Featured image for How Much Is Car Insurance For A 16 Year Old

Image source: bankrate.com

Car insurance for a 16-year-old is exceptionally expensive, with average annual premiums often exceeding $2,000. The final cost is dramatically influenced by factors like gender, location, vehicle choice, and the insurer’s own pricing model. Adding the teen to a parent’s policy and seeking out good student discounts are the most effective ways to significantly reduce this financial burden.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What 16 Year Olds Pay For Car Insurance: A Parent’s (and Teen’s) Survival Guide

- 4 Why Is Car Insurance For a 16 Year Old So Expensive?

- 5 Breaking Down the Numbers: Average Costs for 16-Year-Old Drivers

- 6 The 7 Biggest Factors That Determine What You’ll Pay

- 7 Smart Strategies to Lower the Cost (Without Compromising Safety)

- 8 The Practical Steps: How to Get That First Quote

- 9 The Emotional Bottom Line: It’s an Investment

- 10 Frequently Asked Questions

- 10.1 How much does car insurance typically cost for a 16-year-old?

- 10.2 Why is car insurance so expensive for 16-year-olds?

- 10.3 What factors influence the cost of car insurance for a 16 year old?

- 10.4 How can I lower car insurance for a 16 year old?

- 10.5 Is it better for a 16-year-old to have their own car insurance policy?

- 10.6 What cars are cheapest to insure for a 16 year old?

Key Takeaways

- Expect high premiums: Teen drivers face the highest rates due to risk.

- Seek good student discounts: Maintain good grades to lower your premium.

- Join a parent’s policy: This is often more affordable than a standalone policy.

- Choose a safe, modest car: Avoid sports cars to reduce insurance costs.

- Compare multiple quotes: Shop around to find the best insurance deal.

- Maintain a clean record: Avoid accidents and tickets to keep rates low.

📑 Table of Contents

- What 16 Year Olds Pay For Car Insurance: A Parent’s (and Teen’s) Survival Guide

- Why Is Car Insurance For a 16 Year Old So Expensive?

- Breaking Down the Numbers: Average Costs for 16-Year-Old Drivers

- The 7 Biggest Factors That Determine What You’ll Pay

- Smart Strategies to Lower the Cost (Without Compromising Safety)

- The Practical Steps: How to Get That First Quote

- The Emotional Bottom Line: It’s an Investment

What 16 Year Olds Pay For Car Insurance: A Parent’s (and Teen’s) Survival Guide

Let’s set the scene. Your 16-year-old has just passed their driving test. The freedom! The independence! The… utterly terrifying insurance quote that just landed in your inbox. If your first reaction was a sharp gasp followed by checking if there was a decimal point in the wrong place, you’re not alone.

For most families, figuring out what 16 year olds pay for car insurance is a rite of passage, often accompanied by sticker shock. It’s the moment you realize that the “new driver” premium isn’t just a little higher—it’s in a whole different stratosphere. But why? And more importantly, what can you actually do about it?

In this guide, we’ll walk through the realities of car insurance for a 16-year-old driver. We’ll break down the numbers, explain the “why” behind the cost, and—most crucially—share practical, actionable strategies to make it more manageable. Consider this your friendly map through the confusing and expensive world of teen driver insurance.

Why Is Car Insurance For a 16 Year Old So Expensive?

Before we get to the numbers, it’s essential to understand the “why.” Insurance companies aren’t being mean; they’re being mathematical. Their rates are based on risk, and statistically, teen drivers are the riskiest group on the road.

Visual guide about How Much Is Car Insurance For A 16 Year Old

Image source: forbes.com

The Harsh Statistics of Teen Driving

According to the CDC, teen drivers aged 16–19 are nearly three times more likely than drivers aged 20 and older to be in a fatal crash per mile driven. Inexperience is the biggest factor. They’re still learning to scan for hazards, judge speeds, and manage distractions. This lack of a driving history means insurers see a big question mark, and they price that uncertainty accordingly.

How Insurance Companies See Your Teen

Beyond general stats, insurers look at specific risk factors common to 16-year-olds. This includes a higher likelihood of speeding, not wearing seat belts, and driving with peer passengers, which can dramatically increase crash risk. The simple fact is, a 16-year-old driver represents a significantly higher probability of a costly claim than a 40-year-old driver with a clean 20-year record.

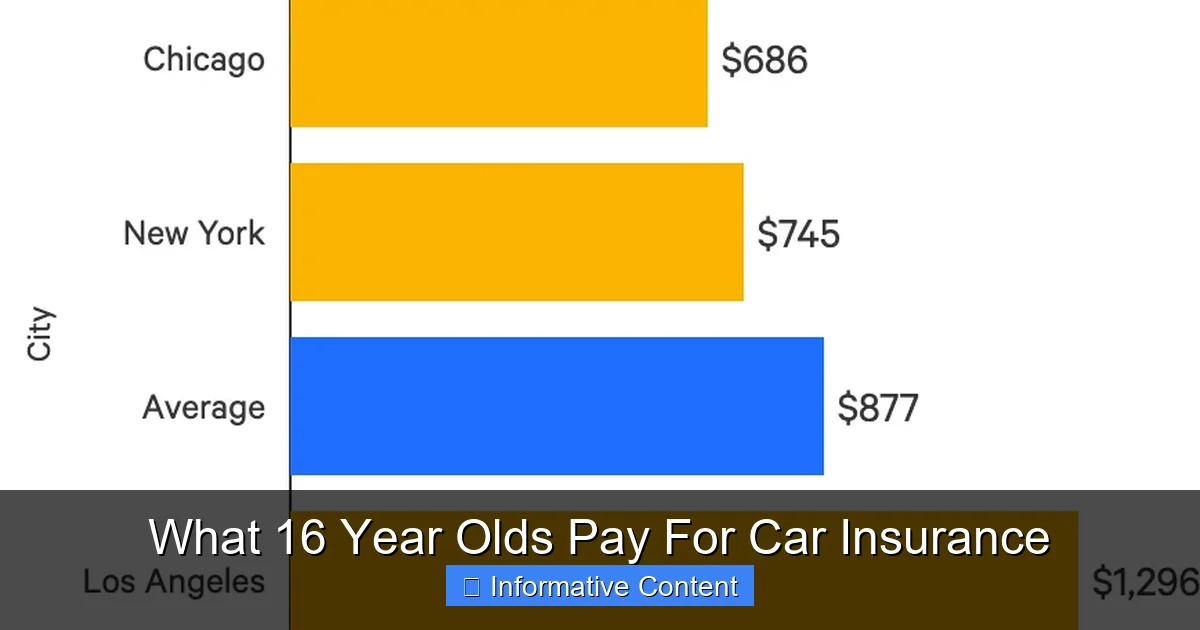

Breaking Down the Numbers: Average Costs for 16-Year-Old Drivers

Okay, let’s talk about what you really came here for: the cost. It’s vital to remember that what 16 year olds pay for car insurance is never a single number. It’s a range influenced by a universe of factors, which we’ll detail in the next section. But averages give us a starting point.

Visual guide about How Much Is Car Insurance For A 16 Year Old

Image source: res.cloudinary.com

Adding a Teen vs. a Standalone Policy

There are two primary ways to insure a 16-year-old:

- Adding them to your existing policy: This is almost always the most affordable route. The teen gets the benefit of your (presumably) longer driving history and any multi-car discounts. The cost is an additional premium on top of your current bill.

- A standalone policy for the teen: This is the most expensive option by far. Without the cushion of a parent’s policy and discounts, the teen bears 100% of the high-risk premium. This is rare and typically only happens if the teen owns the car outright and lives independently.

Most of the averages you’ll see refer to the cost of adding a 16-year-old to a parent’s policy.

Sample Cost Table: A Snapshot of Averages

The following table illustrates how annual premiums can vary based on a key factor: the car they drive. These are illustrative national averages for adding a 16-year-old to a parents’ policy. Your actual cost will vary wildly by state, coverage, and other factors.

| Vehicle Type for the 16-Year-Old | Estimated Annual Premium Impact* | Why It Costs This Way |

|---|---|---|

| Brand New SUV or Sports Car | $5,000 – $8,000+ | High repair/replacement cost + high performance = maximum risk. |

| Recent Model Sedan (e.g., 2020 Honda Civic) | $3,500 – $5,500 | Moderate value and common safety features moderate the cost somewhat. |

| Older, Safe Sedan (e.g., 2012 Volvo S60) | $2,800 – $4,500 | Lower value reduces comprehensive/collision cost; safety features may help. |

| ‘Beater’ Car (Liability-Only Coverage) | $1,800 – $3,200 | You only pay for the high risk they pose to others, not to repair their own car. |

*These are broad estimates for demonstration. Always get personalized quotes.

The 7 Biggest Factors That Determine What You’ll Pay

Think of your insurance quote as a recipe. These factors are the ingredients that get mixed together to create your final premium.

Visual guide about How Much Is Car Insurance For A 16 Year Old

Image source: bikes4sale.in

1. Location, Location, Location

Where you live is huge. Insuring a teen in a dense urban area with high traffic, theft rates, and repair costs will be much more expensive than in a rural town. State insurance regulations also play a massive role.

2. The Car They Drive

As the table shows, this is critical. A fast sports car or a brand-new expensive SUV is a recipe for a sky-high premium. The safest, most boring used car you can find is the wallet-friendly choice.

3. Your Coverage Levels and Deductibles

Are you getting state minimum liability or full coverage with low deductibles? More coverage = higher premium. Opting for higher deductibles on comprehensive and collision can lower the cost.

4. Gender

While some states have banned this factor, in many places, 16-year-old boys still cost significantly more to insure than 16-year-old girls due to historical crash data showing young males are involved in more severe accidents.

5. Grades in School

This is a big one you can control! The “Good Student Discount” is real and powerful. Most companies offer a significant discount (often 10-25%) for maintaining a B average or higher. It shows responsibility.

6. Driver’s Training

Completing a certified driver’s education course, beyond just the minimum state requirements, almost always qualifies for a discount. It’s proof of extra training.

7. Your Own Driving and Insurance History

When you add your teen, your record matters. A parent with a clean record and a long history with their insurer will get a better rate than a parent with recent accidents or tickets.

Smart Strategies to Lower the Cost (Without Compromising Safety)

You can’t change your teen’s age, but you can be strategic. Here’s how to fight back against the high cost of car insurance for a 16 year old.

Choose the Right First Car

Forget flashy. Think safe, reliable, and inexpensive to repair. Look for used sedans or minivans with high safety ratings from the IIHS. Avoid high-theft models. The lower the car’s value, the lower your comprehensive and collision premiums will be.

Leverage Every Single Discount

Become a discount detective. Ask every insurer about:

- Good Student Discount: Provide report cards.

- Driver’s Ed Discount: Show completion certificate.

- Distant Student Discount: If your teen is at school over 100 miles away without the car.

- Telematics/Usage-Based Discount: Using a phone app or plug-in device to monitor safe driving habits (smooth braking, limited late-night driving). This can be great for careful teens.

- Multi-Policy & Multi-Car Discounts: Bundle your auto and home insurance, and insure all family cars with the same company.

Consider Coverage Adjustments Carefully

On an older car, consider dropping comprehensive and collision coverage if the annual premium exceeds 10% of the car’s value. This is a calculated risk, but it can save hundreds. Never skimp on liability limits, however. Protecting your assets from a lawsuit is crucial.

The “Named Insured” Strategy

List the parent as the primary driver of the car the teen uses most often, and list the teen as an occasional driver. This can sometimes lower the rate compared to listing the teen as primary. Be honest with the insurer about actual use, however.

The Practical Steps: How to Get That First Quote

Feeling overwhelmed? Break it down into steps.

Step 1: Gather Your Information

Have your current policy, your teen’s driver’s license number, and the VIN of the car they’ll drive ready. Know their GPA and where their driver’s ed certificate is.

Step 2: Shop Around, Shop Around, Shop Around

This is the single most important action. Rates for teen drivers vary more between companies than for anyone else. Get quotes from at least 5-6 different insurers. Don’t just check the big names online; call an independent insurance agent who can quote multiple companies at once.

Step 3: Compare Apples to Apples

When you get quotes, ensure they are for the exact same coverage levels, limits, and deductibles. Otherwise, you’re not comparing the real cost.

Step 4: Ask About Long-Term Loyalty Benefits

Some companies offer “accident forgiveness” features or guarantees that rates won’t skyrocket after one minor claim. These can be valuable when insuring a new driver.

The Emotional Bottom Line: It’s an Investment

Yes, the financial hit is real. But try to reframe it. This high premium isn’t just a tax on parenthood; it’s an investment in a massive life skill for your child. Every dollar spent (and hopefully, every discount earned) is part of teaching them responsibility, the true cost of ownership, and the importance of safe behavior.

The cost of car insurance for a 16 year old is a temporary peak. As they build a clean driving record year after year, those premiums will come down. The goal of this first expensive year isn’t just to get them insured—it’s to get them through it safely, building the habits that will make them a low-risk driver for decades to come.

Take a deep breath, arm yourself with the strategies here, and start shopping. The process is a hassle, but the reward—seeing your responsible teen gain confidence and independence—is genuinely priceless.

Frequently Asked Questions

How much does car insurance typically cost for a 16-year-old?

Car insurance for a 16-year-old is often quite high, averaging between $3,000 to $6,000 per year. This is because teenagers are considered high-risk drivers due to their lack of experience and higher likelihood of accidents.

Why is car insurance so expensive for 16-year-olds?

Insurance companies view 16-year-olds as high-risk drivers because they have minimal driving experience and statistically higher accident rates. This perceived risk leads to significantly higher premiums to offset potential claims and losses.

What factors influence the cost of car insurance for a 16 year old?

Key factors include the type of car, driving record, location, and coverage levels chosen. Additionally, academic performance can affect rates, as many insurers offer discounts for good students to encourage responsible behavior.

How can I lower car insurance for a 16 year old?

To reduce premiums, consider adding the teen to a parent’s policy, choosing a safe and inexpensive car, and maintaining good grades for student discounts. Completing a defensive driving course can also lead to lower rates by demonstrating reduced risk.

Is it better for a 16-year-old to have their own car insurance policy?

It’s usually more affordable for a 16-year-old to be added to a parent’s existing policy rather than having a separate one. This leverages the parent’s driving history and multi-car discounts, which can substantially reduce overall costs.

What cars are cheapest to insure for a 16 year old?

Older, safe, and reliable models with high safety ratings typically have lower insurance costs. Avoid sports cars and luxury vehicles, as they come with higher premiums due to increased repair costs and theft rates.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.