Deciding whether buying or leasing a car is better depends on your financial goals, driving habits, and lifestyle preferences. Buying builds equity and offers long-term savings, while leasing provides lower monthly payments and the chance to drive newer models more often.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Is Buying or Leasing a Car Better? A Complete Guide

- 4 Understanding the Basics: What Does Buying a Car Mean?

- 5 Understanding the Basics: What Does Leasing a Car Mean?

- 6 Cost Comparison: Buying vs. Leasing Over Time

- 7 Lifestyle and Personal Factors to Consider

- 8 Hidden Costs and Fine Print: What to Watch For

- 9 Making the Right Choice for You

- 10 Frequently Asked Questions

- 10.1 Is it better to lease or buy a car for tax purposes?

- 10.2 Can I negotiate a lease deal like I would when buying?

- 10.3 What happens if I go over my lease mileage limit?

- 10.4 Can I buy my leased car at the end of the lease?

- 10.5 Is leasing a good idea for high-mileage drivers?

- 10.6 Do I need gap insurance when leasing?

Key Takeaways

- Buying builds ownership: When you buy a car, you own it outright after the loan is paid off, allowing you to keep it indefinitely or sell it for value.

- Leasing offers lower monthly payments: Lease payments are typically 20–30% lower than loan payments because you’re only paying for the vehicle’s depreciation during the lease term.

- Mileage limits matter in leasing: Most leases come with annual mileage caps (usually 10,000–15,000 miles); exceeding them results in extra fees.

- Maintenance costs differ: Leased cars are usually under warranty, so repairs are often covered, while owned cars require out-of-pocket maintenance as they age.

- Customization is limited with leases: You can’t modify a leased vehicle, whereas owners can personalize their cars freely.

- Long-term cost favors buying: Over 10+ years, buying is usually cheaper than repeatedly leasing new vehicles.

- Lifestyle impacts the decision: Frequent upgraders may prefer leasing; those who drive a lot or keep cars long-term should consider buying.

📑 Table of Contents

- Is Buying or Leasing a Car Better? A Complete Guide

- Understanding the Basics: What Does Buying a Car Mean?

- Understanding the Basics: What Does Leasing a Car Mean?

- Cost Comparison: Buying vs. Leasing Over Time

- Lifestyle and Personal Factors to Consider

- Hidden Costs and Fine Print: What to Watch For

- Making the Right Choice for You

Is Buying or Leasing a Car Better? A Complete Guide

So, you’re in the market for a new car. Congratulations! But now comes the big question: should you buy or lease? It’s one of the most common dilemmas car shoppers face—and for good reason. The decision affects your monthly budget, long-term finances, driving freedom, and even how often you get to enjoy that new-car smell.

At first glance, leasing might seem like the easier, more affordable option. Lower monthly payments, minimal down costs, and the ability to drive a brand-new vehicle every few years sound pretty appealing. On the other hand, buying means higher monthly payments but eventual ownership—no more car payments after the loan ends. You own the asset, can drive as much as you want, and even sell it later for cash.

The truth is, there’s no one-size-fits-all answer. Whether buying or leasing a car is better depends on your personal situation, financial goals, and driving habits. Some people thrive with the predictability of a lease, while others value the freedom and long-term savings that come with ownership. In this guide, we’ll break down the pros and cons of each option, compare costs, explore real-life scenarios, and help you decide which path aligns best with your lifestyle.

Understanding the Basics: What Does Buying a Car Mean?

When you buy a car, you’re purchasing it outright—either with cash or through an auto loan. Once the loan is paid off (typically over 3 to 7 years), the car is 100% yours. You can drive it as long as you want, sell it, trade it in, or even pass it down to a family member.

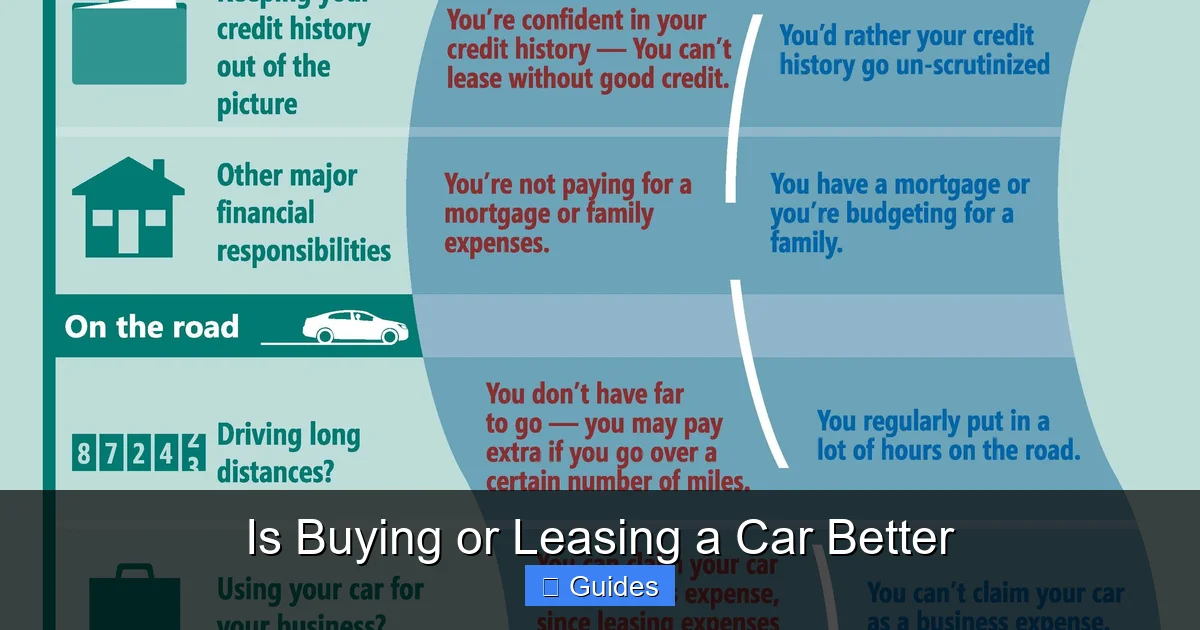

Visual guide about Is Buying or Leasing a Car Better

Image source: fiology.com

How Car Buying Works

Buying a car usually involves a down payment (often 10–20% of the car’s price), followed by monthly loan payments that include principal and interest. The total cost includes the vehicle price, taxes, registration, and financing charges. Once the loan is complete, you own the car free and clear.

For example, let’s say you buy a $30,000 car with a $6,000 down payment and a 5-year loan at 5% interest. Your monthly payment would be around $450. After 60 payments, you’ve paid about $33,000 total—but now you own a car that may still have significant resale value.

Pros of Buying a Car

- Ownership and equity: You build equity in the vehicle the moment you drive it off the lot. Over time, this can translate into real value, especially if you maintain the car well.

- No mileage restrictions: Drive as much as you want—whether it’s cross-country road trips or daily 50-mile commutes, there are no penalties for high mileage.

- Freedom to customize: Want to add a spoiler, upgrade the sound system, or repaint the car? Go for it. Owners can modify their vehicles however they like.

- No wear-and-tear fees: Unlike leases, there are no charges for dings, scratches, or general wear. You’re responsible for maintenance, but not for “excess” damage.

- Long-term savings: After the loan is paid off, you’re only paying for insurance, fuel, and maintenance—no monthly car payment. Over 10 years, this can save you thousands compared to leasing.

Cons of Buying a Car

- Higher monthly payments: Loan payments are typically higher than lease payments because you’re paying for the full value of the car, not just its depreciation.

- Depreciation hits hard: New cars lose about 20% of their value in the first year and up to 60% over three years. This means your car is worth less than you paid, especially early on.

- Maintenance costs rise over time: As the car ages, repairs and part replacements become more frequent and expensive. Once the warranty expires, you’re on the hook for all costs.

- Less frequent upgrades: If you want a new car every few years, buying means you’ll need to sell or trade in your current vehicle, which can be time-consuming and costly.

Understanding the Basics: What Does Leasing a Car Mean?

Leasing a car is essentially renting it for a fixed period—usually 24 to 36 months. You pay for the vehicle’s depreciation during that time, plus interest, taxes, and fees. At the end of the lease, you return the car to the dealership unless you choose to buy it at its residual value.

Visual guide about Is Buying or Leasing a Car Better

Image source: editorialge.com

How Car Leasing Works

When you lease, you agree to a monthly payment based on the car’s expected depreciation over the lease term. For example, if a $35,000 car is expected to be worth $20,000 after three years, you’re paying for that $15,000 loss in value, plus financing charges.

Leases often require a down payment (called a “cap cost reduction”), though some offers advertise “$0 down.” You’ll also agree to an annual mileage limit (typically 10,000–15,000 miles) and must return the car in good condition.

Pros of Leasing a Car

- Lower monthly payments: Since you’re only paying for depreciation, not the full value, lease payments are usually 20–30% lower than loan payments for the same car.

- Drive a new car more often: Most people lease for 2–3 years, meaning they can upgrade to the latest model with updated tech, safety features, and styling every few years.

- Lower sales tax: In many states, you only pay sales tax on the monthly lease payment, not the full price of the car—resulting in significant savings.

- Warranty coverage: Leased cars are typically under the manufacturer’s warranty for the entire lease term, so major repairs are usually covered.

- No hassle selling: At the end of the lease, you simply return the car. No need to deal with private buyers, trade-ins, or depreciation losses.

Cons of Leasing a Car

- No ownership: You don’t own the car. Once the lease ends, you have nothing to show for your payments unless you buy the vehicle.

- Mileage restrictions: Exceeding the agreed mileage limit (e.g., 12,000 miles per year) results in fees—often $0.10 to $0.25 per mile. For high-mileage drivers, this can add up fast.

- Wear-and-tear charges: The dealership will inspect the car at return. Excessive damage (beyond “normal wear”) may result in additional fees.

- Customization limits: You can’t modify a leased car. No aftermarket parts, paint jobs, or performance upgrades allowed.

- Long-term cost is higher: If you lease repeatedly, you’ll always have a car payment. Over 10 years, leasing multiple cars can cost significantly more than buying one and keeping it.

Cost Comparison: Buying vs. Leasing Over Time

To truly understand whether buying or leasing a car is better, let’s look at a real-world cost comparison over a 10-year period.

Visual guide about Is Buying or Leasing a Car Better

Image source: investopedia.com

Scenario: $35,000 Car, 15,000 Miles Per Year

Option 1: Buying

– Down payment: $7,000

– Loan: $28,000 at 5% interest over 6 years

– Monthly payment: ~$440

– Total paid over 6 years: ~$33,840

– Car value after 6 years: ~$14,000 (estimated)

– Years 7–10: Only insurance, fuel, and maintenance (~$1,500/year)

– Total 10-year cost: ~$33,840 + ($1,500 × 4) = ~$39,840

– Net cost after selling car: ~$39,840 – $14,000 = ~$25,840

Option 2: Leasing (3-year terms, 3 leases over 9 years, then buy a used car)

– Lease 1: $350/month × 36 months = $12,600

– Lease 2: $350/month × 36 months = $12,600

– Lease 3: $350/month × 36 months = $12,600

– Total lease payments: $37,800

– Year 10: Buy a $15,000 used car with $3,000 down and $250/month loan

– Total 10-year cost: $37,800 + $3,000 + ($250 × 12) = ~$44,800

– No asset to sell at the end

In this example, buying saves over $18,000 over 10 years. Even accounting for higher maintenance costs in later years, ownership comes out ahead financially.

When Leasing Might Save Money

Leasing can be cheaper in the short term or if you drive very few miles. For example, if you only drive 8,000 miles a year and want a luxury car with low payments, leasing a $50,000 vehicle might cost $450/month—far less than a $700+ loan payment. Plus, you avoid the risk of major repairs.

However, if you drive 20,000+ miles annually, leasing becomes expensive due to mileage overage fees. In that case, buying—even with higher payments—is usually the smarter financial move.

Lifestyle and Personal Factors to Consider

Beyond numbers, your lifestyle plays a huge role in whether buying or leasing a car is better for you.

Driving Habits

If you’re a commuter who racks up 15,000+ miles a year, leasing could cost you hundreds in overage fees. But if you work from home and only drive on weekends, a lease with a 10,000-mile limit might be perfect.

Desire for New Technology

Love having the latest infotainment system, driver-assist features, or electric vehicle tech? Leasing lets you upgrade every 2–3 years without the hassle of selling. Buyers who keep cars 7+ years may miss out on rapid advancements.

Financial Flexibility

Leasing frees up cash flow. If you’re saving for a house, starting a business, or have variable income, lower monthly payments can provide breathing room. But remember: you’re not building equity.

Emotional Attachment

Some people form strong bonds with their cars. If you love customizing, maintaining, and driving the same vehicle for years, buying is the way to go. Leasers often feel detached—knowing the car isn’t really theirs.

Job Stability and Relocation

If you’re in a stable job and plan to stay in one area, buying makes sense. But if you move frequently or work in a field with high turnover, leasing offers flexibility—no need to sell a car when relocating.

Hidden Costs and Fine Print: What to Watch For

Both buying and leasing come with hidden fees and terms that can catch you off guard.

Buying Pitfalls

- Extended warranties: Dealers often push costly add-ons. Ask if they’re necessary—many are redundant with manufacturer coverage.

- Gap insurance: If your car is totaled early in the loan, gap insurance covers the difference between what you owe and the car’s value. Consider it if you put little down.

- Prepayment penalties: Some loans charge fees for paying off early. Check your contract.

Leasing Pitfalls

- Acquisition fees: Upfront charges (often $500–$1,000) to start the lease. Negotiate or ask the dealer to waive them.

- Disposition fees: Charges (~$300–$500) when returning the car at lease end. Some leases include this in the monthly payment.

- Excess wear guidelines: “Normal wear” is subjective. Take photos before returning the car and review the lease agreement carefully.

- Early termination fees: Ending a lease early can cost thousands. Only lease if you’re confident you’ll keep the car the full term.

Making the Right Choice for You

So, is buying or leasing a car better? The answer depends on your priorities.

If you value long-term savings, ownership, and driving freedom, buying is likely the better choice. You’ll pay more upfront, but over time, you’ll save money and own a valuable asset.

If you prefer lower monthly payments, driving new cars often, and avoiding repair worries, leasing might suit you better—especially if you drive modestly and stay within lease terms.

A good rule of thumb:

– Buy if you plan to keep the car 5+ years, drive a lot, or want to customize it.

– Lease if you want lower payments, enjoy new models, and drive under 12,000 miles/year.

And remember: you can always change your strategy. Many people lease their first car to test drive a brand or model, then buy their next one once they’re ready for ownership.

Frequently Asked Questions

Is it better to lease or buy a car for tax purposes?

It depends on how you use the vehicle. Business owners may deduct lease payments as a business expense, which can make leasing more tax-efficient. Buyers can also deduct interest on auto loans for business use, but personal buyers get no tax benefits.

Can I negotiate a lease deal like I would when buying?

Yes! You can negotiate the capitalized cost (price of the car), money factor (interest rate), and even waive fees. Treat leasing like buying—research prices, get quotes from multiple dealers, and don’t accept the first offer.

What happens if I go over my lease mileage limit?

You’ll be charged per mile—typically $0.10 to $0.25. For example, going 2,000 miles over a 36,000-mile lease could cost $200–$500. Some leases offer mileage buy-ups upfront to avoid this.

Can I buy my leased car at the end of the lease?

Yes, most leases allow you to purchase the car at its residual value (pre-set price). This can be a good deal if the car’s market value is higher than the residual, but compare prices before deciding.

Is leasing a good idea for high-mileage drivers?

Generally, no. High-mileage drivers (15,000+ miles/year) will likely exceed lease limits and face steep overage fees. Buying or leasing a used car with higher mileage allowances may be better.

Do I need gap insurance when leasing?

Most leases include gap coverage automatically, but confirm with your contract. If not, consider adding it—especially if you put little or no money down—to protect against owing more than the car is worth if it’s totaled.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.