Deciding whether to lease or buy a car depends on your financial goals, driving habits, and long-term plans. Leasing offers lower monthly payments and access to newer models, while buying builds equity and offers ownership freedom. Understanding the trade-offs helps you make a smarter, more informed decision.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Is It Best to Lease or Buy a Car? A Complete Guide to Making the Right Choice

- 4 Understanding the Basics: What Does Leasing and Buying Really Mean?

- 5 Financial Comparison: Leasing vs. Buying

- 6 Lifestyle and Practical Considerations

- 7 Maintenance, Warranty, and Repair Costs

- 8 End-of-Term Options: What Happens When the Lease or Loan Ends?

- 9 Who Should Lease? Who Should Buy?

- 10 Final Thoughts: Is It Best to Lease or Buy a Car?

- 11 Frequently Asked Questions

Key Takeaways

- Leasing typically means lower monthly payments: You’re only paying for the vehicle’s depreciation during the lease term, not the full value, which can make leasing more affordable month-to-month.

- Buying builds equity over time: Once you pay off your loan, the car is yours, and you can sell it or keep it without monthly payments.

- Leases come with mileage and wear restrictions: Exceeding the agreed-upon mileage or returning a damaged vehicle can result in hefty fees.

- Buying offers more freedom and customization: You can modify your car, drive as much as you want, and keep it as long as it runs.

- Maintenance costs differ between options: Leased cars are usually under warranty, reducing repair costs, while owned vehicles may require more out-of-pocket maintenance as they age.

- Your driving habits and financial situation matter most: Frequent drivers or those who want long-term value may prefer buying, while those who like new tech and lower payments may lean toward leasing.

- Early termination and end-of-term options vary: Ending a lease early can be costly, while selling or trading in a purchased car gives you more flexibility.

📑 Table of Contents

- Is It Best to Lease or Buy a Car? A Complete Guide to Making the Right Choice

- Understanding the Basics: What Does Leasing and Buying Really Mean?

- Financial Comparison: Leasing vs. Buying

- Lifestyle and Practical Considerations

- Maintenance, Warranty, and Repair Costs

- End-of-Term Options: What Happens When the Lease or Loan Ends?

- Who Should Lease? Who Should Buy?

- Final Thoughts: Is It Best to Lease or Buy a Car?

Is It Best to Lease or Buy a Car? A Complete Guide to Making the Right Choice

So, you’re in the market for a new car. You’ve narrowed down your options, test-driven a few models, and now you’re staring at the final decision: should you lease or buy? It’s a question that puzzles millions of drivers every year. And honestly, there’s no one-size-fits-all answer. What works for your neighbor might not work for you. The truth is, whether it’s best to lease or buy a car depends on your personal situation—your budget, how you drive, and what you value most in a vehicle.

Let’s be real: cars aren’t cheap. Whether you’re eyeing a sleek sedan, a rugged SUV, or a fuel-efficient hybrid, the financial commitment is real. And while the excitement of driving off the lot in a shiny new ride is hard to beat, it’s important to think beyond the initial thrill. Leasing and buying each come with their own set of benefits and drawbacks. Leasing might seem attractive because of lower monthly payments and the chance to drive a new car every few years. But buying gives you ownership, freedom, and long-term savings—if you play your cards right.

In this guide, we’ll break down everything you need to know to decide whether it’s best to lease or buy a car. We’ll look at the financial implications, lifestyle factors, and long-term consequences of each option. By the end, you’ll have a clearer picture of which path aligns with your goals. No jargon, no sales pitches—just honest, practical advice to help you make a smart decision.

Understanding the Basics: What Does Leasing and Buying Really Mean?

Before we dive into the pros and cons, let’s make sure we’re on the same page about what leasing and buying actually involve.

What Is Leasing a Car?

Leasing a car is essentially renting it for a fixed period, typically two to four years. You make monthly payments based on the car’s expected depreciation during that time, plus interest and fees. At the end of the lease, you return the vehicle to the dealership—unless you choose to buy it outright. Think of it like a long-term rental with rules: you agree to mileage limits, maintenance requirements, and wear-and-tear standards.

Visual guide about Is It Best to Lease or Buy a Car

Image source: fiverr-res.cloudinary.com

One of the biggest draws of leasing is that you’re not paying for the entire value of the car—just the portion that it loses in value while you’re driving it. That’s why monthly payments are often significantly lower than loan payments for the same vehicle. For example, leasing a $40,000 SUV might cost $400 a month, while buying it with a loan could run $600 or more. That difference can be a game-changer for people on a tight budget.

What Does It Mean to Buy a Car?

Buying a car means you’re purchasing it outright—either with cash or through a financing loan. Once the loan is paid off, the car is 100% yours. You can drive it as much as you want, modify it, sell it, or keep it for 10+ years. There are no mileage restrictions, no penalties for scratches, and no pressure to return it after a few years.

When you buy, you’re investing in an asset—even though cars depreciate quickly. The idea is that over time, the car pays for itself through use, and once the loan is gone, you’re driving “free” (aside from insurance, gas, and maintenance). For many people, the sense of ownership and long-term value makes buying the better choice.

Key Differences at a Glance

- Ownership: With leasing, you never own the car. With buying, you do.

- Monthly Payments: Leases usually have lower payments than loans for the same car.

- Mileage Limits: Leases often cap annual mileage (e.g., 10,000–15,000 miles). Buying has no limits.

- Customization: You can modify a purchased car. Leased cars must be returned in near-original condition.

- End-of-Term Options: At the end of a lease, you return the car or buy it. With a purchase, you can sell, trade, or keep it.

Financial Comparison: Leasing vs. Buying

Money is often the deciding factor when it comes to whether it’s best to lease or buy a car. Let’s break down the financial side of both options so you can see which one makes more sense for your wallet.

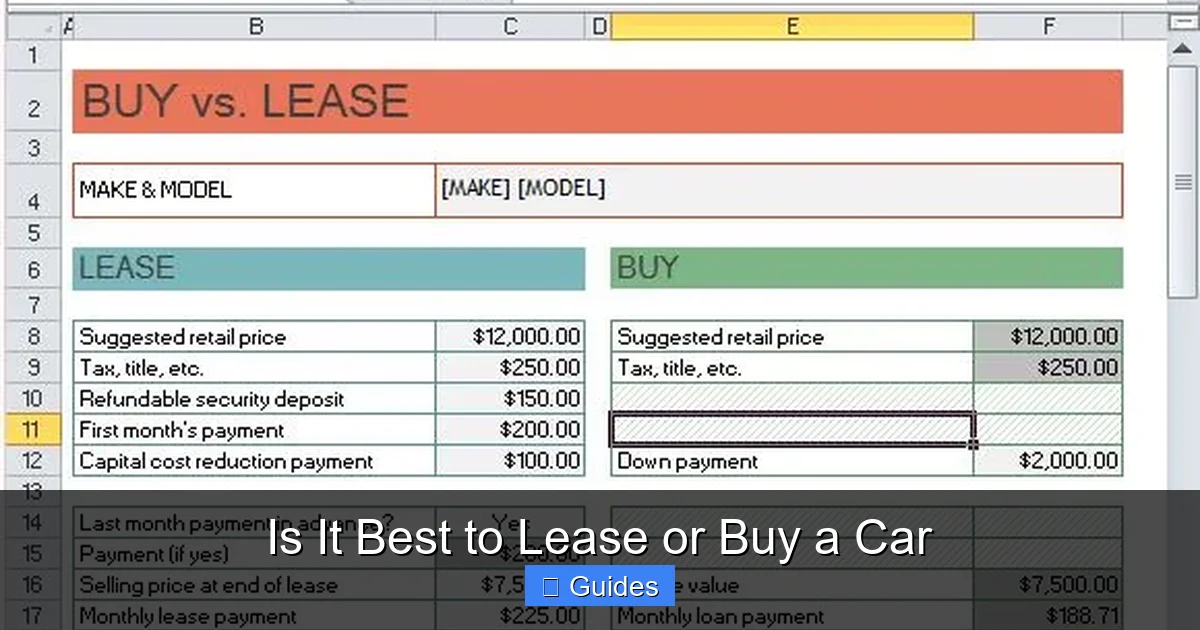

Upfront and Monthly Costs

Leasing usually requires a lower down payment—sometimes as little as $0–$3,000—compared to buying, which often needs 10–20% down. Monthly payments are also typically 20–30% lower for a lease. For example, a $35,000 car might cost $350/month to lease but $550/month to buy with a 5-year loan.

Visual guide about Is It Best to Lease or Buy a Car

Image source: slideteam.net

However, those lower payments come with a catch: you’re not building equity. Every dollar you pay on a lease goes toward depreciation and fees, not ownership. With a loan, each payment chips away at the principal, increasing your stake in the vehicle.

Long-Term Costs and Depreciation

Cars lose value fast—often 20% in the first year and up to 60% over three years. When you lease, you’re only paying for that depreciation during the lease term. That can be a smart way to avoid the steepest drop in value. But when you buy, you absorb the full depreciation hit—though you benefit if the car holds its value well or if you keep it long enough to offset the initial loss.

Let’s say you buy a $30,000 car and keep it for 10 years. Even if it’s worth only $5,000 at the end, you’ve had a reliable vehicle for a decade with no monthly payments after year 5 or 6. That’s hard to beat. In contrast, leasing means you’ll always have a car payment—every 2–4 years, you’ll need to lease or buy another vehicle.

Interest Rates and Fees

Both leasing and buying involve interest, but they’re calculated differently. Lease payments include a “money factor,” which is like an interest rate but not expressed as one. It’s often lower than auto loan rates, which helps keep payments down. However, leases come with additional fees: acquisition fees, disposition fees, and potential penalties for excess wear or mileage.

Buying a car with a loan means you’ll pay interest over the life of the loan. Rates vary based on credit score, loan term, and lender. A 5-year loan at 5% interest on a $25,000 car adds about $3,300 in interest. While that sounds like a lot, remember: you own the car at the end.

Tax Implications

In some cases, leasing can offer tax advantages—especially for business use. If you use your leased car for work, you may be able to deduct a portion of the lease payments. The same applies to purchased vehicles, but the rules are more complex. For personal use, there’s usually no tax benefit either way, unless you live in a state with sales tax on leases (which some do).

Example: Leasing vs. Buying a $35,000 Car

Let’s compare two scenarios over three years:

- Leasing: $3,000 down, $400/month for 36 months = $17,400 total. At the end, you return the car.

- Buying: $7,000 down, $550/month for 36 months = $26,800 total. After 3 years, the car is worth about $18,000, so your net cost is $8,800.

In this example, leasing costs less upfront and monthly, but you have nothing to show for it. Buying costs more initially, but you still have an asset worth $18,000. Over time, buying wins—but only if you keep the car long enough.

Lifestyle and Practical Considerations

Money isn’t the only factor. Your lifestyle, driving habits, and personal preferences play a huge role in whether it’s best to lease or buy a car.

How Much Do You Drive?

If you’re clocking 20,000 miles a year, leasing might not be the best idea. Most leases cap mileage at 10,000–15,000 miles annually. Going over can cost $0.10–$0.25 per mile—adding up fast. For example, driving 18,000 miles on a 12,000-mile lease means 6,000 extra miles at $0.15 each = $900 in fees.

Visual guide about Is It Best to Lease or Buy a Car

Image source: templatesamples.net

Buying has no mileage limits. Whether you’re road-tripping across the country or commuting 50 miles a day, you’re free to drive as much as you want. For high-mileage drivers, buying is almost always the better choice.

Do You Like New Cars?

If you love having the latest tech, safety features, and styling, leasing lets you upgrade every few years. Most leases last 2–4 years, so you can trade in for a new model just as the warranty expires. That means you’re always driving a car under warranty, with minimal repair worries.

Buying means you’re stuck with the same car for years—unless you sell it. While some people enjoy customizing and maintaining their vehicles, others get bored quickly. If you crave novelty, leasing might satisfy that itch.

How Do You Treat Your Car?

Leased cars must be returned in good condition. Scratches, dents, and worn interiors can lead to “excess wear and tear” charges. If you’re hard on your vehicles—or have kids and pets—you might rack up fees at the end of the lease.

When you buy, you don’t have to worry about minor damage. A few scratches? No big deal. Worn seats? That’s just character. You’re free to use your car as intended—without stressing over every ding.

Do You Plan to Keep the Car Long-Term?

If you’re the type who keeps a car for 10+ years, buying is almost always the smarter move. Once the loan is paid off, you’re driving payment-free. Even with maintenance costs, the long-term savings are significant.

Leasing is better for people who prefer shorter commitments. Maybe you move frequently, change jobs, or just don’t want to be tied down. Leasing offers flexibility—but at the cost of perpetual payments.

Customization and Personalization

Love adding spoilers, tinting windows, or upgrading the sound system? You can do all that with a purchased car. But with a lease, modifications are usually prohibited or must be reversed before return. If personalizing your ride matters to you, buying gives you the freedom to make it truly yours.

Maintenance, Warranty, and Repair Costs

One area where leasing and buying differ significantly is in maintenance and repair responsibilities.

Warranty Coverage

Most new cars come with a manufacturer’s warranty—typically 3 years/36,000 miles for basic coverage and 5 years/60,000 miles for powertrain. Since leases usually last 2–4 years, your car will almost always be under warranty during the entire lease term. That means repairs are covered, and you avoid unexpected costs.

When you buy, the warranty still applies during the covered period. But once it expires, you’re on the hook for all repairs. For older cars, this can mean expensive fixes—like transmission replacements or engine work.

Maintenance Requirements

Leases often require you to follow the manufacturer’s maintenance schedule. Skipping oil changes or ignoring recalls can void the lease agreement and lead to penalties. Some leasing companies even require proof of service.

With a purchased car, you’re free to service it as you see fit—though skipping maintenance will shorten the car’s life. Many owners use independent mechanics or do basic work themselves to save money.

Repair Costs Over Time

New cars are reliable, but as they age, repair costs rise. A 5-year-old car might need new brakes, tires, or suspension parts. A 10-year-old car could face major mechanical issues. When you lease, you avoid these costs because you return the car before it gets too old.

Buying means you’ll eventually face higher maintenance bills—but you also benefit from not having monthly payments. For example, after paying off a $300/month loan, you might spend $100/month on repairs. That’s still cheaper than leasing a new car for $400/month.

Extended Warranties and GAP Insurance

Some buyers purchase extended warranties to cover repairs beyond the factory warranty. These can be helpful but are often expensive and may not pay off. Leasers don’t usually need them—since the car is under warranty—but they should consider GAP (Guaranteed Asset Protection) insurance, which covers the difference between the car’s value and what you owe if it’s totaled.

GAP insurance is often included in leases but must be added separately when buying. It’s especially important for buyers who put little money down or have long loan terms.

End-of-Term Options: What Happens When the Lease or Loan Ends?

The end of your car commitment brings different choices depending on whether you leased or bought.

Ending a Lease

When your lease term ends, you have three options:

- Return the car: This is the most common choice. You’ll undergo an inspection for excess wear and mileage. If everything’s in order, you walk away—no equity, but no debt either.

- Buy the car: You can purchase the vehicle at its predetermined residual value. This is often a good deal if the car has held its value well or if you’ve grown attached to it.

- Lease a new car: Many people roll into a new lease, especially if they like driving new models. Dealerships often offer incentives to keep you in the brand.

One downside: ending a lease early can be costly. Early termination fees can run into the thousands, making it hard to walk away if your needs change.

Ending a Loan (Owning the Car)

Once your loan is paid off, the car is yours. You can:

- Keep driving it: Many people keep their cars for years after the loan ends, enjoying payment-free driving.

- Sell it: You can sell the car privately or trade it in. Private sales usually bring more money, but trade-ins are convenient.

- Use it as a trade-in: When buying a new car, your paid-off vehicle can reduce the cost of the next one.

The key advantage here is flexibility. You’re not locked into a contract, and you have full control over the car’s future.

Which Option Offers More Freedom?

Buying clearly wins in terms of freedom. No mileage limits, no wear-and-tear rules, no pressure to return the car. You decide how long to keep it and what to do with it. Leasing offers convenience and lower payments, but it comes with strings attached.

Who Should Lease? Who Should Buy?

Now that we’ve covered the details, let’s talk about who benefits most from each option.

You Might Want to Lease If…

- You want lower monthly payments and can’t afford a large down payment.

- You drive fewer than 15,000 miles per year.

- You like having a new car every few years with the latest features.

- You don’t want to deal with long-term maintenance and repairs.

- You’re using the car for business and can deduct lease payments.

- You prefer predictable costs and don’t want to worry about depreciation.

You Might Want to Buy If…

- You plan to keep the car for 5+ years.

- You drive a lot—more than 15,000 miles annually.

- You want to build equity and avoid perpetual car payments.

- You enjoy customizing or modifying your vehicle.

- You’re financially stable and can handle higher monthly payments.

- You value ownership and long-term savings.

Real-Life Examples

Sarah, 32, Marketing Manager: Sarah leases a luxury sedan. She drives 12,000 miles a year, loves new tech, and doesn’t want repair hassles. Her $450/month lease fits her budget, and she plans to upgrade in three years. For her, leasing makes sense.

Mike, 45, Teacher: Mike buys a reliable SUV with a 6-year loan. He drives 18,000 miles a year for work and family trips. He plans to keep the car for 10 years. After the loan, he’ll have no payments—just gas and maintenance. Buying saves him money long-term.

Final Thoughts: Is It Best to Lease or Buy a Car?

So, is it best to lease or buy a car? The answer isn’t black and white. It depends on your financial situation, driving habits, and personal preferences. Leasing offers lower payments, newer cars, and less maintenance stress—but you never own the vehicle and face restrictions. Buying costs more upfront but builds equity, offers freedom, and saves money over time if you keep the car long enough.

There’s no shame in either choice. What matters most is that you make a decision based on your needs, not marketing hype or peer pressure. Take a hard look at your budget, how you use your car, and where you see yourself in five years. Talk to a financial advisor if needed. And remember: the best car decision is the one that fits your life—not someone else’s.

Whether you lease or buy, drive smart, maintain your vehicle, and enjoy the ride.

Frequently Asked Questions

Is it better to lease or buy a car for long-term savings?

Buying is generally better for long-term savings if you keep the car after the loan is paid off. You avoid perpetual payments and benefit from ownership, while leasing means you’ll always have a car payment.

Can you negotiate a car lease?

Yes, you can negotiate the capitalized cost (price of the car), money factor (interest rate), and mileage allowance. Research comparable prices and be prepared to walk away if the terms aren’t favorable.

What happens if you go over the mileage limit on a lease?

You’ll be charged a per-mile fee, typically $0.10 to $0.25. For example, exceeding by 5,000 miles at $0.15/mile costs $750. Some leases offer mileage buyouts upfront to avoid this.

Is it possible to buy a car at the end of a lease?

Yes, you can purchase the car at its residual value, which is set at the start of the lease. This can be a good deal if the car has held its value well or if you’ve grown attached to it.

Do you pay sales tax on a leased car?

It depends on your state. Some states tax the full value of the car upfront, while others tax only the monthly payments. Check your local laws to understand the tax implications.

Can you lease a used car?

Yes, many dealerships offer certified pre-owned leasing programs. These often have lower payments than new car leases and come with warranties, making them a middle-ground option.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.