Insurance for a sports car typically costs more than standard vehicles due to higher repair costs, theft risk, and performance capabilities. Premiums vary widely based on your driving record, location, coverage level, and the specific model—but smart shopping and safety features can help lower costs.

[FEATURED_IMAGE_PLACEOLDER]

So, you’ve got your eye on that sleek, low-slung sports car—maybe a Porsche 911, a Chevrolet Corvette, or a Nissan GT-R. It purrs like a predator, turns heads at every stoplight, and makes your daily commute feel like a track day. But before you sign the papers and hit the open road, there’s one crucial question you can’t ignore: *How much is insurance for a sports car?*

Let’s be honest—sports cars aren’t just about speed and style. They come with a unique set of insurance challenges that can make your monthly premium feel more like a car payment. Unlike your average family sedan, sports cars are built for performance, which insurers see as a red flag. Higher speeds, expensive parts, and increased theft risk all contribute to steeper premiums. But don’t let that scare you off just yet. With the right knowledge and strategy, you can still enjoy your dream ride without breaking the bank on coverage.

In this guide, we’ll break down everything you need to know about sports car insurance costs—from what drives up your rates to how you can bring them down. Whether you’re a first-time buyer or upgrading from a previous model, understanding the ins and outs of insuring a high-performance vehicle will help you make smarter, more informed decisions. So buckle up—we’re diving deep into the world of sports car insurance.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Why Is Sports Car Insurance So Expensive?

- 4 Average Cost of Sports Car Insurance

- 5 Factors That Influence Your Premium

- 6 How to Lower Your Sports Car Insurance Costs

- 7 Special Considerations for Exotic and Classic Sports Cars

- 8 Common Mistakes to Avoid

- 9 Final Thoughts: Is It Worth It?

- 10 Frequently Asked Questions

- 10.1 Why is sports car insurance more expensive than regular car insurance?

- 10.2 Can I lower my sports car insurance premium?

- 10.3 Do I need full coverage for a sports car?

- 10.4 Does my credit score affect my sports car insurance rate?

- 10.5 Are older sports cars cheaper to insure?

- 10.6 Can I insure a modified sports car?

Key Takeaways

- Sports car insurance is significantly more expensive than average: Expect to pay 20% to 100%+ more than for a standard sedan, depending on the model and your profile.

- Vehicle performance directly impacts rates: High horsepower, top speed, and acceleration increase perceived risk and thus premiums.

- Your driving history matters most: A clean record can offset some of the high base rates, while accidents or tickets will spike costs further.

- Location plays a big role: Urban areas with higher traffic density and theft rates lead to pricier policies than rural zones.

- Comprehensive and collision coverage are often required: Lenders and lessors usually mandate full coverage, which adds to the total cost.

- Anti-theft and safety features can reduce premiums: Tracking devices, alarms, and advanced driver aids may qualify you for discounts.

- Shopping around saves money: Comparing quotes from multiple insurers can reveal savings of hundreds—or even thousands—of dollars annually.

📑 Table of Contents

Why Is Sports Car Insurance So Expensive?

Let’s start with the big question: Why does insuring a sports car cost so much more than a regular car? The short answer? Risk. Insurance companies base their premiums on how likely you are to file a claim—and how expensive that claim might be. Sports cars tick both boxes.

First, there’s the performance factor. Vehicles with high horsepower, rapid acceleration, and top speeds over 150 mph are statistically more likely to be involved in accidents. Why? Because they’re easier to lose control of, especially for inexperienced drivers. Even seasoned drivers can misjudge a corner or overcorrect during sudden braking. Insurers know this, and they price accordingly.

Then there’s the repair cost. Sports cars often use specialized parts, lightweight materials like carbon fiber, and advanced engineering that make repairs far more expensive than on a standard vehicle. A cracked bumper on a Honda Civic might cost $500 to fix. On a Lamborghini Huracán? Try $15,000. And that’s before labor. Because of this, even minor fender benders can lead to massive claims.

Theft risk is another major concern. Sports cars are prime targets for thieves due to their high resale value and desirability. Models like the Ford Mustang GT, Dodge Challenger SRT, and BMW M3 are frequently stolen or broken into. Insurers factor in regional theft statistics, so if you live in an area with high auto theft rates, your premium will reflect that.

Lastly, sports cars are often driven less responsibly—or at least, that’s the perception. While not every sports car owner is a speed demon, insurers generalize based on data. High-performance vehicles are more commonly associated with speeding tickets, reckless driving, and racing—even if you only drive to the grocery store. This stereotype leads to higher base rates across the board.

The Role of Vehicle Value and Depreciation

Another often-overlooked factor is the actual value of the car. Sports cars tend to be more expensive upfront, and even after depreciation, they retain significant value. Insuring a $70,000 car costs more than insuring a $25,000 one—especially when you’re covering comprehensive and collision. The higher the insured value, the higher the potential payout, and the higher your premium.

But here’s a twist: some sports cars depreciate faster than others. For example, a brand-new Ferrari might lose 30% of its value in the first year, while a used Porsche 911 might hold its value much better. This can affect your insurance costs over time. If you’re buying a used sports car, you might actually pay less in premiums than someone with a brand-new model—even if the car is just a few years old.

How Insurers Assess Risk

Insurance companies use complex algorithms to assess risk, and sports cars trigger several red flags. They look at:

– **Horsepower and torque:** Higher numbers = higher risk.

– **Top speed:** Cars capable of 150+ mph are seen as more dangerous.

– **0–60 mph time:** Faster acceleration increases accident likelihood.

– **Vehicle type:** Convertibles, coupes, and rear-wheel-drive models are often pricier to insure.

– **Safety ratings:** Surprisingly, some sports cars score lower on crash tests due to their lightweight design and low profile.

Even if your car has advanced safety features like automatic emergency braking or lane departure warnings, insurers may not weigh them as heavily as they do in family SUVs. The performance outweighs the safety in their risk models.

Average Cost of Sports Car Insurance

Visual guide about How Much Is Insurance for a Sports Car

Image source: thumbs.dreamstime.com

Now for the numbers. How much can you actually expect to pay? The average annual cost of full coverage insurance for a sports car ranges from $2,500 to $6,000—but it can go much higher depending on the model and your profile.

Let’s look at some real-world examples:

– **Chevrolet Corvette (C8):** $3,200–$4,800 per year for full coverage.

– **Porsche 911:** $4,000–$7,500 annually, depending on trim and location.

– **Nissan GT-R:** $5,000–$9,000+ due to high theft rates and repair costs.

– **Ford Mustang GT:** $2,800–$4,500, making it one of the more affordable sports cars to insure.

– **Lamborghini Huracán:** $10,000–$20,000+ per year—yes, you read that right.

These are national averages. Your actual cost could be lower or higher based on where you live, your age, driving history, and credit score.

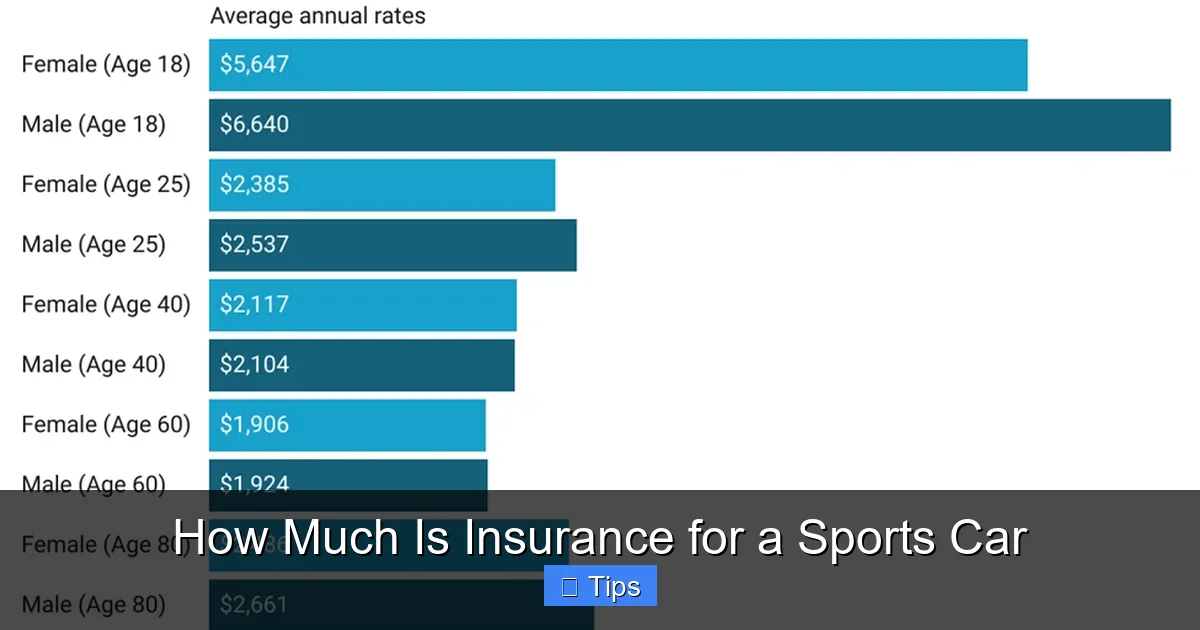

How Age and Experience Affect Rates

Age is a huge factor. Young drivers—especially those under 25—pay significantly more for sports car insurance. Why? Statistically, younger drivers are more likely to speed, take risks, and get into accidents. A 22-year-old male with a clean record might pay $6,000 a year for a Corvette, while a 45-year-old with 20 years of accident-free driving might pay just $2,800.

Gender also plays a role, though less so than it used to. Historically, men paid more than women for sports cars due to higher accident rates. While the gap has narrowed, it still exists in many states.

Experience matters too. If you’ve owned a sports car before, insurers may view you as a lower risk. Some companies even offer “experienced driver” discounts for those with a history of safe high-performance driving.

Geographic Differences in Pricing

Where you live can make or break your insurance bill. Urban areas like Los Angeles, New York City, and Miami have higher premiums due to traffic congestion, crime rates, and population density. For example, insuring a Mustang GT in rural Wyoming might cost $2,200 a year, while the same car in downtown Chicago could run $4,200.

States also have different regulations. Michigan, for instance, has no-fault insurance laws and some of the highest average premiums in the country—even for non-sports cars. Florida and Louisiana are also notoriously expensive due to high claim frequency and litigation rates.

On the flip side, states like Maine, Idaho, and Ohio tend to have lower average insurance costs. If you’re flexible about location, this is something to consider—especially if you’re buying a high-end sports car.

Factors That Influence Your Premium

Visual guide about How Much Is Insurance for a Sports Car

Image source: lh4.googleusercontent.com

Beyond the car itself, several personal and policy-related factors affect how much you’ll pay. Let’s break them down.

Driving Record and Claims History

Your driving history is one of the biggest determinants of your insurance rate. A clean record with no accidents or tickets can help offset the high base cost of a sports car. But even one speeding ticket can increase your premium by 20–30%. A DUI? That could double it—or get you dropped entirely.

Claims history matters too. If you’ve filed multiple claims in the past three to five years, insurers will see you as a high-risk customer. This is especially true for sports car owners, who are already under scrutiny.

Coverage Level and Deductibles

The type of coverage you choose has a major impact on cost. Most sports car owners opt for full coverage, which includes:

– **Liability:** Covers damage and injuries you cause to others.

– **Collision:** Pays for damage to your car from accidents.

– **Comprehensive:** Covers theft, vandalism, weather damage, and more.

Full coverage is usually required if you’re financing or leasing your car. But even if you own it outright, skipping comprehensive and collision is risky—especially with a $60,000 vehicle.

You can lower your premium by choosing a higher deductible—the amount you pay out of pocket before insurance kicks in. A $1,000 deductible might save you $300–$500 a year compared to a $500 deductible. Just make sure you can afford to pay it if you ever need to file a claim.

Credit Score and Insurance History

In most states, insurers use your credit-based insurance score to help determine rates. People with good credit (700+) typically pay less than those with poor credit (below 600). This is because studies show a correlation between credit health and claim frequency.

A continuous insurance history also helps. If you’ve been insured for years without lapses, you’re seen as more responsible. Gaps in coverage—even for a few days—can lead to higher rates.

Annual Mileage and Usage

How much you drive matters. The less you use your sports car, the lower your risk of an accident—and the lower your premium. Many insurers offer low-mileage discounts for drivers who put fewer than 7,500 miles per year on their vehicle.

If you only drive your sports car on weekends or for pleasure, be sure to mention that. Some companies offer “pleasure use” or “limited use” discounts that can save you hundreds.

Marital Status and Household Factors

Believe it or not, being married can lower your insurance rate. Insurers see married people as more stable and less likely to take risks. Living with other licensed drivers (like a spouse or teen) can also affect your rate—especially if they have poor driving records.

How to Lower Your Sports Car Insurance Costs

Visual guide about How Much Is Insurance for a Sports Car

Image source: capstoneinsurancegroup.com

Okay, so sports car insurance is expensive—but that doesn’t mean you’re stuck with sky-high premiums. There are several smart strategies to reduce your costs without sacrificing coverage.

Shop Around and Compare Quotes

This is the #1 way to save. Every insurer uses different formulas, so the same car and driver profile can yield wildly different quotes. Get at least three to five quotes from companies like GEICO, Progressive, State Farm, Nationwide, and specialty insurers like Hagerty or Grundy.

Specialty insurers often offer better rates for classic, collector, or high-performance cars. They understand the unique needs of sports car owners and may offer agreed-value policies, which pay the full insured amount in case of a total loss—no depreciation.

Bundling and Loyalty Discounts

Many insurers offer discounts if you bundle your auto policy with home, renters, or life insurance. You might save 10–25% just by having multiple policies with the same company.

Loyalty discounts are also common. Staying with the same insurer for several years can earn you a 5–15% reduction. Just make sure you’re not overpaying—sometimes switching saves more than staying.

Install Anti-Theft and Safety Devices

Adding a GPS tracking system, alarm, or immobilizer can qualify you for anti-theft discounts. Some insurers offer up to 15% off for vehicles equipped with devices like LoJack or OnStar.

Advanced safety features like adaptive cruise control, blind-spot monitoring, and automatic emergency braking may also earn you discounts—though not always as much as you’d hope. Still, every little bit helps.

Take a Defensive Driving Course

Completing an approved defensive driving course can reduce your premium by 5–10%. It shows insurers that you’re serious about safety. Some states even require it for drivers with recent violations.

Consider Usage-Based Insurance

Programs like Progressive’s Snapshot or Allstate’s Drivewise monitor your driving habits via a mobile app or plug-in device. If you drive safely—avoiding hard braking, speeding, and late-night trips—you could earn significant discounts.

This is especially useful for sports car owners who drive responsibly but are penalized by the vehicle type.

Choose the Right Model

Not all sports cars are created equal when it comes to insurance. Some are cheaper to insure than others. For example:

– **More affordable to insure:** Ford Mustang, Chevrolet Camaro, Subaru WRX STI.

– **Mid-range:** Porsche 718 Cayman, Audi TT, BMW Z4.

– **Most expensive:** Lamborghini, Ferrari, McLaren, high-end AMG models.

If insurance cost is a concern, consider a slightly less exotic model. A used BMW M3 might offer similar performance to a new Audi RS5 but cost less to insure.

Special Considerations for Exotic and Classic Sports Cars

If you’re driving a Ferrari, Lamborghini, or a classic 1960s Corvette, standard auto insurance might not cut it. These vehicles require specialized coverage.

Agreed-Value vs. Actual Cash Value

Most standard policies use “actual cash value,” which factors in depreciation. If your $100,000 sports car is totaled after five years, you might only get $60,000.

Agreed-value policies, common with classic and exotic car insurers, let you and the company agree on the car’s worth upfront. In a total loss, you get that full amount—no depreciation.

Storage and Usage Requirements

Many specialty insurers require that your sports car be stored in a secure garage and driven only occasionally—say, less than 5,000 miles per year. They may also require annual inspections or proof of maintenance.

These restrictions help lower risk, which translates to lower premiums. But if you plan to drive your car daily, you’ll need a different type of policy.

Collector Car Insurance

Companies like Hagerty and Grundy specialize in collector and classic car insurance. They offer flexible usage, agreed-value coverage, and access to car shows and events. While not for everyone, they’re ideal for weekend warriors and car enthusiasts.

Common Mistakes to Avoid

Even experienced drivers make errors when insuring a sports car. Here are a few to watch out for:

– **Underinsuring your vehicle:** Skimping on coverage to save money can leave you exposed in a major accident.

– **Not disclosing modifications:** Aftermarket parts like turbos, exhausts, or suspension upgrades can increase risk. Failing to report them could void your policy.

– **Ignoring state requirements:** Every state has minimum liability limits. Make sure you meet them—even if you think you don’t need them.

– **Forgetting to update your policy:** If you move, get married, or install a new safety device, notify your insurer. You might qualify for a discount.

Final Thoughts: Is It Worth It?

So, is the high cost of sports car insurance worth it? That depends on your priorities. If you’re passionate about performance, design, and the driving experience, then yes—the joy of owning a sports car often outweighs the financial burden.

But it’s important to go in with your eyes open. Budget not just for the car payment, fuel, and maintenance, but also for insurance. A $300–$500 monthly premium is common, and for exotic models, it can be much higher.

The good news? With smart shopping, responsible driving, and the right coverage, you can enjoy your sports car without financial stress. Don’t let insurance scare you away—just plan for it.

Frequently Asked Questions

Why is sports car insurance more expensive than regular car insurance?

Sports cars cost more to insure because they have higher performance capabilities, expensive repair costs, and are more likely to be stolen or involved in accidents. Insurers see them as higher-risk vehicles.

Yes! You can reduce costs by shopping around, installing anti-theft devices, maintaining a clean driving record, choosing a higher deductible, and taking advantage of discounts like bundling or defensive driving courses.

Do I need full coverage for a sports car?

If you’re financing or leasing your sports car, full coverage (including collision and comprehensive) is usually required. Even if you own it outright, full coverage is strongly recommended due to the high value of the vehicle.

Does my credit score affect my sports car insurance rate?

Yes, in most states. Insurers use credit-based insurance scores to assess risk. A higher credit score typically leads to lower premiums, while poor credit can increase your rate.

Are older sports cars cheaper to insure?

Not always. While older cars may have lower market values, some classic or high-demand models (like a vintage Corvette) can be expensive to insure due to repair costs and collector value.

Can I insure a modified sports car?

Yes, but you must disclose all modifications to your insurer. Performance upgrades like turbochargers or suspension changes can increase your premium or require a specialized policy.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.