Leasing a car typically costs between $200 and $600 per month, but the exact amount depends on the vehicle, your credit, down payment, and lease terms. This guide breaks down everything you need to know to understand pricing and make a smart leasing decision.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Understanding Car Leasing: What It Is and How It Works

- 4 How Much Does It Actually Cost to Lease a Car?

- 5 Key Factors That Affect Your Lease Payment

- 6 How to Calculate Your Lease Payment

- 7 Tips to Get the Best Lease Deal

- 8 Pros and Cons of Leasing a Car

- 9 Should You Lease or Buy?

- 10 Final Thoughts: Is Leasing Right for You?

- 11 Frequently Asked Questions

Key Takeaways

- Monthly lease payments usually range from $200 to $600: The cost varies widely based on the car’s value, lease length, and your financial profile.

- Your credit score plays a major role: Higher credit scores often lead to lower interest rates (called the “money factor”) and better lease deals.

- Down payments lower monthly costs but increase upfront fees: Putting more money down reduces your monthly payment, but it’s not always the best financial move.

- Mileage limits affect long-term value: Most leases allow 10,000 to 15,000 miles per year—exceeding this can result in steep per-mile fees.

- Wear and tear charges can add up: Returning a car with excessive damage may lead to extra fees at the end of the lease.

- Lease deals often include incentives: Manufacturers frequently offer promotional lease rates, especially on new models or during slow sales periods.

- You don’t own the car at the end: Unlike buying, leasing means you return the vehicle after the term—but you can often buy it if you choose.

📑 Table of Contents

- Understanding Car Leasing: What It Is and How It Works

- How Much Does It Actually Cost to Lease a Car?

- Key Factors That Affect Your Lease Payment

- How to Calculate Your Lease Payment

- Tips to Get the Best Lease Deal

- Pros and Cons of Leasing a Car

- Should You Lease or Buy?

- Final Thoughts: Is Leasing Right for You?

Understanding Car Leasing: What It Is and How It Works

So, you’re thinking about leasing a car—but what does that actually mean? In simple terms, leasing a car is like renting it for a long period, usually two to four years. Instead of buying the vehicle outright, you pay to use it during the lease term. At the end, you return the car to the dealership (unless you decide to buy it).

Leasing has become a popular alternative to buying, especially for people who like driving newer models with the latest tech, safety features, and warranties. It often comes with lower monthly payments compared to financing a purchase, and you’re typically covered by a manufacturer’s warranty for the entire lease period. That means fewer surprise repair bills.

But here’s the catch: you don’t build equity like you would if you bought the car. Once the lease ends, you walk away—unless you choose to purchase the vehicle at its residual value. Still, for many drivers, the benefits of lower payments, lower taxes (in some states), and the joy of driving a new car every few years make leasing a smart choice.

How Leasing Differs from Buying

One of the biggest misconceptions about leasing is that it’s just “renting a car.” While that’s somewhat true, leasing is more structured and long-term than a typical rental. When you lease, you agree to a set term, mileage limit, and condition requirements. You also pay for the car’s depreciation during that time—not the full value.

For example, if a new car costs $40,000 and is expected to be worth $24,000 after three years, you’re essentially paying for that $16,000 drop in value, plus fees and interest. When you buy, you pay the full price (or finance it), and you own the car afterward—even if it’s worth less.

Leasing also means you’re responsible for maintenance, but only up to normal wear and tear. Most leases require you to follow the manufacturer’s service schedule, and skipping oil changes or ignoring warning lights can lead to penalties.

Why People Choose to Lease

There are several reasons why leasing makes sense for certain drivers. First, monthly payments are often significantly lower than loan payments for the same vehicle. This frees up cash for other expenses or investments.

Second, you get to drive a new car every few years. If you love having the latest infotainment systems, advanced driver assistance features, or a fresh design, leasing lets you upgrade regularly without the hassle of selling a used car.

Third, leases often come with full warranty coverage. That means if something breaks—like the transmission or infotainment system—it’s usually covered, so you’re not stuck with a big repair bill.

Finally, some people lease because they don’t drive a lot. If you put on fewer than 12,000 miles a year, leasing can be a cost-effective way to enjoy a new vehicle without overpaying for unused miles.

How Much Does It Actually Cost to Lease a Car?

Visual guide about How Much Is It to Lease a Car

Image source: i.insider.com

Now for the big question: how much is it to lease a car? The short answer is that monthly payments typically range from $200 to $600, but that’s just the surface. The real cost depends on several key factors, including the car’s price, lease term, down payment, credit score, and more.

Let’s break it down with a real-world example. Say you’re leasing a 2024 Honda Accord. The sticker price is around $32,000. With a 36-month lease, 12,000 miles per year, and a $2,000 down payment, your monthly payment might be around $320. But if you choose a luxury SUV like a BMW X5, that same setup could cost $650 or more per month.

Keep in mind that the advertised “low monthly payment” you see in ads often comes with specific conditions—like a large down payment, excellent credit, or a high mileage allowance. Always read the fine print.

Average Lease Payment by Vehicle Type

Lease costs vary widely depending on the type of vehicle. Here’s a general idea of what you might expect:

– **Compact cars (e.g., Honda Civic, Toyota Corolla):** $200–$300/month

– **Midsize sedans (e.g., Toyota Camry, Hyundai Sonata):** $250–$400/month

– **SUVs (e.g., Honda CR-V, Ford Escape):** $300–$500/month

– **Luxury vehicles (e.g., BMW 3 Series, Mercedes C-Class):** $500–$800/month

– **Electric vehicles (e.g., Tesla Model 3, Chevrolet Bolt):** $300–$600/month (sometimes lower with incentives)

These numbers are based on typical 36-month leases with moderate down payments and average credit. Your actual cost could be higher or lower.

Hidden Costs to Watch Out For

While the monthly payment gets most of the attention, there are other costs involved in leasing a car. These can add up quickly if you’re not careful.

First, there’s the **acquisition fee**, which is like a setup charge from the leasing company. This usually ranges from $500 to $1,000 and is often rolled into the first payment or added to your monthly cost.

Then there’s the **security deposit**, which may be required if you have lower credit. This is typically one month’s payment and is refundable at the end of the lease if there’s no damage.

You’ll also pay **sales tax** on your monthly payments in most states. Some states tax the full price of the car upfront, while others tax only the monthly payment. This can significantly affect your total cost.

Finally, there are **disposition fees**—charges for returning the car at the end of the lease. These usually range from $300 to $500 and cover the cost of inspecting and reconditioning the vehicle.

Key Factors That Affect Your Lease Payment

Visual guide about How Much Is It to Lease a Car

Image source: signaturely.com

Now that you know the average range, let’s dive into what actually determines how much you’ll pay each month. Understanding these factors will help you negotiate a better deal and avoid overpaying.

1. The Car’s Sticker Price and Residual Value

The biggest factor in your lease payment is the car’s **capitalized cost**—essentially the price you agree to pay for the vehicle. The lower this number, the lower your monthly payment.

But it’s not just about the sticker price. Leasing companies also consider the car’s **residual value**—how much it’s expected to be worth at the end of the lease. Cars that hold their value well (like Toyotas and Hondas) have higher residual values, which means lower depreciation costs and lower monthly payments.

For example, a car with a $30,000 price and a 60% residual value after three years will cost you less to lease than one with a 50% residual value—even if they start at the same price.

2. Lease Term and Mileage Allowance

How long you lease the car and how many miles you drive each year also affect your payment.

Most leases last 24, 36, or 48 months. Shorter leases often have higher monthly payments because you’re paying off the depreciation faster. Longer leases spread the cost out but may come with higher total interest.

Mileage limits are usually set at 10,000, 12,000, or 15,000 miles per year. If you exceed this, you’ll pay a per-mile fee—typically $0.10 to $0.25. So if you drive 18,000 miles in a year on a 12,000-mile lease, that’s 6,000 extra miles at $0.15 each = $900 in penalties.

If you know you’ll drive more, consider a higher mileage lease upfront. It’s almost always cheaper than paying overage fees later.

3. Down Payment (Cap Cost Reduction)

The down payment—also called a **capitalized cost reduction**—lowers the amount you’re financing, which reduces your monthly payment. For example, putting $3,000 down on a $30,000 car means you’re only leasing $27,000.

But here’s the trade-off: that $3,000 is gone if you total the car early or end the lease early. It’s not like a down payment on a loan, which builds equity. Many financial experts recommend minimizing the down payment to protect your cash.

Instead of a large down payment, consider rolling it into the monthly payment or using it to lower the interest rate (see money factor below).

4. Your Credit Score and Money Factor

Your credit score affects the **money factor**—the leasing equivalent of an interest rate. The higher your score, the lower the money factor, and the less you’ll pay in finance charges.

For example, a money factor of 0.00200 is roughly equivalent to a 4.8% APR. If your credit is excellent, you might qualify for 0.00100 (about 2.4% APR). But if your score is below 650, the money factor could be 0.00300 or higher (7.2%+ APR).

Always ask for the money factor in writing and convert it to an APR to compare with loan rates. You can do this by multiplying the money factor by 2,400.

5. Manufacturer Incentives and Dealer Fees

Car manufacturers often offer **lease incentives** to move inventory. These can include cash rebates, reduced money factors, or waived fees. For example, a $2,000 incentive on a $35,000 car can drop your monthly payment by $50–$60.

Dealers may also add their own fees, like documentation fees (often $300–$800) or advertising fees. Some of these are negotiable, so don’t be afraid to ask.

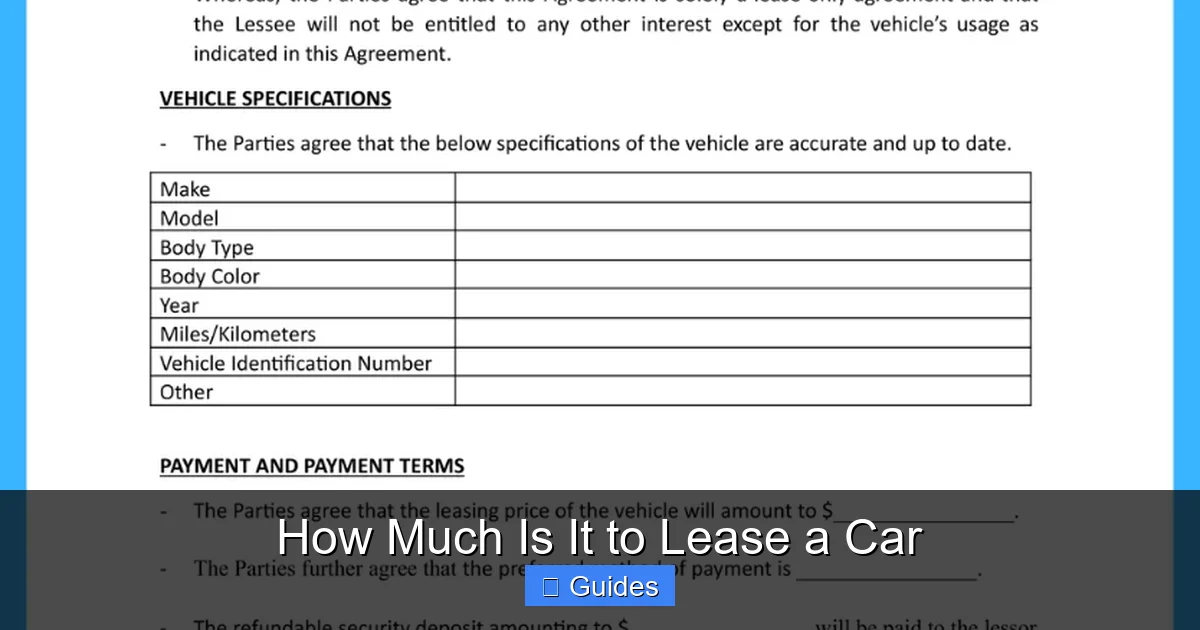

How to Calculate Your Lease Payment

Visual guide about How Much Is It to Lease a Car

Image source: images.template.net

Want to estimate your own lease payment? Here’s a simple formula:

Monthly Payment = (Depreciation + Finance Charge) / Lease Term

Let’s break it down:

– **Depreciation** = (Cap Cost – Residual Value)

– **Finance Charge** = (Cap Cost + Residual Value) × Money Factor

– **Lease Term** = Number of months

For example:

Cap Cost: $30,000

Residual Value (60% after 36 months): $18,000

Money Factor: 0.00200

Lease Term: 36 months

Depreciation = $30,000 – $18,000 = $12,000

Finance Charge = ($30,000 + $18,000) × 0.00200 = $96

Monthly Payment = ($12,000 + $96) / 36 = $336

This doesn’t include taxes, fees, or down payments, but it gives you a solid estimate.

Using Online Lease Calculators

If math isn’t your thing, use a free online lease calculator. Websites like Edmunds, Kelley Blue Book, and Cars.com let you plug in the car’s price, residual value, money factor, and term to get an instant estimate.

These tools are great for comparing different vehicles and lease terms. Just remember to double-check the numbers with the dealer—sometimes the residual or money factor isn’t what you expect.

Tips to Get the Best Lease Deal

Now that you understand the costs, here’s how to get the best possible lease deal without overpaying.

1. Negotiate the Capitalized Cost

Just like when buying a car, you should negotiate the price of the vehicle. The lower the cap cost, the lower your monthly payment. Research the invoice price (what the dealer paid) and aim to lease at or below that.

Use pricing guides like Edmunds or TrueCar to see what others are paying in your area. Walk in with data, not emotions.

2. Avoid Excessive Down Payments

We mentioned this earlier, but it’s worth repeating: putting too much money down increases your risk. If the car is totaled or stolen early in the lease, you may not get that money back.

Instead, consider a small down payment (one month’s payment) or roll it into the monthly cost. This keeps your cash safe and gives you more flexibility.

3. Watch Out for Add-Ons and Extras

Dealers may try to sell you extras like gap insurance, maintenance packages, or tire protection. While some of these can be useful, many are overpriced.

Gap insurance is often included in leases, so you may not need to buy it separately. Maintenance packages can be convenient, but you might pay less by doing oil changes yourself or using a local shop.

4. Time Your Lease Right

Leasing at the right time can save you hundreds. The best time to lease is usually at the end of the month, quarter, or model year when dealers are trying to meet sales goals.

Also, look for manufacturer promotions. Brands often offer special lease deals during holidays or when launching new models.

5. Read the Fine Print

Before signing, read the entire lease agreement. Check for:

– Exact mileage limits and overage fees

– Wear and tear guidelines

– Early termination penalties

– Disposition fees

– Required maintenance

If something isn’t clear, ask. Don’t assume everything is standard.

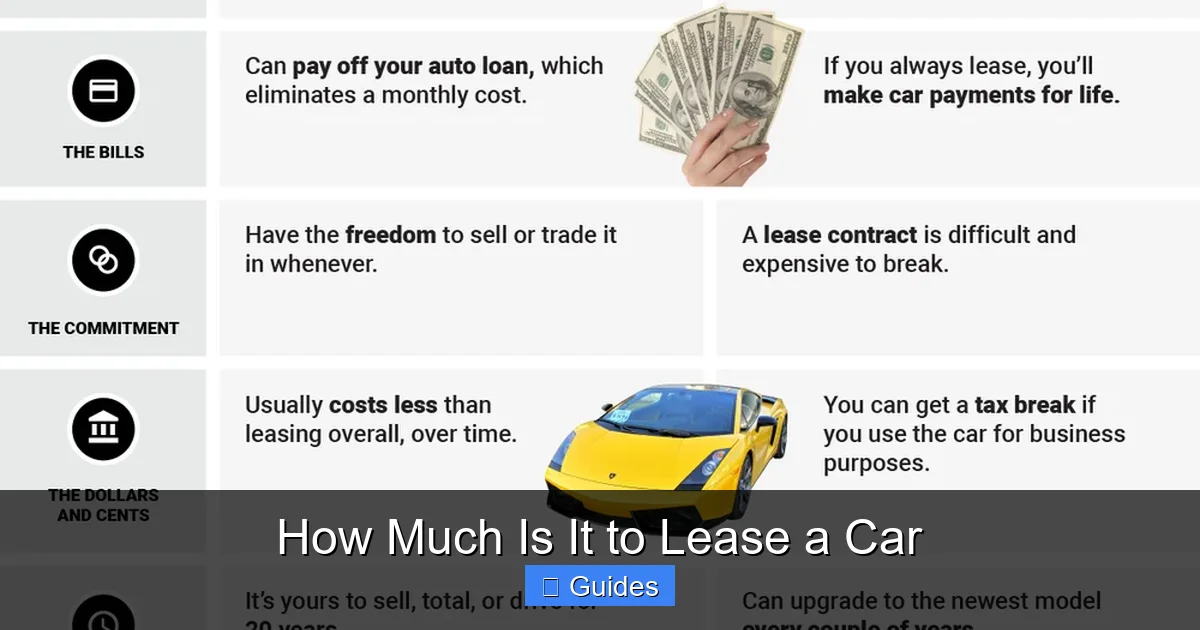

Pros and Cons of Leasing a Car

Like any financial decision, leasing has advantages and disadvantages. Let’s weigh them so you can decide if it’s right for you.

Pros of Leasing

- Lower monthly payments: You’re only paying for depreciation, not the full value.

- Drive a new car every few years: Enjoy the latest tech and safety features.

- Warranty coverage: Most repairs are covered during the lease term.

- Lower sales tax: In many states, you only pay tax on the monthly payment, not the full price.

- No long-term commitment: Return the car when the lease ends.

Cons of Leasing

- No ownership: You don’t build equity or own the car.

- Mileage restrictions: Exceeding limits can be expensive.

- Wear and tear fees: Damage beyond “normal” use may cost you.

- Early termination penalties: Ending the lease early can be costly.

- Continuous payments: You’ll always have a car payment unless you go without a vehicle.

Should You Lease or Buy?

The lease vs. buy debate comes down to your lifestyle, driving habits, and financial goals.

Lease if:

– You want lower monthly payments

– You drive less than 15,000 miles per year

– You like driving new cars every 2–4 years

– You don’t want to deal with long-term maintenance

Buy if:

– You plan to keep the car for 5+ years

– You drive a lot of miles

– You want to build equity

– You prefer no mileage restrictions

For many people, a hybrid approach works: lease for a few years, then buy the car at the end if it’s still in good shape. Or, lease a new car every few years while investing the savings.

Final Thoughts: Is Leasing Right for You?

So, how much is it to lease a car? As you’ve seen, the answer isn’t one-size-fits-all. Monthly payments can range from $200 to $600 or more, depending on the vehicle, your credit, and the terms you choose.

But beyond the numbers, leasing is about lifestyle. It’s for people who value lower payments, newer technology, and the freedom to upgrade regularly. It’s not for everyone—but for the right driver, it can be a smart, cost-effective way to enjoy a reliable vehicle.

Before you sign, do your homework. Compare offers, read the fine print, and negotiate the price. And remember: the lowest monthly payment isn’t always the best deal. Look at the total cost over the lease term, including fees, taxes, and potential penalties.

With the right approach, leasing can be a great way to drive the car you want—without breaking the bank.

Frequently Asked Questions

How much is it to lease a car per month?

Most car leases cost between $200 and $600 per month, depending on the vehicle, lease term, down payment, and your credit score. Compact cars tend to be on the lower end, while luxury vehicles can cost $700 or more.

Is leasing a car cheaper than buying?

Leasing usually has lower monthly payments than buying, but you don’t build equity. Over the long term, buying may be cheaper if you keep the car for many years. Leasing is better for short-term, low-mileage drivers.

Can you negotiate a car lease?

Yes! You can negotiate the capitalized cost (price), money factor (interest rate), and fees—just like when buying. Research the car’s invoice price and use competing offers to get a better deal.

What happens if you go over the mileage limit?

If you exceed your annual mileage limit, you’ll be charged a per-mile fee—typically $0.10 to $0.25. For example, driving 3,000 extra miles at $0.15 each would cost $450 at the end of the lease.

Can you end a car lease early?

Yes, but it usually comes with penalties. Early termination fees can be thousands of dollars. Some leases allow you to transfer the lease to another person, which may reduce costs.

Do you need good credit to lease a car?

A good credit score (650+) helps you qualify for lower money factors and better lease terms. However, some dealers offer leases to people with lower credit, though the payments may be higher.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.