Breaking a car lease doesn’t have to be stressful or expensive. With the right strategy—like transferring your lease, buying out the vehicle, or negotiating with your lessor—you can exit your agreement smoothly and often save money in the process.

In This Article

- 1 Key Takeaways

- 2 How to Break a Car Lease

- 3 Understand Your Lease Agreement

- 4 Option 1: Lease Transfer (Lease Assumption)

- 5 Option 2: Buy Out and Resell the Vehicle

- 6 Option 3: Negotiate an Early Termination

- 7 Option 4: Return the Car and Pay the Fees

- 8 Legal Protections and Special Circumstances

- 9 Final Tips for a Smooth Lease Break

- 10 Conclusion

- 11 Key Takeaways

- 12 Frequently Asked Questions

Key Takeaways

- Review your lease agreement first: Understand early termination clauses, fees, and mileage limits before taking action.

- Lease transfer is often the best option: Many leasing companies allow you to transfer your lease to another qualified driver, avoiding hefty penalties.

- Consider a lease buyout: If the car’s market value is higher than the residual, buying it and reselling could turn a profit.

- Negotiate with your lessor: Open communication may lead to reduced fees or flexible exit terms, especially if you’re facing hardship.

- Watch for wear-and-tear charges: Excess damage or mileage can add thousands to your final bill—address these early.

- Use online marketplaces: Websites like Swapalease or LeaseTrader help connect you with potential lease takers.

- Know your rights: Federal and state laws may protect you in cases of military deployment, disability, or fraud.

[FEATURED_IMAGE_PLACEHOLDER]

How to Break a Car Lease

So, you’ve got a car lease—and now you need out. Maybe your lifestyle changed, you got a new job in another city, or you just realized the monthly payments aren’t fitting your budget anymore. Whatever the reason, breaking a car lease can feel overwhelming. You might be imagining massive fees, legal trouble, or a damaged credit score. But here’s the good news: exiting a car lease early is often possible—and sometimes even affordable—if you know the right steps.

Leasing a car isn’t like buying one. When you lease, you’re essentially renting the vehicle for a set period (usually 24 to 36 months) and paying for its depreciation during that time. Because the leasing company still owns the car, they have rules about how and when you can end the agreement. But those rules aren’t set in stone. With smart planning and a clear understanding of your options, you can break your lease without wrecking your finances.

In this guide, we’ll walk you through every practical way to exit your car lease early—legally, ethically, and often without paying a fortune. Whether you’re dealing with a tight budget, a job relocation, or simply want a different vehicle, you’ll find actionable strategies that fit your situation. Let’s dive in.

Understand Your Lease Agreement

Before you do anything, grab your lease contract and read it carefully. This document is your roadmap—it tells you exactly what you’re allowed to do, what penalties you might face, and whether early termination is even an option. Many people skip this step and end up paying more than necessary because they didn’t know the rules.

Key Clauses to Look For

Your lease agreement will include several important sections. Pay close attention to:

- Early termination clause: This outlines the process and costs for ending your lease before the term ends. Some leases charge a flat fee, while others calculate penalties based on remaining payments.

- Disposition fee: A charge (usually $300–$500) that the leasing company may apply when you return the car early.

- Mileage limits: Most leases allow 10,000 to 15,000 miles per year. Exceeding this can cost $0.10 to $0.25 per mile—so if you’ve driven 5,000 extra miles, that’s $500–$1,250 in fees.

- Wear and tear guidelines: The lease will define what counts as “excessive” damage. Scratches, dents, or stained upholstery beyond normal use may result in repair charges.

- Gap insurance: This covers the difference between what you owe and the car’s value if it’s totaled. It’s usually included, but confirm it’s active.

Example: Reading Between the Lines

Let’s say your lease says: “Early termination fee equals the sum of all remaining monthly payments, minus any equity in the vehicle.” That sounds scary—but it might not be as bad as it seems. If you have 12 payments left at $400 each, that’s $4,800. But if the car’s current market value is $2,000 more than the residual (the amount you’d pay to buy it), that $2,000 could offset the fee. So your actual cost might be $2,800—not $4,800.

Pro Tip: Contact Your Lessor Early

Don’t wait until the last minute. Call your leasing company as soon as you know you need out. Ask them to explain the early termination process and provide a written estimate of fees. Some companies even offer “hardship programs” for customers facing medical issues, job loss, or relocation. Being upfront can open doors to better options.

Option 1: Lease Transfer (Lease Assumption)

One of the most popular and cost-effective ways to break a car lease is through a lease transfer—also called lease assumption. This means finding someone else to take over your lease payments, mileage, and responsibilities. The new driver becomes the lessee, and you’re off the hook.

How Lease Transfer Works

The process varies by leasing company, but here’s the general flow:

- Check if your lease allows transfers. Most major companies (like Toyota Financial, Honda Lease, or BMW Financial) permit it, but some smaller lenders don’t.

- Find a qualified candidate. They’ll need good credit, a valid license, and meet the lessor’s income requirements.

- Submit an application. The new driver applies with the leasing company, who runs a credit check and approves or denies them.

- Complete the transfer. Once approved, the new lessee takes over payments, and you return the car or hand over the keys.

Where to Find a Lease Taker

You can’t just hand your car to a friend and call it done. The new driver must be approved by the leasing company. That’s where online platforms come in:

- Swapalease.com: The largest lease transfer marketplace. You list your lease (free), and interested buyers contact you. Swapalease handles the paperwork and connects you with the lessor.

- LeaseTrader.com: Similar to Swapalease, with a focus on helping people find or transfer leases. They also offer a “lease buyout” service.

- Facebook Groups and Craigslist: You can post locally, but be cautious. Always verify the person’s identity and have them pre-approved by the leasing company before handing over the car.

Real-Life Example: Sarah’s Successful Transfer

Sarah leased a 2022 Honda CR-V for $380/month with 18 months left. She got a job in another state and needed out. She listed her lease on Swapalease for $100 (a one-time fee). Within two weeks, a teacher from Ohio applied. The leasing company approved him, and Sarah transferred the lease. She paid a $395 transfer fee to Honda Financial but avoided $6,840 in remaining payments. Net savings: over $6,300.

Tips for a Smooth Transfer

- Be honest about the car’s condition. Disclose any dents, stains, or mechanical issues upfront.

- Set a reasonable transfer incentive. Some people offer to pay the first month’s payment or cover the transfer fee to attract buyers.

- Don’t skip the credit check. Even if someone seems trustworthy, the leasing company will run their credit—so save time by only pursuing pre-approved candidates.

Option 2: Buy Out and Resell the Vehicle

If your car is worth more than the residual value (the amount you’d pay to buy it at the end of the lease), you might be sitting on a goldmine. Buying out your lease and selling the car privately could not only let you exit the lease but also put money in your pocket.

What Is a Lease Buyout?

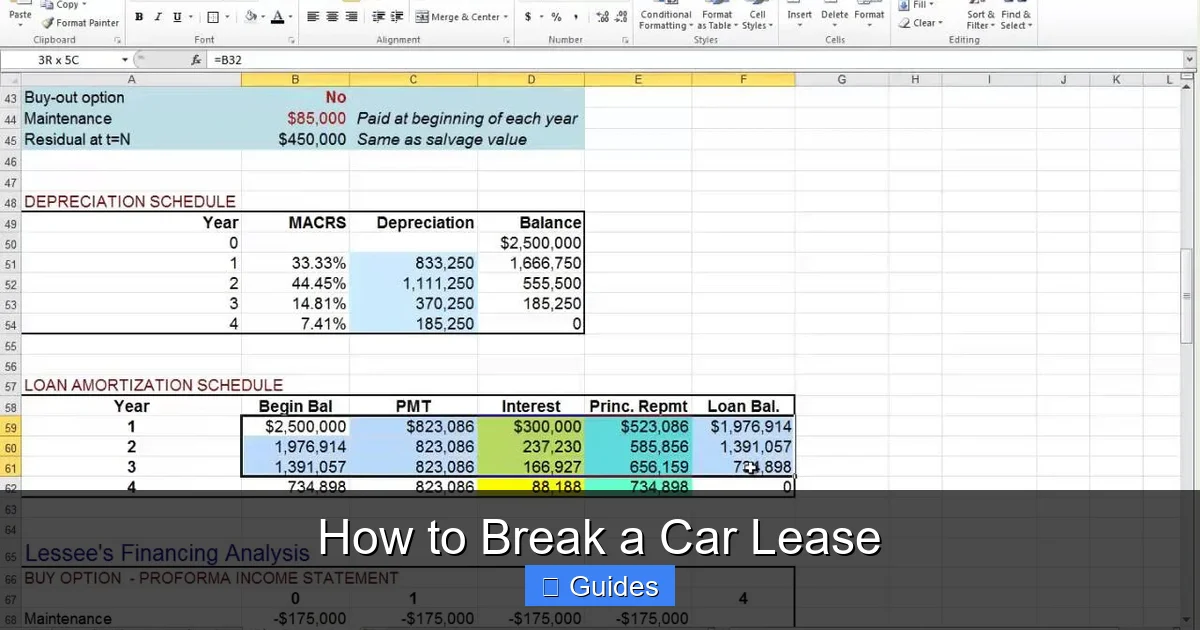

A lease buyout means purchasing the vehicle from the leasing company at the end of the lease—or before. The price is set in your contract as the “residual value.” For example, if you leased a $35,000 car with a 50% residual, you can buy it for $17,500.

How to Profit from a Buyout

Here’s the math:

- Residual value: $17,500 (what you pay to buy the car)

- Current market value: $20,000 (what you can sell it for)

- Profit: $2,500 (minus fees like title transfer and advertising)

This works best with in-demand vehicles—like trucks, SUVs, or fuel-efficient cars—that have held their value well.

Step-by-Step Buyout Process

- Check the car’s market value. Use Kelley Blue Book (KBB) or Edmunds to get a private-party estimate.

- Compare it to your residual value. If market value > residual, you have equity.

- Contact your leasing company. Ask for a buyout quote, including taxes and fees.

- Secure financing (if needed). You can use a bank loan, credit union, or even a personal loan.

- Complete the purchase. Get the title, registration, and insurance in your name.

- Sell the car privately. Use platforms like Autotrader, Cars.com, or Facebook Marketplace.

Example: Mike’s $3,000 Profit

Mike leased a 2021 Ford F-150 with a residual of $28,000. After 24 months, KBB valued it at $32,000. He bought it for $28,500 (including fees), then sold it for $31,500. After advertising and a minor repair, he netted $2,700—and walked away lease-free.

Watch Out for These Pitfalls

- Depreciation can change fast: If you wait too long, the car’s value might drop below the residual.

- You’re responsible for repairs: Once you own the car, any issues are yours to fix before selling.

- Taxes and fees add up: Sales tax, title transfer, and registration can cost $500–$1,000 depending on your state.

Option 3: Negotiate an Early Termination

Sometimes, the best way to break a lease is to talk directly to your lessor. Many leasing companies would rather work with you than risk losing money on a repossessed or abandoned vehicle. If you’re facing a genuine hardship, they may offer flexible solutions.

When to Negotiate

You have the most leverage when:

- You’re relocating for work (especially if it’s out of state or overseas).

- You’ve experienced a medical emergency or disability.

- You’re in the military and being deployed.

- The car has recurring mechanical issues not covered under warranty.

- You’re struggling financially due to job loss or reduced income.

How to Approach the Conversation

Be honest, respectful, and prepared. Here’s a script you can adapt:

“Hi, I’m [Your Name], and I currently lease a [Year/Make/Model]. Due to [reason—e.g., job relocation], I need to end my lease early. I’ve reviewed my contract and understand there may be fees, but I’d like to discuss possible options. Are there any hardship programs or reduced termination fees available?”

What Lessors Might Offer

- Reduced termination fee: Instead of paying all remaining payments, they may accept a lump sum (e.g., 2–3 months’ worth).

- Lease extension with lower payments: If you’re short on cash, they might stretch the term to reduce monthly costs.

- Deferred payments: Some companies allow you to skip a few payments and add them to the end.

- Referral bonus: If you refer a new lessee, they might waive part of your fee.

Real Example: Jessica’s Deployment Deal

Jessica, an Army officer, was deployed overseas six months into her 36-month lease. She called her leasing company and explained her situation. They waived the early termination fee and allowed her to return the car with no penalty, citing the Servicemembers Civil Relief Act (SCRA), which protects military members from certain lease penalties.

Option 4: Return the Car and Pay the Fees

If none of the above options work, you can always return the car early and pay the early termination fee. It’s not ideal, but it’s straightforward—and sometimes unavoidable.

How Much Will It Cost?

The fee typically includes:

- All remaining monthly payments

- A disposition fee ($300–$500)

- Any excess mileage charges

- Wear-and-tear repair costs

- Administrative fees

For example, if you have 10 payments left at $400 each, that’s $4,000. Add a $400 disposition fee and $600 in mileage overages, and your total could be $5,000.

Ways to Reduce the Cost

- Pay only the present value: Some lessors calculate fees based on the present value of future payments (discounted for time), which can be lower than the full sum.

- Apply equity: If the car is worth more than the residual, that equity may offset part of the fee.

- Bundle with a new lease: Some dealers will reduce your termination fee if you lease a new car from them.

Example: David’s Clean Exit

David had 8 months left on his lease at $350/month. He returned the car early and paid $2,800 in remaining payments, $400 disposition fee, and $200 in minor repairs. Total: $3,400. While not cheap, it was the only option after his business failed.

Legal Protections and Special Circumstances

You’re not always on your own. Federal and state laws offer protections that can help you break a lease with reduced or no penalties.

Servicemembers Civil Relief Act (SCRA)

If you’re in the U.S. military and receive deployment orders or a permanent change of station (PCS), you can terminate your lease early with no penalty. You must provide written notice and a copy of your orders.

State-Specific Laws

Some states have consumer protection laws that limit lease termination fees or require lessors to mitigate damages by re-leasing the car quickly. For example:

- California: Lessors must make reasonable efforts to re-lease the vehicle and can only charge you for the difference in payments.

- New York: Early termination fees must be “reasonable” and cannot exceed the lessor’s actual losses.

Fraud or Misrepresentation

If the dealer lied about the lease terms, mileage, or vehicle condition, you may have grounds to void the contract. Keep all emails, ads, and paperwork as evidence.

Final Tips for a Smooth Lease Break

Breaking a car lease doesn’t have to be a nightmare. With the right approach, you can exit cleanly and even come out ahead. Here are a few final tips:

- Act quickly: The sooner you start the process, the more options you’ll have.

- Keep the car in good condition: Wash it, fix small dents, and document its state with photos.

- Stay in communication: Regular updates with your lessor can lead to better outcomes.

- Get everything in writing: Verbal promises aren’t binding. Always request confirmation via email or letter.

- Consider the long-term impact: While breaking a lease may affect your relationship with the lessor, it won’t hurt your credit score unless you default on payments.

Conclusion

Breaking a car lease is more achievable than most people think. Whether you transfer the lease to a new driver, buy out the vehicle and sell it, negotiate with your lessor, or simply pay the fees, there’s a path that fits your situation. The key is to act early, understand your contract, and explore all your options.

Remember: leasing companies want to avoid losses too. They’d often prefer a quick, clean exit over a drawn-out dispute. By being proactive, honest, and informed, you can break your lease with minimal stress and maximum savings.

So don’t panic. Grab your lease agreement, assess your options, and take the first step today. Your freedom—and your next car—might be closer than you think.

Can I break my car lease without a penalty?

It depends on your lease terms and circumstances. In some cases—like military deployment or dealer fraud—you may break the lease with no penalty. Otherwise, fees usually apply, but options like lease transfer can minimize costs.

How much does it cost to break a car lease early?

Costs vary widely. You may pay remaining payments, a disposition fee ($300–$500), excess mileage charges, and wear-and-tear repairs. Total costs can range from $1,000 to $5,000 or more, depending on your lease and how early you exit.

Can I transfer my lease to a friend?

Yes, if your leasing company allows it and your friend meets their credit and income requirements. The new driver must be approved before the transfer is official.

What happens if I just stop making payments?

Stopping payments can lead to repossession, damage to your credit score, and legal action. Always contact your lessor to discuss options instead of defaulting.

Can I break my lease if the car breaks down often?

If the car has recurring mechanical issues not covered under warranty, you may have grounds to negotiate an early exit. Document all repairs and contact your lessor to discuss your options.

Is it better to buy out or transfer my lease?

It depends on the car’s value and your situation. If the market value is higher than the residual, buying and selling may profit you. If not, a lease transfer is usually the cheaper and easier option.

This is a comprehensive guide about how to break a car lease.

Key Takeaways

- Understanding how to break a car lease: Provides essential knowledge

Frequently Asked Questions

What is how to break a car lease?

how to break a car lease is an important topic with many practical applications.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.