Car insurance for 18 year olds is typically expensive due to lack of driving experience, but costs vary widely by state, vehicle, and coverage level. With smart choices—like choosing a safe car, maintaining good grades, and comparing quotes—you can significantly reduce your premium.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 How Much Is Car Insurance for 18 Year Olds?

- 4 Why Is Car Insurance So Expensive for 18-Year-Olds?

- 5 Average Car Insurance Costs for 18-Year-Olds

- 6 Factors That Affect Car Insurance Rates for 18-Year-Olds

- 7 Ways to Save on Car Insurance as an 18-Year-Old

- 8 Should 18-Year-Olds Get Their Own Policy or Stay on a Parent’s?

- 9 Tips for First-Time Car Insurance Buyers

- 10 Final Thoughts: Managing Car Insurance Costs as an 18-Year-Old

- 11 Frequently Asked Questions

- 11.1 Why is car insurance so expensive for 18-year-olds?

- 11.2 Can an 18-year-old get their own car insurance policy?

- 11.3 What type of car is cheapest to insure for an 18-year-old?

- 11.4 Do good grades really lower car insurance rates?

- 11.5 How much can I save by taking a defensive driving course?

- 11.6 Will my car insurance go down when I turn 25?

Key Takeaways

- 18-year-olds pay high car insurance rates: On average, annual premiums range from $3,000 to $7,000, depending on location and coverage.

- Age and experience are key factors: Insurance companies view young drivers as high-risk due to higher accident rates.

- Vehicle type matters: Sports cars and luxury vehicles increase premiums, while safe, economical cars are cheaper to insure.

- Good student discounts help: Many insurers offer discounts for maintaining a B average or higher in school.

- Shop around and compare quotes: Rates can vary by hundreds of dollars between companies—always get at least three quotes.

- Consider being added to a parent’s policy: This is often cheaper than getting a standalone policy.

- Defensive driving courses can lower costs: Completing an approved course may qualify you for a discount with some insurers.

📑 Table of Contents

- How Much Is Car Insurance for 18 Year Olds?

- Why Is Car Insurance So Expensive for 18-Year-Olds?

- Average Car Insurance Costs for 18-Year-Olds

- Factors That Affect Car Insurance Rates for 18-Year-Olds

- Ways to Save on Car Insurance as an 18-Year-Old

- Should 18-Year-Olds Get Their Own Policy or Stay on a Parent’s?

- Tips for First-Time Car Insurance Buyers

- Final Thoughts: Managing Car Insurance Costs as an 18-Year-Old

How Much Is Car Insurance for 18 Year Olds?

Turning 18 and getting your driver’s license is a big milestone—but it also comes with a hefty price tag when it comes to car insurance. If you’re an 18-year-old (or the parent of one), you’ve probably noticed that car insurance isn’t cheap. In fact, it’s often one of the most expensive financial responsibilities a young adult faces. But why is it so costly? And more importantly, what can you do to bring those numbers down?

The short answer? Car insurance for 18 year olds is expensive—but not impossible to manage. On average, an 18-year-old driver pays between $3,000 and $7,000 per year for a full-coverage policy. That’s significantly higher than what older, more experienced drivers pay. The good news? There are proven strategies to reduce your premium without sacrificing essential protection. From choosing the right car to taking advantage of discounts, small decisions can lead to big savings.

In this guide, we’ll break down exactly how much car insurance costs for 18-year-olds, explore the factors that influence those rates, and share practical tips to help you get the best deal. Whether you’re shopping for your first policy or helping a teen driver get insured, this guide will give you the knowledge you need to make smart, informed choices.

Why Is Car Insurance So Expensive for 18-Year-Olds?

Let’s face it—insurance companies don’t love young drivers. And for good reason. Statistically, drivers under 25 are involved in more accidents than any other age group. According to the National Highway Traffic Safety Administration (NHTSA), drivers aged 16 to 19 are nearly three times more likely to be in a fatal crash than drivers 20 and older. At 18, you’re still in that high-risk category, even if you’ve had your license for a while.

Visual guide about How Much Is Car Insurance for 18 Year Olds

Image source: agilerates.com

Lack of Driving Experience

One of the biggest reasons car insurance is so expensive for 18-year-olds is simple: you haven’t been driving long enough to build a safe driving record. Insurance companies rely heavily on historical data to assess risk. Since new drivers don’t have a track record of safe driving, they’re considered a gamble. The more risk an insurer takes on, the higher the premium.

Higher Accident Rates

Teen drivers are more likely to speed, text while driving, or make poor decisions behind the wheel. These behaviors increase the chance of accidents, which means higher claims for insurers. Even if you’re a cautious driver, the statistics work against you. Until you’ve logged several years of accident-free driving, you’ll be grouped with the higher-risk crowd.

Gender Can Play a Role

Believe it or not, gender still affects insurance rates—especially for young drivers. Male drivers under 25 typically pay more than female drivers of the same age. This is because young men are statistically more likely to engage in risky driving behaviors. However, this gap narrows significantly after age 25, and some states have banned gender-based pricing altogether.

Where You Live Matters

Your location has a huge impact on your insurance premium. Urban areas with heavy traffic, high crime rates, and frequent accidents tend to have higher rates than rural areas. For example, an 18-year-old in Detroit, Michigan, might pay over $10,000 per year, while someone in rural Maine might pay closer to $2,500. State regulations, population density, and local accident rates all play a role.

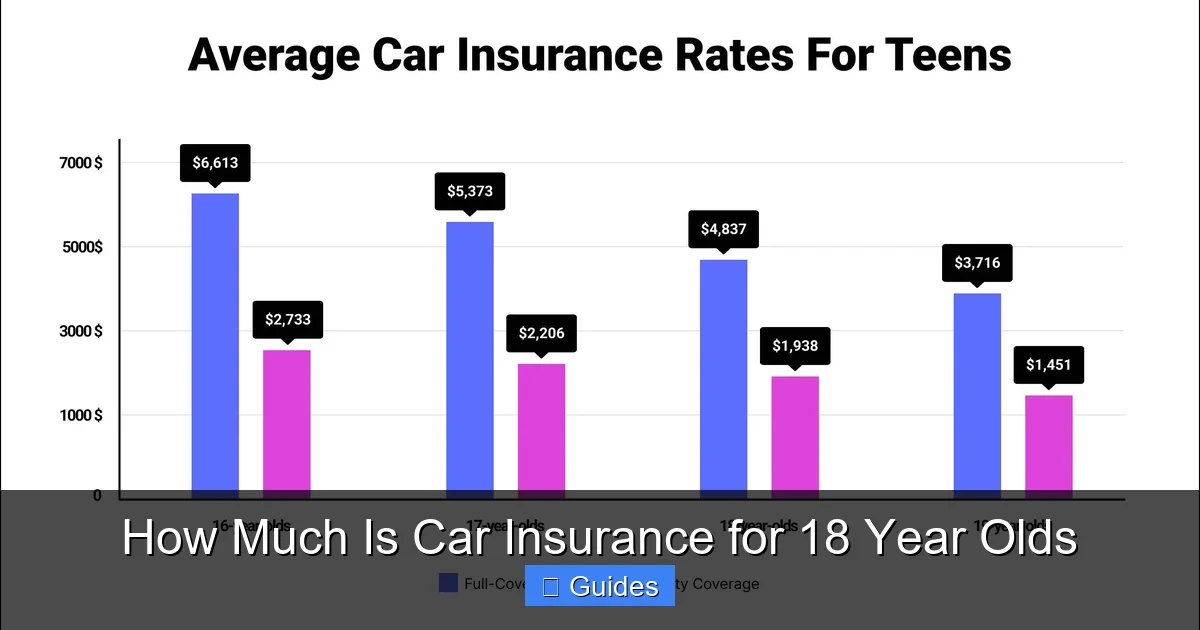

Average Car Insurance Costs for 18-Year-Olds

So, how much is car insurance for 18 year olds, exactly? The answer depends on several factors, but we can look at national averages to get a general idea. According to recent data from sources like the Insurance Information Institute and major insurers, here’s what you can expect:

Visual guide about How Much Is Car Insurance for 18 Year Olds

Image source: csinsure.com

- Full coverage policy: $3,000–$7,000 per year

- Liability-only policy: $1,500–$3,500 per year

- Monthly premium (full coverage): $250–$600

- Monthly premium (liability-only): $125–$300

These numbers can vary widely based on your state, driving history, vehicle, and the insurance company you choose. For example, a liability-only policy in North Dakota might cost as little as $1,200 per year, while the same policy in Florida could run over $4,000. Full coverage is even more expensive in high-risk areas.

State-by-State Examples

Let’s look at a few real-world examples to illustrate the differences:

- California: Average full coverage for an 18-year-old is around $4,200 per year. California has strict insurance requirements and high population density, which drives up costs.

- Texas: Expect to pay about $5,000 per year for full coverage. Texas has high accident rates and expensive repair costs, especially in cities like Houston and Dallas.

- Ohio: One of the more affordable states, with average full coverage around $2,800 per year. Lower population density and fewer accidents help keep rates down.

- New York: One of the most expensive states, with full coverage averaging $6,500 or more. High traffic, theft rates, and legal costs contribute to the high premiums.

These examples show that where you live can make a massive difference. Even within the same state, rates can vary between cities and neighborhoods. Always get local quotes to get an accurate picture.

Liability vs. Full Coverage

Another key factor is the type of coverage you choose. Most states require at least liability insurance, which covers damage and injuries you cause to others. But liability-only policies don’t protect your own vehicle. Full coverage includes liability, collision, and comprehensive insurance, which covers damage to your car from accidents, theft, vandalism, and weather.

For an 18-year-old, full coverage is often recommended—especially if you’re financing or leasing a car. Lenders typically require it. But if you own an older, low-value car, liability-only might make sense to save money. Just remember: if you total your car, you’ll have to pay for a replacement out of pocket.

Factors That Affect Car Insurance Rates for 18-Year-Olds

Now that you know the average costs, let’s dig into what actually determines how much you’ll pay. Insurance companies use a complex formula to calculate premiums, but most factors fall into a few key categories.

Visual guide about How Much Is Car Insurance for 18 Year Olds

Image source: cdn2.adrianflux.co.uk

1. Age and Driving Experience

As we’ve discussed, age is one of the biggest factors. The younger you are, the higher your rate—especially if you’ve only had your license for a short time. Each year of safe driving helps lower your premium. By age 25, most drivers see a significant drop in their insurance costs.

2. Type of Vehicle

The car you drive has a huge impact on your insurance rate. Insurers look at safety ratings, repair costs, theft rates, and performance. Here’s how different types of vehicles compare:

- Economy cars (e.g., Honda Civic, Toyota Corolla): Low repair costs, good safety ratings, and low theft rates make these the cheapest to insure.

- SUVs and minivans (e.g., Honda CR-V, Toyota Sienna): Generally safe and practical, but larger vehicles can be more expensive to repair.

- Sports cars (e.g., Ford Mustang, Chevrolet Camaro): High performance and high theft risk lead to much higher premiums.

- Luxury vehicles (e.g., BMW, Mercedes-Benz): Expensive parts and repairs mean higher insurance costs.

If you’re shopping for your first car, stick with a reliable, safe, and affordable model. Avoid anything flashy or high-performance—it’ll cost you more at the pump and at the insurance office.

3. Driving Record

Even at 18, your driving history matters. A clean record with no accidents or tickets will help keep your rates lower. But one speeding ticket or at-fault accident can increase your premium by 20% or more. Some insurers offer accident forgiveness, but it’s not common for young drivers.

4. Credit Score (in Most States)

In most states (except California, Hawaii, and Massachusetts), insurers use credit-based insurance scores to help determine rates. A lower credit score can lead to higher premiums, even if you’ve never had an accident. This is because studies show a correlation between credit history and claim frequency. If you’re just starting to build credit, consider getting a secured credit card and paying it off in full each month.

5. Annual Mileage

The more you drive, the higher your risk of an accident. If you commute long distances or drive frequently for work or school, your premium may be higher. Conversely, if you only drive a few thousand miles per year, you might qualify for a low-mileage discount.

6. Coverage Limits and Deductibles

Higher coverage limits and lower deductibles mean more protection—but also higher premiums. For example, a $1,000 deductible will cost more per month than a $2,500 deductible. Choose limits that protect your assets but don’t over-insure. A good rule of thumb is to have enough liability coverage to cover your net worth.

Ways to Save on Car Insurance as an 18-Year-Old

The good news? Even though car insurance is expensive for 18-year-olds, there are plenty of ways to reduce your costs. With a little effort, you can save hundreds—or even thousands—of dollars per year.

1. Stay on Your Parent’s Policy

One of the easiest ways to save is to be added to a parent’s insurance policy instead of getting your own. Most insurers allow this, and it’s almost always cheaper than a standalone policy. You’ll benefit from the parent’s longer driving history and lower risk profile. Just make sure the car is registered in the parent’s name or that you’re listed as a primary driver.

2. Maintain Good Grades

Many insurance companies offer a “good student discount” for drivers who maintain a B average or higher. This typically requires submitting transcripts or report cards. The discount can be 10–25% off your premium, which adds up over time. Even if you’re not in school, some insurers offer discounts for completing a driver’s education course.

3. Take a Defensive Driving Course

Completing an approved defensive driving or driver’s education course can qualify you for a discount with many insurers. These courses teach safe driving techniques and help reduce risk. Some states even require them for new drivers. Check with your insurance company to see if they offer this discount and which courses are approved.

4. Choose a Safe, Affordable Car

As mentioned earlier, the car you drive plays a big role in your insurance cost. Opt for a vehicle with high safety ratings, low repair costs, and a low theft rate. Avoid modified cars or anything with a powerful engine. You can use tools like the Insurance Institute for Highway Safety (IIHS) website to compare safety ratings.

5. Increase Your Deductible

Raising your deductible—the amount you pay out of pocket before insurance kicks in—can lower your monthly premium. For example, increasing your deductible from $500 to $1,000 might save you 15–20% on your premium. Just make sure you can afford the higher deductible if you ever need to file a claim.

6. Shop Around and Compare Quotes

Never accept the first quote you get. Insurance rates vary widely between companies, even for the same driver and vehicle. Get quotes from at least three different insurers—including national companies like GEICO, State Farm, and Progressive, as well as local or regional insurers. Use online comparison tools or work with an independent agent to find the best deal.

7. Ask About Discounts

Many insurers offer discounts that aren’t always advertised. Common ones include:

- Multi-car discount: If you insure more than one vehicle with the same company.

- Pay-in-full discount: Paying your annual premium upfront instead of monthly.

- Paperless billing discount: Opting for electronic statements.

- Safe driver discount: For maintaining a clean driving record.

- Telematics or usage-based programs: Some insurers offer discounts for safe driving tracked via a mobile app or device.

Don’t be afraid to ask your agent about available discounts. You might be surprised by what you qualify for.

Should 18-Year-Olds Get Their Own Policy or Stay on a Parent’s?

This is one of the most common questions for young drivers and their families. Should an 18-year-old get their own insurance policy, or is it better to stay on a parent’s plan? The answer depends on your situation, but in most cases, staying on a parent’s policy is the smarter financial move.

Pros of Staying on a Parent’s Policy

- Lower premiums: Parents typically have longer driving histories and better credit, which leads to lower rates.

- Easier claims process: The parent is usually the primary policyholder, which can simplify things if an accident occurs.

- Continuity of coverage: No gaps in insurance, which can prevent rate hikes.

Cons of Staying on a Parent’s Policy

- Liability concerns: If the teen causes a major accident, the parent’s assets could be at risk.

- Policy cancellation risk: If the parent cancels the policy, the teen may have trouble getting insured later.

- Less independence: The teen doesn’t build their own insurance history.

When to Get Your Own Policy

There are situations where getting your own policy makes sense:

- You’re living independently and the car is in your name.

- Your parents’ insurer won’t allow you to be added to their policy.

- You want to build your own credit and insurance history.

- You’re financing the car and the lender requires you to be the primary policyholder.

If you do get your own policy, make sure to shop around and take advantage of every discount available. And remember: your rates will drop significantly as you gain more driving experience.

Tips for First-Time Car Insurance Buyers

Buying car insurance for the first time can feel overwhelming. There’s a lot to consider, from coverage types to deductibles to discounts. Here are some practical tips to help you navigate the process:

1. Understand Your State’s Requirements

Every state has minimum insurance requirements, but they vary widely. Some states require only liability coverage, while others require uninsured motorist protection or personal injury protection (PIP). Make sure you know what’s legally required in your state before shopping for a policy.

2. Don’t Skimp on Liability Coverage

It’s tempting to go with the minimum liability limits to save money, but this can be a costly mistake. If you cause an accident and the damages exceed your coverage, you could be sued for the difference. A good rule of thumb is to have at least $100,000 per person and $300,000 per accident in liability coverage.

3. Consider Adding Uninsured/Underinsured Motorist Coverage

This protects you if you’re hit by a driver who doesn’t have insurance or doesn’t have enough coverage. It’s relatively inexpensive and can save you thousands in medical bills and repairs.

4. Review Your Policy Annually

Your insurance needs can change over time. Maybe you’ve moved, gotten a better grade, or completed a driving course. Review your policy each year and shop around to make sure you’re still getting the best deal.

5. Keep Your Driving Record Clean

The best way to keep your insurance costs down is to drive safely. Avoid speeding, distracted driving, and other risky behaviors. A clean record will help you qualify for lower rates and discounts over time.

Final Thoughts: Managing Car Insurance Costs as an 18-Year-Old

Car insurance for 18-year-olds is undeniably expensive, but it doesn’t have to break the bank. By understanding the factors that affect your premium and taking proactive steps to reduce risk, you can save a significant amount of money. Start by comparing quotes, choosing a safe vehicle, and taking advantage of every discount available.

Remember, your insurance costs will decrease as you gain more driving experience and build a clean record. In a few years, you’ll likely see your premiums drop by 30% or more. Until then, stay informed, drive safely, and make smart financial decisions. With the right approach, you can protect yourself on the road without draining your wallet.

Frequently Asked Questions

Why is car insurance so expensive for 18-year-olds?

Car insurance is expensive for 18-year-olds because they are considered high-risk drivers due to lack of experience and higher accident rates. Insurance companies use statistical data showing that young drivers are more likely to be involved in crashes, which leads to higher premiums.

Can an 18-year-old get their own car insurance policy?

Yes, an 18-year-old can get their own car insurance policy. However, it’s often cheaper to be added to a parent’s policy, especially if the parent has a good driving record and longer history with the insurer.

What type of car is cheapest to insure for an 18-year-old?

Safe, reliable, and economical cars like the Honda Civic, Toyota Corolla, or Subaru Impreza are usually the cheapest to insure. Avoid sports cars, luxury vehicles, or models with high theft or repair costs.

Do good grades really lower car insurance rates?

Yes, many insurance companies offer a “good student discount” for drivers who maintain a B average or higher. This can reduce premiums by 10–25%, so it’s worth submitting your grades if your insurer offers this discount.

How much can I save by taking a defensive driving course?

Completing an approved defensive driving course can save you 5–15% on your car insurance premium, depending on the insurer and state. Some companies require the course to be state-approved, so check with your provider first.

Will my car insurance go down when I turn 25?

Yes, most drivers see a significant drop in car insurance rates after turning 25. This is because insurers consider drivers over 25 to be lower risk due to greater experience and maturity. Rates typically decrease gradually each year after age 25.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.