Deciding whether to lease or buy a car depends on your budget, driving habits, and long-term goals. Leasing offers lower monthly payments and the latest tech, while buying builds equity and saves money over time if you keep the car long enough.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Introduction: The Great Car Decision Dilemma

- 4 Understanding the Basics: What Does Leasing and Buying Really Mean?

- 5 Pros and Cons of Leasing a Car

- 6 Pros and Cons of Buying a Car

- 7 Cost Comparison: Leasing vs. Buying Over Time

- 8 Lifestyle and Personal Factors That Influence Your Decision

- 9 Tips for Making the Right Choice

- 10 Conclusion: There’s No One-Size-Fits-All Answer

- 11 Frequently Asked Questions

Key Takeaways

- Leasing offers lower monthly payments: You’re only paying for the car’s depreciation during the lease term, not the full value, which keeps costs down.

- Buying builds ownership and equity: Once you pay off your loan, the car is yours—no monthly payments and full freedom to sell or modify it.

- Leasing includes mileage and wear restrictions: Exceeding limits can result in hefty fees, making it less ideal for high-mileage drivers.

- Buying has higher upfront and monthly costs: Down payments, interest, and insurance are typically higher, but you avoid long-term leasing fees.

- Leasing lets you drive newer cars more often: Most leases last 2–4 years, so you can upgrade to the latest models with updated safety and tech features.

- Buying is better for long-term savings: After the loan is paid off, you own a depreciated asset with no payments—ideal if you drive for 8+ years.

- Your lifestyle matters most: Frequent drivers, customizers, and those who keep cars long-term usually benefit more from buying.

📑 Table of Contents

- Introduction: The Great Car Decision Dilemma

- Understanding the Basics: What Does Leasing and Buying Really Mean?

- Pros and Cons of Leasing a Car

- Pros and Cons of Buying a Car

- Cost Comparison: Leasing vs. Buying Over Time

- Lifestyle and Personal Factors That Influence Your Decision

- Tips for Making the Right Choice

- Conclusion: There’s No One-Size-Fits-All Answer

Introduction: The Great Car Decision Dilemma

So, you’re in the market for a new car. You’ve narrowed down the make and model, maybe even taken a test drive. But now comes the big question: should you lease or buy? It’s a decision that affects your wallet, your lifestyle, and your peace of mind for years to come.

At first glance, leasing might seem like the easier path—lower monthly payments, no long-term commitment, and the chance to drive a shiny new vehicle every few years. But buying has its own perks: ownership, customization freedom, and the satisfaction of paying off a major asset. The truth is, there’s no one-size-fits-all answer. What works for a city commuter who drives 10,000 miles a year might not suit a road-trip-loving family logging 20,000 miles annually.

This guide will walk you through the nitty-gritty of leasing versus buying, so you can make a smart, informed choice. We’ll break down the costs, compare long-term value, and help you match the right option to your personal situation. Whether you’re a first-time buyer or a seasoned car owner, understanding the trade-offs will save you money and stress down the road.

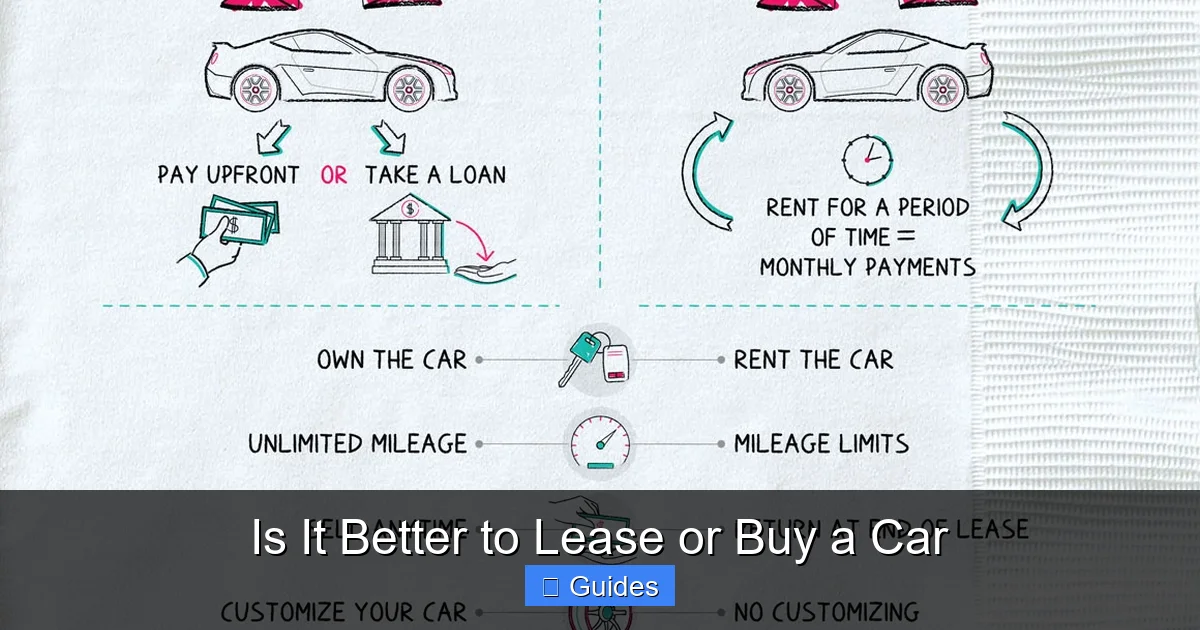

Understanding the Basics: What Does Leasing and Buying Really Mean?

Visual guide about Is It Better to Lease or Buy a Car

Image source: carpaymentcalculator.net

Before diving into the pros and cons, let’s make sure we’re on the same page about what leasing and buying actually involve.

What Is Leasing a Car?

Leasing a car is essentially renting it for a fixed period—usually 24 to 36 months, though 48-month leases are also common. Instead of purchasing the vehicle, you’re paying for its depreciation during the lease term, plus interest (called the “money factor”), taxes, and fees. At the end of the lease, you return the car to the dealership, assuming it’s in good condition and within the mileage limits.

Think of it like renting an apartment. You don’t own it, but you get to use it for a set time. And just like an apartment lease, there are rules—how much you can drive, how you maintain it, and what happens if you damage it.

What Does It Mean to Buy a Car?

Buying a car means you’re purchasing it outright—either with cash or through a loan. If you finance, you make monthly payments over 3 to 7 years until the loan is paid off. Once that happens, the car is fully yours. You can drive it as much as you want, modify it, sell it, or keep it for decades.

Buying gives you full ownership and control. No mileage caps, no wear-and-tear fees, and no pressure to return the car in perfect condition. But it also means higher monthly payments and a bigger upfront investment.

Key Differences at a Glance

Here’s a quick comparison to help clarify:

- Ownership: Leasing = no ownership; Buying = full ownership

- Monthly Payments: Leasing = typically lower; Buying = typically higher

- Mileage Limits: Leasing = strict (10,000–15,000 miles/year); Buying = unlimited

- Customization: Leasing = limited or not allowed; Buying = full freedom

- End of Term: Leasing = return the car; Buying = keep or sell it

- Long-Term Cost: Leasing = ongoing payments; Buying = one-time cost (after loan)

Understanding these core differences is the first step toward making the right choice for your needs.

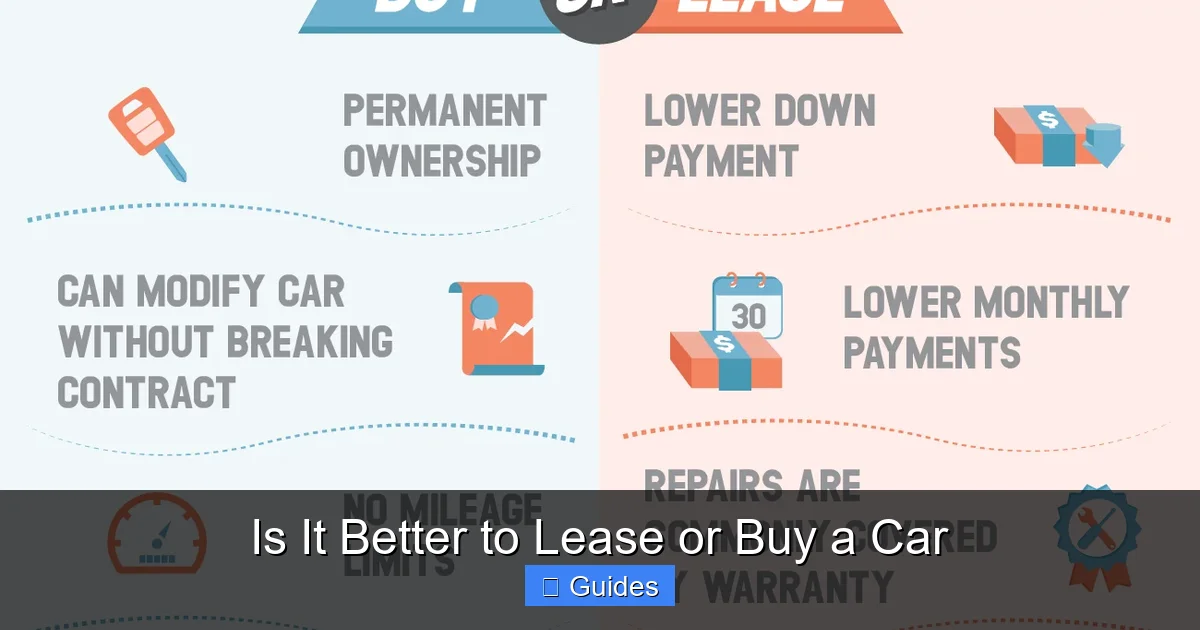

Pros and Cons of Leasing a Car

Visual guide about Is It Better to Lease or Buy a Car

Image source: worksheets.clipart-library.com

Leasing has become increasingly popular, especially among drivers who want the latest technology and safety features without the long-term commitment. But it’s not perfect for everyone. Let’s break down the advantages and disadvantages.

Advantages of Leasing

Lower Monthly Payments

One of the biggest draws of leasing is the lower monthly cost. Since you’re only paying for the car’s depreciation during the lease term—not the full value—your payments are often 20% to 30% less than a loan payment for the same vehicle. For example, a $40,000 car might cost $450/month to lease but $650/month to finance over 60 months.

Drive a New Car Every Few Years

Leasing lets you upgrade to a new model every 2 to 4 years. This means you’ll always have access to the latest infotainment systems, advanced driver-assistance features (like adaptive cruise control and lane-keeping assist), and improved fuel efficiency. If you love having the newest tech, leasing keeps you current without the hassle of selling your old car.

Lower Upfront Costs

Leases often require a smaller down payment—sometimes as little as $0 down. You might also pay a security deposit and the first month’s payment, but overall, the initial out-of-pocket cost is usually lower than buying.

Warranty Coverage

Most leases last 3 years, which typically falls within the manufacturer’s warranty period. That means major repairs are usually covered, and you won’t face unexpected out-of-pocket expenses for things like transmission failure or engine issues.

No Resale Hassle

When the lease ends, you simply return the car to the dealership. No need to list it online, negotiate with buyers, or worry about depreciation. It’s a clean, stress-free exit.

Disadvantages of Leasing

Mileage Restrictions

Leases come with strict mileage limits—typically 10,000, 12,000, or 15,000 miles per year. If you exceed this, you’ll pay a per-mile fee, often $0.10 to $0.25 per mile. For example, driving 18,000 miles in a year on a 12,000-mile lease could cost you an extra $1,500. If you’re a frequent traveler or have a long commute, this can add up fast.

No Ownership or Equity

You’re essentially paying to use the car, not to own it. Once the lease ends, you have nothing to show for your payments. Unlike buying, where you build equity, leasing offers no long-term financial return.

Wear and Tear Fees

Leased cars must be returned in “good condition.” That means excessive scratches, dents, or interior damage can result in charges. Even normal wear might be scrutinized. Dealerships often charge for things like worn tires or stained upholstery, so you’ll want to keep the car in top shape.

Early Termination Fees

Ending a lease early is expensive. You’ll likely have to pay the remaining payments or a hefty penalty. This makes leasing a poor choice if your financial situation or lifestyle might change suddenly.

Customization Limits

Most leases prohibit modifications. You can’t install a lift kit, change the exhaust, or even tint the windows without approval. If you like to personalize your ride, leasing might feel restrictive.

Who Should Consider Leasing?

Leasing works best for:

- People who drive less than 15,000 miles per year

- Those who want lower monthly payments

- Drivers who enjoy having the latest car models

- Individuals who don’t want to deal with long-term maintenance or resale

- Business professionals who need a reliable, presentable vehicle

If you fit this profile, leasing could be a smart, cost-effective choice.

Pros and Cons of Buying a Car

Visual guide about Is It Better to Lease or Buy a Car

Image source: blog.taxact.com

Buying a car is the traditional path—and for good reason. It offers freedom, ownership, and long-term savings. But it also comes with higher costs and responsibilities. Let’s explore both sides.

Advantages of Buying

Ownership and Equity

When you buy a car, it’s yours. Once the loan is paid off, you own a valuable asset outright. You can sell it, trade it in, or keep it for years. This equity can be used toward your next vehicle purchase, giving you financial flexibility.

No Mileage or Usage Restrictions

You can drive as much as you want, wherever you want. Whether you’re road-tripping across the country or commuting 50 miles each way, there are no penalties. This makes buying ideal for high-mileage drivers, rideshare workers, or families with multiple drivers.

Freedom to Customize

Want to add a spoiler, upgrade the sound system, or paint it a custom color? Go for it. When you own the car, you can modify it however you like—no approval needed.

Long-Term Cost Savings

Although monthly payments are higher, buying is cheaper in the long run. Once the loan is paid off (say, after 5 years), you have no car payments for as long as the vehicle lasts. If you keep the car for 8–10 years, you’ll save thousands compared to leasing multiple vehicles over the same period.

No Wear and Tear Fees

You don’t have to worry about scratches, dents, or interior wear. Normal use is expected, and you won’t be charged for it. This is especially helpful if you have kids, pets, or enjoy outdoor activities.

Disadvantages of Buying

Higher Monthly Payments

Buying a car usually means higher monthly payments than leasing. For example, a $35,000 car financed over 60 months at 5% interest might cost $660/month—significantly more than a comparable lease.

Higher Upfront Costs

Down payments for loans are often 10%–20% of the car’s value. On a $35,000 car, that’s $3,500 to $7,000 upfront. You’ll also pay sales tax, registration, and possibly higher insurance premiums.

Depreciation

Cars lose value quickly—often 20% in the first year and 50% after three years. If you plan to sell the car soon, you might not recoup your investment. This is especially true for luxury or niche vehicles.

Maintenance and Repairs

Once the warranty expires (usually after 3 years or 36,000 miles), you’re responsible for all repairs. Major issues like transmission failure or engine problems can cost thousands. While leasing transfers this risk to the manufacturer, buying means you bear it.

Resale Hassle

Selling a used car takes time and effort. You’ll need to clean it, fix minor issues, list it online, and negotiate with buyers. If the car has high mileage or isn’t in demand, you might not get a great price.

Who Should Consider Buying?

Buying is ideal for:

- People who drive more than 15,000 miles per year

- Those who plan to keep the car for 5+ years

- Drivers who want to customize their vehicle

- Individuals with stable income who can handle higher payments

- Families needing a reliable, long-term vehicle

If you value ownership and long-term savings, buying is likely the better path.

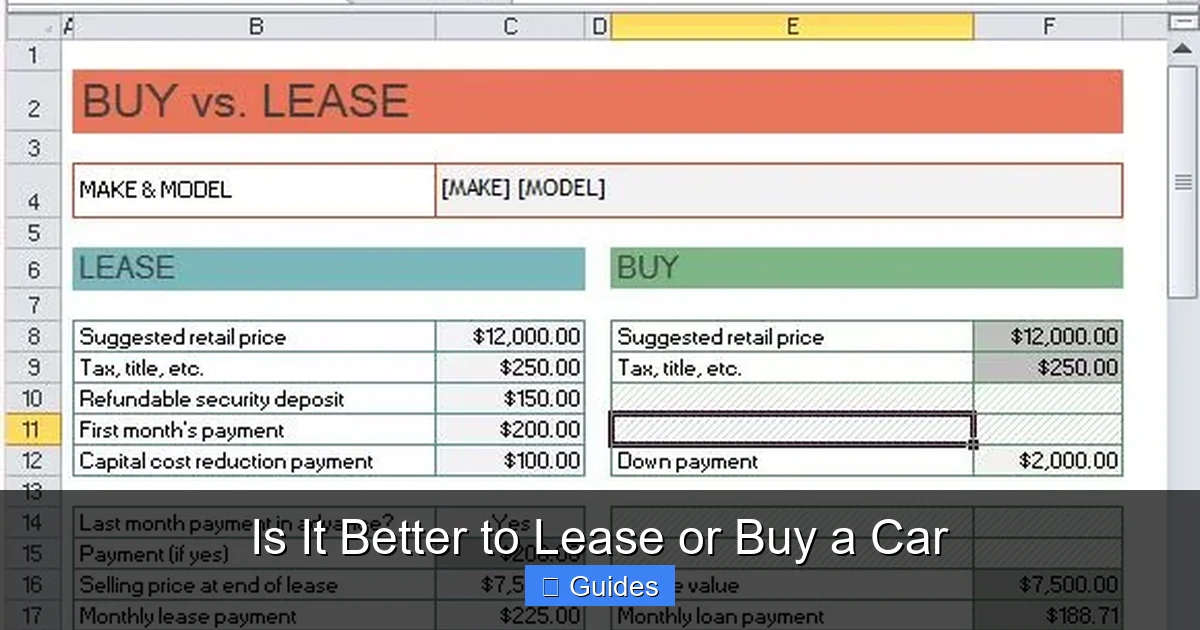

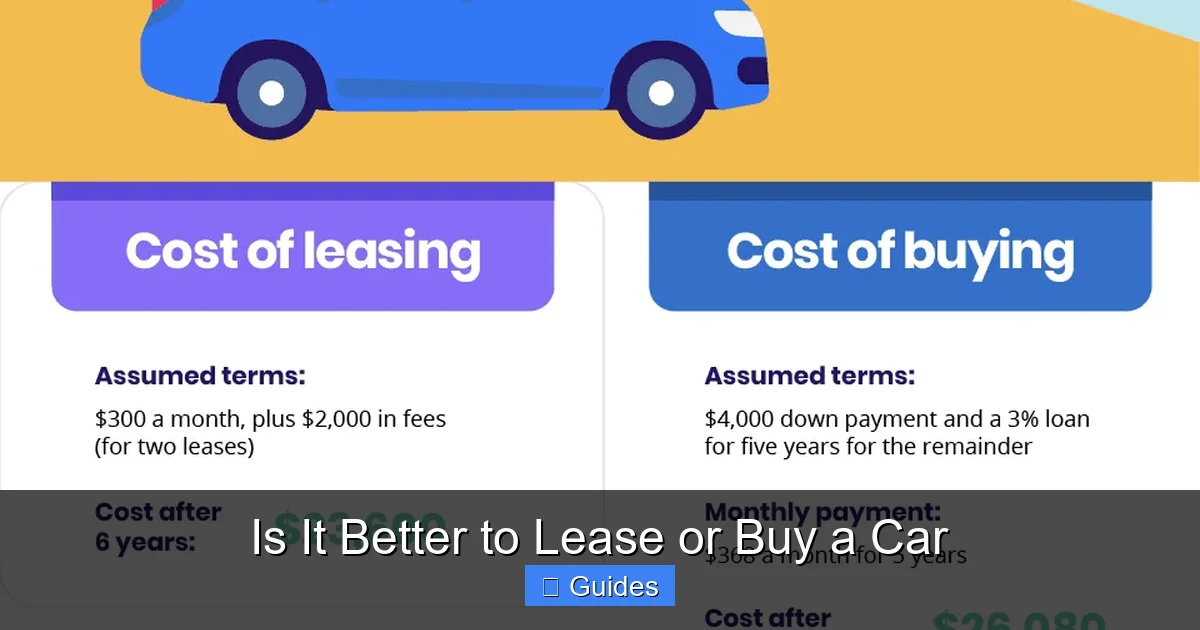

Cost Comparison: Leasing vs. Buying Over Time

To truly understand which option saves you money, let’s look at a real-world example.

Scenario: $35,000 Car Over 6 Years

Let’s say you’re considering a $35,000 SUV. You plan to drive 12,000 miles per year and keep the vehicle for 6 years. Here’s how leasing and buying compare:

Leasing Option:

- Lease term: 36 months

- Monthly payment: $400

- Down payment: $2,000

- Total cost over 3 years: ($400 × 36) + $2,000 = $16,400

- After 3 years, you lease another identical car for another 3 years

- Total cost over 6 years: $16,400 × 2 = $32,800

- You own nothing at the end

Buying Option:

- Loan: $35,000 at 5% interest over 60 months

- Monthly payment: $660

- Down payment: $5,000

- Total cost over 5 years: ($660 × 60) + $5,000 = $44,600

- In year 6, no car payment

- Car value after 6 years: ~$15,000 (estimated resale)

- Net cost: $44,600 – $15,000 = $29,600

Result: Buying costs $29,600 over 6 years, while leasing costs $32,800. Buying saves you $3,200—and you still own a car worth $15,000.

What If You Keep the Car Longer?

Now, let’s say you keep the bought car for 10 years. Maintenance costs average $500/year after year 5.

- Total ownership cost: $44,600 (loan) + ($500 × 5) = $47,100

- Resale value after 10 years: ~$8,000

- Net cost: $47,100 – $8,000 = $39,100

- Leasing for 10 years (3 leases): $16,400 × 3 = $49,200

Now, buying saves you over $10,000.

Key Insight

The longer you keep a car, the more buying pays off. Leasing keeps you in a cycle of payments with no ownership. Buying, while more expensive upfront, becomes cheaper over time—especially if you drive the car into the ground.

Lifestyle and Personal Factors That Influence Your Decision

Beyond numbers, your lifestyle plays a huge role in whether leasing or buying is better for you.

Driving Habits

If you drive less than 12,000 miles a year, leasing might work. But if you’re logging 18,000+ miles, buying is almost always smarter. Excess mileage fees can erase any savings from lower lease payments.

Financial Situation

Leasing requires good credit and stable income. If your job is uncertain or your credit is shaky, buying with a longer loan term might be more manageable—even if payments are higher.

Tech Enthusiasts vs. Practical Drivers

Love the latest gadgets? Leasing lets you upgrade every few years. Prefer reliability and simplicity? Buying a well-reviewed, long-lasting model (like a Toyota or Honda) and keeping it for a decade makes more sense.

Family and Usage Needs

Families with kids, pets, or gear (bikes, camping equipment) often benefit from buying. You need space, durability, and freedom—things leasing can restrict.

Emotional Attachment

Some people love their cars and want to keep them for years. If you’re the type to name your car and take pride in maintaining it, buying aligns with that mindset.

Tips for Making the Right Choice

Still unsure? Here are some practical tips to help you decide:

- Calculate your annual mileage: If it’s over 15,000, lean toward buying.

- Compare total 5-year costs: Include down payments, monthly payments, fees, and estimated resale value.

- Check lease terms carefully: Look at mileage limits, wear policies, and early termination fees.

- Negotiate both deals: Whether leasing or buying, you can negotiate the price, money factor, or interest rate.

- Consider certified pre-owned (CPO): CPO cars offer warranty protection and lower prices—great for buyers who want reliability without new-car costs.

- Think long-term: Ask yourself: “Will I still be happy with this car in 5 years?”

Conclusion: There’s No One-Size-Fits-All Answer

So, is it better to lease or buy a car? The honest answer is: it depends.

Leasing offers lower payments, newer technology, and hassle-free returns—perfect for low-mileage drivers who value convenience and innovation. Buying provides ownership, long-term savings, and total freedom—ideal for high-mileage drivers, families, and anyone planning to keep their car for years.

The best choice isn’t about what’s “better” in general—it’s about what’s better for you. Take a hard look at your budget, driving habits, and lifestyle. Run the numbers. And remember: the smartest car decision isn’t the one with the lowest monthly payment—it’s the one that fits your life and your wallet.

Whether you lease or buy, the key is to make an informed choice. With the right information, you can drive away confident that you’ve made the right move.

Frequently Asked Questions

Is it cheaper to lease or buy a car?

It depends on how long you keep the car. Leasing has lower monthly payments, but buying is cheaper over time—especially if you keep the vehicle for 6+ years. Buying builds equity, while leasing offers no ownership.

Can you negotiate a car lease?

Yes, you can negotiate the capitalized cost (price of the car), money factor (interest rate), and lease terms. Just like buying, doing your research and being prepared helps you get a better deal.

What happens at the end of a car lease?

You return the car to the dealership, assuming it’s within mileage limits and in good condition. You may pay wear-and-tear fees, and you can often lease or buy a new car right away.

Can you buy a car at the end of a lease?

Yes, most leases allow you to purchase the vehicle at the end of the term for its residual value. This can be a good option if you love the car and want to keep it.

Is leasing a car bad for your credit?

Leasing isn’t inherently bad for credit. In fact, making on-time lease payments can help build your credit score. However, ending a lease early or missing payments can hurt your credit.

Should I lease or buy if I drive a lot?

If you drive more than 15,000 miles per year, buying is almost always the better choice. Leasing mileage limits and excess fees can make high-mileage driving very expensive.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.