Figuring out how much car you can afford based on salary doesn’t have to be confusing. By following simple budgeting rules and understanding your financial picture, you can make a smart, stress-free car purchase that fits your lifestyle—without breaking the bank.

Buying a car is one of the biggest financial decisions most people make—right after purchasing a home. But unlike a house, a car starts losing value the moment you drive it off the lot. That’s why it’s so important to figure out how much car you can afford based on salary before you start browsing dealerships or scrolling through online listings.

You might be tempted to focus only on the monthly payment, but that’s just one piece of the puzzle. Your salary gives you a starting point, but it doesn’t tell the whole story. Taxes, living expenses, debt, and savings goals all play a role in what you can truly afford. The good news? With a little planning and some simple math, you can find a car that fits your budget—and your life—without sacrificing your financial health.

In this guide, we’ll walk you through everything you need to know to determine how much car you can afford based on your salary. We’ll cover smart budgeting rules, real-life examples, hidden costs, and practical tips to help you make a confident, informed decision. Whether you’re buying new or used, financing or paying cash, this guide will help you drive away happy—and financially secure.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Understanding Your Salary and Take-Home Pay

- 4 The 20/4/10 Rule: A Simple Guideline for Car Affordability

- 5 Calculating Your Car Budget Step by Step

- 6 Hidden Costs of Car Ownership

- 7 The Role of Credit Score in Car Affordability

- 8 New vs. Used: Which Is More Affordable?

- 9 Tips for Sticking to Your Budget

- 10 Conclusion

- 11 Frequently Asked Questions

- 11.1 How much of my salary should I spend on a car?

- 11.2 Should I use gross or net income to calculate car affordability?

- 11.3 Is it better to buy new or used?

- 11.4 How does my credit score affect how much car I can afford?

- 11.5 What if I can’t afford a 20% down payment?

- 11.6 Can I afford a car if I have student loans or other debt?

Key Takeaways

- Use the 20/4/10 rule: Put down 20%, finance for no more than 4 years, and keep monthly costs (loan, insurance, gas, maintenance) under 10% of your gross monthly income.

- Know your take-home pay: Your salary isn’t the same as your take-home pay—factor in taxes, retirement, and other deductions when calculating affordability.

- Don’t forget hidden costs: Insurance, fuel, maintenance, parking, and registration can add hundreds to your monthly expenses.

- Check your credit score: A higher score means lower interest rates, which can save you thousands over the life of your loan.

- Consider total cost of ownership: Some cars cost less upfront but more to maintain—research reliability and repair costs before buying.

- Avoid stretching your budget: Buying the most expensive car you “qualify” for can leave you house-poor or car-poor—prioritize financial flexibility.

- Use online calculators: Tools from banks, credit unions, and car sites help estimate payments and affordability based on your real numbers.

📑 Table of Contents

- Understanding Your Salary and Take-Home Pay

- The 20/4/10 Rule: A Simple Guideline for Car Affordability

- Calculating Your Car Budget Step by Step

- Hidden Costs of Car Ownership

- The Role of Credit Score in Car Affordability

- New vs. Used: Which Is More Affordable?

- Tips for Sticking to Your Budget

- Conclusion

Understanding Your Salary and Take-Home Pay

When people talk about “salary,” they often mean their gross annual income—the number on their job offer or paycheck before taxes and deductions. But when it comes to budgeting for a car, what matters most is your take-home pay, also known as net income. This is the amount that actually lands in your bank account each month after federal and state taxes, Social Security, Medicare, health insurance, retirement contributions, and other withholdings.

For example, if you earn $60,000 per year, your gross monthly income is $5,000. But after taxes and deductions, your take-home pay might be closer to $3,800. That’s a difference of $1,200 per month—money that could otherwise go toward a car payment, insurance, or savings. Relying on gross income to calculate affordability can lead to overspending and financial stress.

Why Take-Home Pay Matters More

Your take-home pay reflects your real spending power. It’s the money you use to pay rent, buy groceries, cover utilities, and yes—buy a car. If you base your car budget on gross income, you might end up with a payment that feels manageable on paper but stretches your actual cash flow too thin.

Let’s say you earn $75,000 a year. That’s $6,250 per month gross. But after taxes and deductions, you take home about $4,700. If you use the 10% rule (more on that soon), you should aim to keep your total car-related expenses under $470 per month. But if you mistakenly use $6,250 as your baseline, you might think $625 is acceptable—overestimating your affordability by $155.

How to Calculate Your Take-Home Pay

To get an accurate picture, look at your most recent pay stub. Add up all deductions—federal tax, state tax, FICA, health insurance, 401(k), HSA, etc.—and subtract them from your gross pay. That’s your net income. Multiply by the number of paychecks you receive per year (e.g., 26 for biweekly, 12 for monthly) to estimate your annual take-home pay.

Alternatively, use an online paycheck calculator. Sites like SmartAsset or ADP offer free tools where you can input your salary, location, and deductions to estimate your net income. This gives you a clearer starting point for budgeting.

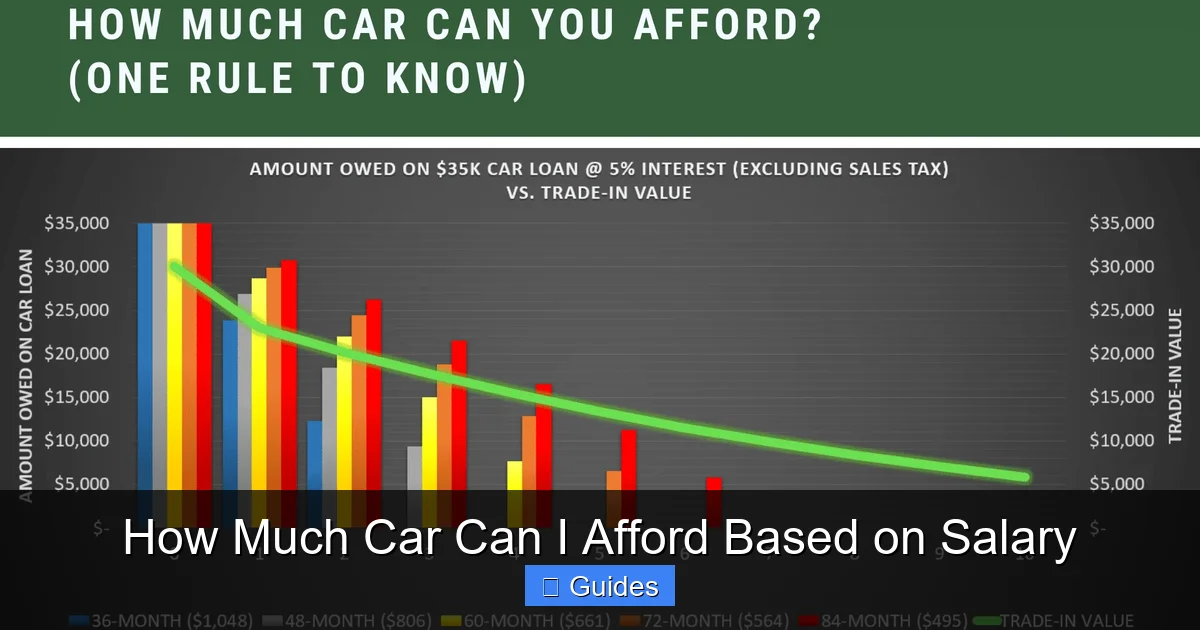

The 20/4/10 Rule: A Simple Guideline for Car Affordability

Visual guide about How Much Car Can I Afford Based on Salary

Image source: dollarsanity.com

One of the most trusted rules for determining how much car you can afford based on salary is the 20/4/10 rule. It’s straightforward, practical, and designed to keep your car expenses manageable without derailing your financial goals.

Here’s how it works:

– 20% down payment: Put at least 20% of the car’s purchase price down upfront.

– 4-year loan term: Finance the car for no more than 4 years (48 months).

– 10% of gross income: Keep your total monthly car expenses (loan payment, insurance, fuel, maintenance) under 10% of your gross monthly income.

This rule balances affordability with financial responsibility. It ensures you’re not over-leveraged, minimizes interest costs, and leaves room in your budget for other priorities.

Breaking Down the 20/4/10 Rule

Let’s say you earn $60,000 per year. That’s $5,000 per month gross. According to the 10% rule, your total monthly car costs should not exceed $500.

Now, let’s apply the full rule. Suppose you’re looking at a $25,000 car. A 20% down payment would be $5,000, leaving $20,000 to finance. At a 5% interest rate over 4 years, your monthly loan payment would be about $460. Add insurance ($120), gas ($80), and maintenance ($40), and your total monthly cost is $700—well over the $500 limit.

In this case, the $25,000 car isn’t affordable under the 20/4/10 rule. You’d need to either increase your down payment, choose a cheaper car, or extend the loan term (though that increases interest costs).

Why the 20/4/10 Rule Works

This rule prevents common pitfalls:

– Small down payments lead to higher monthly payments and negative equity (owing more than the car is worth).

– Long loan terms (6–7 years) reduce monthly payments but cost more in interest and increase the risk of being upside-down on the loan.

– High monthly costs crowd out savings, emergency funds, and other financial goals.

By sticking to 20/4/10, you protect your financial flexibility and avoid the stress of a car payment that feels like a second mortgage.

Calculating Your Car Budget Step by Step

Visual guide about How Much Car Can I Afford Based on Salary

Image source: notwaitingtolive.com

Now that you understand the guidelines, let’s walk through a real-world example to show how to calculate how much car you can afford based on salary.

Step 1: Determine Your Monthly Take-Home Pay

Let’s say you earn $72,000 per year. After taxes and deductions, your take-home pay is $4,800 per month.

Step 2: Apply the 10% Rule

10% of your gross monthly income ($6,000) is $600. So, your total monthly car expenses should not exceed $600.

Step 3: Estimate Fixed and Variable Costs

Break down your car expenses:

– Loan payment: This depends on the car price, down payment, interest rate, and loan term.

– Insurance: Get quotes based on the car model, your age, driving history, and location.

– Fuel: Estimate based on your commute and the car’s MPG.

– Maintenance and repairs: Budget $50–$100 per month, more for older or luxury vehicles.

– Registration and parking: Varies by state and city.

For example:

– Insurance: $130/month

– Gas: $90/month (15 miles each way, 25 MPG, $3.50/gallon)

– Maintenance: $60/month

– Registration: $20/month (averaged over the year)

Total fixed and variable costs (excluding loan): $300/month

That leaves $300 for your loan payment.

Step 4: Use a Loan Calculator

With $300 available for a loan payment, a 5% interest rate, and a 4-year term, you can afford to finance about $12,800.

Add a 20% down payment ($3,200), and the maximum car price you can afford is around $16,000.

So, based on a $72,000 salary, a $16,000 car fits within the 20/4/10 rule.

Step 5: Adjust Based on Reality

If you want a newer or more feature-rich car, consider:

– Increasing your down payment (saving more before buying)

– Choosing a used car with lower depreciation

– Improving your credit score for a better interest rate

– Extending the loan term slightly (but not beyond 5 years)

Remember: the goal isn’t to max out your budget—it’s to find a car that meets your needs without compromising your financial health.

Hidden Costs of Car Ownership

Visual guide about How Much Car Can I Afford Based on Salary

Image source: newtraderu.com

Many buyers focus only on the sticker price or monthly payment, but cars come with ongoing expenses that can sneak up on you. Ignoring these hidden costs is a common mistake that leads to budget overruns and financial strain.

Insurance: It’s Not One-Size-Fits-All

Insurance is often the second-largest car expense after the loan payment. Rates vary widely based on:

– Car type: Sports cars and luxury vehicles cost more to insure.

– Your age and driving history: Younger drivers and those with accidents or tickets pay more.

– Location: Urban areas with higher theft and accident rates have higher premiums.

– Coverage level: Comprehensive and collision coverage add to the cost.

For example, a 25-year-old driving a used Honda Civic might pay $100/month, while the same person driving a new BMW 3 Series could pay $250/month. Always get insurance quotes before finalizing your car choice.

Fuel and Maintenance: The Daily Drain

Fuel costs depend on your commute, driving habits, and gas prices. A 30-mile round-trip commute in a 20 MPG car costs about $150/month at $3.50/gallon. Switch to a 35 MPG hybrid, and it drops to $85.

Maintenance includes oil changes, tire rotations, brake pads, and unexpected repairs. Newer cars may have lower maintenance costs, but older models can surprise you. Budget at least $50/month, more if the car is out of warranty.

Depreciation: The Silent Cost

Cars lose value fast. A new car can depreciate 20% in the first year and 50% in three years. That means a $30,000 car could be worth $15,000 after three years. If you sell it, you lose $15,000. If you’re financing, you might owe more than it’s worth—known as being “upside-down.”

Used cars depreciate slower, making them a smarter financial choice for many buyers.

Parking, Tolls, and Fines

If you live in a city, parking can cost $100–$300/month. Tolls add up on commutes. And don’t forget parking tickets, speeding fines, or emissions test fees. These small costs can total $50–$100/month.

The Role of Credit Score in Car Affordability

Your credit score doesn’t just affect whether you get approved for a car loan—it directly impacts how much you’ll pay. A higher score means lower interest rates, which can save you hundreds or even thousands over the life of the loan.

How Credit Scores Affect Interest Rates

Lenders use credit scores to assess risk. Here’s a rough breakdown:

– Excellent (750+): 3–4% interest

– Good (700–749): 4–6%

– Fair (650–699): 6–10%

– Poor (600–649): 10–15%

– Bad (below 600): 15%+ or loan denial

Let’s say you’re financing $20,000 over 4 years.

– At 4%, your monthly payment is $452, total interest: $1,696

– At 10%, your payment is $508, total interest: $4,384

That’s a difference of $2,688—just because of your credit score.

Improving Your Credit Before Buying

If your score is low, take steps to improve it before applying for a loan:

– Pay down credit card balances (keep utilization under 30%)

– Make all payments on time

– Avoid opening new credit accounts

– Check your credit report for errors

Even a 50-point increase can qualify you for a better rate. Consider waiting a few months to buy if it means saving hundreds in interest.

New vs. Used: Which Is More Affordable?

One of the biggest decisions in car buying is whether to go new or used. Each has pros and cons, but when it comes to affordability, used cars usually win.

The Case for Used Cars

Used cars offer:

– Lower purchase price: You avoid the steep first-year depreciation.

– Lower insurance: Older cars cost less to insure.

– More value: You can get a higher trim or more features for the same price.

For example, a 3-year-old Toyota Camry with 40,000 miles might cost $18,000—$12,000 less than a new one. It’s still reliable, under warranty, and saves you money upfront and over time.

When a New Car Makes Sense

New cars are worth considering if:

– You want the latest safety features (automatic braking, blind-spot monitoring)

– You plan to keep the car for 10+ years

– You qualify for low-interest financing or rebates

– You need a specific model or feature only available new

But be prepared to pay more and lose value faster.

Certified Pre-Owned (CPO): The Best of Both Worlds

CPO programs offer used cars that are inspected, refurbished, and backed by a manufacturer warranty. They’re typically 1–3 years old with low mileage and come with perks like roadside assistance. CPO cars cost more than regular used cars but less than new—and offer peace of mind.

Tips for Sticking to Your Budget

Even with a solid plan, it’s easy to overspend when buying a car. Dealerships are skilled at upselling, and emotions can cloud judgment. Here are tips to stay on track.

Set a Hard Limit

Decide on a maximum price before you start shopping. Write it down and stick to it. Don’t let sales tactics push you into a more expensive car.

Get Pre-Approved

Shop for financing before visiting dealerships. Get pre-approved from your bank or credit union. This gives you negotiating power and prevents you from accepting a high-interest dealer loan.

Test Drive, But Don’t Rush

Take your time. Test drive multiple cars. Compare prices online. Sleep on big decisions. Avoid buying on impulse.

Negotiate the Price, Not Just the Payment

Dealers may offer a low monthly payment by extending the loan term or adding fees. Focus on the total price of the car. Negotiate the out-the-door price, including taxes and fees.

Walk Away if Needed

If the deal doesn’t feel right, walk away. There are plenty of cars and dealers. Don’t let pressure tactics force you into a bad decision.

Conclusion

Figuring out how much car you can afford based on salary is about more than just dividing your income by 12. It’s about understanding your take-home pay, following smart budgeting rules like the 20/4/10 guideline, and accounting for all the costs of ownership—not just the monthly payment.

By taking a thoughtful, informed approach, you can find a car that fits your lifestyle and your budget. Whether you choose new or used, finance or pay cash, the key is to prioritize financial health over flashy features or status symbols.

Remember: a car is a tool, not an investment. It gets you from point A to point B. The best car for you is one that meets your needs, fits your budget, and leaves room in your life for savings, experiences, and peace of mind.

So before you sign on the dotted line, ask yourself: Can I really afford this? And more importantly—should I?

Frequently Asked Questions

How much of my salary should I spend on a car?

Most financial experts recommend keeping your total monthly car expenses—including loan, insurance, gas, and maintenance—under 10% of your gross monthly income. This ensures your car doesn’t crowd out other financial priorities.

Should I use gross or net income to calculate car affordability?

Use your take-home (net) income for budgeting, but the 10% rule is based on gross income. Net income helps you understand your real cash flow, while gross income provides a consistent benchmark for affordability.

Is it better to buy new or used?

Used cars are generally more affordable due to slower depreciation and lower insurance costs. However, new cars offer the latest safety features and full warranties. Certified pre-owned vehicles offer a good middle ground.

How does my credit score affect how much car I can afford?

A higher credit score qualifies you for lower interest rates, reducing your monthly payment and total loan cost. Improving your score before buying can save you thousands over the life of the loan.

What if I can’t afford a 20% down payment?

If you can’t put down 20%, consider saving longer, choosing a cheaper car, or making a smaller down payment—but be aware you may face higher monthly payments and risk being upside-down on the loan.

Can I afford a car if I have student loans or other debt?

Yes, but factor all debt payments into your budget. Lenders look at your debt-to-income ratio, and high debt can limit how much you qualify for. Prioritize paying down high-interest debt before taking on a car loan.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.