condition limits, and return the car at the end—unless you choose to buy it. For the right driver, leasing is a smart, stress-free option.

But it’s not a free ride. Hidden fees, mileage penalties, and wear-and-tear charges can add up. And if you’re someone who drives a lot, loves to personalize your car, or wants to stop making payments someday, buying might be the better path.

Before you sign, ask yourself: Do I understand the terms? Can I stick to the mileage limit? Am I okay with never owning this car? If you answer yes, leasing could be a great fit. Just remember—knowledge is power. The more you know about how a car lease works, the better decisions you’ll make.

Frequently Asked Questions

Can I lease a car with bad credit?

Yes, but it may be more expensive. Leasing companies check your credit score, and lower scores often result in higher money factors (interest rates) or require a larger down payment. Some subprime lenders offer leases, but read the terms carefully to avoid excessive fees.

What happens if I total a leased car?

If your leased car is totaled, your insurance will pay the actual cash value. Most leases include gap insurance, which covers the difference between that amount and what you still owe. Without gap coverage, you could be on the hook for thousands.

Can I transfer my lease to someone else?

Some leases allow transfer (called lease assumption), but it’s not guaranteed. The leasing company must approve the new lessee’s credit, and fees may apply. It’s easier with certain brands like Mercedes or BMW, which have formal transfer programs.

Is it better to lease or buy a used car?

Leasing a used car (sometimes called a “CPO lease”) can offer lower payments and less depreciation risk. However, used car leases are less common and may have higher interest rates. Compare total costs over time to see what makes sense.

Do I need full coverage insurance on a leased car?

Yes. Leasing companies require comprehensive and collision coverage with low deductibles (usually $500 or less). This protects their asset—the car—in case of damage or theft. Skimping on insurance could violate your lease agreement.

Can I negotiate a lease?

Absolutely. You can negotiate the capitalized cost, money factor, and even the residual value (in some cases). Dealers want to make a sale, so don’t be afraid to ask for better terms—just be prepared to walk away if they don’t budge.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.