Buying a car through your business can offer tax advantages and improve cash flow—if done correctly. This guide walks you through the legal steps, tax implications, financing options, and record-keeping essentials to help you make a smart, compliant purchase.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Why Buy a Car Through Your Business?

- 4 Understanding Business Use vs. Personal Use

- 5 Tax Benefits of Buying a Car Through Your Business

- 6 How to Buy the Car: Ownership Options

- 7 Financing a Business Vehicle

- 8 Record-Keeping and Compliance

- 9 Special Considerations by Business Type

- 10 When It Makes Sense—and When It Doesn’t

- 11 Conclusion

- 12 Frequently Asked Questions

- 12.1 Can I deduct car payments if I buy a car through my business?

- 12.2 What happens if I use my business car for personal trips?

- 12.3 Can I use Section 179 on a used car?

- 12.4 Do I need a separate insurance policy for a business-owned car?

- 12.5 Can I write off a luxury car through my business?

- 12.6 What if my business is an LLC taxed as a sole proprietorship?

Key Takeaways

- Understand the tax benefits: You may deduct vehicle expenses like gas, maintenance, insurance, and depreciation if the car is used for business.

- Choose the right ownership structure: Decide whether to buy the car under your business name or lease it—each has different tax and liability implications.

- Track mileage and usage: Keep detailed logs to prove business use and avoid IRS scrutiny.

- Explore financing options: Business auto loans often have better rates and terms than personal loans.

- Know the difference between Section 179 and standard depreciation: Section 179 allows you to deduct the full cost of a qualifying vehicle in the year of purchase, up to limits.

- Consult a tax professional: Rules vary by business type and location—get expert advice to maximize savings and stay compliant.

📑 Table of Contents

- Why Buy a Car Through Your Business?

- Understanding Business Use vs. Personal Use

- Tax Benefits of Buying a Car Through Your Business

- How to Buy the Car: Ownership Options

- Financing a Business Vehicle

- Record-Keeping and Compliance

- Special Considerations by Business Type

- When It Makes Sense—and When It Doesn’t

- Conclusion

Why Buy a Car Through Your Business?

So, you’re running a business—maybe you’re a freelancer, consultant, real estate agent, or small business owner—and you need a reliable vehicle. Instead of using your personal car and hoping to get reimbursed later, have you considered buying a car through your business? It might sound complicated, but when done right, it can save you money, simplify accounting, and even boost your bottom line.

Buying a car through your business isn’t just about convenience. It’s a strategic move that can unlock tax deductions, improve cash flow, and give you more control over your vehicle expenses. Whether you’re driving to client meetings, making deliveries, or traveling between job sites, a business-owned vehicle can be a powerful asset.

But here’s the catch: the IRS has rules. You can’t just buy a luxury SUV and write off 100% of the cost unless it’s truly used for business. That’s why understanding the guidelines, tracking usage, and choosing the right ownership model are crucial. This guide will walk you through everything you need to know—from tax deductions to financing—so you can make a smart, compliant decision.

Understanding Business Use vs. Personal Use

Visual guide about How to Buy a Car Through Your Business

Image source: carsplan.com

Before you even look at car models, you need to understand the difference between business and personal use. The IRS cares deeply about how much of your vehicle’s use is for work. Why? Because only the business portion of your expenses can be deducted.

Let’s say you drive 15,000 miles a year. If 10,000 of those miles are for client meetings, site visits, or deliveries, then roughly 67% of your vehicle use is business-related. That means you can deduct 67% of your car expenses—like gas, insurance, repairs, and depreciation.

But what if you use the car for both work and personal trips? That’s common. The key is consistency and documentation. You can’t just claim 80% business use because it “feels right.” You need proof.

How to Track Mileage Accurately

The best way to prove business use is by keeping a mileage log. This should include:

- Date of trip

- Starting and ending odometer readings

- Purpose of the trip (e.g., “Meeting with client at XYZ Corp”)

- Destination

- Total miles driven

You can use a simple notebook, a spreadsheet, or a dedicated app like MileIQ, Everlance, or QuickBooks Self-Employed. These apps automatically track your drives and categorize them as business or personal. At tax time, you’ll have a clean, IRS-friendly report.

Pro tip: Start logging from day one. Don’t wait until tax season to estimate. The IRS may disallow deductions if your records are incomplete or inconsistent.

What Counts as Business Use?

Not all driving counts as business use. Here’s what typically qualifies:

- Travel between job sites

- Client meetings

- Bank visits for business deposits

- Pickup and delivery of goods or materials

- Attending conferences or training events

What doesn’t count? Your daily commute from home to your office. That’s considered personal, even if you’re self-employed. However, if you work from home and drive to a client, that trip is 100% business use.

Tax Benefits of Buying a Car Through Your Business

Visual guide about How to Buy a Car Through Your Business

Image source: res.cloudinary.com

Now for the good part: the tax savings. When you buy a car through your business, you can deduct a portion of the costs—sometimes a large portion. But the exact benefits depend on how you use the vehicle and how you structure the purchase.

There are two main ways to deduct vehicle expenses: the standard mileage rate and the actual expense method. Let’s break them down.

Standard Mileage Rate Method

The IRS sets a standard mileage rate each year. For 2024, it’s 67 cents per mile for business use. If you drove 10,000 business miles, you can deduct $6,700.

This method is simple. You don’t need to track every gas receipt or repair bill. Just keep a mileage log. However, you can only use this method if:

- You use the car for business and don’t lease it under a closed-end lease

- You didn’t claim Section 179 or bonus depreciation in prior years

- You’re not using five or more cars at the same time for business

Once you switch to the actual expense method, you generally can’t go back to the standard rate.

Actual Expense Method

This method lets you deduct the actual costs of operating the vehicle, including:

- Gas and oil

- Repairs and maintenance

- Tires

- Insurance

- Registration fees

- Depreciation

You multiply each expense by your business use percentage. For example, if your car is 70% business use and you spend $3,000 on gas, you can deduct $2,100.

The actual expense method is better if your car is expensive or you drive a lot. It also allows you to take advantage of depreciation deductions, which can be substantial.

Depreciation and Section 179 Deduction

Depreciation lets you recover the cost of the car over time. For 2024, the first-year depreciation limit for a new car is $12,400 if you use the actual expense method. But if your vehicle qualifies, you might be able to deduct much more using Section 179.

Section 179 allows businesses to deduct the full purchase price of qualifying equipment—including vehicles—in the year of purchase, up to a limit. For 2024, the maximum deduction is $1,220,000, with a phase-out threshold of $3,050,000.

However, there’s a catch: to qualify for the full Section 179 deduction, the vehicle must be used more than 50% for business. And for passenger vehicles, there are additional limits. For example, SUVs over 6,000 pounds gross vehicle weight (GVW) can qualify for up to $28,900 in first-year deductions.

Let’s say you buy a $60,000 Ford F-250 for your construction business. If it’s used 100% for work, you could deduct $28,900 under Section 179, plus bonus depreciation. That’s a huge tax break.

But if you buy a $50,000 sedan used 60% for business, your Section 179 deduction is limited to $30,000 (60% of $50,000), and then further capped by IRS passenger vehicle limits.

How to Buy the Car: Ownership Options

Visual guide about How to Buy a Car Through Your Business

Image source: res.cloudinary.com

Now that you understand the tax benefits, let’s talk about how to actually buy the car. You have a few options, each with pros and cons.

Buy the Car in Your Business Name

This is the most straightforward approach. Your business purchases the vehicle, and the title is in the company’s name. You can finance it through a business auto loan or pay cash.

Pros:

- Full control over the asset

- Easier to claim deductions

- Can use Section 179 and depreciation

- Protects personal assets (if your business is an LLC or corporation)

Cons:

- Higher down payment or stricter credit requirements

- May affect business credit utilization

- Resale can be more complex

To buy in your business name, you’ll need:

- Business license and EIN

- Proof of insurance in the business name

- Bank statements or financial statements (for financing)

Lease the Car Through Your Business

Leasing can be a smart move if you want lower monthly payments or plan to upgrade frequently. You can deduct the lease payments as a business expense, but only the business-use portion.

For example, if you lease a car for $500/month and use it 80% for business, you can deduct $400/month.

Pros:

- Lower monthly payments

- Drive a newer car with warranty coverage

- Potential tax deductions on lease payments

Cons:

- Mileage limits (usually 10,000–15,000 miles/year)

- Fees for excess wear and tear

- No ownership at the end

- Section 179 doesn’t apply to leased vehicles

If you lease, make sure the lease agreement is in your business name and that you track mileage carefully to avoid overage fees.

Buy in Your Name and Reimburse Through the Business

Some business owners buy the car personally and then get reimbursed by the company. This can work, but it’s riskier from a tax perspective.

You can still deduct vehicle expenses, but you must prove the reimbursement is for legitimate business use. The business should have a written reimbursement policy, and you should keep detailed records.

This method can blur the lines between personal and business finances, which could raise red flags with the IRS. It’s generally better to keep the car in the business name if possible.

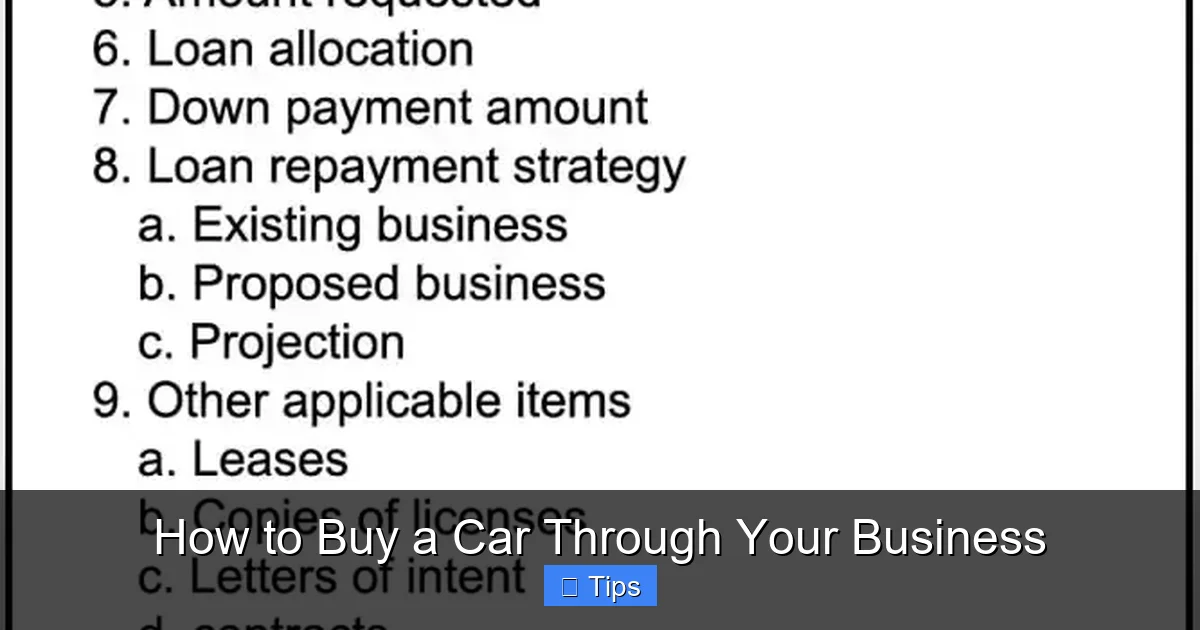

Financing a Business Vehicle

Financing a car through your business can be easier and more advantageous than a personal loan—especially if your business has strong credit.

Business Auto Loans

These loans are specifically for purchasing vehicles for business use. Lenders may offer lower interest rates and longer terms than personal loans.

To qualify, you’ll typically need:

- Business bank statements (3–6 months)

- Profit and loss statements

- Business license and EIN

- Proof of insurance

Interest on business auto loans is tax-deductible, which adds to your savings.

Equipment Financing

Some lenders treat vehicles as equipment, offering equipment financing with fixed rates and terms. This can be a good option for trucks, vans, or specialty vehicles.

SBA Loans

The Small Business Administration (SBA) offers 7(a) loans that can be used for vehicle purchases. These loans have longer repayment terms (up to 10 years) and lower down payments, but the application process is more involved.

Cash Purchase

If your business has the cash, buying outright avoids interest and simplifies ownership. You still get to claim depreciation and other deductions, and you own the asset free and clear.

Just make sure the purchase doesn’t strain your cash flow. Always keep enough working capital for operations.

Record-Keeping and Compliance

This is where many business owners slip up. The IRS doesn’t just want to see deductions—it wants proof.

What Records to Keep

For at least three to six years, keep:

- Mileage logs (digital or paper)

- Receipts for gas, repairs, insurance, and registration

- Loan or lease agreements

- Depreciation schedules

- Bank statements showing payments

Use accounting software like QuickBooks, Xero, or FreshBooks to track expenses automatically. These tools can categorize transactions and generate reports for tax time.

Avoiding IRS Red Flags

The IRS may audit you if:

- You claim 100% business use on a luxury car

- Your mileage seems unrealistic (e.g., 50,000 miles/year)

- You switch methods frequently without justification

- Your deductions are inconsistent with income

To stay safe:

- Be realistic about business use

- Don’t exaggerate deductions

- Use consistent methods year to year

- Get a tax pro to review your filings

Special Considerations by Business Type

The rules for buying a car through your business can vary depending on your business structure.

Sole Proprietorships and Single-Member LLCs

If you’re a sole proprietor, your business income and expenses are reported on Schedule C of your personal tax return. You can still deduct vehicle expenses, but the car should ideally be in your name or the business name (if you have an EIN).

Keep in mind: if the car is in your name, you’re personally liable for any accidents or debts.

Corporations and Multi-Member LLCs

For corporations and multi-member LLCs, it’s best to buy the car in the business name. This protects personal assets and makes deductions cleaner.

The business can pay for the car, insurance, and maintenance, and report it all on corporate tax returns. Just make sure to follow corporate formalities—like board resolutions for major purchases.

S Corporations

S corps have special rules. If a shareholder uses a company car for personal trips, it may be considered taxable income. To avoid this, limit personal use or reimburse the company for personal miles.

When It Makes Sense—and When It Doesn’t

Buying a car through your business isn’t always the best move. Here’s when it makes sense:

- You drive a lot for work (10,000+ miles/year)

- Your business is profitable and can use deductions

- You need a reliable vehicle for operations

- You want to build business credit

But it might not be worth it if:

- You only drive occasionally for business

- Your business is new or unprofitable

- You prefer simplicity and low maintenance

- You’re concerned about liability

In those cases, consider using a personal car and getting reimbursed, or using ride-sharing and rental cars for work trips.

Conclusion

Buying a car through your business can be a smart financial move—if you do it right. From tax deductions to financing options, there are real benefits to structuring the purchase correctly. But it’s not just about saving money. It’s about staying compliant, keeping good records, and making choices that support your business goals.

Start by understanding your vehicle usage. Track every mile. Choose the right ownership model. Explore financing options. And most importantly, talk to a tax professional who understands small business vehicles.

With the right strategy, your business car can be more than just transportation—it can be a tool for growth, efficiency, and tax savings. So go ahead, hit the road with confidence.

Frequently Asked Questions

Can I deduct car payments if I buy a car through my business?

You can’t deduct the entire car payment, but you can deduct the interest portion as a business expense. The principal repayment isn’t deductible, but you may be able to claim depreciation on the vehicle’s value.

What happens if I use my business car for personal trips?

Personal use reduces your deductible percentage. You must track and report personal miles, and excessive personal use could trigger IRS scrutiny or tax implications, especially in S corporations.

Can I use Section 179 on a used car?

Yes, as long as the used car is new to you (not previously owned by you or your business) and used more than 50% for business. The same weight and usage rules apply as with new vehicles.

Do I need a separate insurance policy for a business-owned car?

Yes. The car should be insured in the business name with a commercial auto policy. This protects the business and ensures coverage aligns with business use, especially for liability and fleet risks.

Can I write off a luxury car through my business?

You can deduct expenses based on business use, but luxury vehicles face strict IRS depreciation caps. High-end sedans and sports cars have lower annual deduction limits, even with Section 179.

What if my business is an LLC taxed as a sole proprietorship?

You can still deduct vehicle expenses on Schedule C. However, it’s safer to title the car in the LLC name (with an EIN) to maintain liability protection and clarify business use for tax purposes.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.