Buying a car with little credit history is possible—even if you’re just starting out or rebuilding your financial life. With the right approach, including securing a co-signer, choosing the right lender, and improving your credit profile, you can drive off in a reliable vehicle without a perfect score.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Introduction: You Don’t Need Perfect Credit to Drive

- 4 Understanding Your Credit Situation

- 5 How to Get Pre-Approved for a Car Loan

- 6 Using a Co-Signer to Improve Your Chances

- 7 Exploring Alternative Financing Options

- 8 Choosing the Right Car for Your Budget

- 9 Building Credit After Your Purchase

- 10 Conclusion: Drive Forward with Confidence

- 11 Frequently Asked Questions

- 11.1 Can I buy a car with no credit history?

- 11.2 What credit score do I need to buy a car?

- 11.3 Is it better to lease or buy a car with little credit?

- 11.4 How much should I put down on a car with little credit?

- 11.5 Will buying a car help build my credit?

- 11.6 What should I avoid when buying a car with little credit?

Key Takeaways

- Start by checking your credit report: Know where you stand before applying for a loan. Errors on your report could be hurting your score unfairly.

- Consider a co-signer: A trusted family member or friend with good credit can boost your approval odds and help you secure better loan terms.

- Explore alternative lenders: Credit unions, online lenders, and buy-here-pay-here dealerships often work with borrowers who have limited credit.

- Save for a larger down payment: Putting more money down reduces the loan amount and shows lenders you’re serious about repaying.

- Choose a reliable, affordable car: Opt for a used vehicle with good fuel economy and low maintenance costs to keep monthly payments manageable.

- Make on-time payments: Once you get the loan, consistent payments will help build your credit for future purchases.

- Avoid high-interest traps: Be cautious of predatory lenders offering “no credit check” loans with extremely high rates and fees.

📑 Table of Contents

- Introduction: You Don’t Need Perfect Credit to Drive

- Understanding Your Credit Situation

- How to Get Pre-Approved for a Car Loan

- Using a Co-Signer to Improve Your Chances

- Exploring Alternative Financing Options

- Choosing the Right Car for Your Budget

- Building Credit After Your Purchase

- Conclusion: Drive Forward with Confidence

Introduction: You Don’t Need Perfect Credit to Drive

Let’s face it—getting your first car is a big deal. Whether you’re a recent graduate, a young professional, or someone just starting to build their financial life, the dream of owning a car is both exciting and practical. But when you walk into a dealership or apply for a loan online, one thing can stop you in your tracks: little or no credit history.

Many people assume that without a long credit history, they’re automatically disqualified from getting a car loan. That’s not true. While it’s true that lenders love to see a solid credit track record, there are plenty of ways to buy a car with little credit history. The key is knowing your options, being prepared, and making smart financial moves. In this guide, we’ll walk you through every step—from understanding your credit situation to driving off the lot with confidence.

Understanding Your Credit Situation

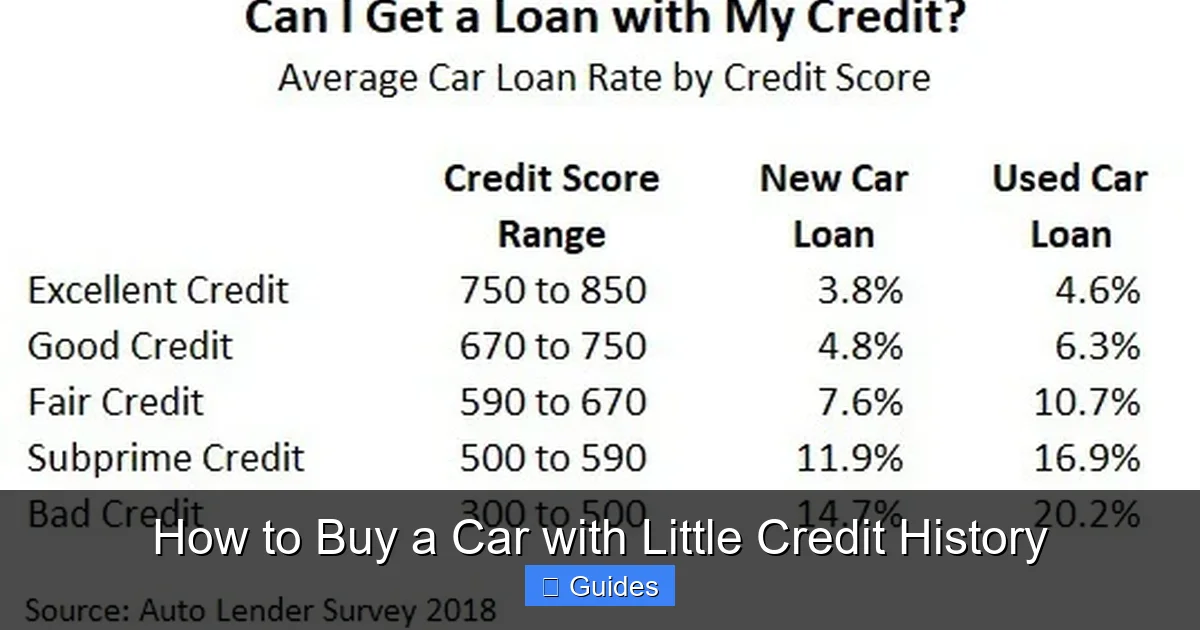

Before you even think about shopping for a car, it’s important to know where you stand financially. Your credit history plays a major role in whether you’ll get approved for a loan and what interest rate you’ll pay. But what if you don’t have much of a history at all?

Visual guide about How to Buy a Car with Little Credit History

Image source: wisebusinessplans.com

What Is Credit History?

Credit history is a record of how you’ve borrowed and repaid money in the past. It includes things like credit cards, student loans, personal loans, and even utility payments (in some cases). Lenders use this information to predict how likely you are to repay a new loan. The longer and more positive your history, the better your chances of approval.

If you’re young, new to the country, or have never used credit, you might have what’s called a “thin file”—meaning there’s not enough data for a traditional credit score. This doesn’t mean you’re a bad borrower. It just means lenders have less information to go on.

Check Your Credit Report for Free

The first step is to get a copy of your credit report. You’re entitled to one free report every year from each of the three major credit bureaus—Equifax, Experian, and TransUnion—at AnnualCreditReport.com. Review it carefully for errors, such as accounts you didn’t open or payments marked late when they weren’t.

Even if your score is low or nonexistent, don’t panic. Many lenders specialize in working with people in your situation. The goal is to show responsibility and reliability, even if your credit file is thin.

Building Credit from Scratch

If you have little to no credit, now is the perfect time to start building it. One of the easiest ways is to get a secured credit card. These cards require a cash deposit (usually $200–$500) that becomes your credit limit. Use it for small purchases—like gas or groceries—and pay the balance in full each month. Over time, this creates a positive payment history.

Another option is becoming an authorized user on someone else’s credit card (like a parent’s). As long as they use the card responsibly, their good habits can help boost your credit profile. Just make sure the card issuer reports authorized user activity to the credit bureaus.

How to Get Pre-Approved for a Car Loan

Getting pre-approved for a car loan is one of the smartest moves you can make—especially with little credit history. It gives you a clear idea of how much you can afford and shows dealers you’re serious. Plus, it can save you from falling for high-pressure sales tactics.

Visual guide about How to Buy a Car with Little Credit History

Image source: financequickfix.com

Shop Around for Lenders

Don’t just go to the dealership and accept the first financing offer. Instead, apply with multiple lenders to compare rates and terms. Start with:

- Credit unions: These nonprofit institutions often offer lower interest rates and are more willing to work with borrowers who have limited credit. Many have “first-time buyer” programs.

- Online lenders: Companies like LightStream, Upstart, and Marcus by Goldman Sachs consider factors beyond just your credit score, such as education and job history.

- Traditional banks: Some banks offer auto loans to customers with little credit, especially if you already have a checking or savings account with them.

Each lender will run a credit check, but if you apply within a short window (usually 14–45 days), it counts as a single inquiry on your report—minimizing the impact on your score.

What to Expect During Pre-Approval

When you apply for pre-approval, the lender will ask for basic information like your income, employment history, and monthly expenses. They’ll also check your credit. Even with little history, you may still qualify—especially if you have stable income and low debt.

Be honest about your financial situation. Lenders appreciate transparency, and it helps them find the right loan for you. If you’re denied, ask why. Sometimes it’s just a matter of needing a co-signer or a larger down payment.

Understanding Loan Terms

Once you get pre-approved, review the loan terms carefully. Key things to look for include:

- Interest rate: This is the cost of borrowing money. Even a small difference can save you hundreds over the life of the loan.

- Loan term: Shorter terms (like 36 or 48 months) mean higher monthly payments but less interest overall. Longer terms (60–72 months) lower your monthly payment but cost more in the long run.

- Down payment: The more you put down, the less you have to borrow. Aim for at least 10–20% of the car’s value.

- Monthly payment: Make sure it fits comfortably within your budget—ideally no more than 10–15% of your take-home pay.

Use an online auto loan calculator to estimate your payments and total interest. This helps you compare offers and avoid overextending yourself.

Using a Co-Signer to Improve Your Chances

If you’re struggling to get approved on your own, a co-signer can be a game-changer. A co-signer is someone who agrees to take responsibility for the loan if you can’t make payments. This reduces the lender’s risk and increases your chances of approval—often with better terms.

Visual guide about How to Buy a Car with Little Credit History

Image source: carolinasleague.org

Who Can Be a Co-Signer?

The best co-signers are people with strong credit, stable income, and a good relationship with you—like a parent, sibling, or close family friend. They should understand that co-signing is a serious commitment. If you miss a payment, it affects their credit too.

Before asking someone to co-sign, have an honest conversation. Explain your plan to make payments on time and how you’ll handle unexpected expenses. Show them you’re responsible and serious about repaying the loan.

Benefits of Having a Co-Signer

A co-signer can help you:

- Get approved for a loan you might not qualify for alone

- Secure a lower interest rate

- Qualify for a larger loan amount

- Build credit faster with on-time payments

Over time, as your credit improves, you may be able to refinance the loan in your name only—freeing your co-signer from responsibility.

Risks to Consider

While a co-signer can help, there are risks. If you miss payments, your co-signer’s credit score could drop, and they may have to pay the bill. This can strain relationships. To avoid problems:

- Set up automatic payments so you never miss a due date

- Keep your co-signer informed about your financial situation

- Work toward refinancing as soon as your credit improves

Remember: co-signing is a sign of trust. Treat it with respect.

Exploring Alternative Financing Options

If traditional lenders turn you down, don’t give up. There are alternative ways to finance a car—even with little credit history. These options may come with higher costs, so it’s important to weigh the pros and cons carefully.

Buy-Here-Pay-Here Dealerships

These dealerships finance cars directly, often without checking your credit. Instead, they may require proof of income, a down payment, and sometimes a GPS tracker or starter interrupt device (which can disable the car if you miss a payment).

While convenient, these loans typically come with high interest rates and short repayment terms. They can be a good short-term solution, but they’re not ideal for building credit or saving money long-term.

In-House Financing

Some dealerships offer in-house financing, where they act as the lender. These programs may be more flexible with credit requirements, but again, interest rates can be high. Always read the fine print and compare the total cost to other loan options.

Personal Loans

You can also use a personal loan to buy a car. These loans are unsecured, meaning you don’t need collateral, but they often have higher interest rates than auto loans—especially for borrowers with little credit. Still, if you can get a low rate, it’s a viable option.

Lease Options

Leasing a car means you’re essentially renting it for a set period (usually 2–3 years). Monthly payments are typically lower than loan payments, and some leases require little or no down payment. However, you don’t own the car at the end, and there are mileage and wear-and-tear restrictions.

Leasing can be a good way to drive a newer car with lower monthly costs, but it doesn’t help you build equity or credit as effectively as buying.

Choosing the Right Car for Your Budget

Once you’re approved for financing, it’s time to pick a car. With little credit history, it’s especially important to choose wisely. A car that’s too expensive or unreliable can lead to financial stress and missed payments.

New vs. Used: What’s Best for You?

New cars come with the latest features, warranties, and lower maintenance costs—but they also depreciate quickly. A used car is usually more affordable and can be a smarter financial choice, especially when you’re just starting out.

Look for reliable models known for longevity and low repair costs, such as:

- Toyota Corolla or Camry

- Honda Civic or Accord

- Hyundai Elantra

- Mazda3

Check vehicle history reports (like Carfax or AutoCheck) to avoid cars with accidents or major repairs.

Set a Realistic Budget

Just because you’re approved for a certain amount doesn’t mean you should spend it all. Stick to a budget that includes not just the monthly payment, but also:

- Insurance (which can be higher for new drivers or certain models)

- Fuel

- Maintenance and repairs

- Registration and taxes

A good rule of thumb: your total car expenses shouldn’t exceed 15–20% of your monthly income.

Negotiate the Price

Don’t accept the sticker price. Research the car’s market value using tools like Kelley Blue Book or Edmunds. Then, negotiate with the dealer. Even a few hundred dollars off can save you thousands over the life of the loan.

If you’re not comfortable negotiating, bring a friend or family member who is. Or consider buying from a private seller, where prices are often lower and negotiation is expected.

Building Credit After Your Purchase

Buying a car with little credit history is just the beginning. The real benefit comes from using this opportunity to build a strong credit profile for the future.

Make On-Time Payments

Your payment history is the most important factor in your credit score. Set up automatic payments or calendar reminders to ensure you never miss a due date. Even one late payment can hurt your score.

Keep Your Credit Utilization Low

If you have a credit card, try to keep your balance below 30% of your limit—ideally under 10%. This shows lenders you’re using credit responsibly.

Monitor Your Credit Regularly

Use free services like Credit Karma, Experian, or your bank’s credit monitoring tool to track your progress. Watch for improvements in your score and address any issues quickly.

Over time, consistent positive behavior will build a solid credit history—opening doors to better loan rates, lower insurance premiums, and even rental or job opportunities.

Conclusion: Drive Forward with Confidence

Buying a car with little credit history isn’t easy—but it’s absolutely possible. With the right strategy, a little preparation, and a focus on responsible borrowing, you can get behind the wheel of a reliable vehicle and start building a stronger financial future.

Start by understanding your credit, getting pre-approved, and exploring all your financing options. Consider a co-signer if needed, choose a car that fits your budget, and make every payment on time. Remember, this isn’t just about getting a car—it’s about proving to yourself and lenders that you’re a responsible borrower.

Every journey begins with a single step. Yours starts today.

Frequently Asked Questions

Can I buy a car with no credit history?

Yes, you can buy a car with no credit history. Many lenders, especially credit unions and online platforms, work with first-time buyers. You may need a co-signer, a larger down payment, or proof of stable income to qualify.

What credit score do I need to buy a car?

There’s no single credit score requirement, but generally, a score of 660 or higher is considered good. With little or no credit, you can still qualify through alternative lenders or with a co-signer, though interest rates may be higher.

Is it better to lease or buy a car with little credit?

Buying is usually better for building credit and long-term value, but leasing can offer lower monthly payments and less risk. If you choose to lease, make sure the terms are fair and the mileage limits work for your lifestyle.

How much should I put down on a car with little credit?

Aim for at least 10–20% down. A larger down payment reduces the loan amount, lowers monthly payments, and shows lenders you’re serious about repaying the debt—improving your approval odds.

Will buying a car help build my credit?

Yes, if you make on-time payments. Auto loans are installment loans, and consistent, timely payments are reported to credit bureaus, helping to build your credit history over time.

What should I avoid when buying a car with little credit?

Avoid high-interest “no credit check” loans, skipping the pre-approval process, and buying a car that stretches your budget. Also, don’t ignore your credit report—errors could be hurting your chances unfairly.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.