Leasing a car online is faster, more convenient, and often cheaper than traditional methods. With the right knowledge, you can compare offers, negotiate terms, and sign your lease agreement—all without stepping into a dealership.

Leasing a car used to mean spending hours at a dealership, haggling over prices, and flipping through stacks of paperwork. But thanks to digital innovation, you can now lease a car online—quickly, comfortably, and often with better deals. Whether you’re looking for a sleek sedan, a rugged SUV, or a fuel-efficient hybrid, the internet has made it easier than ever to find, compare, and secure your next vehicle without ever leaving your couch.

The process of leasing a car online combines the convenience of e-commerce with the flexibility of traditional leasing. You can browse inventory, calculate monthly payments, apply for credit, and even schedule delivery—all from your smartphone or laptop. And because online dealers often have lower overhead costs, they can pass those savings on to you in the form of lower monthly payments or better incentives. But like any financial decision, leasing a car online requires careful planning and attention to detail. This guide will walk you through every step, so you can lease with confidence and get behind the wheel of your dream car—no stress, no hassle.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Why Lease a Car Online?

- 4 How to Lease a Car Online: Step-by-Step Guide

- 5 Understanding Lease Terms and Fees

- 6 Top Online Platforms for Leasing a Car

- 7 Tips for Getting the Best Online Lease Deal

- 8 Common Mistakes to Avoid

- 9 Conclusion

- 10 Frequently Asked Questions

- 10.1 Can I lease a car online with bad credit?

- 10.2 Is it cheaper to lease a car online than at a dealership?

- 10.3 Do I need to visit a dealership to lease a car online?

- 10.4 What happens at the end of an online car lease?

- 10.5 Can I negotiate the terms of an online car lease?

- 10.6 Are online car leases secure?

Key Takeaways

- Research is key: Start by comparing makes, models, and lease deals from multiple online platforms to find the best fit for your needs and budget.

- Check your credit score: Your credit history impacts your lease approval and interest rate, so review it before applying.

- Understand lease terms: Know the difference between money factor, residual value, and mileage limits to avoid surprises.

- Negotiate online: Many online dealers allow virtual negotiation—don’t hesitate to ask for better rates or incentives.

- Read the fine print: Always review the lease agreement carefully before signing to understand fees, wear-and-tear policies, and early termination clauses.

- Use trusted platforms: Stick to reputable websites like Carvana, Vroom, or manufacturer-certified online leasing programs for safety and transparency.

- Delivery and setup: Most online leases include home delivery and digital paperwork, making the process seamless and contactless.

📑 Table of Contents

Why Lease a Car Online?

Leasing a car online offers a modern alternative to the traditional dealership experience. Instead of navigating crowded lots and pushy salespeople, you can explore a wide range of vehicles from the comfort of your home. Online leasing platforms often feature detailed photos, 360-degree views, vehicle history reports, and customer reviews—giving you more transparency than ever before.

One of the biggest advantages is convenience. You can compare multiple lease offers side by side, filter by price, mileage, and features, and even calculate your estimated monthly payment in real time. Many platforms also offer instant pre-approval, so you know your budget before you start shopping. Plus, online leasing is often faster. What used to take days or weeks can now be completed in just a few hours.

Another benefit is pricing transparency. Online dealers typically display all costs upfront, including the capitalized cost (the vehicle’s negotiated price), money factor (similar to an interest rate), and any fees. This makes it easier to spot a good deal and avoid hidden charges. And because you’re not limited to local inventory, you can access a much larger selection of vehicles—even from other states.

Cost Savings and Incentives

Leasing online can also save you money. Without the need for a physical showroom, online dealers often have lower operating costs, which translates to better lease terms. Many platforms offer exclusive online promotions, such as reduced down payments, waived acquisition fees, or discounted monthly payments for the first few months.

For example, some manufacturers run special lease deals exclusively through their websites. These might include $0 down offers, low APR financing, or loyalty bonuses for returning customers. Additionally, online leasing eliminates the pressure to add unnecessary extras like extended warranties or paint protection—common upsells at traditional dealerships.

Flexibility and Choice

Another major perk is the sheer variety of vehicles available. Whether you want a brand-new 2024 model or a certified pre-owned car with low mileage, online platforms give you access to thousands of options. You can filter by make, model, year, color, and even specific features like Apple CarPlay, adaptive cruise control, or all-wheel drive.

Some websites even let you customize your lease. For instance, you might choose a higher mileage limit if you drive frequently, or opt for a shorter lease term if you prefer to upgrade every two years. This level of personalization is hard to match in a traditional dealership setting.

How to Lease a Car Online: Step-by-Step Guide

Leasing a car online is simpler than you might think. By following a few key steps, you can complete the entire process in a matter of hours. Here’s how to do it the right way.

Step 1: Determine Your Budget and Needs

Before you start browsing, figure out how much you can afford to spend each month. Most financial experts recommend that your car payment—including insurance, fuel, and maintenance—should not exceed 15% of your take-home pay. For leasing, focus on the monthly payment rather than the total cost of the vehicle, since you’re only paying for the car’s depreciation during the lease term.

Also, consider your driving habits. How many miles do you drive per year? Do you need a lot of cargo space? Will you be driving in snow or off-road? Answering these questions will help you narrow down your options. For example, if you drive 15,000 miles a year, make sure your lease allows for that mileage—otherwise, you could face steep overage fees.

Step 2: Research and Compare Vehicles

Once you know your budget and needs, start researching vehicles. Use trusted online platforms like Edmunds, Kelley Blue Book (KBB), or manufacturer websites to compare models. Look at lease deals, customer reviews, reliability ratings, and fuel efficiency.

Pay attention to the “lease deal” section on these sites. They often highlight special offers, such as low monthly payments or reduced down payments. For example, you might find a 2024 Honda CR-V with a $299/month lease for 36 months with $2,999 due at signing. Compare this to a similar offer on a Toyota RAV4 or Subaru Forester to see which gives you the best value.

Step 3: Check Your Credit Score

Your credit score plays a big role in lease approval and the interest rate you’ll receive. Most online leasing platforms will run a soft credit check during pre-approval, which won’t affect your score. But it’s still a good idea to check your credit report beforehand.

You can get a free credit report from AnnualCreditReport.com. Look for errors or negative items that could be dragging your score down. If your score is below 650, you may still qualify for a lease, but you might face higher interest rates or require a larger down payment. Consider improving your credit before applying, or look for lease programs designed for people with less-than-perfect credit.

Step 4: Get Pre-Approved

Many online leasing platforms offer instant pre-approval. This gives you a clear idea of your budget and strengthens your negotiating position. To get pre-approved, you’ll typically need to provide basic information like your name, address, income, and employment details.

Pre-approval also speeds up the final process. Once you find the car you want, you can move quickly to finalize the lease without waiting for credit checks or financing approval.

Step 5: Choose Your Lease Terms

Now it’s time to decide on the specifics of your lease. Key factors include:

– **Lease term:** Most leases are 24, 36, or 48 months. Shorter terms mean higher monthly payments but lower total cost and the ability to upgrade sooner.

– **Mileage limit:** Standard leases allow 10,000 to 15,000 miles per year. If you drive more, you can pay for a higher limit upfront or risk overage fees (usually $0.15 to $0.25 per mile).

– **Money factor:** This is the lease equivalent of an interest rate. It’s usually a small decimal like 0.00125. To convert it to an APR, multiply by 2,400. So 0.00125 x 2,400 = 3% APR.

– **Residual value:** This is the car’s estimated value at the end of the lease. A higher residual means lower monthly payments.

For example, a car with a $30,000 MSRP and a 60% residual value after 36 months has a residual of $18,000. You’re only paying for the $12,000 in depreciation, plus interest and fees.

Step 6: Negotiate the Deal

Even online, negotiation is possible. Many platforms allow you to message a sales representative or use a chat feature to discuss terms. Don’t be afraid to ask for a lower capitalized cost, a reduced money factor, or waived fees.

You can also use competing offers as leverage. If you find a similar car for a lower price on another site, mention it. Online dealers want your business and may be willing to match or beat the offer.

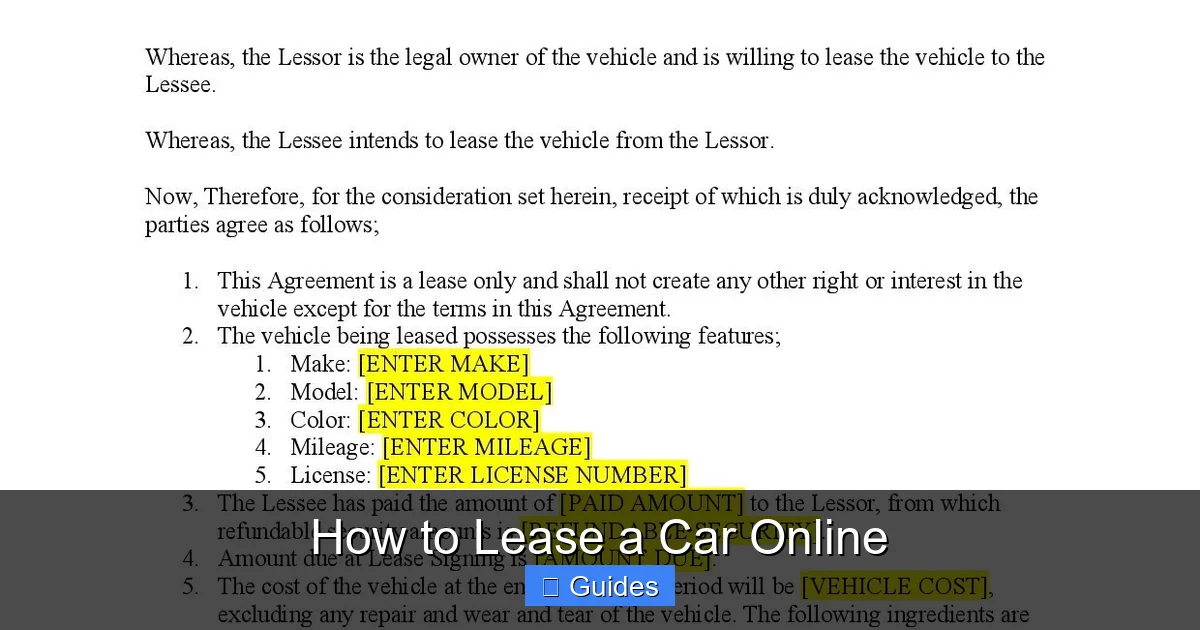

Step 7: Review and Sign the Lease Agreement

Once you’re happy with the terms, it’s time to sign. Most online platforms use digital signatures, so you can complete the process from your phone or computer. But before you click “agree,” read the entire lease agreement carefully.

Look for:

– Total monthly payment

– Down payment and due-at-signing amount

– Mileage limits and overage fees

– Wear-and-tear guidelines

– Early termination penalties

– Disposition fee (charged when you return the car)

If anything is unclear, ask for clarification. Never sign a lease you don’t fully understand.

Step 8: Schedule Delivery or Pickup

After signing, you’ll arrange to receive your car. Many online dealers offer home delivery, often within 24 to 72 hours. A driver will bring the vehicle to your door, complete the final paperwork, and walk you through the features.

Alternatively, you may choose to pick up the car at a nearby service center. Either way, make sure to inspect the vehicle thoroughly before accepting it. Check for scratches, dents, or mechanical issues. Take photos as documentation.

Understanding Lease Terms and Fees

Leasing a car involves more than just monthly payments. To avoid surprises, it’s essential to understand the key terms and fees involved.

Capitalized Cost

This is the negotiated price of the vehicle, similar to the purchase price when buying. The lower the capitalized cost, the lower your monthly payments. You can reduce it by negotiating or using manufacturer incentives.

Money Factor

The money factor is the lease’s interest rate, expressed as a decimal. To compare it to a traditional APR, multiply by 2,400. For example, a money factor of 0.00200 equals a 4.8% APR. A lower money factor means lower financing costs.

Residual Value

This is the car’s estimated value at the end of the lease. It’s expressed as a percentage of the MSRP. A higher residual means the car holds its value well, resulting in lower monthly payments. For example, a car with a 60% residual after 36 months will cost less to lease than one with a 50% residual.

Depreciation

This is the difference between the capitalized cost and the residual value. It’s the amount you’re actually paying for during the lease. For example, if a car costs $30,000 and has a $18,000 residual, you’re paying for $12,000 in depreciation.

Fees to Watch For

– **Acquisition fee:** A one-time charge (usually $500–$1,000) to set up the lease.

– **Disposition fee:** Charged when you return the car (typically $300–$500).

– **Security deposit:** Sometimes required, especially for lower credit scores.

– **Title and registration fees:** Vary by state.

– **Excess wear and tear charges:** If the car is returned with damage beyond normal use.

Top Online Platforms for Leasing a Car

Not all online car leasing platforms are created equal. Here are some of the best options to consider.

Carvana

Known for its “vending machine” delivery and fully online experience, Carvana offers a wide selection of used and certified pre-owned vehicles. You can lease or buy, and the site includes detailed vehicle history reports and 7-day return policy. Leasing is available in select states.

Vroom

Similar to Carvana, Vroom provides a seamless online car-buying and leasing experience. They offer home delivery, transparent pricing, and a 7-day money-back guarantee. Their lease options are competitive, especially for late-model used cars.

Toyota, Honda, and Other Manufacturer Websites

Many automakers now offer online leasing directly through their websites. For example, Toyota’s “Lease a Toyota” portal lets you build your car, compare offers, and apply online. These programs often include special incentives and loyalty bonuses.

Edmunds and KBB

While not dealers themselves, Edmunds and Kelley Blue Book are excellent resources for comparing lease deals. They aggregate offers from dealerships across the country, so you can see what’s available in your area. Some even allow you to apply directly through their sites.

CarLease.com and Swapalease.com

These specialized platforms focus exclusively on leasing. CarLease.com helps you find and compare lease deals, while Swapalease.com lets you take over someone else’s existing lease—great for short-term needs or avoiding long commitments.

Tips for Getting the Best Online Lease Deal

With so many options available, it’s easy to get overwhelmed. Use these tips to make the most of your online leasing experience.

Time Your Lease Right

Leasing at the end of the month, quarter, or year can lead to better deals. Dealers often have quotas to meet and may be more willing to negotiate. Also, new model years typically arrive in late summer, so leasing an outgoing model in August or September can save you money.

Consider a Shorter Lease Term

While 36-month leases are the most common, a 24-month lease might be better if you like to upgrade frequently. You’ll pay more per month, but you’ll avoid long-term commitments and potential wear-and-tear issues.

Watch Out for Excess Mileage

If you drive more than 12,000 miles a year, consider paying for a higher mileage limit upfront. It’s usually cheaper than paying overage fees later. For example, adding 5,000 extra miles per year might cost $1,000 upfront, but overage fees could be $1,875 over three years.

Maintain the Car

Follow the manufacturer’s maintenance schedule and keep records. This helps avoid wear-and-tear charges when you return the car. Avoid modifications like tinting, lift kits, or custom wheels—they can void your lease agreement.

Read Reviews and Check Ratings

Before choosing a platform, read customer reviews on sites like Trustpilot or the Better Business Bureau. Look for complaints about hidden fees, poor communication, or delivery issues.

Common Mistakes to Avoid

Even experienced shoppers can make errors when leasing online. Here are some pitfalls to watch out for.

Not Reading the Fine Print

It’s tempting to skip the details, but the lease agreement contains important information about fees, penalties, and your responsibilities. Always read it thoroughly.

Overestimating Your Budget

Just because you can afford a $500 monthly payment doesn’t mean you should. Remember to factor in insurance, fuel, maintenance, and potential overage fees.

Ignoring Insurance Requirements

Leased vehicles require full coverage insurance, often with higher liability limits than state minimums. Make sure your policy meets the lease terms.

Skipping the Inspection

When your car is delivered, inspect it carefully. Note any damage and take photos. This protects you from being charged for pre-existing issues.

Not Planning for the End of the Lease

At the end of your lease, you’ll need to return the car, buy it, or lease a new one. Start planning a few months in advance to avoid last-minute stress.

Conclusion

Leasing a car online is a smart, modern way to drive a new vehicle without the hassle of traditional dealerships. With the right research, preparation, and attention to detail, you can secure a great deal from the comfort of your home. From comparing offers and checking your credit to negotiating terms and scheduling delivery, every step can be completed digitally—saving you time, money, and stress.

Remember, the key to a successful online lease is understanding the terms, knowing your budget, and using trusted platforms. Don’t rush the process. Take your time to compare options, read the fine print, and ask questions. Whether you’re leasing your first car or upgrading to a newer model, the online experience offers unmatched convenience and flexibility.

So why wait? Start exploring your options today and get ready to drive off in the car you’ve always wanted—no dealership required.

Frequently Asked Questions

Can I lease a car online with bad credit?

Yes, it’s possible to lease a car online with bad credit, but you may face higher interest rates or require a larger down payment. Some online platforms specialize in helping people with lower credit scores by offering subprime lease programs.

Is it cheaper to lease a car online than at a dealership?

Often, yes. Online dealers typically have lower overhead costs and can pass those savings to you in the form of lower monthly payments, reduced fees, or special incentives. Plus, you avoid common dealership upsells.

Do I need to visit a dealership to lease a car online?

No. Most online leasing platforms allow you to complete the entire process remotely, including signing the lease and scheduling home delivery. However, you may need to visit a service center for vehicle pickup or maintenance.

What happens at the end of an online car lease?

At the end of your lease, you can return the car, buy it at the residual value, or lease a new vehicle. The leasing company will inspect the car for excess wear and mileage, and you may be charged fees if applicable.

Can I negotiate the terms of an online car lease?

Yes, many online platforms allow negotiation through chat or email. You can ask for a lower price, reduced fees, or better lease terms—just like you would at a traditional dealership.

Are online car leases secure?

As long as you use reputable platforms with secure websites and verified customer reviews, online car leases are safe. Always check for HTTPS in the URL and avoid sharing sensitive information over unsecured networks.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.