Featured image for Car Insurance For 16 Year Old Cost

Image source: insuraviz.com

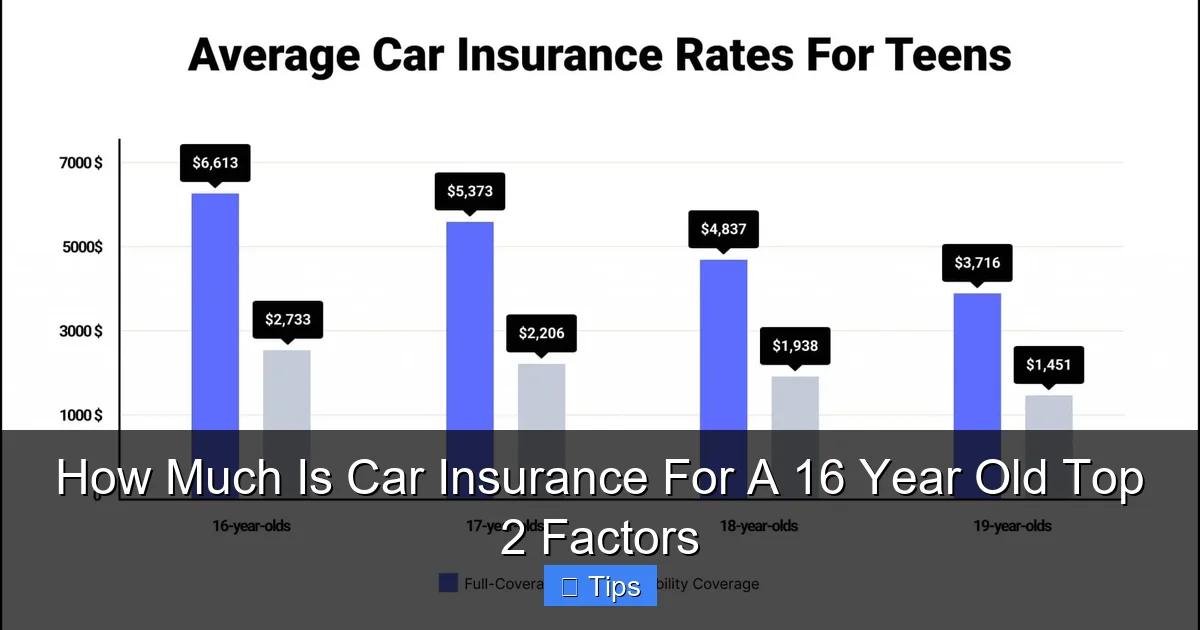

Car insurance for a 16-year-old can be exceptionally expensive due to their statistical risk profile as new, inexperienced drivers. This article reveals the two primary factors driving these high premiums: the driver’s age and lack of driving history, along with the specific make and model of the vehicle being insured. Understanding these key determinants is crucial for families navigating the cost of insuring a new teen driver.

The thrill of turning sixteen often comes with the exciting prospect of getting a driver’s license. The freedom of the open road, the independence of driving yourself to school, work, or social events – it’s a rite of passage many young people eagerly anticipate. However, for parents and new drivers alike, this milestone also ushers in a significant financial consideration: car insurance. The question of How Much Is Car Insurance For A 16 Year Old is often met with sticker shock, as rates for this demographic are notoriously high.

It’s no secret that insuring a 16-year-old driver can feel like a daunting financial burden. Insurers view young, inexperienced drivers as the highest risk on the road, leading to premium rates that can be several times higher than those for older, more experienced drivers. Understanding the intricacies behind these costs and what factors specifically drive them up is crucial for navigating this essential expense. While many variables contribute to the final price, two factors stand out as having the most profound impact, shaping the answer to How Much Is Car Insurance For A 16 Year Old more than any others.

This comprehensive guide will delve deep into the primary determinants of insurance costs for newly licensed 16-year-olds. We’ll explore the ‘top two’ factors – the driver themselves and the vehicle they drive – along with other significant influences. More importantly, we’ll provide practical strategies and insights to help families understand these costs and potentially mitigate them, turning what seems like an overwhelming expense into a manageable one. So, if you’re asking, “How Much Is Car Insurance For A 16 Year Old?”, prepare to gain a clearer picture and actionable advice.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 The Harsh Reality: Why Car Insurance for a 16 Year Old is So Expensive

- 4 Top Factor 1: The Driver (The 16-Year-Old Behind the Wheel)

- 5 Top Factor 2: The Vehicle (What They’re Driving)

- 6 Other Significant Factors Influencing Insurance Costs

- 7 Strategies to Reduce Car Insurance Costs for a 16 Year Old

- 8 Understanding the Numbers: A Hypothetical Cost Breakdown

- 9 Conclusion

- 10 Frequently Asked Questions

- 10.1 How much is car insurance for a 16 year old?

- 10.2 Why is car insurance so expensive for a 16-year-old?

- 10.3 What factors heavily influence the cost of car insurance for a 16-year-old?

- 10.4 Are there ways to lower car insurance costs for a 16-year-old?

- 10.5 Does the type of car affect car insurance rates for a 16-year-old?

- 10.6 Can good grades help reduce car insurance premiums for a 16-year-old?

Key Takeaways

- Expect high premiums: 16-year-olds face significantly higher insurance costs due to inexperience.

- Choose a safe, older car: Vehicle choice drastically impacts premium; avoid sports cars.

- Add to parent’s policy: This is almost always cheaper than a standalone plan.

- Utilize available discounts: Good student, defensive driving, and telematics save money.

- Maintain a clean record: Accidents and tickets will significantly raise future rates.

- Compare multiple quotes: Different insurers offer varying rates; shop diligently for the best.

📑 Table of Contents

- The Harsh Reality: Why Car Insurance for a 16 Year Old is So Expensive

- Top Factor 1: The Driver (The 16-Year-Old Behind the Wheel)

- Top Factor 2: The Vehicle (What They’re Driving)

- Other Significant Factors Influencing Insurance Costs

- Strategies to Reduce Car Insurance Costs for a 16 Year Old

- Understanding the Numbers: A Hypothetical Cost Breakdown

- Conclusion

The Harsh Reality: Why Car Insurance for a 16 Year Old is So Expensive

Before diving into specific factors, it’s essential to grasp the fundamental reason why insuring a 16-year-old is so costly. Insurance companies operate on risk assessment. They analyze vast amounts of data to predict the likelihood of a policyholder filing a claim. When it comes to 16-year-olds, the statistics paint a clear, albeit challenging, picture.

Inexperience and Risk: The Primary Drivers

- Statistical Data: National safety organizations consistently report that 16- and 17-year-old drivers have the highest crash rates per mile driven compared to any other age group. This isn’t just a slight increase; it’s significantly higher. Their lack of experience means they are less adept at identifying and reacting to hazards, judging speeds and distances, and handling adverse driving conditions. This stark reality is the bedrock of understanding How Much Is Car Insurance For A 16 Year Old.

- Lack of Driving History: Unlike older drivers who have years of accident-free driving to prove their reliability, a 16-year-old has no prior history. Insurers, therefore, have no positive data to offset the inherent risk associated with their age group.

- Distracted Driving Potential: While distracted driving is a problem across all age groups, teenagers are particularly susceptible. Peer passengers, mobile phones, and general youthful exuberance can divert attention from the road, increasing the likelihood of an accident.

Actuarial Science and Young Drivers

Insurance companies employ actuaries who are essentially mathematicians specializing in risk. They use complex statistical models to determine premiums. For young drivers, particularly 16-year-olds, the models consistently show a higher probability of:

- Being involved in an accident.

- Causing more severe accidents (resulting in higher bodily injury and property damage claims).

- Incurring higher repair costs due to more frequent collisions.

Because of this elevated risk profile, insurers must charge higher premiums to cover the anticipated costs of claims from this age group. This is the financial mechanism explaining How Much Is Car Insurance For A 16 Year Old.

Top Factor 1: The Driver (The 16-Year-Old Behind the Wheel)

The single most influential factor in determining How Much Is Car Insurance For A 16 Year Old is, unsurprisingly, the 16-year-old driver themselves. Their personal characteristics, habits, and efforts to mitigate risk play a monumental role.

Visual guide about Car Insurance For 16 Year Old Cost

Image source: insuraviz.com

Age and Gender

- Age: As highlighted, 16 is the peak age for insurance risk. Rates typically decrease as drivers gain more experience, often seeing significant drops around ages 18, 21, and 25.

- Gender: Historically, young male drivers have faced higher premiums than young female drivers due to statistical data indicating higher rates of accidents and more severe accidents among young men. However, some states have banned the use of gender as a rating factor, so this can vary by location.

Driving Record (or Lack Thereof)

While a 16-year-old driver starts with no record, any infractions they accumulate, even minor ones, can have a devastating impact on their premiums. A speeding ticket, a fender bender, or any moving violation will almost guarantee a significant increase in costs and make it much harder to answer the question, How Much Is Car Insurance For A 16 Year Old, in an affordable way.

Academic Performance

This might seem unrelated, but many insurers offer “good student discounts.” This is based on the premise that students who are responsible enough to maintain good grades (typically a B average or 3.0 GPA) are also more likely to be responsible drivers. This discount can be one of the most substantial available for young drivers, making a noticeable difference in How Much Is Car Insurance For A 16 Year Old.

Driver’s Education and Telematics

- Certified Driver’s Education: Completing an approved driver’s education course can not only equip a 16-year-old with essential skills but also qualify them for an insurance discount. Insurers often view these courses as a sign of proactive risk reduction.

- Usage-Based Insurance (UBI) / Telematics Programs: Many insurance companies now offer programs where a device is plugged into the car’s diagnostic port or an app is used on a smartphone to monitor driving habits (speed, braking, mileage, time of day driven). Safe driving can lead to significant discounts. While it might feel like an invasion of privacy to some, for a 16-year-old, it can be a powerful tool to demonstrate responsible driving and lower premiums, directly impacting How Much Is Car Insurance For A 16 Year Old.

Top Factor 2: The Vehicle (What They’re Driving)

After the driver themselves, the type of vehicle a 16-year-old operates is the second most critical factor determining insurance costs. Not all cars are created equal in the eyes of an insurer.

Visual guide about Car Insurance For 16 Year Old Cost

Image source: forbes.com

Make, Model, and Year

- Safety Ratings: Cars with excellent safety ratings protect occupants better in a crash, reducing the likelihood of expensive bodily injury claims. Features like multiple airbags, advanced crash-avoidance systems, and robust structural designs are looked upon favorably.

- Repair Costs: Vehicles that are expensive to repair (e.g., luxury brands, cars with specialized parts, or those with complex bodywork) will naturally have higher collision and comprehensive premiums. Insurers know that if a 16-year-old crashes, the cost to fix their specific car will be a major component of the claim.

- Theft Rates: Certain makes and models are more frequently targeted by thieves. If a car is on a high-theft list, its comprehensive coverage (which covers theft) will be more expensive.

Engine Size and Horsepower

The stereotype of a fast car leading to faster driving holds true for insurers. Vehicles with powerful engines, especially sports cars or high-performance models, are often associated with aggressive driving and a higher propensity for accidents. Insuring a high-performance vehicle for a 16-year-old will almost certainly result in astronomical premiums, making the answer to How Much Is Car Insurance For A 16 Year Old extremely high.

Vehicle Safety Features

Modern vehicles come equipped with a myriad of safety features that can influence insurance costs:

- Standard Safety Features: Anti-lock brakes (ABS), electronic stability control (ESC), and numerous airbags are often standard and contribute to lower overall risk.

- Advanced Driver-Assistance Systems (ADAS): Features like automatic emergency braking, lane departure warning, blind-spot monitoring, and adaptive cruise control can actively prevent accidents or reduce their severity. While they can sometimes increase repair costs if damaged, their accident-prevention capabilities often lead to discounts. When considering How Much Is Car Insurance For A 16 Year Old, a car with these features is often a smarter choice.

Other Significant Factors Influencing Insurance Costs

Beyond the top two factors, several other elements play a crucial role in shaping the final premium for a 16-year-old driver.

Visual guide about Car Insurance For 16 Year Old Cost

Image source: agilerates.com

Location, Location, Location

Where the car is primarily garaged and driven has a substantial impact on rates:

- Urban vs. Rural: Densely populated urban areas typically have higher accident rates, more traffic congestion, and increased instances of vehicle theft and vandalism, leading to higher premiums. Rural areas, with less traffic, often see lower rates.

- Local Crime Rates: If a specific zip code has a higher rate of car theft or vandalism, the comprehensive portion of the insurance will be more expensive.

- Weather Patterns: Areas prone to severe weather (e.g., hail, hurricanes, heavy snow) may also see higher comprehensive coverage costs.

Type and Amount of Coverage

The choices made regarding coverage directly affect How Much Is Car Insurance For A 16 Year Old:

- Minimum State Requirements: Every state mandates a minimum amount of liability coverage. While opting for the bare minimum will result in the lowest premium, it offers minimal protection and could leave a family financially vulnerable after a serious accident.

- Full Coverage: This typically includes liability, collision (covers damage to your car in an accident you cause), and comprehensive (covers damage from non-collision events like theft, vandalism, weather). Most lenders require full coverage if the car is financed or leased. For a 16-year-old, collision and comprehensive can be very expensive due to their high accident risk.

- Liability Limits: Choosing higher liability limits (e.g., 100/300/100 instead of 25/50/25) provides better financial protection but increases the premium. Given the severity of potential accidents involving young drivers, robust liability coverage is often recommended despite the added cost.

- Deductibles: This is the amount paid out-of-pocket before insurance kicks in for collision and comprehensive claims. A higher deductible generally leads to a lower premium, but it means a greater personal expense if a claim is filed.

The Insurer and Policy Structure

How the policy is structured and which company you choose also matters:

- Adding to Parent’s Policy vs. Own Policy: Almost always, adding a 16-year-old to an existing family policy is significantly cheaper than having them get their own standalone policy. Family policies benefit from multi-car discounts, the parents’ good driving records, and the broader risk pool. This is arguably the most impactful strategy when asking, “How Much Is Car Insurance For A 16 Year Old?”.

- Multi-Car/Multi-Policy Discounts: Bundling car insurance with homeowner’s or renter’s insurance, or insuring multiple vehicles with the same company, can unlock significant savings.

- Comparison Shopping: Different insurers have different algorithms and target markets, so quotes can vary wildly for the exact same coverage. It’s crucial to compare rates from multiple providers.

Strategies to Reduce Car Insurance Costs for a 16 Year Old

While the cost of insuring a 16-year-old can be high, there are numerous proactive steps families can take to mitigate the financial impact. Understanding How Much Is Car Insurance For A 16 Year Old means also understanding how to reduce that cost.

Maximize Discounts

- Good Student Discount: Encourage excellent academic performance. A B average or higher can translate into significant savings.

- Driver’s Education Discount: Ensure the 16-year-old completes an accredited driver’s education course.

- Telematics/Usage-Based Insurance: Enroll in programs that monitor driving habits. If the 16-year-old drives responsibly, this can lead to substantial discounts over time.

- Defensive Driving Courses: Some insurers offer discounts for voluntarily completing additional approved defensive driving courses, even beyond the initial driver’s ed.

- Away-at-School Discount: If the 16-year-old goes to college more than 100 miles away without a car, they may qualify for a discount.

Choose the Right Vehicle

This is where the ‘Top 2 Factors’ really align. The choice of car is paramount:

- Opt for Safe, Reliable, and Modestly Priced Sedans or SUVs: Look for vehicles with excellent safety ratings, a proven track record for reliability, and lower repair costs.

- Avoid Sports Cars, Luxury Vehicles, and High-Performance Models: These will dramatically inflate premiums due to higher risk and repair costs.

- Consider Older, Well-Maintained Vehicles: If the car’s cash value is low, you might be able to drop collision and comprehensive coverage (after careful consideration of financial risk), which can drastically reduce premiums for a 16-year-old.

Smart Policy Choices

- Add to Parent’s Policy: As mentioned, this is almost always the most cost-effective solution. The family benefits from multi-car discounts and the parents’ driving history.

- Consider Higher Deductibles (with Caution): Increasing the deductible for collision and comprehensive coverage will lower premiums. However, ensure you have the funds readily available to cover the deductible if a claim arises.

- Evaluate Coverage Needs Carefully: While minimum coverage is risky, consider if every optional add-on is necessary for a 16-year-old’s vehicle, especially if it’s an older, lower-value car.

- Bundle Policies: Combine car insurance with homeowner’s, renter’s, or umbrella policies with the same insurer to unlock multi-policy discounts.

Drive Safely and Responsibly

This cannot be stressed enough. A clean driving record is the ultimate long-term strategy for keeping insurance costs down. For a 16-year-old, avoiding tickets and accidents will prevent rate hikes and eventually lead to lower premiums as they gain experience. This is the single best way to ensure How Much Is Car Insurance For A 16 Year Old reduces over time.

Comparison Shopping

Never settle for the first quote. Get quotes from at least 3-5 different insurance providers, including large national carriers and local independent agencies. Rates can vary by hundreds or even thousands of dollars for the same coverage, especially when insuring a 16-year-old.

Understanding the Numbers: A Hypothetical Cost Breakdown

To help illustrate How Much Is Car Insurance For A 16 Year Old, let’s look at some hypothetical scenarios. Please remember that these are illustrative figures and actual costs will vary significantly based on location, specific insurer, vehicle, coverage limits, and the individual driver’s profile. These averages are national estimates for a full coverage policy and are designed to demonstrate the relative impact of different factors.

Here’s a general idea of how different scenarios can influence annual car insurance premiums for a 16-year-old:

| Scenario Description | Estimated Annual Premium Range | Key Influencing Factors |

|---|---|---|

| 16-Year-Old Male, Independent Policy, Sports Car, No Discounts | $7,000 – $12,000+ | High-risk driver age, high-risk vehicle, no existing multi-car/multi-policy discounts, typically highest rates for 16-year-old male. |

| 16-Year-Old Male, Added to Parent’s Policy, Safe Sedan, No Discounts | $3,500 – $6,500 | Benefit of being on parent’s policy, multi-car discount, safer vehicle, but still high-risk driver age. |

| 16-Year-Old Female, Added to Parent’s Policy, Safe Sedan, Good Student Discount | $2,500 – $5,000 | Benefit of being on parent’s policy, multi-car discount, safer vehicle, good student discount applied, potentially lower gender-based risk (where applicable). |

| 16-Year-Old Male, Added to Parent’s Policy, Safe Sedan, Good Student + Telematics Discount | $2,000 – $4,500 | Combines previous benefits with additional discounts from safe driving monitoring. Demonstrates the impact of proactive risk reduction. |

| 16-Year-Old Female, Independent Policy, Older Basic Sedan, No Discounts | $4,000 – $7,500 | Higher cost due to independent policy, offset slightly by a safer, older vehicle (potentially with just liability coverage, if full coverage isn’t required). Still reflects high-risk driver age. |

As you can see, the difference between the most expensive and most affordable scenarios can be staggering. The initial answer to How Much Is Car Insurance For A 16 Year Old might seem high, but proactive choices can significantly alter the outcome.

Conclusion

The journey to obtaining a driver’s license at 16 is an exciting milestone, but the financial implications of car insurance are a significant hurdle for many families. The underlying reason for the high cost boils down to risk: 16-year-olds are statistically the most inexperienced drivers on the road, leading to higher accident rates and, consequently, higher premiums. Understanding How Much Is Car Insurance For A 16 Year Old requires a deep dive into the factors that define this risk.

The top two factors, the individual 16-year-old driver and the vehicle they operate, are the most influential determinants. A responsible, academically strong 16-year-old driving a safe, economical car will invariably pay less than an average 16-year-old driving a powerful, expensive vehicle. However, families are not powerless in this situation. By strategically leveraging discounts, making smart vehicle choices, opting for appropriate coverage, and relentlessly comparison shopping, the often-shocking cost of insuring a 16-year-old can be significantly managed.

Ultimately, the best strategy for answering “How Much Is Car Insurance For A 16 Year Old?” with a more palatable number is a multi-faceted approach centered on responsibility. Encourage safe driving habits from day one, prioritize academic excellence, and choose a vehicle that balances safety with affordability. While the initial premiums may seem daunting, these proactive steps will not only lead to lower insurance costs but also foster a safer, more responsible young driver for years to come. The investment in understanding these factors and implementing these strategies will pay dividends, both financially and in peace of mind.

Frequently Asked Questions

How much is car insurance for a 16 year old?

Car insurance for a 16-year-old is significantly higher than for more experienced drivers due to their perceived higher risk. While costs vary widely, you can generally expect annual premiums to be in the range of several thousand dollars.

Why is car insurance so expensive for a 16-year-old?

Insurance companies classify 16-year-olds as high-risk drivers because they lack driving experience and have a statistically higher likelihood of getting into accidents. This increased risk translates directly into substantially higher insurance premiums to cover potential claims.

What factors heavily influence the cost of car insurance for a 16-year-old?

The two biggest factors influencing car insurance for a 16-year-old are their inexperience behind the wheel and the type of vehicle they drive. Other elements like location, grades, and whether they are on a parent’s policy also play a significant role.

Are there ways to lower car insurance costs for a 16-year-old?

Yes, several strategies can help reduce premiums. Adding a 16-year-old to a parent’s existing policy is usually cheaper than a standalone policy, and choosing a safer, older, less powerful car can make a big difference. Additionally, completing a driver education course or maintaining good grades often qualifies for discounts.

Does the type of car affect car insurance rates for a 16-year-old?

Absolutely, the type of car significantly impacts car insurance rates for a 16-year-old. Insuring a newer, sportier, or more expensive vehicle will result in much higher premiums due to the increased cost of repairs or replacement. Opting for an older, safer, and less powerful car is often the most cost-effective choice.

Yes, many insurance providers offer a “good student discount” to teenagers who maintain a certain GPA, typically a B average (3.0) or higher. This discount acknowledges responsible behavior, which insurers believe correlates with safer driving habits and a lower risk of accidents.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.