Getting a dealer license for car auctions opens doors to exclusive buying opportunities and better pricing. This guide walks you through every step—from state requirements to application tips—so you can become a licensed dealer and start bidding with confidence.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Introduction: Why a Dealer License Matters for Car Auctions

- 4 Understanding the Basics of a Dealer License

- 5 Step-by-Step Guide to Getting Your Dealer License

- 5.1 Step 1: Research Your State’s Requirements

- 5.2 Step 2: Choose and Register Your Business Entity

- 5.3 Step 3: Secure a Business Location

- 5.4 Step 4: Obtain a Surety Bond

- 5.5 Step 5: Complete Required Education or Exams

- 5.6 Step 6: Gather and Submit Your Application

- 5.7 Step 7: Wait for Approval and Receive Your License

- 6 Registering with Car Auction Houses

- 7 Maintaining Your Dealer License and Staying Compliant

- 8 Cost Breakdown: What to Expect When Getting Licensed

- 9 Final Tips for Success

- 10 Conclusion

- 11 Frequently Asked Questions

- 11.1 Do I need a dealer license to buy cars at auction?

- 11.2 Can I operate a dealer business from home?

- 11.3 How much does a dealer license cost?

- 11.4 What happens if my dealer license expires?

- 11.5 Can I get a dealer license with bad credit?

- 11.6 Do I need separate licenses for different auction houses?

Key Takeaways

- Understand state-specific requirements: Each state has different rules for dealer licensing, including fees, exams, and documentation.

- Choose the right license type: Most auction participants need a wholesale dealer license, not a retail one.

- Secure a business location: A physical business address is usually required, even if you operate online.

- Obtain a surety bond: Most states require a $25,000 to $50,000 bond to protect customers and the state.

- Complete pre-licensing education: Some states mandate coursework or exams before approval.

- Register with auction houses: Once licensed, you’ll need to apply directly with auctions like Manheim or ADESA.

- Maintain compliance: Renew your license annually and follow all state and auction rules to avoid penalties.

📑 Table of Contents

- Introduction: Why a Dealer License Matters for Car Auctions

- Understanding the Basics of a Dealer License

- Step-by-Step Guide to Getting Your Dealer License

- Registering with Car Auction Houses

- Maintaining Your Dealer License and Staying Compliant

- Cost Breakdown: What to Expect When Getting Licensed

- Final Tips for Success

- Conclusion

Introduction: Why a Dealer License Matters for Car Auctions

If you’ve ever watched a car auction—whether online or in person—you’ve probably noticed that not just anyone can bid. Most auctions are restricted to licensed dealers, which means if you want to buy vehicles at wholesale prices, fix them up, and resell for profit, you’ll need a dealer license. It’s not just about access; it’s about credibility, pricing power, and long-term business growth.

Think of a dealer license as your golden ticket into the world of professional car buying. Without it, you’re stuck paying retail prices at dealerships or private sales. But with a license, you can bid on repossessed cars, fleet vehicles, and off-lease models at a fraction of their market value. Whether you’re starting a small flipping business or expanding an existing auto operation, getting licensed is the first real step toward scaling up.

Understanding the Basics of a Dealer License

Visual guide about How to Get a Dealer License for Car Auctions

Image source: getultimateauction.com

Before diving into the application process, it’s important to understand what a dealer license actually is—and what it isn’t. A dealer license is a legal permit issued by your state’s Department of Motor Vehicles (DMV) or equivalent agency that allows you to buy and sell vehicles for profit. It’s not the same as a business license, though you’ll likely need both.

There are typically two main types of dealer licenses: retail and wholesale. Retail licenses allow you to sell directly to the public, often requiring a physical showroom and signage. Wholesale licenses, on the other hand, are designed for dealers who buy and sell primarily to other dealers or through auctions. For most people interested in car auctions, a wholesale dealer license is the right choice.

It’s also worth noting that dealer licenses are not one-size-fits-all. Each state sets its own rules, fees, and requirements. Some states, like Texas and Florida, have straightforward processes, while others, like California and New York, can be more complex. Always check with your local DMV or licensing authority to get the most accurate, up-to-date information.

Who Needs a Dealer License?

You might be wondering: “Do I really need a license just to buy a few cars at auction?” The short answer is yes—if you plan to resell them. Buying vehicles with the intent to resell, even occasionally, legally qualifies you as a dealer in most states. Operating without a license can result in fines, vehicle impoundment, or even criminal charges.

Common scenarios where a dealer license is required include:

- Flipping cars for profit (buying, reconditioning, and reselling)

- Buying multiple vehicles per year for resale

- Participating in wholesale auctions like Manheim, ADESA, or Copart

- Operating a mobile or online car sales business

Even if you’re not planning to open a full dealership, having a license gives you access to inventory and pricing that’s simply not available to the general public.

Step-by-Step Guide to Getting Your Dealer License

Visual guide about How to Get a Dealer License for Car Auctions

Image source: shipvehicles.com

Now that you understand why a dealer license is essential, let’s walk through the actual process of getting one. While the specifics vary by state, the general steps are consistent across most jurisdictions. Here’s a detailed breakdown to help you navigate the journey smoothly.

Step 1: Research Your State’s Requirements

The first and most important step is to research your state’s specific dealer licensing requirements. Start by visiting your state DMV website or contacting their dealer licensing division. Look for a “Dealer License Guide” or similar resource—many states publish these online.

Key things to look for include:

- Required license type (wholesale vs. retail)

- Application fees (typically $100–$500)

- Surety bond amount (usually $25,000–$50,000)

- Business location requirements

- Education or exam requirements

- Background check policies

For example, in Arizona, you’ll need a $25,000 bond and a physical business location, while in Ohio, the bond is $25,000, but you may qualify for a home-based dealer license under certain conditions.

Step 2: Choose and Register Your Business Entity

Before applying for a dealer license, you’ll need to establish a legal business structure. Most dealers operate as either a sole proprietorship, LLC, or corporation. An LLC is often the best choice because it offers liability protection and tax flexibility.

To register your business:

- Choose a unique business name and check availability with your state.

- File formation documents (like Articles of Organization for an LLC) with the Secretary of State.

- Obtain an Employer Identification Number (EIN) from the IRS—even if you don’t have employees.

- Open a business bank account to keep finances separate.

Having a formal business structure not only helps with licensing but also builds credibility with auction houses and lenders.

Step 3: Secure a Business Location

Most states require a physical business address to issue a dealer license. This doesn’t necessarily mean you need a showroom full of cars—many wholesale dealers operate from small offices or even home-based setups, depending on local zoning laws.

Your location must:

- Be zoned for commercial use (check with your city or county)

- Have a permanent sign with your business name and license number

- Be accessible during business hours (even if just for paperwork)

If you’re operating from home, confirm that your city allows home-based dealer operations. Some areas prohibit it, while others require a separate entrance or parking for customers.

Pro tip: Consider renting a small office or shared workspace to meet requirements without the cost of a full dealership.

Step 4: Obtain a Surety Bond

A surety bond is a form of insurance that protects customers and the state in case you violate dealer laws. It’s not the same as liability insurance—it’s a financial guarantee that you’ll operate ethically and follow regulations.

The bond amount varies by state but typically ranges from $25,000 to $50,000. You don’t pay the full amount upfront. Instead, you pay a premium (usually 1–3% of the bond amount) to a surety company, which then issues the bond.

For example, a $25,000 bond might cost you $250–$750 per year. The surety company will run a credit check, so good credit helps lower your rate.

To get a bond:

- Shop around with reputable surety providers (like JW Surety or NNA Surety).

- Submit an application with your business details and financial info.

- Pay the premium and receive your bond certificate.

Keep in mind: If you commit fraud or fail to follow dealer laws, a claim can be made against your bond, and you’ll be responsible for repaying the surety company.

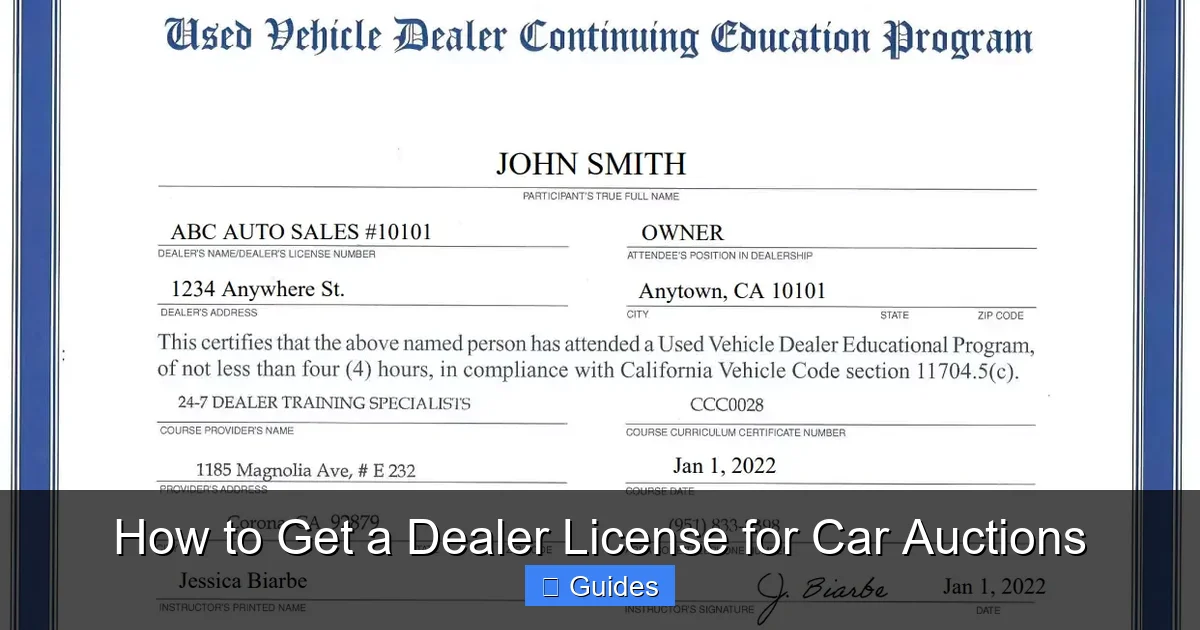

Step 5: Complete Required Education or Exams

Some states require pre-licensing education or a written exam before issuing a dealer license. These courses cover topics like:

- State dealer laws and regulations

- Odometer disclosure rules

- Buyer’s guide requirements

- Record-keeping and titling procedures

For instance, California requires a 6-hour pre-licensing course and a written exam. Florida mandates a 4-hour course for new dealers. Even if your state doesn’t require it, taking a course can help you avoid costly mistakes down the road.

Many courses are available online and can be completed in a few hours. Check your state DMV website for approved providers.

Step 6: Gather and Submit Your Application

Once you’ve completed the above steps, it’s time to assemble your application. Most states allow online submissions, but some still require paper forms.

Typical documents include:

- Completed dealer license application

- Proof of business registration (Articles of Organization, EIN letter)

- Lease agreement or deed for your business location

- Surety bond certificate

- Proof of insurance (general liability and garage liability)

- Fingerprints and background check (if required)

- Education certificate (if applicable)

- Application fee (paid via check, money order, or online)

Double-check everything before submitting. Missing documents or errors can delay your approval by weeks.

Step 7: Wait for Approval and Receive Your License

After submitting your application, the DMV will review your materials, verify your bond, and conduct any necessary background checks. Processing times vary—some states approve licenses in 2–3 weeks, while others take 6–8 weeks.

Once approved, you’ll receive your dealer license number and a physical card. Keep this safe—you’ll need it to register with auction houses and when titling vehicles.

Congratulations! You’re now a licensed dealer.

Registering with Car Auction Houses

Visual guide about How to Get a Dealer License for Car Auctions

Image source: boardgamegoose.com

Having a dealer license is only half the battle. To actually bid at auctions, you’ll need to register with individual auction companies. Each auction house has its own process, fees, and requirements.

Major Auction Houses and Their Requirements

Here’s a quick overview of the top auction networks and what they typically require:

Manheim: One of the largest wholesale auction companies in the U.S. To register, you’ll need:

- Valid dealer license

- Surety bond (must be listed on the bond)

- Business license

- Proof of insurance

- Bank reference or line of credit

- Completed application and registration fee ($100–$300)

Manheim also offers online bidding through their Marketplace platform, which requires additional setup.

ADESA: Another major player, ADESA requires similar documentation. They also conduct a credit check and may require a minimum bank balance or credit line.

Copart: Known for salvage and damaged vehicles, Copart requires:

- Dealer license

- Surety bond

- Proof of insurance

- Completed application

- Registration fee ($75–$150)

Copart allows both in-person and online bidding, making it accessible for remote dealers.

Tips for a Smooth Auction Registration

To avoid delays:

- Apply early—some auctions take 2–4 weeks to process applications.

- Ensure your bond is active and matches the name on your license.

- Have your insurance agent add the auction house as an additional insured.

- Attend a live auction orientation if required.

- Set up a bidding account and familiarize yourself with the platform.

Once approved, you’ll receive login credentials and can start bidding on vehicles.

Maintaining Your Dealer License and Staying Compliant

Getting your license is just the beginning. To keep it active and avoid penalties, you must follow ongoing compliance rules.

Renewal Requirements

Most dealer licenses are valid for 1–2 years and must be renewed before expiration. Renewal typically involves:

- Paying a renewal fee ($50–$200)

- Updating your business information

- Providing proof of current insurance and bond

- Completing continuing education (if required)

Set calendar reminders to avoid late renewals, which can result in fines or license suspension.

Record-Keeping and Reporting

As a licensed dealer, you’re required to maintain detailed records of every vehicle you buy and sell. This includes:

- Purchase and sale agreements

- Title transfers

- Odometer disclosures

- Buyer’s guides (for retail sales)

- Inventory logs

Many states require you to submit monthly or quarterly reports to the DMV. Use accounting software or a simple spreadsheet to stay organized.

Avoiding Common Violations

Common mistakes that can jeopardize your license include:

- Selling without a proper buyer’s guide (for retail sales)

- Failing to disclose odometer readings

- Operating without current insurance or bond

- Using a residential address in a non-zoned area

- Buying or selling outside your license scope (e.g., retail sales with a wholesale license)

Stay informed about changes in dealer laws by joining industry groups like the National Independent Automobile Dealers Association (NIADA).

Cost Breakdown: What to Expect When Getting Licensed

Budgeting is crucial when starting your dealer journey. Here’s a realistic cost breakdown for most states:

- Business registration: $50–$500 (depending on entity type)

- Dealer license application fee: $100–$500

- Surety bond premium: $250–$1,500/year (based on bond amount and credit)

- Business location: $0–$1,000/month (home-based vs. rented office)

- Insurance: $500–$2,000/year (general and garage liability)

- Education course: $50–$200

- Auction registration fees: $100–$300 per auction house

Total startup costs typically range from $1,000 to $3,000, depending on your state and setup. While it’s an investment, the access to wholesale inventory often pays for itself within the first few vehicle flips.

Final Tips for Success

Getting a dealer license is a smart move, but success depends on more than just paperwork. Here are a few final tips to help you thrive:

- Start small: Begin with 1–2 vehicles to learn the process before scaling up.

- Build relationships: Connect with other dealers, mechanics, and auction reps to get insider tips.

- Use online tools: Platforms like VinAudit, AutoCheck, and Manheim MarketView help you research vehicle history and pricing.

- Stay legal: Always follow state and auction rules—don’t cut corners.

- Track your profits: Use accounting software to monitor expenses, taxes, and ROI.

With the right license, mindset, and strategy, you can turn car auctions into a profitable and sustainable business.

Conclusion

Getting a dealer license for car auctions isn’t just about checking boxes—it’s about unlocking a world of opportunity. From accessing wholesale pricing to building a legitimate auto business, the benefits far outweigh the initial effort. While the process varies by state, the core steps remain the same: research, prepare, apply, and comply.

By following this guide, you’ll be well on your way to becoming a licensed dealer with the confidence to bid, buy, and sell like a pro. Remember, every successful dealer started exactly where you are now—ready to take the first step. So gather your documents, secure your bond, and get ready to roll into the fast lane of car auctions.

Frequently Asked Questions

Do I need a dealer license to buy cars at auction?

Yes, if you plan to resell the vehicles. Most auctions only allow licensed dealers to bid. Buying without a license for resale purposes is illegal in most states.

Can I operate a dealer business from home?

It depends on your state and local zoning laws. Some states allow home-based dealer licenses, while others require a commercial location. Always check with your city or county before applying.

How much does a dealer license cost?

Total costs typically range from $1,000 to $3,000, including application fees, bond premiums, insurance, and business registration. Prices vary by state.

What happens if my dealer license expires?

If your license expires, you may face fines, lose auction access, or be prohibited from titling vehicles. Renew on time to avoid disruptions.

Can I get a dealer license with bad credit?

Yes, but it may be harder to secure a surety bond. Some surety companies work with lower credit scores but charge higher premiums. Improving your credit can reduce costs.

Do I need separate licenses for different auction houses?

No, your state dealer license is universal. However, each auction house requires separate registration and may have additional fees or requirements.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.