Leasing a $70,000 car typically costs between $800 and $1,500 per month, depending on the make, model, lease terms, and your credit score. Understanding factors like depreciation, money factor, and down payments helps you negotiate a better deal and avoid overpaying.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 How Much Is a Lease on a $70k Car? A Complete Guide

- 4 Breaking Down the Cost of Leasing a $70k Car

- 5 Factors That Influence Your Monthly Lease Payment

- 6 Real-World Examples: Lease Payments on $70k Cars

- 7 Tips to Get the Best Lease Deal on a $70k Car

- 8 Should You Lease or Buy a $70k Car?

- 9 Final Thoughts: Is Leasing a $70k Car Worth It?

- 10 Frequently Asked Questions

Key Takeaways

- Monthly payments for a $70k car lease usually range from $800 to $1,500, influenced by the vehicle’s residual value, lease length, and interest rate.

- Depreciation is the biggest cost driver—luxury cars lose value quickly, which increases your monthly payment.

- Your credit score directly affects the money factor (lease interest rate), with higher scores securing lower rates.

- Down payments (cap cost reductions) lower monthly costs but increase upfront expenses and risk if the car is totaled.

- Lease terms of 24 to 36 months are most common, offering a balance between affordability and flexibility.

- Mileage limits (10,000–15,000 miles/year) impact cost—exceeding them results in steep per-mile fees.

- Negotiating the capitalized cost and money factor can save hundreds over the life of the lease.

📑 Table of Contents

- How Much Is a Lease on a $70k Car? A Complete Guide

- Breaking Down the Cost of Leasing a $70k Car

- Factors That Influence Your Monthly Lease Payment

- Real-World Examples: Lease Payments on $70k Cars

- Tips to Get the Best Lease Deal on a $70k Car

- Should You Lease or Buy a $70k Car?

- Final Thoughts: Is Leasing a $70k Car Worth It?

How Much Is a Lease on a $70k Car? A Complete Guide

So, you’re eyeing a shiny new luxury car—maybe a BMW 5 Series, a Mercedes-Benz E-Class, or a Tesla Model S—and the sticker price hovers around $70,000. You’ve heard leasing might be a smarter financial move than buying outright, but you’re not sure what that actually means for your monthly budget. You’re asking the right question: *How much is a lease on a $70k car?*

The short answer? Expect to pay anywhere from $800 to $1,500 per month. But that number isn’t set in stone. It depends on a handful of key factors, including the car’s depreciation rate, how long you plan to lease it, your credit score, and how much you’re willing to put down upfront. Unlike buying, where you’re paying for the entire vehicle, leasing only covers the car’s depreciation during your term, plus fees and interest. That’s why leasing can feel more affordable—even on high-end models.

But don’t let the lower monthly payments fool you. Leasing a $70k car still requires careful planning. You’ll need to understand the fine print, negotiate smartly, and consider long-term costs like mileage overages and wear-and-tear charges. This guide will walk you through everything you need to know to lease a $70,000 car with confidence—whether you’re a first-time lessee or upgrading from a more modest vehicle.

Breaking Down the Cost of Leasing a $70k Car

Visual guide about How Much Is a Lease on a $70k Car

Image source: rentalregime.com

When you lease a car, you’re essentially renting it for a fixed period—usually 24 to 36 months. Instead of paying off the entire $70,000 value, you’re only paying for the portion of the car’s value that it loses during your lease. This is called depreciation, and it’s the single biggest factor in your monthly payment.

Let’s say your $70,000 car is expected to be worth $42,000 after three years. That means it depreciates by $28,000 over the lease term. That $28,000 is divided by 36 months, giving you a base payment of about $778. But that’s not the full story. You also pay interest (called the “money factor”), taxes, fees, and possibly a down payment. Add those in, and your monthly payment climbs—often into the $900–$1,200 range.

For example, a 2024 BMW 530i with a $70,000 MSRP might lease for around $1,050 per month with $3,000 due at signing. A similarly priced Audi A6 could run $980/month with $2,500 down. These numbers vary by region, dealership incentives, and your creditworthiness.

Why Depreciation Matters Most

Luxury cars like those in the $70k range tend to depreciate faster than economy models. A new BMW or Mercedes might lose 40–50% of its value in the first three years. That rapid drop means you’re paying for a larger chunk of the car’s original price each month. In contrast, a Toyota Camry might only lose 30% over the same period, making its lease payments significantly lower.

This is why leasing a high-end vehicle can still be expensive—even though you’re not buying it. The faster the car loses value, the higher your monthly payment will be. Always check the manufacturer’s residual value estimates before signing. A higher residual (the car’s expected value at lease end) means lower payments.

Money Factor: The Lease Interest Rate

The money factor is the lease equivalent of an interest rate. It’s usually a tiny decimal like 0.00125, but it has a big impact on your monthly cost. To make it easier to understand, multiply the money factor by 2,400. So 0.00125 × 2,400 = 3.0%, which is your effective annual interest rate.

If you have excellent credit (720+), you’ll qualify for the lowest money factors—sometimes as low as 0.0008 (1.92% APR). But if your credit is fair (650–699), the rate could jump to 0.0020 (4.8% APR) or higher. On a $70k car, that difference could add $100+ to your monthly payment.

Taxes, Fees, and Other Hidden Costs

Don’t forget about taxes and fees. Most states tax the monthly lease payment, not the full car price. So if your payment is $1,000 and your sales tax is 7%, you’ll pay $70 extra each month. That’s $2,520 over three years.

You’ll also pay acquisition fees (usually $500–$1,000), registration, and possibly a disposition fee at the end of the lease. Some dealers roll these into the monthly payment, while others require upfront payment. Always ask for a full breakdown before signing.

Factors That Influence Your Monthly Lease Payment

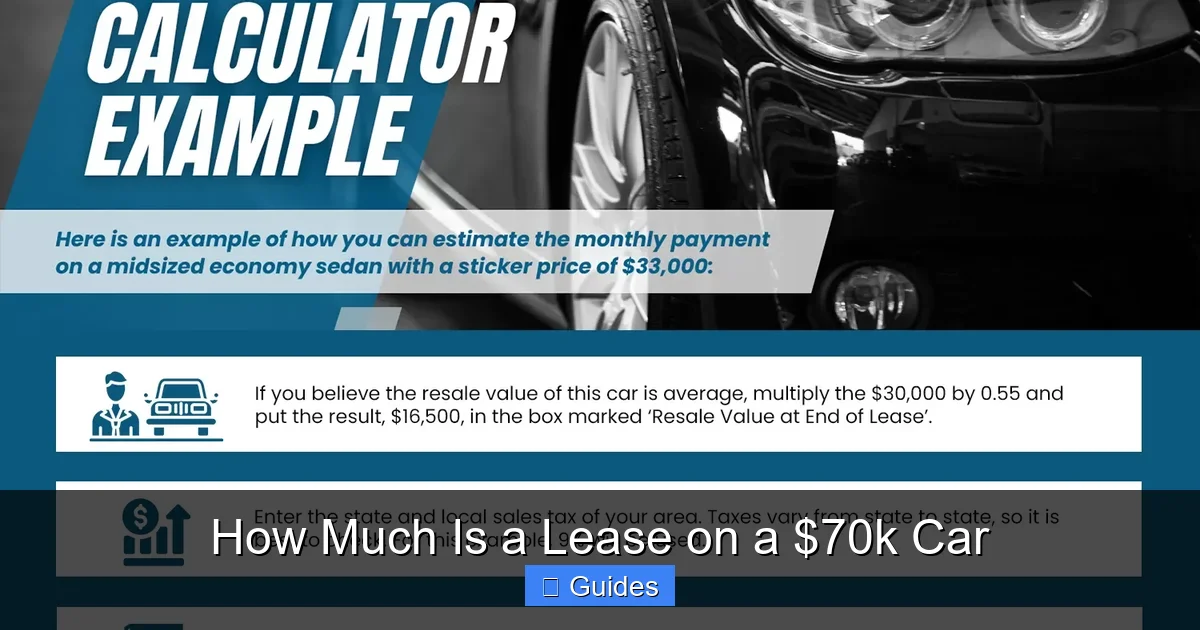

Visual guide about How Much Is a Lease on a $70k Car

Image source: eautolease.com

Now that you know the basics, let’s dive into the specific factors that determine how much you’ll actually pay each month to lease a $70k car. These aren’t just details—they’re levers you can pull to lower your cost.

1. Lease Term: 24, 36, or 48 Months?

Shorter leases (24 months) often have lower monthly payments because the car depreciates less in two years than in three or four. However, you’ll pay more in the long run due to higher acquisition fees and less time to spread out costs. A 36-month lease is the sweet spot for most people—it balances affordability with flexibility.

For example, a $70k car might lease for $1,100/month for 24 months, $950/month for 36 months, and $850/month for 48 months. But the 48-month lease means you’re driving a car that’s nearly halfway to its residual value, which could lead to higher wear-and-tear charges later.

2. Down Payment (Cap Cost Reduction)

Putting money down—also called a capitalized cost reduction—lowers your monthly payment. For instance, putting $5,000 down on a $70k car could reduce your payment by $120–$150 per month. But be cautious: if the car is totaled or stolen, you don’t get that money back. It’s essentially a non-refundable deposit.

Many experts recommend avoiding large down payments. Instead, use that cash for an emergency fund or invest it. Some dealers offer “sign-and-drive” leases with $0 due at signing—great for cash flow, but often at the cost of a slightly higher monthly payment.

3. Mileage Limits and Overages

Most leases include an annual mileage limit—typically 10,000, 12,000, or 15,000 miles. If you drive more, you’ll pay a per-mile fee at the end of the lease, usually $0.15 to $0.25 per mile. On a $70k luxury car, that can add up fast.

For example, driving 18,000 miles in a year on a 12,000-mile lease means 6,000 extra miles. At $0.20/mile, that’s $1,200 in penalties. To avoid this, choose a higher mileage allowance upfront—even if it raises your monthly payment slightly. It’s almost always cheaper than paying overage fees later.

4. Credit Score and Financing

Your credit score affects the money factor, as we mentioned earlier. But it also influences whether you qualify for promotional lease rates. Manufacturers often offer special lease deals to customers with top-tier credit.

If your score is below 700, consider improving it before leasing. Pay down credit card balances, correct errors on your report, and avoid new credit applications. Even a 50-point increase can save you hundreds over the lease term.

5. Make, Model, and Trim Level

Not all $70k cars are created equal. A fully loaded Tesla Model S might lease for less than a base BMW M5 because of differences in depreciation, incentives, and demand. Always compare lease quotes for similar models.

Also, consider certified pre-owned (CPO) luxury cars. A two-year-old $70k car that’s now worth $50k might lease for $600–$800/month—much less than a brand-new version. You get most of the luxury features at a fraction of the cost.

Real-World Examples: Lease Payments on $70k Cars

Visual guide about How Much Is a Lease on a $70k Car

Image source: vehiclegrip.com

Let’s look at actual lease examples to give you a clearer picture. These are based on national averages and typical lease terms as of 2024.

Example 1: 2024 BMW 530i

– MSRP: $70,500

– Residual (36 months): 58% ($40,890)

– Depreciation: $29,610

– Money factor: 0.0010 (2.4% APR)

– Down payment: $3,000

– Monthly payment: ~$1,050 (including tax)

This is a common scenario for a well-equipped BMW. The high residual helps keep payments manageable, but the luxury tax and fees add up.

Example 2: 2024 Mercedes-Benz E 350

– MSRP: $71,200

– Residual (36 months): 56% ($39,872)

– Depreciation: $31,328

– Money factor: 0.0012 (2.88% APR)

– Down payment: $2,500

– Monthly payment: ~$1,120

The E-Class has slightly lower residual value, which increases the monthly cost. But Mercedes often runs lease promotions that can reduce the money factor or offer cash incentives.

Example 3: 2024 Tesla Model S

– MSRP: $70,000 (after federal tax credit)

– Residual (36 months): 60% ($42,000)

– Depreciation: $28,000

– Money factor: 0.0009 (2.16% APR)

– Down payment: $0 (sign-and-drive offer)

– Monthly payment: ~$890

Tesla’s higher residual and lower money factor make it one of the more affordable luxury leases—especially with no down payment.

These examples show how small differences in residual value, money factor, and incentives can shift your monthly payment by $200 or more. Always get multiple quotes and compare the total cost over the lease term.

Tips to Get the Best Lease Deal on a $70k Car

Leasing a luxury car doesn’t have to break the bank. With the right strategy, you can drive a $70k vehicle for less than you think. Here’s how.

Negotiate the Capitalized Cost

The capitalized cost is the price you agree to pay for the car—similar to the purchase price when buying. Most people focus on the monthly payment, but dealers can inflate the cap cost to hide higher profits. Always negotiate this number down, just like you would when buying.

Aim to get the cap cost at or below the invoice price. Use tools like Edmunds or Kelley Blue Book to find the dealer’s cost. Even a $2,000 reduction can save you $50–$60 per month.

Ask for the Money Factor in Writing

Dealers aren’t always transparent about the money factor. Some will quote a low monthly payment but use a high money factor to make up the difference. Always ask for the money factor in writing and convert it to an APR (multiply by 2,400). If it seems high, shop around or wait for a promotion.

Time Your Lease with Manufacturer Incentives

Automakers often run lease specials at the end of the model year (August–October) or during holiday sales events. These can include reduced money factors, cash allowances, or waived acquisition fees. For example, BMW might offer a $2,000 lease cash incentive on the 5 Series in September.

Sign up for brand newsletters and follow dealership social media to catch these deals early.

Consider a Lease Buyout or Transfer

If you fall in love with your leased car, you can buy it at the end of the term for the residual value. Alternatively, you can transfer the lease to someone else through a lease transfer service. This is helpful if you need to get out of the lease early.

Some websites let you list your lease for transfer, often with a small fee. Just make sure the new lessee is approved by the finance company.

Avoid Excess Wear and Tear

Luxury cars come with high expectations for condition. Scratches, dents, or stained upholstery can lead to hefty charges at lease end. Take photos when you pick up the car and keep it clean. Consider a paint protection film or ceramic coating to preserve the finish.

Also, rotate tires regularly and follow the maintenance schedule. Some leases include wear-and-tear waivers for a small monthly fee—worth considering if you’re prone to minor dings.

Should You Lease or Buy a $70k Car?

Leasing isn’t for everyone. It’s important to weigh the pros and cons before committing.

Pros of Leasing a $70k Car

– Lower monthly payments than buying

– Drive a new car every 2–3 years

– Minimal maintenance costs (usually under warranty)

– No hassle selling or trading in later

Cons of Leasing a $70k Car

– No ownership—you’re always renting

– Mileage and wear restrictions

– Fees for early termination or excess damage

– Higher long-term cost if you keep leasing indefinitely

If you love driving the latest models and don’t mind not owning the car, leasing is a great option. But if you drive a lot, want to customize your vehicle, or plan to keep it long-term, buying might be better—even with higher monthly payments.

Final Thoughts: Is Leasing a $70k Car Worth It?

So, how much is a lease on a $70k car? As we’ve seen, it’s typically between $800 and $1,500 per month, depending on the vehicle, your credit, and the terms you negotiate. While that’s not cheap, it’s often more affordable than financing the same car over five or six years.

The key to a smart lease is understanding the numbers, negotiating the cap cost and money factor, and avoiding unnecessary fees. Don’t let the allure of a luxury ride cloud your judgment. Do your homework, compare offers, and read the fine print.

Leasing a $70k car can be a great way to enjoy high-end performance and technology without the long-term commitment of ownership. Just make sure it fits your lifestyle and budget. With the right approach, you can drive in style—without driving yourself into debt.

Frequently Asked Questions

How much is a lease on a $70k car per month?

The average monthly lease payment for a $70,000 car ranges from $800 to $1,500. This depends on the car’s residual value, lease term, money factor, down payment, and taxes.

Is it better to lease or buy a $70k car?

Leasing offers lower monthly payments and the chance to drive a new car every few years, but you don’t build equity. Buying costs more upfront but saves money long-term if you keep the car.

Can I negotiate a lease on a $70k car?

Yes. You can negotiate the capitalized cost, money factor, and fees—just like when buying. Always ask for a written breakdown of all charges.

What happens if I go over my mileage limit?

You’ll be charged a per-mile fee, usually $0.15 to $0.25. For example, driving 3,000 extra miles could cost $450–$750 at lease end.

Do I need a high credit score to lease a $70k car?

A credit score of 720 or higher helps you qualify for the best lease rates. Scores below 650 may result in higher money factors and less favorable terms.

Can I lease a used $70k car?

Yes, many dealers offer lease programs on certified pre-owned luxury vehicles. These often have lower monthly payments due to slower depreciation.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.