Featured image for how-much-does-it-cost-to-lease-a-mitsubishi-outlander

Image source: investopedia.com

Leasing a Mitsubishi Outlander can be surprisingly affordable, with current promotional offers often starting under $300 per month. Your exact cost is determined by key factors like the trim level, your credit score, and the negotiated down payment. For the absolute best deal, always verify the latest national incentives and shop multiple dealerships.

In This Article

- 1 Get The Latest Mitsubishi Outlander Lease Cost Details

- 1.1 Key Takeaways

- 1.2 📑 Table of Contents

- 1.3 Understanding the Current Mitsubishi Outlander Lease Cost Landscape

- 1.4 How Leasing an Outlander Actually Works: A Simple Walkthrough

- 1.5 Key Factors That Directly Impact Your Outlander Lease Payment

- 1.6 Navigating the Dealership: Tips for Getting the Best Lease Deal

- 1.7 Is Leasing an Outlander Right for You? The Pros and Cons

- 1.8 Mitsubishi Outlander Trim-Level Lease Cost Overview

- 1.9 Final Thoughts on Finding Your Ideal Outlander Lease

- 1.10 Frequently Asked Questions

- 1.10.1 What is the current Mitsubishi Outlander lease cost per month?

- 1.10.2 Are there any manufacturer incentives that lower the Mitsubishi Outlander lease payment?

- 1.10.3 What factors influence the total cost to lease a Mitsubishi Outlander?

- 1.10.4 How does leasing compare to buying a Mitsubishi Outlander in terms of cost?

- 1.10.5 What are the typical terms and conditions in a Mitsubishi Outlander lease agreement?

- 1.10.6 Can I negotiate the lease cost for a Mitsubishi Outlander, and how?

Get The Latest Mitsubishi Outlander Lease Cost Details

Let’s be honest. Car shopping can feel like a huge puzzle. You’re trying to fit together pieces like budget, features, and monthly payments. And lately, leasing has become a really popular piece of that puzzle. It’s not just for luxury cars anymore.

Maybe you’ve seen the Mitsubishi Outlander on the road—that sleek, modern SUV with a confident stance. You like the idea of a three-row SUV without the towering price tag of some competitors. But the big question hanging in the air is: what does it really cost to drive one home each month?

If you’re asking, “How much does it cost to lease a Mitsubishi Outlander?” you’re in the right spot. I’ve been through the leasing process myself, and I know it can seem full of confusing terms and hidden numbers. Today, we’re going to clear all that up. We’ll walk through the latest Mitsubishi Outlander lease cost details, break down what affects your payment, and I’ll share some practical tips I’ve learned along the way. Think of this as a friendly chat to help you make a smart, informed decision.

Key Takeaways

- Research average costs: Know the market rate to negotiate effectively.

- Choose the right trim: Balance features with your budget needs.

- Opt for optimal lease term: Shorter terms can save money long-term.

- Set accurate mileage: Estimate your driving to avoid overage charges.

- Seek current incentives: Manufacturer offers can lower your payment.

- Review all fees: Identify and question any extra charges.

- Calculate total lease cost: Compare deals based on overall expense.

📑 Table of Contents

- Understanding the Current Mitsubishi Outlander Lease Cost Landscape

- How Leasing an Outlander Actually Works: A Simple Walkthrough

- Key Factors That Directly Impact Your Outlander Lease Payment

- Navigating the Dealership: Tips for Getting the Best Lease Deal

- Is Leasing an Outlander Right for You? The Pros and Cons

- Mitsubishi Outlander Trim-Level Lease Cost Overview

- Final Thoughts on Finding Your Ideal Outlander Lease

Understanding the Current Mitsubishi Outlander Lease Cost Landscape

First things first, let’s talk numbers. The Mitsubishi Outlander lease cost you see advertised is a starting point, a bit like the manufacturer’s suggested retail price (MSRP). It’s a great anchor, but your final payment will be uniquely yours.

As of the latest model year, you can typically find advertised Mitsubishi Outlander lease deals starting in the mid-$200s to low-$300s per month. But—and this is a big but—that’s usually for a base ES trim with front-wheel drive, for a 36-month term, with a specific amount due at signing (often around $3,000). This is a promotional lease designed to get your attention.

Why the range? Think of a lease like a long-term rental. You’re paying for the vehicle’s depreciation during the time you have it, plus fees and interest. The final Mitsubishi Outlander lease cost depends on a dance between several key factors: the vehicle’s selling price, its predicted future value (the “residual value”), the money factor (which is like the interest rate), and your local taxes and fees.

It’s also super seasonal. You might find the sweetest deals when the new model year is arriving, or during holiday sales events. I always tell friends to keep an eye on the Mitsubishi national website for the latest offers, but remember, your local dealer is where the final deal is made.

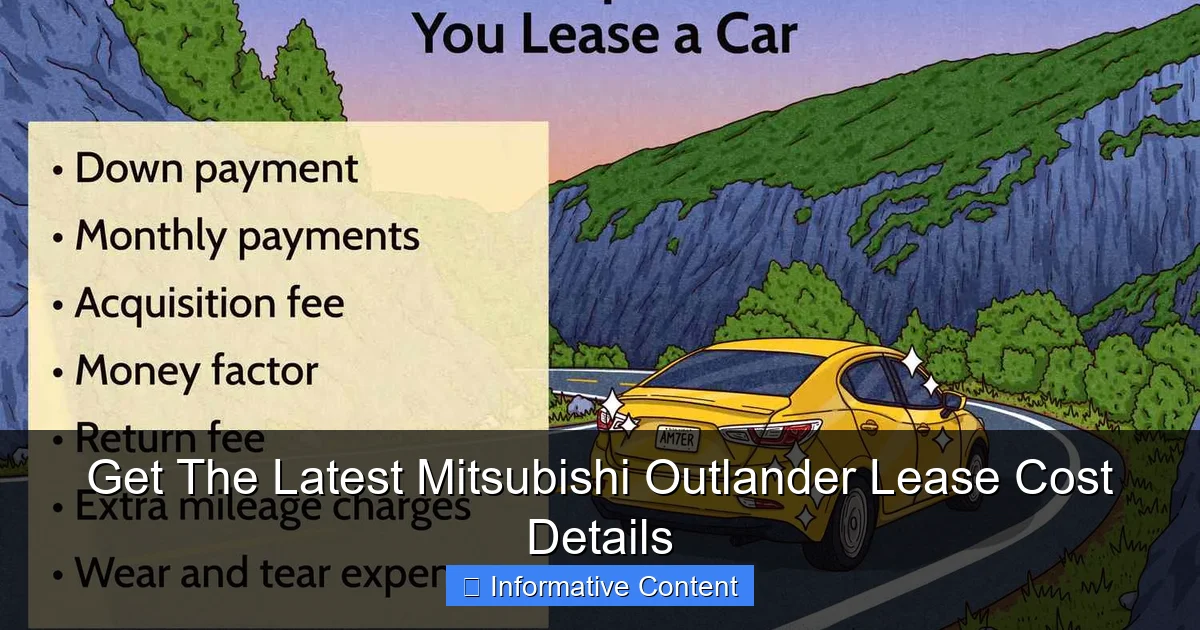

What Makes Up Your Monthly Payment?

Your monthly payment isn’t just a random number. It’s calculated. Here’s the simple breakdown:

- Depreciation: This is the biggest chunk. The finance company estimates what the Outlander will be worth at the end of the lease (the residual value). Your payment covers the difference between the capitalized cost (sale price) and that future value.

- Finance Charge (or Rent Charge): This is the cost of borrowing the money, expressed as a “money factor.” It’s like interest on the loan.

- Taxes and Fees: Your state’s sales tax applied to the monthly payment, plus any registration or documentation fees rolled into the payment.

How Leasing an Outlander Actually Works: A Simple Walkthrough

If you’ve never leased before, the process can seem mysterious. It doesn’t have to be. Let’s walk through it step-by-step, just like I did when I got my first lease.

Visual guide about how-much-does-it-cost-to-lease-a-mitsubishi-outlander

Image source: carpaymentcalculator.net

You start by choosing your Outlander. Pick the trim level that fits your life. Do you need the three-rows of the base model, or do you want the extra tech and comfort of the SEL or the plug-in hybrid Outlander PHEV? This choice is the biggest driver of your Mitsubishi Outlander lease cost.

Next, you agree on a price. Yes, you can and should negotiate the selling price of the car, just like if you were buying it. A lower selling price means a lower depreciation amount, which means a lower monthly payment. Don’t skip this step!

Then, the dealership’s finance manager will present the lease terms. This includes the length (usually 24, 36, or 39 months), the annual mileage limit (10,000, 12,000, or 15,000 miles are common), and the money factor. They’ll calculate your payment based on these terms. You’ll review a document called the “lease agreement” that spells out everything, including what happens if you exceed the mileage or if there’s excess wear and tear.

Finally, you drive off the lot. You’re responsible for basic maintenance (like oil changes) and insurance during the lease term. At the end, you simply return the vehicle, pay any end-of-lease fees if applicable, and walk away or start a new lease.

A Real-World Example

Let’s make it concrete. Imagine an Outlander SE with an MSRP of $33,000. You negotiate the selling price down to $31,500. The lease is for 36 months/12,000 miles per year with a 58% residual value. The money factor is equivalent to a 4% APR.

- Depreciation Portion: ($31,500 – ($33,000 x 0.58)) / 36 months = ~$217/month

- Finance Portion: ($31,500 + ($33,000 x 0.58)) x (0.04 / 24) = ~$43/month

- Pre-tax monthly: ~$260. Add your local sales tax (say 7%) for a final payment of around $278 per month.

This is a simplified example, but it shows how the pieces fit together. Your “due at signing” would cover your first payment, a security deposit, acquisition fee, and registration.

Key Factors That Directly Impact Your Outlander Lease Payment

Now that we know how it’s built, let’s look at the levers you can pull to change your Mitsubishi Outlander lease cost. Some are in your control, others are set by the market.

Visual guide about how-much-does-it-cost-to-lease-a-mitsubishi-outlander

Image source: cdn.broadbandsearch.net

1. Trim Level and Options

This is the most obvious one. Leasing an Outlander ES FWD will cost significantly less per month than a top-tier Outlander SEL S-AWC or the plug-in hybrid PHEV model. Every upgrade package, paint color, or accessory added to the MSRP increases the vehicle’s value and, therefore, the amount that depreciates.

2. The Negotiated Selling Price

I can’t stress this enough. The “cap cost” is the heart of the deal. Use online tools to find the fair market price in your area. Negotiate this price down before you even start talking monthly payments. A discount of $1,500 on the sale price can easily save you $40 or more per month on a 36-month lease.

3. The Mileage Allowance

Choosing your annual mileage is a critical decision. A standard 10,000-mile-per-year lease will have a higher residual value (the car is predicted to be worth more with fewer miles) than a 15,000-mile lease. Opting for more miles upfront increases your monthly Mitsubishi Outlander lease cost, but it’s almost always cheaper than paying the per-mile penalty (often $0.20/mile) at the end.

4. Lease Term Length

Shorter terms (24 months) usually have higher monthly payments but lower total interest and the perk of getting a new car more often. Longer terms (39 months) spread the cost out, giving you a lower payment, but you’re committed for longer and the car’s warranty coverage timeline becomes more relevant.

5. Your Credit Score

Your credit tier determines the money factor (interest rate) you qualify for. Excellent credit will get you the best, subvented rates from Mitsubishi Motors Credit. Lower credit scores mean a higher money factor, which directly increases your finance charge each month.

Walking into a dealership can feel intimidating. But with a little preparation, you can feel confident. Here’s what I’ve learned works.

Visual guide about how-much-does-it-cost-to-lease-a-mitsubishi-outlander

Image source: motorbiscuit.com

Do Your Homework First. Know the current national Mitsubishi Outlander lease offers. Research the invoice price and a fair target price for the exact trim you want. Websites like Edmunds or Kelley Blue Book are great for this.

Focus on the Total Cost, Not Just the Monthly Payment. A dealer can make a monthly payment look attractive by stretching the term or increasing the down payment. Always ask for the “Gross Capitalized Cost” (the selling price plus any fees) and the “Money Factor.” If they hesitate to share these, that’s a red flag.

Consider Multiple Dealers. Get quotes from a few different Mitsubishi dealerships in your area. You can often do this via email. Let them know you’re shopping around for the best overall lease terms on an Outlander.

Understand “Due at Signing.” That attractive low payment often requires several thousand dollars upfront. This usually includes your first month’s payment, a security deposit, the acquisition fee, registration, and taxes. You can often choose to put down less (or even just first payment and fees) by opting for a slightly higher monthly payment—a method called a “sign-and-drive” lease.

Ask About Loyalty and Conquest Incentives. If you currently own a Mitsubishi, you might qualify for a loyalty discount. If you own a competitor’s SUV, you might qualify for a conquest cash incentive. Always ask!

Is Leasing an Outlander Right for You? The Pros and Cons

Leasing isn’t for everyone. It’s a financial tool with clear benefits and trade-offs. Let’s weigh them honestly.

The Advantages

- Lower Monthly Payments: Typically, your monthly Mitsubishi Outlander lease cost will be lower than a loan payment for the same car because you’re only financing the depreciation, not the entire vehicle.

- Drive a New Car More Often: Every 2-4 years, you get to turn in your old Outlander and lease a brand-new one with the latest safety tech, infotainment, and styling.

- Minimal Repair Worries: The factory bumper-to-bumper warranty (usually 5 years/60,000 miles) covers the entire lease period for most drivers. Major repairs are not your financial headache.

- No Hassle at Resale: When the lease ends, you simply return the car. You don’t have to worry about selling it or trading it in.

The Disadvantages

- Mileage Restrictions: You have a contractual limit. Go over, and you’ll write a check at turn-in.

- No Ownership Equity: You are essentially renting. At the end of the term, you have nothing to show for the payments (though you also avoided the depreciation hit of ownership).

- Potential for End-of-Lease Fees: You are responsible for wear and tear deemed “excessive.” Dings, scratches, or worn tires beyond normal use can result in charges.

- Commitment: Getting out of a lease early can be complicated and expensive, often costing as much as or more than seeing it through.

Mitsubishi Outlander Trim-Level Lease Cost Overview

To give you a clearer picture, here’s a generalized snapshot of how different trims can affect the monthly Mitsubishi Outlander lease cost. Remember, these are estimated examples based on common promotional structures (36-month term, 12k miles/year, with several thousand dollars due at signing) and can vary widely by region, credit, and negotiation. Always get a personalized quote.

Disclaimer: The table below contains illustrative estimates. Actual lease payments are determined by the dealer based on creditworthiness, negotiated price, and current programs.

| Trim Level | Key Features | Estimated Monthly Payment Range* | Best For… |

|---|---|---|---|

| Outlander ES FWD | Three rows, 7-passenger seating, 8-inch display, Apple CarPlay/Android Auto | $270 – $330 | Budget-conscious families needing maximum space for the money. |

| Outlander SE FWD/S-AWC | Adds leather seating, power liftgate, 20-inch wheels, upgraded audio | $320 – $390 | Those wanting a more premium look and feel without the top-tier price. |

| Outlander SEL S-AWC | Adds advanced safety tech (MI-PILOT), panoramic sunroof, ventilated front seats | $380 – $460 | Tech-savvy drivers who want the highest level of comfort and driver assistance. |

| Outlander PHEV | Plug-in hybrid powertrain, electric-only range, premium features standard | $450 – $550+ | Drivers seeking fuel efficiency, tax credits (if applicable), and cutting-edge tech. |

*Estimated range based on competitive promotional offers with varying amounts due at signing. Payment assumes top-tier credit.

Final Thoughts on Finding Your Ideal Outlander Lease

So, how much does it cost to lease a Mitsubishi Outlander? As we’ve seen, the answer is, “It depends,” but hopefully now you know exactly what it depends on. The journey from a tempting online ad to a set of keys in your hand is all about understanding the details.

The Mitsubishi Outlander presents a compelling value in the crowded three-row SUV segment. Leasing one can be a smart way to access that value with a predictable monthly cost and the peace of mind that comes with full warranty coverage. The key is to go in prepared.

Arm yourself with knowledge about fair prices, know which lease terms matter most to your life, and don’t be afraid to have a straightforward conversation with the finance manager. Ask for the numbers behind the numbers. The best Mitsubishi Outlander lease cost is the one that fits your budget and your driving life without any stressful surprises.

Take your time, use the tips we discussed, and you’ll be well on your way to enjoying a new Outlander with confidence. Happy driving!

Frequently Asked Questions

What is the current Mitsubishi Outlander lease cost per month?

The average monthly lease payment for a Mitsubishi Outlander typically ranges from $250 to $400, depending on the trim level, lease term, and down payment. Current promotions and regional incentives can also significantly affect the final cost.

Are there any manufacturer incentives that lower the Mitsubishi Outlander lease payment?

Yes, Mitsubishi often offers special lease deals, such as low APR rates, cashback offers, or reduced monthly payments. Checking the manufacturer’s website or visiting a local dealership can provide the latest incentives available.

What factors influence the total cost to lease a Mitsubishi Outlander?

Several factors influence the lease cost, including the vehicle’s MSRP, residual value, money factor, lease term, and your credit score. Additionally, any upfront payments or trade-ins can alter the monthly payment amount.

How does leasing compare to buying a Mitsubishi Outlander in terms of cost?

Leasing a Mitsubishi Outlander usually involves lower monthly payments compared to financing a purchase, but you don’t own the vehicle at the end of the lease. Buying may be more cost-effective in the long run if you plan to keep the car for many years.

What are the typical terms and conditions in a Mitsubishi Outlander lease agreement?

A standard lease agreement includes the monthly payment, lease duration, mileage limits, and wear-and-tear guidelines. It also outlines fees for excess mileage and early termination, so it’s crucial to review all terms carefully.

Can I negotiate the lease cost for a Mitsubishi Outlander, and how?

Yes, you can negotiate the lease cost by discussing the capitalized cost, money factor, and mileage allowance with the dealer. Researching current market rates and being prepared to walk away can help you secure a better deal.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.