Leasing a car can be a smart financial move if you want lower monthly payments and drive a new vehicle every few years. This guide walks you through everything you need to know—from how leasing works to tips for getting the best deal—so you can make an informed decision with confidence.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Is a Car Lease and How Does It Work?

- 4 Pros and Cons of Leasing a Car

- 5 How to Lease a Car: A Step-by-Step Guide

- 5.1 Step 1: Determine Your Budget and Needs

- 5.2 Step 2: Research Vehicles and Lease Deals

- 5.3 Step 3: Check Your Credit Score

- 5.4 Step 4: Get Pre-Approved (Optional but Helpful)

- 5.5 Step 5: Visit Dealerships and Negotiate

- 5.6 Step 6: Review the Lease Agreement Carefully

- 5.7 Step 7: Drive and Maintain the Car

- 5.8 Step 8: Return or Buy the Car at Lease End

- 6 Tips for Getting the Best Car Lease Deal

- 7 Common Mistakes to Avoid When Leasing a Car

- 8 Is Leasing the Right Choice for You?

- 9 Frequently Asked Questions

Key Takeaways

- Leasing is like renting a car long-term: You pay for the vehicle’s depreciation during the lease period, not the full value.

- Monthly payments are typically lower than buying: Because you’re only paying for the car’s use, not ownership, your monthly cost is often more affordable.

- Mileage limits and wear-and-tear rules apply: Most leases include restrictions on how many miles you can drive and how the car should be maintained.

- You don’t own the car at the end: Unless you choose to buy it, you return the vehicle when the lease ends.

- Credit score matters: A strong credit history helps you qualify for better lease terms and lower interest rates (called the money factor).

- Negotiate key terms: Just like buying, you can negotiate the capitalized cost, residual value, and money factor to improve your deal.

- Early termination can be costly: Ending a lease early usually results in penalties, so plan your commitment carefully.

📑 Table of Contents

What Is a Car Lease and How Does It Work?

If you’ve ever wondered, “How do I lease a car?” you’re not alone. Car leasing has become an increasingly popular alternative to buying, especially for drivers who want the latest models, lower monthly payments, and minimal long-term commitment. But before you sign on the dotted line, it’s important to understand exactly what leasing means—and how it differs from purchasing.

At its core, leasing a car is similar to renting. Instead of buying the vehicle outright, you’re essentially paying to use it for a set period, usually two to four years. During that time, you make monthly payments that cover the car’s depreciation (the drop in value) while you drive it, plus interest and fees. At the end of the lease, you return the car to the dealership—unless you decide to buy it.

Think of it this way: when you buy a car, you’re paying for the entire vehicle. When you lease, you’re only paying for the portion of the car’s value that you use. For example, if a new car costs $40,000 and is expected to be worth $24,000 after three years, your lease payments would primarily cover that $16,000 loss in value, plus financing charges.

This structure is why lease payments are typically 20% to 40% lower than loan payments for the same vehicle. You’re not building equity, but you are enjoying the benefits of driving a new car with the latest safety features, tech upgrades, and warranty coverage—all without the long-term financial burden of ownership.

Key Components of a Car Lease

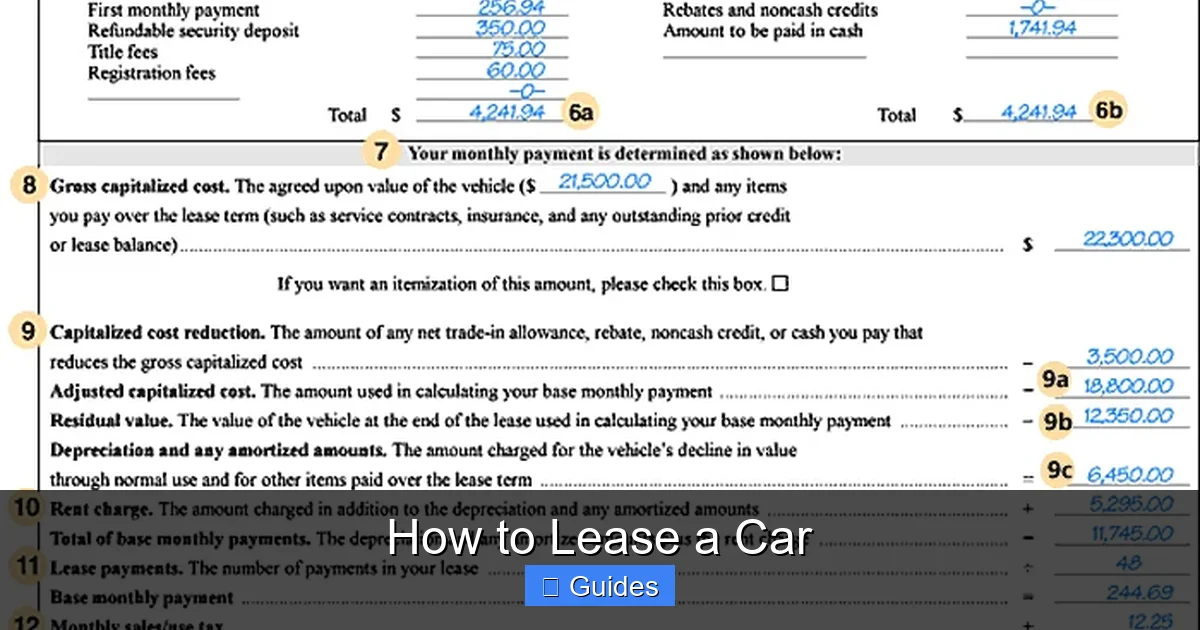

To truly understand how to lease a car, you need to know the three main factors that determine your monthly payment: the capitalized cost, the residual value, and the money factor.

The capitalized cost is the negotiated price of the car—similar to the sticker price when buying. The lower this number, the lower your monthly payments will be. Just like with a purchase, you can (and should) negotiate this price with the dealer.

The residual value is the estimated worth of the car at the end of the lease. It’s expressed as a percentage of the car’s original MSRP (Manufacturer’s Suggested Retail Price). For instance, if a $35,000 car has a 60% residual value after three years, it’s expected to be worth $21,000. The higher the residual value, the lower your monthly payments, because you’re paying for less depreciation.

The money factor is the lease equivalent of an interest rate. It’s a small decimal (like 0.00250) that determines how much you’ll pay in finance charges. To make it easier to compare, multiply the money factor by 2,400—this gives you an approximate annual percentage rate (APR). So 0.00250 × 2,400 = 6% APR.

Your monthly lease payment is calculated using this formula:

(Depreciation + Finance Charges) ÷ Lease Term

Where:

Depreciation = (Capitalized Cost – Residual Value)

Finance Charges = (Capitalized Cost + Residual Value) × Money Factor

Understanding these components empowers you to evaluate lease offers critically and spot a good deal.

Pros and Cons of Leasing a Car

Visual guide about How to Lease a Car

Image source: investopedia.com

Like any financial decision, leasing a car comes with advantages and drawbacks. Whether it’s the right choice for you depends on your driving habits, budget, and lifestyle.

Advantages of Leasing

One of the biggest benefits of leasing is lower monthly payments. Because you’re only paying for the car’s depreciation and not the full value, your out-of-pocket cost each month is significantly less than a loan payment for the same vehicle. This frees up cash for other expenses or savings.

Another major perk is driving a new car every few years. Most leases last 24 to 36 months, so you can upgrade to the latest model with updated technology, safety features, and styling without the hassle of selling or trading in an old car.

Leasing also means lower repair costs. Since leased vehicles are typically under the manufacturer’s warranty for the entire lease term, you’re covered for most major repairs. This reduces the risk of unexpected expenses.

Additionally, there’s no resale hassle. When you buy a car, you eventually have to sell it or trade it in—a process that can be time-consuming and stressful. With a lease, you simply return the car at the end of the term (assuming it’s in good condition).

Disadvantages of Leasing

On the flip side, leasing means you don’t build equity. Every payment you make goes toward using the car, not owning it. At the end of the lease, you have nothing to show for your investment—no asset, no trade-in value.

There are also mileage restrictions. Most leases include an annual mileage limit, usually 10,000 to 15,000 miles. If you exceed this limit, you’ll be charged anywhere from 10 to 25 cents per extra mile. For high-mileage drivers, this can add up quickly.

Wear-and-tear fees are another potential downside. Leased cars must be returned in good condition. Excessive scratches, dents, or interior damage can result in additional charges. While normal wear is expected, “excessive” is often defined by the leasing company—and it can be subjective.

Finally, early termination is expensive. If your needs change and you need to end the lease early, you’ll likely face steep penalties, often equivalent to several months of payments. This lack of flexibility can be a dealbreaker for some.

How to Lease a Car: A Step-by-Step Guide

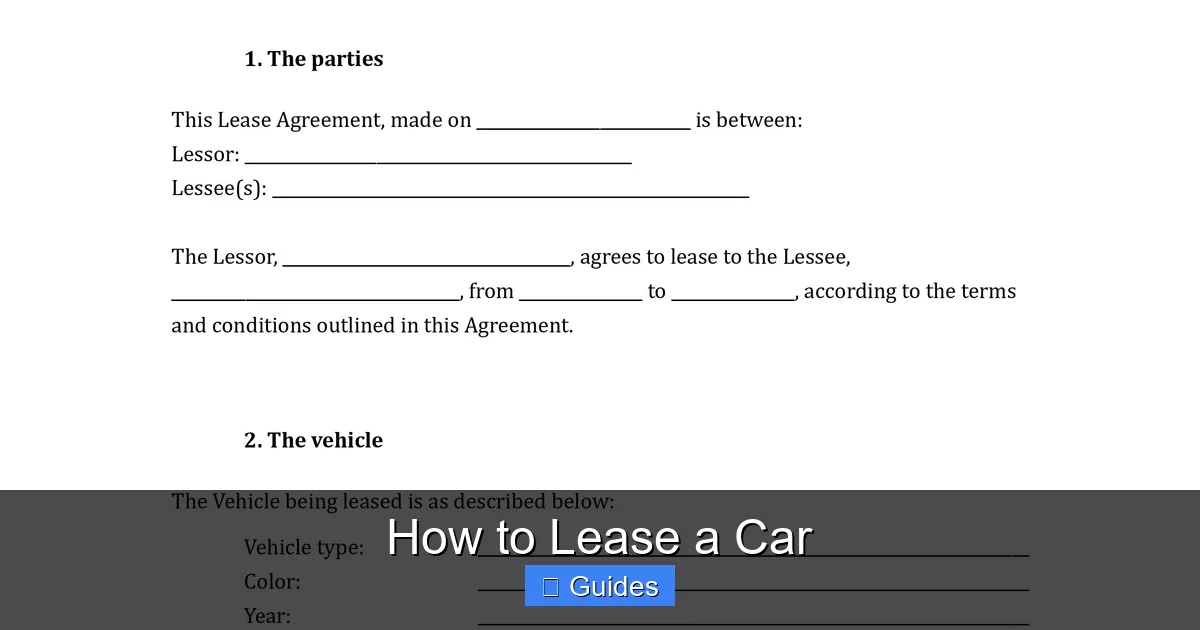

Visual guide about How to Lease a Car

Image source: exceltmp.com

Now that you understand the basics, let’s walk through the process of how to lease a car from start to finish. With the right preparation, you can secure a great deal and avoid common mistakes.

Step 1: Determine Your Budget and Needs

Before you even look at cars, figure out how much you can afford to spend each month. A good rule of thumb is to keep your total car expenses—including insurance, fuel, and maintenance—under 15% to 20% of your take-home pay.

Also, consider your driving habits. How many miles do you drive per year? Do you need a lot of cargo space? Will you be driving on rough roads? These factors will help you choose the right type of vehicle and lease terms.

Step 2: Research Vehicles and Lease Deals

Start by browsing automaker websites, lease comparison tools, and dealership offers. Look for vehicles with high residual values and low money factors—these will give you the best monthly rates.

Pay attention to special lease promotions. Manufacturers often run “lease specials” with reduced capitalized costs or waived fees to move inventory. For example, you might see a deal like “$299/month for 36 months, $2,999 due at signing” on a popular SUV.

Use online calculators to estimate your monthly payment based on different terms. Websites like Edmunds, Kelley Blue Book, and Leasehackr offer free tools that let you plug in numbers and see how changes affect your cost.

Step 3: Check Your Credit Score

Your credit score plays a big role in lease approval and terms. Most leasing companies require a score of at least 650, but the best deals go to those with 720 or higher.

Check your credit report for errors and consider paying down debt before applying. A higher score can save you hundreds of dollars over the life of the lease by qualifying you for a lower money factor.

Step 4: Get Pre-Approved (Optional but Helpful)

While not required, getting pre-approved for a lease through your bank or credit union can give you leverage when negotiating with the dealer. It shows you’re serious and gives you a benchmark to compare against the dealership’s offer.

Step 5: Visit Dealerships and Negotiate

Once you’ve narrowed down your choices, visit dealerships to test drive and discuss lease terms. Don’t focus only on the monthly payment—remember, that’s just one piece of the puzzle.

Instead, negotiate the capitalized cost first. Aim to get it as close to the invoice price as possible. Then, confirm the residual value (this is usually set by the manufacturer and non-negotiable) and ask for the money factor. If it seems high, ask if it can be lowered.

Also, ask about fees. Common ones include the acquisition fee (around $500–$1,000), disposition fee (charged at lease end), and any dealer documentation fees. Some dealers may waive or reduce these if you push back.

Step 6: Review the Lease Agreement Carefully

Before signing, read the entire lease contract. Make sure all the numbers match what you negotiated: capitalized cost, residual value, money factor, mileage allowance, and fees.

Check the wear-and-tear guidelines. Take photos of the car before you drive it off the lot to document its condition. This can protect you from unfair charges later.

Step 7: Drive and Maintain the Car

Once you have the keys, follow the manufacturer’s maintenance schedule. Keep all service records—they may be required at lease end.

Stay within your mileage limit. If you think you’ll exceed it, ask the dealer about buying extra miles upfront. It’s usually cheaper than paying overage fees later.

Step 8: Return or Buy the Car at Lease End

When your lease term is up, you have three options:

1. Return the car and lease a new one.

2. Buy the car at its residual value.

3. Walk away (if allowed by your contract).

If the car is worth more than the residual value on the open market, you might be able to buy it and sell it for a profit—though this is rare.

Tips for Getting the Best Car Lease Deal

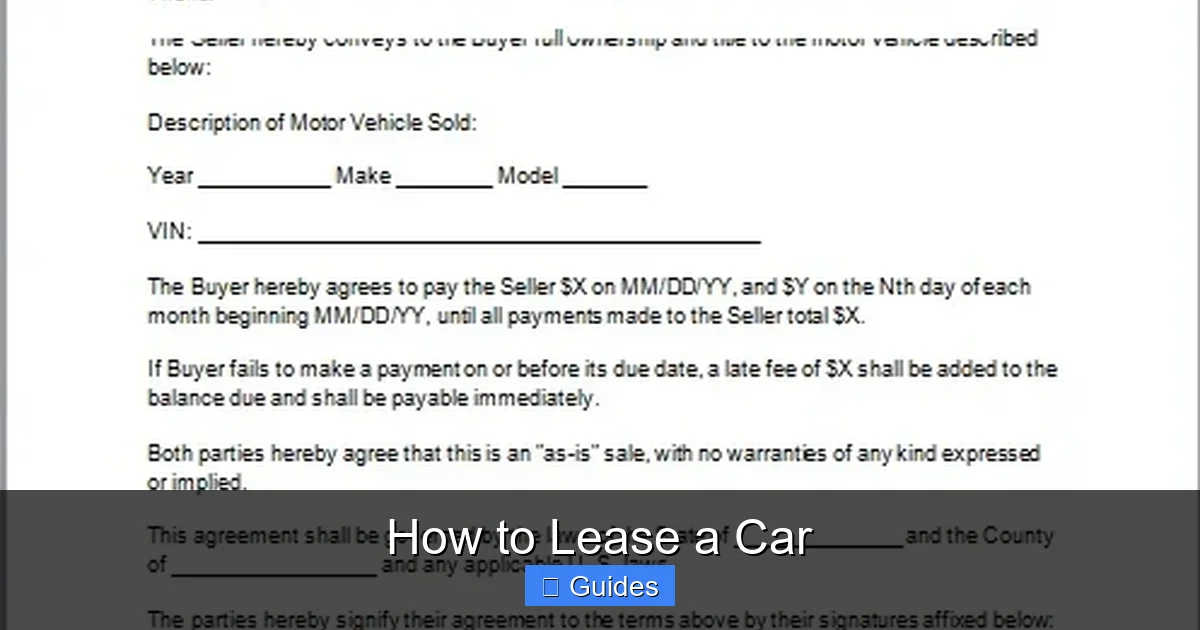

Visual guide about How to Lease a Car

Image source: realcartips.com

Even with a solid understanding of how to lease a car, it’s easy to overpay if you’re not careful. Here are some expert tips to help you land the best possible deal.

Time Your Lease Right

End-of-month, end-of-quarter, and end-of-year are prime times to lease. Dealerships are often trying to meet sales targets, which means they may be more willing to negotiate.

Also, consider leasing when a new model year is about to launch. Dealers want to clear out old inventory, so you may find better incentives on outgoing models.

Negotiate All Variables, Not Just the Payment

Many buyers focus only on lowering the monthly payment, but dealers can manipulate other terms to make the number look good while costing you more overall.

Instead, negotiate the capitalized cost first. A lower price reduces depreciation and finance charges, which directly lowers your payment. Then, confirm the money factor and residual value.

Watch Out for Excessive Fees

Some dealers add unnecessary fees like “advertising fees” or “pre-delivery inspections.” Ask for a breakdown and challenge anything that seems inflated or unclear.

Also, consider rolling fees into the lease. While this increases your monthly payment slightly, it reduces the amount due at signing, which can help with cash flow.

Consider a Lease Buyout or Transfer

If you fall in love with your leased car, you can buy it at the end of the term for the residual value. Alternatively, some leasing companies allow lease transfers, where another person takes over your payments. This can be a good option if you need to get out of the lease early.

Lease a Car with a High Residual Value

Vehicles that hold their value well—like Toyota, Honda, and Subaru models—typically have higher residual values. This means lower depreciation and lower monthly payments.

Avoid cars with steep depreciation curves, such as luxury brands or electric vehicles (which may lose value quickly due to rapid tech advances).

Common Mistakes to Avoid When Leasing a Car

Even experienced drivers can make costly errors when leasing. Here are some pitfalls to watch out for.

Focusing Only on the Monthly Payment

As mentioned earlier, the monthly payment is just one part of the equation. A dealer might offer a low payment by extending the lease term or inflating the capitalized cost. Always look at the full picture.

Not Reading the Fine Print

Lease agreements are full of details—mileage limits, wear-and-tear policies, early termination fees, and more. Skipping the fine print can lead to surprises down the road.

Ignoring Maintenance Requirements

Most leases require you to follow the manufacturer’s maintenance schedule. Skipping oil changes or tire rotations can void your warranty and lead to penalties at lease end.

Overestimating Your Mileage Needs

Choosing a 10,000-mile annual limit when you drive 18,000 miles will cost you dearly. Be honest about your driving habits and select a mileage allowance that fits your lifestyle.

Not Shopping Around

Different dealerships and leasing companies offer different terms. Get quotes from at least three sources to ensure you’re getting a competitive deal.

Is Leasing the Right Choice for You?

Ultimately, the decision to lease a car depends on your personal situation. Leasing makes sense if you:

– Want lower monthly payments

– Prefer driving a new car every few years

– Don’t drive more than 15,000 miles per year

– Can maintain the car properly

– Don’t mind not owning the vehicle

On the other hand, buying may be better if you:

– Drive a lot of miles

– Like to customize your car

– Want to build equity

– Plan to keep the car for many years

There’s no one-size-fits-all answer. But by understanding how to lease a car—and weighing the pros and cons—you can make a smart, informed choice that fits your lifestyle and budget.

Frequently Asked Questions

Can I lease a car with bad credit?

Yes, but it may be more difficult and expensive. Leasing companies typically require a credit score of at least 650. If your score is lower, you might still qualify but with a higher money factor, meaning higher monthly payments. Consider improving your credit or finding a co-signer to get better terms.

What happens if I go over my mileage limit?

If you exceed your annual mileage limit, you’ll be charged an overage fee—usually 10 to 25 cents per mile. For example, going 2,000 miles over a 12,000-mile limit could cost $200 to $500. To avoid this, estimate your driving accurately or buy extra miles upfront at a lower rate.

Can I end my car lease early?

Yes, but it’s usually costly. Early termination fees can include remaining payments, a penalty fee, and disposition charges. Some leasing companies allow lease transfers, where another person takes over your payments, which can reduce or eliminate penalties.

Do I need full coverage insurance when leasing?

Yes, most leasing companies require comprehensive and collision coverage with low deductibles. This protects the vehicle, which is still owned by the leasing company. Check your lease agreement for specific insurance requirements.

Can I negotiate a car lease?

Absolutely. Just like buying, you can negotiate the capitalized cost, money factor, and fees. Focus on the total cost, not just the monthly payment, and don’t be afraid to walk away if the deal isn’t right.

What happens at the end of a car lease?

At the end of the lease, you can return the car, buy it at the residual value, or lease a new vehicle. Before returning it, schedule an inspection and address any excessive wear to avoid extra charges. Make sure all personal items are removed.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.