Wondering how much AAA car insurance costs per month? Rates vary by location, driving history, and coverage level, but most drivers pay between $50 and $150 monthly. This guide breaks down pricing, discounts, and ways to lower your premium with AAA.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 How Much Is AAA Car Insurance a Month? A Complete Guide

- 4 What Factors Affect Your AAA Car Insurance Premium?

- 5 Average AAA Car Insurance Costs by State

- 6 AAA Car Insurance Discounts: How to Save Money

- 7 AAA Membership: Is It Worth the Extra Cost?

- 8 How Does AAA Compare to Other Insurance Companies?

- 9 Tips to Lower Your AAA Car Insurance Premium

- 10 Final Thoughts: Is AAA Car Insurance Right for You?

- 11 Frequently Asked Questions

- 11.1 How much does AAA car insurance cost per month on average?

- 11.2 Do I need to be a AAA member to get car insurance?

- 11.3 Can I get a discount on AAA car insurance?

- 11.4 Is AAA car insurance cheaper than Geico or Progressive?

- 11.5 Does my credit score affect my AAA insurance rate?

- 11.6 Can I lower my AAA premium if I drive less?

Key Takeaways

- Monthly AAA car insurance costs typically range from $50 to $150 depending on your state, age, vehicle, and coverage choices.

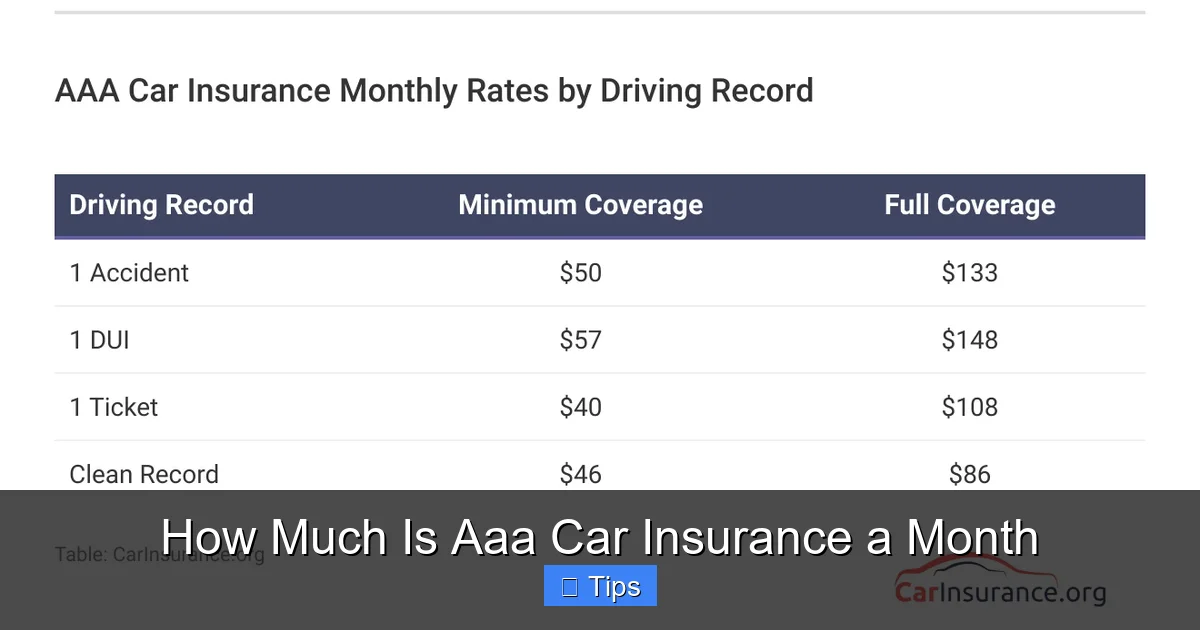

- Your driving record plays a major role in pricing—clean records usually mean lower premiums, while accidents or tickets can increase costs.

- AAA offers multiple discounts such as safe driver, multi-car, good student, and bundling with home or renters insurance.

- Where you live affects your rate significantly—urban areas with higher traffic and theft rates often have higher premiums than rural zones.

- Choosing higher deductibles can reduce monthly payments, but you’ll pay more out of pocket if you file a claim.

- AAA membership is required to get insurance, which adds an annual fee but may be worth it for the added perks and potential savings.

- Comparing quotes from AAA and other insurers ensures you’re getting the best deal for your specific needs.

📑 Table of Contents

- How Much Is AAA Car Insurance a Month? A Complete Guide

- What Factors Affect Your AAA Car Insurance Premium?

- Average AAA Car Insurance Costs by State

- AAA Car Insurance Discounts: How to Save Money

- AAA Membership: Is It Worth the Extra Cost?

- How Does AAA Compare to Other Insurance Companies?

- Tips to Lower Your AAA Car Insurance Premium

- Final Thoughts: Is AAA Car Insurance Right for You?

How Much Is AAA Car Insurance a Month? A Complete Guide

If you’re shopping for car insurance, you’ve probably come across AAA—one of the most trusted names in roadside assistance and auto coverage. But how much is AAA car insurance a month? The short answer? It depends. While AAA is known for excellent customer service and reliable support, its monthly premiums can vary widely based on personal factors like where you live, how you drive, and what kind of car you own.

Many drivers are drawn to AAA not just for insurance, but for the full package: 24/7 roadside help, trip planning, travel discounts, and more. But before you sign up, it’s smart to understand what you might pay each month. On average, AAA car insurance costs between $50 and $150 per month. That’s a broad range, and your actual rate could fall anywhere within—or even outside—that window. In this guide, we’ll break down everything that influences your premium, how AAA stacks up against competitors, and practical tips to keep your costs low.

What Factors Affect Your AAA Car Insurance Premium?

Your monthly car insurance payment isn’t random. Insurance companies like AAA use a detailed formula to calculate risk—and your premium reflects how likely you are to file a claim. Several key factors go into that calculation, and understanding them can help you anticipate your rate and even find ways to reduce it.

Visual guide about How Much Is Aaa Car Insurance a Month

Image source: carinsurance.org

1. Your Driving Record

Your history behind the wheel is one of the biggest predictors of your insurance cost. If you’ve had accidents, speeding tickets, or DUIs, insurers see you as a higher risk. For example, a single at-fault accident could increase your premium by 20% to 50%, depending on severity. On the flip side, maintaining a clean driving record for several years can qualify you for safe driver discounts, which AAA offers to reward responsible behavior.

2. Location, Location, Location

Where you live has a massive impact on your rate. Urban areas like Los Angeles, New York City, or Chicago tend to have higher premiums due to traffic congestion, higher accident rates, and increased vehicle theft. In contrast, rural areas with less traffic and lower crime rates often see lower premiums. Even within the same state, ZIP codes matter. For instance, a driver in downtown San Francisco might pay significantly more than someone in a quiet suburb just 30 miles away.

3. Age and Experience

Young drivers, especially teens and those in their early 20s, typically face the highest insurance rates. This is because statistics show younger drivers are more likely to be involved in accidents. A 16-year-old driver might pay $200 or more per month, while a 35-year-old with a clean record could pay half that. However, rates generally stabilize around age 25 and may even decrease as you gain more experience.

4. Type of Vehicle

The car you drive affects your premium too. High-performance vehicles, luxury cars, and models with high repair costs usually come with higher insurance rates. For example, insuring a sports car like a Mustang or a luxury SUV like a BMW X5 will cost more than a compact sedan like a Honda Civic. Safety ratings also matter—cars with top safety scores from the IIHS or NHTSA may qualify for discounts.

5. Coverage Level and Deductible

The amount of coverage you choose directly impacts your monthly payment. Basic liability-only plans are the cheapest but offer minimal protection. Full coverage—which includes collision, comprehensive, and uninsured motorist protection—costs more but gives you peace of mind. Additionally, choosing a higher deductible (the amount you pay out of pocket before insurance kicks in) can lower your monthly premium. For example, raising your deductible from $500 to $1,000 might save you $10–$20 per month.

Average AAA Car Insurance Costs by State

Because insurance is regulated at the state level, AAA premiums can vary dramatically depending on where you live. Below are some real-world examples of average monthly costs in different states, based on data from recent consumer reports and insurance surveys.

Visual guide about How Much Is Aaa Car Insurance a Month

Image source: thumbor.forbes.com

California

In California, the average AAA car insurance premium is around $120 per month for full coverage. However, drivers in high-risk areas like Los Angeles or San Diego may pay closer to $150. California also has strict liability laws, requiring minimum coverage that can drive up base rates.

Texas

Texas drivers typically pay about $110 per month with AAA. Rural areas like Lubbock or Amarillo may see rates as low as $80, while Houston and Dallas residents often pay over $130 due to traffic density and weather-related risks like hailstorms.

Florida

Florida is one of the most expensive states for car insurance, and AAA is no exception. The average monthly premium here is around $140, with some drivers in Miami paying over $200. High rates are due to no-fault insurance laws, frequent hurricanes, and a large number of uninsured drivers.

Ohio

Ohio offers some of the most affordable car insurance in the country. AAA customers in Columbus or Cleveland might pay as little as $60 per month for basic coverage. Even full coverage averages around $90, making it a great state for budget-conscious drivers.

New York

New York drivers face high premiums, especially in New York City. The average AAA monthly cost here is about $160, with some Manhattan residents paying over $200. High population density, traffic, and theft contribute to these elevated rates.

Keep in mind that these are averages. Your actual rate could be higher or lower based on your personal profile. The best way to get an accurate estimate is to request a free quote from AAA using your specific details.

AAA Car Insurance Discounts: How to Save Money

One of the biggest advantages of choosing AAA for car insurance is the wide range of discounts available. These can significantly reduce your monthly premium, sometimes by 20% or more. Here are some of the most common and valuable discounts AAA offers.

Visual guide about How Much Is Aaa Car Insurance a Month

Image source: d2tez01fe91909.cloudfront.net

Safe Driver Discount

If you’ve gone three to five years without an accident or moving violation, you likely qualify for a safe driver discount. This can save you 10% to 25% on your premium. AAA rewards responsible driving because it lowers their risk—and they pass those savings on to you.

Multi-Car Discount

Insuring more than one vehicle with AAA? You could save up to 20% on each policy. This is especially helpful for families with multiple drivers or households with more than one car. Just make sure all vehicles are registered under the same policyholder.

Good Student Discount

Students with a B average or higher (usually a 3.0 GPA) can qualify for a good student discount. This typically applies to full-time high school or college students under 25. Proof of grades, like a report card or transcript, may be required.

Multi-Policy Discount

Bundling your car insurance with other AAA policies—like home, renters, or life insurance—can unlock significant savings. Many customers save 10% to 15% just by combining policies. It also simplifies billing and customer service.

Low Mileage Discount

If you drive fewer than 7,500 to 10,000 miles per year, you might qualify for a low mileage discount. This is ideal for remote workers, retirees, or people who use public transportation. AAA may ask for odometer readings or use telematics to verify mileage.

Defensive Driving Course Discount

Completing an approved defensive driving course can earn you a discount, usually around 5% to 10%. These courses teach advanced safety techniques and are often available online. Some states even require them for license renewal or point reduction.

Anti-Theft Device Discount

Vehicles equipped with factory-installed anti-theft systems—like alarms, immobilizers, or GPS trackers—may qualify for a discount. This reduces the risk of theft, which lowers the insurer’s potential payout.

To maximize savings, ask your AAA agent about all available discounts when getting a quote. Some may not be automatically applied, so it pays to speak up.

AAA Membership: Is It Worth the Extra Cost?

Here’s something many people don’t realize: to get AAA car insurance, you must be a AAA member. Membership isn’t free—it typically costs between $50 and $100 per year, depending on the level (Classic, Plus, or Premier). So, when calculating your total cost, you’ll need to factor in this annual fee.

What You Get with AAA Membership

AAA membership includes more than just insurance eligibility. You also get access to:

- 24/7 roadside assistance (towing, jump-starts, flat tire changes)

- Trip planning and travel discounts (hotels, rental cars, attractions)

- Free maps and travel guides

- Identity theft monitoring (with higher-tier plans)

- Car battery replacement and maintenance services

Is the Membership Fee Worth It?

For many drivers, yes. If you’ve ever been stranded with a dead battery or needed a tow, you know how valuable roadside help can be. A single tow can cost $100 or more—so one emergency could cover your annual membership fee. Plus, the travel perks can add up quickly if you take road trips or vacation often.

That said, if you rarely drive or already have roadside assistance through your credit card or auto manufacturer, the added cost might not be justified. Weigh the benefits against your lifestyle and driving habits.

Can You Get Insurance Without Membership?

No. AAA requires membership to purchase car insurance. However, the membership is often included or heavily discounted when you sign up for a policy. Some agents may even waive the first year’s fee as a promotion.

How Does AAA Compare to Other Insurance Companies?

AAA is a solid choice for many drivers, but it’s not the only option. So how does it stack up against competitors like Geico, State Farm, Progressive, and Allstate?

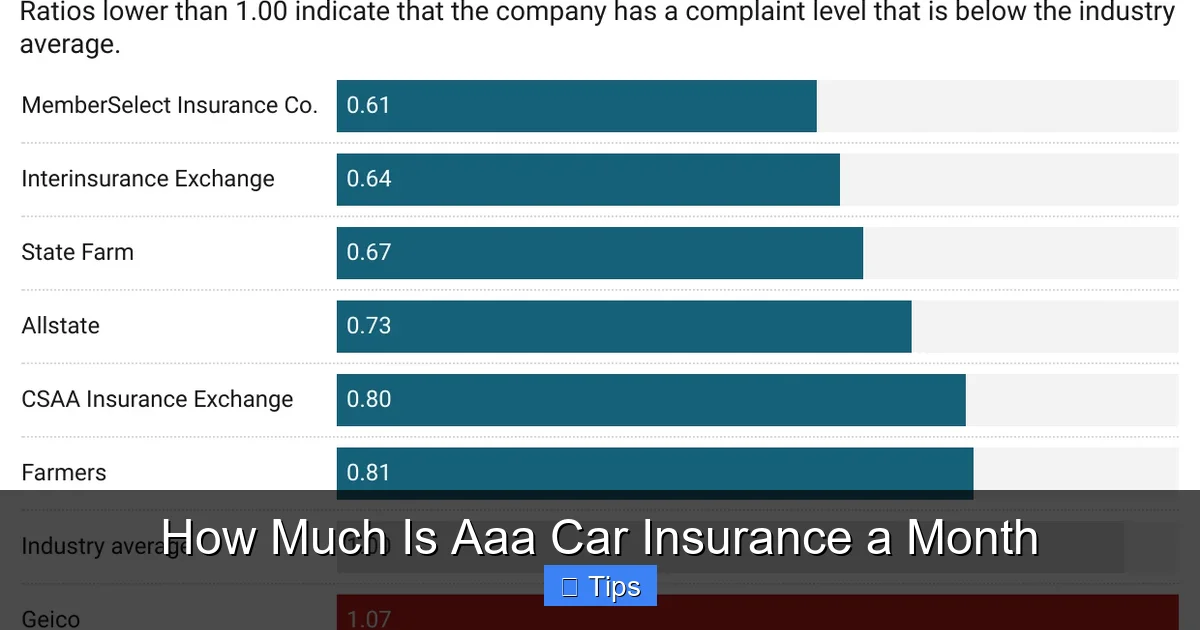

Customer Service and Reputation

AAA consistently ranks high in customer satisfaction surveys. J.D. Power and Consumer Reports often place AAA in the top tier for claims handling and support. Their local clubs and agents provide personalized service, which many customers appreciate.

Pricing

In terms of cost, AAA is generally competitive but not always the cheapest. Geico and Progressive often offer lower rates for young drivers or those with less-than-perfect records. However, AAA may be more affordable for safe drivers in certain states, especially when discounts are applied.

Coverage Options

AAA offers standard coverage types—liability, collision, comprehensive, uninsured motorist, and personal injury protection. They also provide optional add-ons like roadside assistance (included with membership), rental reimbursement, and gap insurance. While their menu isn’t the most expansive, it covers most drivers’ needs.

Digital Tools and Convenience

AAA has improved its online tools in recent years, offering mobile apps, digital ID cards, and online claims filing. However, some competitors like Geico and Progressive have more advanced tech, including usage-based insurance programs and AI-powered chatbots.

Availability

AAA operates through regional clubs, so availability varies. It’s widely available in states like California, Florida, Ohio, and New York, but may not be offered in all 50 states. Always check if AAA insurance is available in your area before shopping.

Ultimately, the best insurer depends on your priorities. If you value personal service, roadside help, and a trusted brand, AAA is a great fit. If you’re focused solely on low cost, it’s worth comparing quotes from multiple providers.

Tips to Lower Your AAA Car Insurance Premium

Even if you’re happy with AAA, there’s always room to save. Here are some practical tips to reduce your monthly payment without sacrificing coverage.

1. Raise Your Deductible

As mentioned earlier, increasing your deductible from $500 to $1,000 can lower your premium. Just make sure you have enough savings to cover the higher out-of-pocket cost if you need to file a claim.

2. Maintain a Clean Driving Record

Safe driving isn’t just good for your safety—it’s good for your wallet. Avoid speeding, distracted driving, and other risky behaviors to keep your record clean and qualify for discounts.

3. Take Advantage of All Discounts

Don’t assume discounts are automatic. Review your policy annually and ask your agent if you qualify for any you’re not using. Even small savings add up over time.

4. Drive Less

If you can reduce your annual mileage—by carpooling, working from home, or using public transit—you may qualify for a low mileage discount. Some insurers even offer pay-per-mile plans, though AAA doesn’t currently have one.

5. Improve Your Credit Score

In most states, insurers use credit-based insurance scores to help determine rates. Paying bills on time, reducing debt, and checking your credit report for errors can improve your score and lower your premium.

6. Reassess Your Coverage Needs

If your car is older and has depreciated significantly, you might not need comprehensive or collision coverage. Dropping these can save you $20–$50 per month. Just make sure you’re not underinsured.

7. Compare Quotes Annually

Insurance rates change frequently. Even if you love AAA, it’s smart to shop around every year or two. You might find a better deal elsewhere—or use a competitor’s quote to negotiate a lower rate with AAA.

Final Thoughts: Is AAA Car Insurance Right for You?

So, how much is AAA car insurance a month? For most drivers, it’s somewhere between $50 and $150, depending on a mix of personal and geographic factors. While it’s not always the cheapest option, AAA offers strong customer service, valuable membership perks, and a wide range of discounts that can make it a smart choice.

If you’re looking for a reliable insurer with a long history of trust and support—and you don’t mind paying a bit more for peace of mind—AAA is worth considering. But don’t stop there. Get quotes from at least two or three other companies to ensure you’re getting the best value. Remember, the lowest price isn’t always the best deal if it comes with poor service or inadequate coverage.

Ultimately, the right car insurance is about more than just cost. It’s about feeling protected on the road, knowing help is available when you need it, and having a partner you can count on. For many drivers, AAA delivers exactly that.

Frequently Asked Questions

How much does AAA car insurance cost per month on average?

The average monthly cost of AAA car insurance ranges from $50 to $150, depending on your location, driving history, vehicle, and coverage level. Rates vary widely by state and personal factors.

Do I need to be a AAA member to get car insurance?

Yes, AAA membership is required to purchase car insurance. Membership costs $50–$100 per year and includes roadside assistance, travel discounts, and other perks.

Can I get a discount on AAA car insurance?

Yes, AAA offers many discounts, including safe driver, multi-car, good student, low mileage, and multi-policy discounts. Ask your agent about all available savings when getting a quote.

Is AAA car insurance cheaper than Geico or Progressive?

Not always. While AAA is competitive, Geico and Progressive often offer lower rates for high-risk drivers. However, AAA may be more affordable for safe drivers in certain states.

Does my credit score affect my AAA insurance rate?

Yes, in most states, AAA uses credit-based insurance scores to help determine premiums. Maintaining a good credit score can help lower your monthly payment.

Yes, if you drive fewer than 7,500–10,000 miles per year, you may qualify for a low mileage discount. Be prepared to provide odometer readings or use telematics to verify your mileage.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.