Leasing a car lets you drive a new vehicle for a set period—usually 2–4 years—with lower monthly payments than buying. You pay only for the car’s depreciation during the lease term, plus fees and interest, but you don’t own it at the end. It’s ideal if you like driving new cars often and want lower upfront costs, but it comes with mileage limits and wear-and-tear rules.

Thinking about getting behind the wheel of a shiny new car—but not sure if buying or leasing is the better move? You’re not alone. Car leasing has become an increasingly popular alternative to traditional auto loans, especially for drivers who value lower monthly payments, the latest tech features, and the thrill of driving something fresh every few years. But while leasing sounds appealing, it’s not a one-size-fits-all solution. Understanding how leasing a car works—from the fine print to the final handshake—can save you thousands and help you avoid common pitfalls.

At its core, leasing a car is like renting it long-term. Instead of purchasing the vehicle outright, you essentially pay to use it for a fixed period, typically 24, 36, or 48 months. During that time, you cover the car’s depreciation (the drop in value while you drive it), plus interest (called the “money factor”), taxes, and fees. When the lease ends, you return the car—unless you decide to buy it at its predetermined residual value. This structure means your monthly payments are generally lower than if you were financing the same car to own it. But it also means you never actually own the vehicle unless you exercise the purchase option.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 How Car Leasing Works: The Basics

- 4 Leasing vs. Buying: Which Is Right for You?

- 5 The Lease Application and Approval Process

- 6 Understanding Lease Payments and Fees

- 7 Driving During the Lease Term

- 8 End-of-Lease Options: What Happens When Your Lease Ends?

- 9 Pros and Cons of Leasing a Car

- 10 Tips for Getting the Best Lease Deal

- 11 Frequently Asked Questions

Key Takeaways

- Lower monthly payments: Leasing typically costs less per month than financing a purchase because you’re only paying for the vehicle’s depreciation during the lease term.

- Drive a new car more often: Most leases last 24 to 36 months, so you can upgrade to a newer model every few years without the hassle of selling your old car.

- Mileage restrictions apply: Leases come with annual mileage limits (usually 10,000–15,000 miles); exceeding them results in per-mile fees at lease end.

- No ownership at the end: Unlike buying, leasing doesn’t build equity—you return the car unless you choose to buy it at its residual value.

- Wear and tear guidelines: You’re responsible for excess damage beyond “normal use,” which may lead to additional charges when returning the vehicle.

- Gap insurance is usually included: Most leases include gap coverage, protecting you if the car is totaled or stolen and the insurance payout falls short of what you owe.

- Early termination fees may apply: Ending a lease early often incurs steep penalties, so it’s best to commit for the full term unless your contract allows flexibility.

📑 Table of Contents

- How Car Leasing Works: The Basics

- Leasing vs. Buying: Which Is Right for You?

- The Lease Application and Approval Process

- Understanding Lease Payments and Fees

- Driving During the Lease Term

- End-of-Lease Options: What Happens When Your Lease Ends?

- Pros and Cons of Leasing a Car

- Tips for Getting the Best Lease Deal

How Car Leasing Works: The Basics

So, what exactly happens when you lease a car? Let’s break it down step by step.

First, you select the make, model, and trim level you want—just like you would when buying. Then, you negotiate the capitalized cost (essentially the price of the car). Unlike buying, where you might haggle over the total price, leasing focuses heavily on this number because it directly affects your monthly payment. A lower capitalized cost means lower payments.

Next, the leasing company (often the automaker’s finance arm, like Toyota Financial Services or Ford Credit) determines the car’s residual value—the estimated worth of the vehicle at the end of the lease. For example, a $40,000 car with a 60% residual after three years would be worth $24,000 at lease end. Your monthly payment covers the difference between the capitalized cost and the residual value—that’s the depreciation—plus finance charges and taxes.

You’ll also agree on a lease term (how long you’ll keep the car) and an annual mileage limit. Most leases allow 10,000 to 15,000 miles per year. If you drive more, you’ll pay extra per mile at the end—often $0.10 to $0.25 per mile over the limit. Finally, you’ll pay an upfront cost, which may include the first month’s payment, a security deposit, acquisition fee, and taxes.

Key Lease Terms Explained

To truly understand how leasing a car works, you need to know these essential terms:

– **Capitalized Cost**: The negotiated price of the vehicle. Lower is better.

– **Residual Value**: The car’s projected value at lease end, expressed as a percentage of its original MSRP.

– **Money Factor**: The lease equivalent of an interest rate. Multiply it by 2,400 to get an approximate APR.

– **Depreciation**: The difference between the capitalized cost and residual value—this is what you’re really paying for.

– **Lease Term**: The length of the lease, usually 24–48 months.

– **Mileage Allowance**: The number of miles you’re allowed to drive annually without penalty.

– **Disposition Fee**: A charge (often $300–$500) for processing the return of the vehicle at lease end.

Leasing vs. Buying: Which Is Right for You?

Visual guide about How Leasing a Car Works

Image source: centralcontracts.uk

One of the biggest decisions drivers face is whether to lease or buy. Both have pros and cons, and the right choice depends on your lifestyle, driving habits, and financial goals.

If you lease, you’ll enjoy lower monthly payments, minimal maintenance worries (since most leases fall within the manufacturer’s warranty period), and the ability to drive a new car every few years. You also avoid the hassle of selling or trading in a used car. However, you don’t build equity, and you’re subject to mileage and condition restrictions.

Buying, on the other hand, means higher monthly payments but full ownership once the loan is paid off. You can drive as much as you want, customize the car, and sell it whenever you choose. Over the long term, buying is usually cheaper—especially if you keep the car for many years after paying off the loan.

Let’s look at a real-world example. Say you’re choosing between a $45,000 SUV. With a 60-month loan at 5% interest, your monthly payment might be around $850. With a 36-month lease, your payment could be closer to $550. That’s a $300 monthly difference—but remember, after three years, the lessee returns the car, while the buyer still owns it and can continue driving it payment-free.

When Leasing Makes Sense

Leasing is a smart choice if:

– You prefer driving a new car every 2–4 years.

– You don’t drive more than 12,000–15,000 miles per year.

– You want lower monthly payments and minimal repair costs.

– You don’t plan to modify or heavily customize your vehicle.

– You’re comfortable not owning the car long-term.

When Buying Is Better

Buying wins if:

– You drive a lot—over 15,000 miles annually.

– You plan to keep the car for 6+ years.

– You want to build equity or avoid monthly payments eventually.

– You enjoy personalizing your vehicle (e.g., aftermarket parts, paint jobs).

– You’re looking for the lowest total cost of ownership over time.

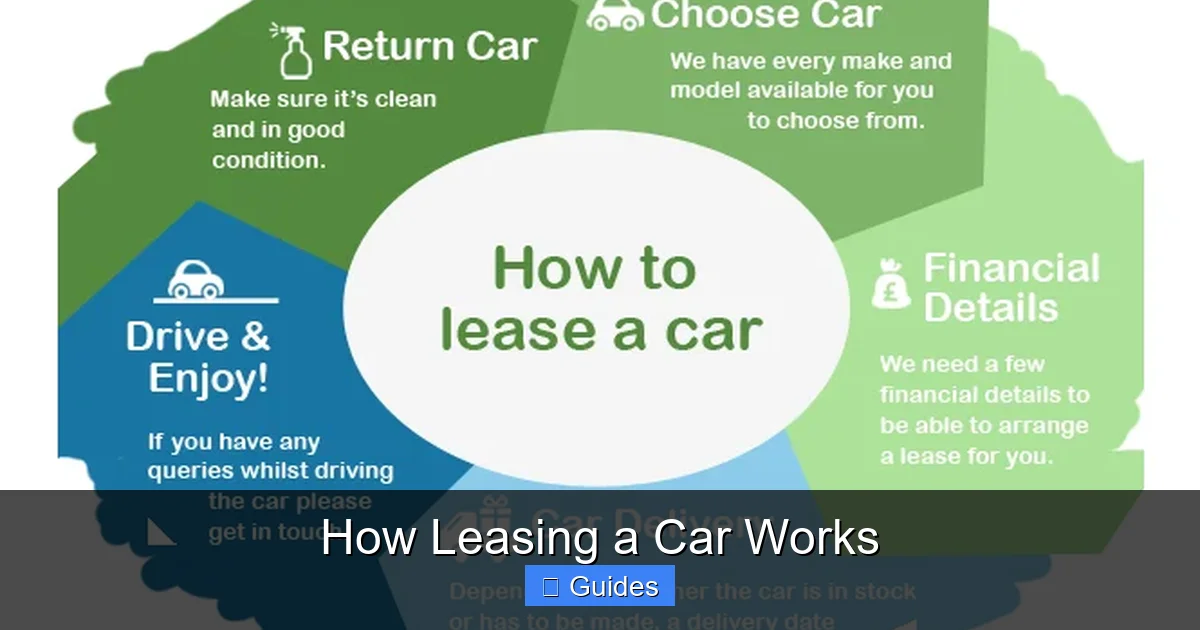

The Lease Application and Approval Process

Visual guide about How Leasing a Car Works

Image source: animagraffs.com

Once you’ve decided to lease, the next step is applying and getting approved. The process is similar to applying for a car loan, but lenders often view leases as lower risk since the vehicle remains the lessor’s asset.

You’ll typically need to provide proof of income, employment, residency, and insurance. Your credit score plays a big role—higher scores (usually 700+) qualify for the best lease deals and lowest money factors. If your credit is fair or poor, you may still get approved, but with higher payments or a larger down payment.

Many dealerships now offer online pre-approval tools, so you can check your eligibility before visiting the lot. This helps you shop with confidence and avoid surprises.

What Affects Your Lease Approval?

Several factors influence whether you’re approved and what terms you receive:

– **Credit Score**: Excellent credit (720+) unlocks the best rates and incentives.

– **Debt-to-Income Ratio**: Lenders want to see that your existing debts don’t overwhelm your income.

– **Down Payment**: A larger down payment (sometimes called a “cap cost reduction”) lowers your monthly payment but increases your risk if the car is totaled.

– **Vehicle Choice**: Some models lease better than others due to strong residual values (e.g., Toyota, Honda, Subaru).

– **Lease Incentives**: Manufacturers often offer special lease deals—like reduced money factors or waived fees—to move certain models.

Pro tip: Avoid putting too much money down on a lease. If the car is stolen or totaled, you may not get that money back—even with gap insurance. Instead, consider rolling the down payment into the monthly cost or using it to lower the capitalized cost through negotiation.

Understanding Lease Payments and Fees

Your monthly lease payment isn’t just a random number—it’s calculated using a specific formula based on several components. Knowing how it’s built helps you spot a good deal and avoid overpaying.

The base payment covers depreciation: (Capitalized Cost – Residual Value) ÷ Lease Term in Months. Then, finance charges are added: (Capitalized Cost + Residual Value) × Money Factor. Finally, taxes and fees are tacked on.

For example, leasing a $42,000 car with a $25,200 residual (60%) over 36 months gives a depreciation of $16,800, or $467 per month. Add finance charges (say, $150/month) and taxes ($50), and your total payment might be around $667.

Common Lease Fees to Watch For

Leasing comes with various fees, some negotiable, others not:

– **Acquisition Fee**: A one-time charge (often $500–$1,000) to set up the lease. Sometimes waived with incentives.

– **Security Deposit**: Refundable if you return the car in good condition (not always required).

– **Disposition Fee**: Charged when you return the car (typically $300–$500).

– **Excess Wear and Tear Fees**: Assessed if the car has damage beyond normal use.

– **Early Termination Fee**: Can be thousands of dollars if you end the lease early.

– **Excess Mileage Fees**: Charged per mile over your annual limit.

Always ask for a full breakdown of all fees before signing. Some dealers may roll fees into the capitalized cost to hide them—don’t let them!

Driving During the Lease Term

Once you drive off the lot, your lease officially begins. But that doesn’t mean you can treat the car however you want. Leases come with rules designed to protect the vehicle’s resale value.

Mileage Limits and Penalties

Most leases include an annual mileage cap—commonly 10,000, 12,000, or 15,000 miles. If you exceed it, you’ll pay a per-mile fee at lease end, often $0.15 to $0.25. For example, driving 5,000 extra miles at $0.20/mile = $1,000 in penalties.

If you know you’ll drive more, consider a higher mileage lease upfront. Paying an extra $20–$30 per month for 20,000 miles/year is cheaper than surprise fees later.

Maintenance and Wear Guidelines

You’re responsible for routine maintenance—oil changes, tire rotations, brakes—and must follow the manufacturer’s schedule. Most leases require proof of maintenance at return.

“Normal wear and tear” is allowed, but excessive damage isn’t. Scratches, dents, stained upholstery, or broken components may result in charges. Take photos when you pick up the car and keep service records.

Tip: Many lessees opt for prepaid maintenance plans or lease-end protection packages to avoid unexpected costs.

Insurance Requirements

Leases require full coverage insurance—liability, collision, and comprehensive—with higher limits than state minimums. Gap insurance is usually included, covering the difference if the car is totaled and insurance payout falls short.

Keep your insurance active throughout the lease. Lapses can result in the lessor adding their own policy (at a high cost) or terminating the lease.

End-of-Lease Options: What Happens When Your Lease Ends?

After 24, 36, or 48 months, your lease term expires—and you have three main choices:

1. **Return the Car**: The most common option. You schedule an inspection, pay any excess fees, and walk away. Some dealers offer lease-end incentives to lease another vehicle.

2. **Buy the Car**: You can purchase the vehicle at its residual value. This makes sense if the market value is higher than the residual (a “positive equity” situation) or if you’ve grown attached to the car.

3. **Lease a New Car**: Many lessees simply move into a new lease, often with the same brand or dealer.

Inspecting the Vehicle at Lease End

Before returning the car, the lessor will inspect it for damage and mileage. Use this checklist:

– Clean the interior and exterior thoroughly.

– Fix minor issues like burnt-out bulbs or wiper blades.

– Remove personal items and toll tags.

– Gather all keys, manuals, and service records.

If you’re charged for wear and tear, ask for a detailed explanation. You may be able to dispute unreasonable fees.

Should You Buy Your Leased Car?

Buying your leased car can be a smart financial move—if the numbers work. Compare the residual value to the car’s current market value (check Kelley Blue Book or Edmunds). If the market value is higher, you’re getting a deal. If it’s lower, you’re overpaying.

Example: Your lease residual is $22,000, but the car is worth $25,000 privately. Buying it saves you $3,000 versus purchasing a similar used model.

However, if the car has high mileage or damage, the residual might not reflect its true condition. Always get an independent inspection before buying.

Pros and Cons of Leasing a Car

Like any financial decision, leasing has upsides and downsides. Here’s a balanced look:

Advantages of Leasing

– **Lower monthly payments** than financing a purchase.

– **Drive a new car every few years** with the latest safety and tech features.

– **Minimal repair costs**—most leases are covered under warranty.

– **No resale hassle**—just return the car at the end.

– **Tax benefits for business use**—if you use the car for work, you may deduct a portion of lease payments.

Disadvantages of Leasing

– **No ownership or equity**—you’re always making payments.

– **Mileage restrictions** can lead to steep penalties.

– **Wear and tear fees** may surprise you at return.

– **Early termination is expensive**.

– **You’re always in debt**—no end to car payments unless you switch to buying.

Tips for Getting the Best Lease Deal

Want to lease smart? Follow these expert tips:

1. **Negotiate the capitalized cost**—not just the monthly payment. A lower price means lower payments.

2. **Shop multiple dealers**—lease deals vary widely by region and inventory.

3. **Time your lease**—end-of-year, end-of-quarter, and model-year clearance events often bring the best offers.

4. **Avoid large down payments**—they increase your risk and don’t significantly reduce payments.

5. **Read the contract carefully**—watch for hidden fees, mileage limits, and wear guidelines.

6. **Consider a lease takeover**—websites like LeaseTrader let you take over someone else’s lease, often with better terms.

Leasing a car can be a great way to enjoy a new vehicle with lower monthly costs—if you understand the rules and plan accordingly. By knowing how leasing a car works, comparing your options, and staying within the terms, you can make the most of this flexible alternative to ownership.

Frequently Asked Questions

Can you lease a car with bad credit?

Yes, but it may be more difficult and expensive. Lenders may require a larger down payment, charge higher money factors, or limit your vehicle choices. Consider improving your credit before applying or look for subprime leasing programs.

Is it better to lease or buy a car?

It depends on your needs. Leasing offers lower payments and newer cars but no ownership. Buying costs more monthly but builds equity and has no mileage limits. Choose based on your driving habits, budget, and long-term goals.

What happens if you go over your mileage limit?

You’ll be charged a per-mile fee at lease end, typically $0.10 to $0.25 per mile. For example, exceeding by 3,000 miles could cost $300–$750. To avoid this, estimate your annual mileage accurately or choose a higher-mileage lease.

Can you terminate a car lease early?

Yes, but it’s usually costly. Early termination fees can be thousands of dollars. Some leases allow transfer to another person (lease assumption), which may reduce penalties. Always check your contract for exit options.

Do you need gap insurance when leasing?

Most leases include gap insurance automatically, covering the difference if the car is totaled and insurance payout falls short. Confirm this with your lessor—don’t assume it’s included unless stated in writing.

Can you negotiate a car lease?

Absolutely! You can negotiate the capitalized cost, money factor, and even some fees. Focus on the total cost, not just the monthly payment. Research invoice prices and current incentives to strengthen your position.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.