Wondering how old a car can be for financing Fairwinds? Fairwinds Credit Union typically finances vehicles up to 12 model years old, but exact rules depend on loan type, vehicle value, and your credit profile. This guide breaks down age limits, loan options, and smart strategies to help you get approved—even for older cars.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Understanding Fairwinds Auto Financing: What You Need to Know

- 4 What Is the Maximum Age for a Car Financed by Fairwinds?

- 5 Loan Terms and How Vehicle Age Impacts Them

- 6 How Your Credit Profile Influences Financing Options

- 7 Tips for Financing an Older Car with Fairwinds

- 8 Alternatives if Your Car Is Too Old for Fairwinds Financing

- 9 Final Thoughts: Smart Strategies for Financing Older Cars

- 10 Frequently Asked Questions

- 10.1 Can I finance a 15-year-old car with Fairwinds?

- 10.2 Does Fairwinds finance cars with over 100,000 miles?

- 10.3 What credit score do I need to finance an older car with Fairwinds?

- 10.4 Can I use a personal loan from Fairwinds to buy an old car?

- 10.5 Do I need a down payment for an older car loan?

- 10.6 Will Fairwinds finance a car with a salvage title?

Key Takeaways

- Maximum vehicle age: Fairwinds generally finances cars up to 12 model years old, though some exceptions may apply based on condition and value.

- Loan term limits: Longer loan terms (like 72 or 84 months) are usually reserved for newer vehicles; older cars may have shorter repayment periods.

- Vehicle condition matters: Even if a car is within the age limit, it must pass a mechanical inspection and have a clean title to qualify.

- Down payment helps: Putting money down increases your chances of approval, especially for older or higher-mileage vehicles.

- Credit score impacts options: Better credit scores open doors to lower rates and more flexible terms, even for older cars.

- Pre-approval is smart: Get pre-approved before car shopping to understand your budget and strengthen your negotiating power.

- Consider certified pre-owned: CPO vehicles often meet Fairwinds’ standards and come with warranties, making them easier to finance.

📑 Table of Contents

- Understanding Fairwinds Auto Financing: What You Need to Know

- What Is the Maximum Age for a Car Financed by Fairwinds?

- Loan Terms and How Vehicle Age Impacts Them

- How Your Credit Profile Influences Financing Options

- Tips for Financing an Older Car with Fairwinds

- Alternatives if Your Car Is Too Old for Fairwinds Financing

- Final Thoughts: Smart Strategies for Financing Older Cars

Understanding Fairwinds Auto Financing: What You Need to Know

Buying a car is exciting—but figuring out how to pay for it? That’s where auto financing comes in. If you’re considering Fairwinds Credit Union for your next vehicle purchase, you’re probably asking: *How old can a car be for financing Fairwinds?* It’s a smart question, because not all lenders treat older vehicles the same way.

Fairwinds Credit Union is known for its member-focused approach, competitive rates, and flexible lending options. But like most financial institutions, they have guidelines around vehicle age to manage risk. While they don’t publish an exact “cutoff” year on their website, industry standards and member experiences suggest that Fairwinds typically finances cars that are no more than 12 model years old at the time of purchase. So, if it’s 2024, you’d likely be looking at vehicles from 2012 or newer.

But here’s the good news: those rules aren’t set in stone. Fairwinds evaluates each application individually. Factors like the car’s condition, mileage, market value, and your creditworthiness all play a role. This means that a well-maintained 2011 Honda Civic with low miles might still qualify—even if it’s technically 13 years old. On the flip side, a 2015 SUV with high mileage and a salvage title probably won’t make the cut, even though it’s within the typical age range.

In this guide, we’ll walk you through everything you need to know about financing older cars with Fairwinds—from age limits and loan terms to tips for boosting your approval odds. Whether you’re eyeing a reliable used sedan or a rugged older truck, understanding these guidelines will help you shop smarter and avoid surprises at the dealership.

What Is the Maximum Age for a Car Financed by Fairwinds?

Visual guide about How Old Can a Car Be for Financing Fairwinds

Image source: openroadac.com

So, what’s the real answer to “how old can a car be for financing Fairwinds”? Based on Fairwinds’ lending practices and feedback from members, the general rule of thumb is **12 model years**. That means if you’re applying in 2024, vehicles from 2012 and newer are most likely to be approved.

But why 12 years? Lenders use this benchmark because vehicles older than that often face higher repair costs, lower resale value, and increased risk of mechanical failure. From a lending perspective, that translates to higher risk—if the car breaks down soon after purchase, the borrower may struggle to keep up with payments, and the lender has less collateral value to recover in case of default.

That said, Fairwinds isn’t rigid. They consider the *overall health* of the vehicle, not just its age. For example:

– A 2011 Toyota Camry with 80,000 miles, full service records, and a clean title might still qualify.

– A 2013 Ford F-150 with 180,000 miles, no maintenance history, and minor accident damage likely won’t.

Fairwinds also uses third-party valuation tools like Kelley Blue Book (KBB) or National Automobile Dealers Association (NADA) guides to assess a car’s current market value. If the vehicle is worth significantly less than the loan amount requested, they may decline the application—or require a larger down payment to bridge the gap.

Exceptions to the Rule

While 12 years is the standard, there are exceptions. Some members have successfully financed vehicles up to 15 years old, especially if:

– The car is a high-demand, reliable model (like a Honda Accord or Subaru Outback).

– It has exceptionally low mileage.

– It’s certified pre-owned (CPO) by a dealership.

– The borrower has excellent credit and a strong income.

Additionally, Fairwinds offers different loan products—such as personal loans or secured loans—that might be used for older vehicles, though these often come with higher interest rates and shorter terms.

How Mileage Affects Approval

Age isn’t the only factor. Mileage plays a big role too. Most lenders, including Fairwinds, prefer vehicles under 100,000 miles. Once you cross that threshold, the risk of major repairs (like transmission or engine issues) increases. A 2012 car with 120,000 miles may be treated more cautiously than a 2014 model with 70,000 miles—even though the older car is technically newer in model year.

That’s why it’s crucial to get a pre-purchase inspection (PPI) from a trusted mechanic before finalizing any deal. Not only does this protect you from buying a lemon, but it also gives you documentation to show Fairwinds that the car is in good working order—which can help your financing application.

Loan Terms and How Vehicle Age Impacts Them

Visual guide about How Old Can a Car Be for Financing Fairwinds

Image source: fcatadvantage-com.cdn-convertus.com

When you finance a car, the loan term—how long you have to repay it—is a key part of your monthly budget. But here’s something many buyers don’t realize: **vehicle age directly affects your available loan terms**.

Fairwinds typically offers auto loans with terms ranging from 24 to 84 months (2 to 7 years). However, the older the car, the shorter the maximum term you’ll likely qualify for.

For example:

– A 2022 Honda CR-V might qualify for a 72- or even 84-month loan.

– A 2015 Nissan Altima may be limited to 60 months.

– A 2012 Toyota Corolla could be capped at 48 months.

Why? Longer loan terms mean the lender is exposed to risk for a longer period. With older cars, there’s a higher chance of depreciation outpacing loan repayment, leaving the borrower “upside-down” (owing more than the car is worth). To mitigate this, lenders shorten the term on older vehicles.

Shorter Terms = Higher Monthly Payments

While shorter loan terms reduce total interest paid over time, they also mean higher monthly payments. Let’s say you’re financing $15,000:

– At 5% interest over 60 months: ~$283/month

– At 5% interest over 48 months: ~$345/month

That’s a $62 difference—which could impact your budget. So while you might save money in the long run with a shorter term, make sure the monthly payment fits comfortably within your finances.

Interest Rates and Older Vehicles

Interest rates also tend to be slightly higher for older cars. Fairwinds bases rates on factors like credit score, loan term, and vehicle age. A newer car is seen as a safer investment, so it often qualifies for the lowest advertised rates. Older vehicles—even within the acceptable age range—may be assigned a slightly higher rate to account for increased risk.

For instance, a borrower with a 750 credit score might get 4.99% APR on a 2023 model, but 6.49% on a 2014 model. Over a 60-month loan, that 1.5% difference could cost you hundreds in extra interest.

How Your Credit Profile Influences Financing Options

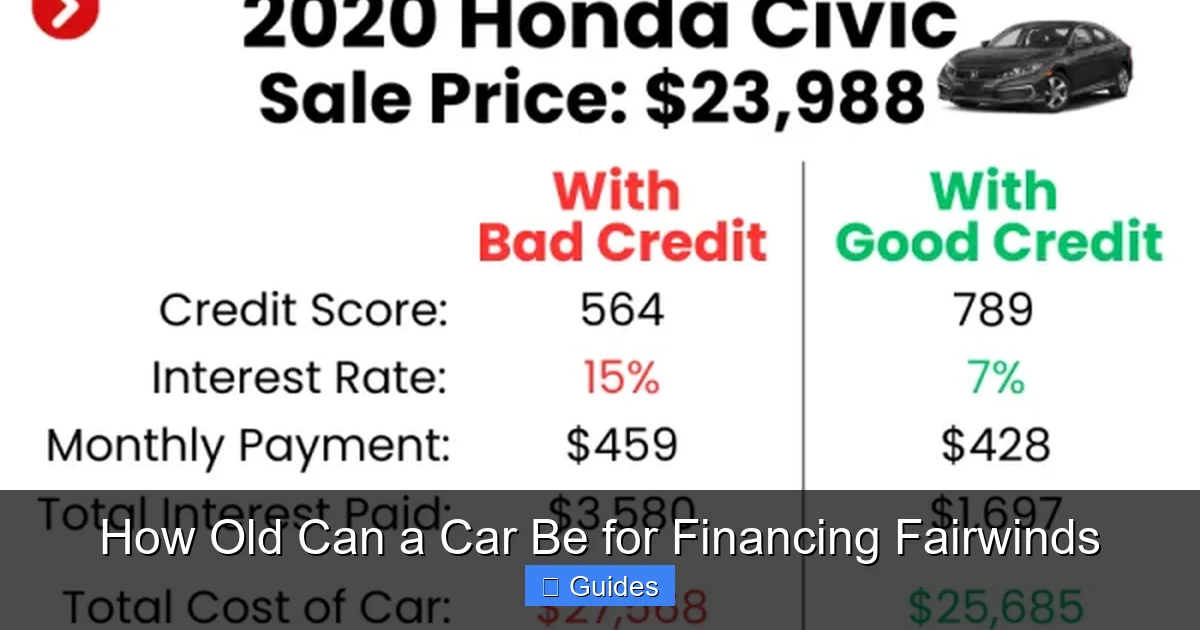

Visual guide about How Old Can a Car Be for Financing Fairwinds

Image source: periodismointegrado.com

Your credit score doesn’t just affect your interest rate—it can also influence whether Fairwinds will finance an older car at all. Members with strong credit (typically 700 or higher) have more flexibility. They’re more likely to get approved for slightly older vehicles and may qualify for better terms.

On the other hand, if your credit score is below 650, Fairwinds may be more cautious—especially with cars that are 10+ years old. In these cases, they might:

– Require a larger down payment (20% or more).

– Limit the loan term.

– Ask for proof of income or employment stability.

– Recommend a co-signer.

Improving Your Chances with a Co-Signer

If your credit isn’t perfect, adding a co-signer with strong credit can significantly boost your approval odds. The co-signer agrees to take responsibility for the loan if you default, which reduces the lender’s risk. This is especially helpful when financing older vehicles, where the lender is already taking on more risk due to age and potential depreciation.

Just remember: co-signing is a big commitment. If you miss payments, it affects both your credit and your co-signer’s. Only use this option if you’re confident in your ability to repay.

Building Credit Before Applying

If you’re not in a rush, consider taking a few months to improve your credit before applying. Simple steps like paying down credit card balances, disputing errors on your credit report, and avoiding new credit inquiries can raise your score by 20–50 points—enough to qualify for better rates and more flexible terms.

Tips for Financing an Older Car with Fairwinds

Now that you know the basics, here are some practical tips to increase your chances of getting approved—even for a car that’s pushing the age limit.

1. Get Pre-Approved First

Before you start test-driving cars, get pre-approved for a loan through Fairwinds. This gives you a clear budget and shows dealers you’re a serious buyer. Pre-approval also locks in your interest rate for a set period (usually 30–60 days), protecting you from rate increases while you shop.

To apply, you’ll need:

– Proof of income (pay stubs or tax returns)

– Proof of residence (utility bill or lease)

– Valid driver’s license

– Information about the vehicle (once you find one)

2. Choose a Reliable Make and Model

Not all older cars are created equal. Some brands and models are known for longevity and low repair costs. Focus your search on vehicles with strong reliability ratings, such as:

– Honda Civic or Accord

– Toyota Camry or Corolla

– Subaru Outback or Forester

– Mazda3 or CX-5

These cars tend to hold their value better and are more likely to pass Fairwinds’ underwriting standards—even if they’re 10–12 years old.

3. Put Money Down

A larger down payment reduces the loan amount, which lowers your monthly payment and decreases the lender’s risk. Aim for at least 10–20% down, especially for older vehicles. For example, on a $12,000 car, a $2,400 down payment means you’re only financing $9,600—making it easier to get approved and avoid being upside-down.

4. Consider a Certified Pre-Owned (CPO) Vehicle

CPO cars are typically 1–5 years old, have been inspected and refurbished by the dealer, and come with extended warranties. Because they’re in excellent condition and often still under factory warranty, they’re easier to finance—even if they’re near the upper age limit. Plus, many CPO programs include roadside assistance and maintenance plans, adding extra peace of mind.

5. Avoid High-Mileage or Salvage-Title Vehicles

Even if a car is within the 12-year window, Fairwinds may decline it if it has:

– Over 120,000 miles

– A salvage or rebuilt title

– Evidence of flood or fire damage

– Missing service records

These red flags suggest higher risk, which can sink your financing application—no matter how good your credit is.

6. Work with a Reputable Dealer or Private Seller

Dealerships often have relationships with lenders like Fairwinds and can help facilitate financing. But if you’re buying from a private seller, make sure the title is clean and the car passes inspection. Fairwinds may require a lien release and proof of ownership before funding the loan.

Alternatives if Your Car Is Too Old for Fairwinds Financing

What if the car you want is 13, 14, or even 15 years old? Don’t worry—there are still options.

Personal Loans

Fairwinds offers unsecured personal loans that can be used for almost anything—including buying a car. These loans don’t require collateral, so the vehicle age doesn’t matter. However, personal loans typically have higher interest rates (8–15% APR) and shorter terms (2–5 years), so your monthly payment will be higher.

For example, a $10,000 personal loan at 10% over 48 months costs about $253/month—compared to $230/month for a secured auto loan at 5%. But if the car you want is too old for auto financing, a personal loan might be your best bet.

Secured Loans Using Other Assets

If you own a boat, RV, or even a savings account with Fairwinds, you might qualify for a secured loan using that asset as collateral. These loans often have lower rates than personal loans and can be used to purchase older vehicles. Just be aware: if you default, the lender can seize the collateral.

Credit Union or Community Bank Options

Some smaller credit unions or community banks are more flexible with older vehicle financing. They may allow cars up to 15 or even 20 years old, especially if they’re well-maintained. It’s worth shopping around—but always compare rates, fees, and terms carefully.

Final Thoughts: Smart Strategies for Financing Older Cars

So, how old can a car be for financing Fairwinds? The short answer: usually up to 12 model years, but exceptions exist based on condition, mileage, and your financial profile. Fairwinds Credit Union aims to help members achieve car ownership responsibly, which means balancing risk with opportunity.

The key to success is preparation. Get your credit in shape, save for a down payment, and focus on reliable, well-maintained vehicles. Use pre-approval to your advantage, and don’t hesitate to ask Fairwinds directly about their current guidelines—they’re often happy to provide personalized advice.

Remember, an older car doesn’t have to mean a worse deal. With the right financing strategy, you can drive away in a dependable vehicle that fits your budget—without overextending yourself. And with Fairwinds’ member-focused approach, you’re not just getting a loan; you’re building a relationship with a financial partner who has your back.

Whether you’re buying your first car or upgrading to something more spacious, understanding the rules around vehicle age and financing will save you time, stress, and money. So go ahead—start your search with confidence, knowing exactly what Fairwinds looks for in an auto loan application.

Frequently Asked Questions

Can I finance a 15-year-old car with Fairwinds?

It’s unlikely, but not impossible. Fairwinds typically finances vehicles up to 12 model years old. However, if the car is in excellent condition, has low mileage, and you have strong credit, you may be able to make a case—especially with a large down payment or co-signer.

Does Fairwinds finance cars with over 100,000 miles?

Yes, but with caution. High mileage increases risk, so Fairwinds may require a larger down payment, shorter loan term, or proof of recent maintenance. Vehicles with over 120,000 miles are less likely to be approved, especially if they’re also older.

What credit score do I need to finance an older car with Fairwinds?

While Fairwinds doesn’t publish a minimum score, a credit score of 650 or higher improves your chances. Scores above 700 give you access to better rates and more flexible terms, even for older vehicles.

Can I use a personal loan from Fairwinds to buy an old car?

Yes. Fairwinds offers personal loans that can be used for car purchases, regardless of age. However, these loans have higher interest rates and shorter terms than auto loans, so compare options carefully.

Do I need a down payment for an older car loan?

Not always, but a down payment (10–20%) is highly recommended. It reduces the loan amount, lowers your monthly payment, and increases approval odds—especially for older or high-mileage vehicles.

Will Fairwinds finance a car with a salvage title?

Generally, no. Fairwinds requires a clean title for auto financing. Salvage or rebuilt titles indicate prior significant damage, which increases risk and usually disqualifies the vehicle from standard auto loans.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.