Deciding whether to lease or finance a car depends on your financial goals, driving habits, and long-term plans. Leasing offers lower monthly payments and the chance to drive a new car every few years, while financing builds equity and allows full ownership. Understanding the pros and cons of each option helps you make a smarter, more informed decision.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Is It Smarter to Lease or Finance a Car? A Complete Guide

- 4 Understanding Car Leasing: How It Works

- 5 Understanding Car Financing: How It Works

- 6 Cost Comparison: Leasing vs. Financing

- 7 Lifestyle and Driving Habits: Which Option Fits You?

- 8 Financial Health and Credit Considerations

- 9 End-of-Term Options: What Happens When It’s Over?

- 10 Making the Smart Choice: Tips and Final Advice

- 11 Frequently Asked Questions

Key Takeaways

- Leasing typically has lower monthly payments: You’re only paying for the vehicle’s depreciation during the lease term, not the full value, which keeps costs down.

- Financing builds ownership equity: Once you pay off the loan, the car is yours, and you can sell it, trade it, or keep driving it with no payments.

- Leasing comes with mileage and wear restrictions: Exceeding limits can result in hefty fees, so it’s best for drivers with predictable, low-mileage needs.

- Financing offers more freedom and customization: You can modify your car, drive as much as you want, and avoid end-of-lease charges.

- Leasing may include warranty coverage: Most leases fall within the manufacturer’s warranty period, reducing repair costs.

- Financing can be better long-term value: After the loan ends, you’ll have years of payment-free driving, while leasing means ongoing monthly costs.

- Your credit score affects both options: A strong credit history helps secure better interest rates or lease terms, so check your score before applying.

📑 Table of Contents

- Is It Smarter to Lease or Finance a Car? A Complete Guide

- Understanding Car Leasing: How It Works

- Understanding Car Financing: How It Works

- Cost Comparison: Leasing vs. Financing

- Lifestyle and Driving Habits: Which Option Fits You?

- Financial Health and Credit Considerations

- End-of-Term Options: What Happens When It’s Over?

- Making the Smart Choice: Tips and Final Advice

Is It Smarter to Lease or Finance a Car? A Complete Guide

So you’re in the market for a new car. Congratulations! But before you start test-driving your dream ride, there’s a big decision to make: should you lease or finance? It’s a question that stumps even savvy car buyers. The answer isn’t one-size-fits-all. What’s smarter for one person might be a financial misstep for another.

At first glance, leasing might seem like the easier route—lower monthly payments, no long-term commitment, and the chance to drive a shiny new vehicle every few years. But financing, while requiring higher monthly outlays, leads to full ownership and long-term savings. The key is understanding how each option works, what it costs, and how it fits your lifestyle.

This guide will walk you through the ins and outs of leasing versus financing. We’ll break down the costs, compare flexibility, and help you decide which path aligns with your financial goals. Whether you’re a daily commuter, a weekend adventurer, or someone who just wants reliable transportation, we’ve got you covered.

Understanding Car Leasing: How It Works

Visual guide about Is It Smarter to Lease or Finance a Car

Image source: companieslogo.com

Leasing a car is like renting it for an extended period—usually two to four years. Instead of buying the vehicle, you’re paying for its depreciation during the lease term, plus fees and interest. At the end of the lease, you return the car to the dealership unless you choose to buy it.

What You Pay for When You Lease

When you lease, your monthly payment covers three main things: depreciation, interest (called the “money factor”), and fees. Depreciation is the biggest chunk—it’s how much the car loses in value while you drive it. For example, if a $35,000 car is expected to be worth $20,000 after three years, you’re essentially paying for that $15,000 drop in value.

Interest is calculated using the money factor, which is similar to an interest rate but expressed differently (e.g., 0.0025 instead of 6%). Fees include the acquisition fee (like a down payment), disposition fee (charged when you return the car), and sometimes a security deposit.

Lease Terms and Mileage Limits

Most leases come with strict terms. You’ll agree to a set number of miles per year—typically 10,000, 12,000, or 15,000. If you go over, you’ll pay a per-mile penalty, often $0.10 to $0.25. For example, driving 18,000 miles on a 12,000-mile lease could cost you $1,500 extra.

You’re also expected to maintain the car in good condition. Excessive wear and tear—like deep scratches, dents, or stained upholstery—can result in additional charges at lease-end.

Pros and Cons of Leasing

Leasing has clear advantages. Monthly payments are usually 20% to 60% lower than financing the same car. You’ll also enjoy lower sales tax in many states (only on the monthly payment, not the full price), and you’re often covered by the manufacturer’s warranty for the entire lease term.

But there are downsides. You don’t own the car, so you’re always making payments. There’s no equity to build, and you’re limited in how you can use the vehicle. Want to customize it with a loud exhaust or lift kit? Not allowed. Planning a cross-country road trip every summer? You might blow past your mileage limit.

Understanding Car Financing: How It Works

Visual guide about Is It Smarter to Lease or Finance a Car

Image source: womenonbusiness.com

Financing a car means taking out a loan to buy it. You make monthly payments over a set term—typically 36 to 72 months—and once the loan is paid off, the car is yours. You can drive it, sell it, trade it, or modify it however you like.

What You Pay for When You Finance

Your monthly payment includes principal (the amount borrowed), interest, and possibly taxes and fees. The interest rate depends on your credit score, loan term, and the lender. A higher credit score usually means a lower rate.

For example, a $30,000 car with a 5% interest rate over 60 months would cost about $566 per month. After five years, you’d have paid $33,960—$3,960 in interest. But the car is now yours.

Loan Terms and Down Payments

Most auto loans require a down payment, often 10% to 20% of the car’s price. A larger down payment reduces your monthly payment and total interest paid. It also lowers the risk of being “upside down” on the loan—owing more than the car is worth.

Loan terms range from short (36 months) to long (84 months or more). Shorter terms mean higher monthly payments but less interest over time. Longer terms reduce monthly costs but increase total interest paid.

Pros and Cons of Financing

Financing gives you ownership and freedom. No mileage limits, no wear-and-tear penalties, and the ability to personalize your ride. Once the loan is paid off, you’ll enjoy years of payment-free driving—something leasing can’t offer.

But financing has its challenges. Monthly payments are higher than leasing, and you’re responsible for maintenance and repairs once the warranty expires. Depreciation still hits hard in the first few years, so you might owe more than the car is worth early on.

Cost Comparison: Leasing vs. Financing

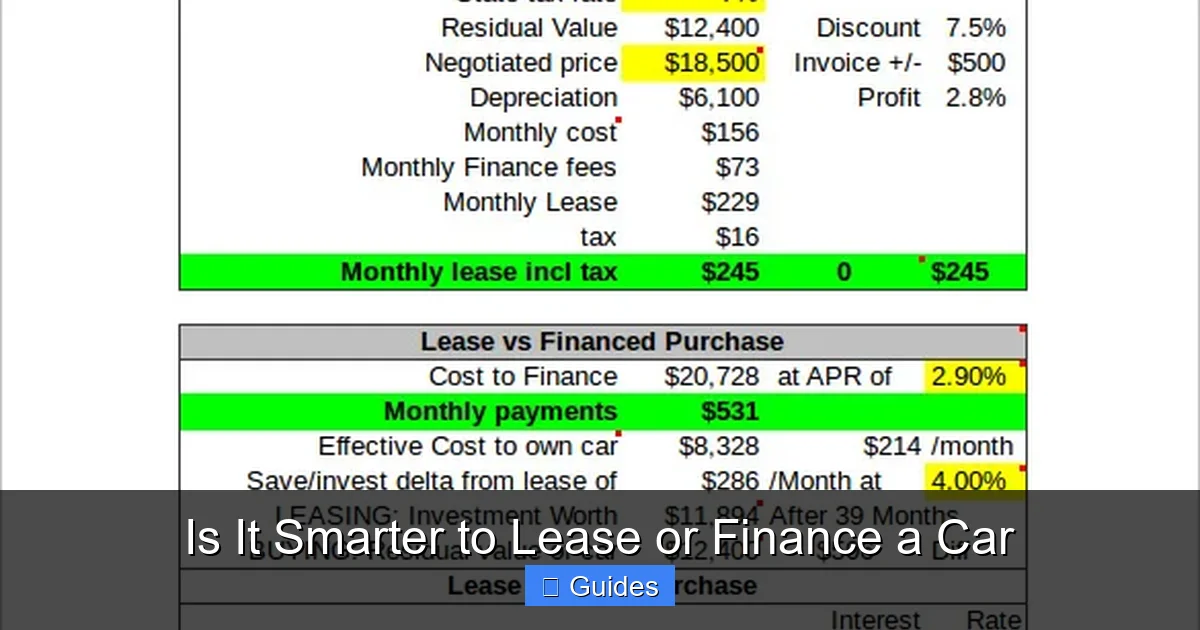

Visual guide about Is It Smarter to Lease or Finance a Car

Image source: images.sampletemplates.com

Let’s put leasing and financing head-to-head with a real-world example.

Scenario: 2024 Honda Accord EX

– MSRP: $32,000

– Lease: 36 months, $299/month, $2,999 due at signing, 12,000 miles/year

– Finance: 60 months, $580/month, $3,200 down, 5% interest rate

Over three years, the lease costs $13,763 ($299 x 36 + $2,999). The finance option costs $22,080 ($580 x 36 + $3,200). That’s $8,317 more—but remember, after five years, the financed car is yours. The lease ends, and you’re back to square one.

Long-Term Value

If you plan to keep a car for 10 years, financing wins. After five years of payments, you’ll drive for another five with no monthly cost. Leasing would require three more years of payments—and then another lease or purchase.

But if you prefer driving new cars every few years and don’t want to deal with resale or repairs, leasing might be smarter. You’ll always have the latest tech, safety features, and warranty coverage.

Hidden Costs to Watch For

Both options have hidden fees. Leases include acquisition fees ($500–$1,000), disposition fees ($300–$500), and potential excess mileage or wear charges. Financing may include prepayment penalties, late fees, or higher interest if your credit isn’t strong.

Always read the fine print. Ask about all fees upfront, and compare total costs—not just monthly payments.

Lifestyle and Driving Habits: Which Option Fits You?

Your daily routine plays a big role in whether leasing or financing is smarter.

Low Mileage Drivers

If you drive less than 12,000 miles a year and stick to city or suburban routes, leasing could be ideal. You’ll stay within mileage limits and avoid penalties. You’ll also benefit from lower payments and warranty coverage.

High Mileage or Long Commutes

Driving 15,000+ miles a year? Financing is usually better. Leasing with high mileage means constant overage fees. Financing lets you drive freely without extra charges.

Tech Enthusiasts and Early Adopters

Love having the latest infotainment system, driver-assist features, or electric vehicle tech? Leasing lets you upgrade every few years. You’ll always be on the cutting edge without the hassle of selling a used car.

Long-Term Owners

If you keep cars for 8–10 years, financing builds equity and saves money over time. You’ll pay off the loan and enjoy years of no payments. Leasing would cost more in the long run.

Customization and Personalization

Want to tint windows, upgrade the stereo, or add performance parts? Financing gives you full control. Leasing contracts typically prohibit modifications.

Financial Health and Credit Considerations

Your financial situation is a major factor in the lease vs. finance decision.

Credit Score Impact

Both leasing and financing require a credit check. A strong credit score (700+) helps you qualify for lower interest rates or better lease terms. A lower score may mean higher payments or a larger down payment.

Down Payment and Cash Flow

Leasing often requires a larger upfront payment (called a “cap cost reduction”) to lower monthly costs. Financing may need a down payment too, but it reduces the loan amount and interest.

If cash flow is tight, leasing might seem easier—but remember, you’re not building equity. If you can afford higher monthly payments, financing pays off long-term.

Tax and Business Use

Business owners may benefit from leasing. In some cases, you can deduct lease payments as a business expense. Financing allows deductions on interest and depreciation, but rules are stricter.

Check with a tax professional to see which option offers better tax advantages for your situation.

End-of-Term Options: What Happens When It’s Over?

The end of a lease or loan brings different choices.

Ending a Lease

At lease-end, you can:

– Return the car and walk away (after paying any fees).

– Buy the car at its residual value (pre-set in the contract).

– Lease a new car from the same dealer.

Buying the car makes sense if it’s in great condition and the residual price is fair. But if the market value is higher, you might get a better deal elsewhere.

Ending a Loan

Once your loan is paid off, the car is yours. You can:

– Keep driving it.

– Sell it privately for cash.

– Trade it in for a new vehicle.

Selling privately usually gets you more money than a trade-in. But it takes time and effort.

Resale Value and Depreciation

Depreciation hits hardest in the first few years. A new car can lose 20% of its value the moment you drive it off the lot. Leasing avoids this risk—you’re not responsible for resale value. Financing means you absorb the depreciation, but you benefit if the car holds value well.

Making the Smart Choice: Tips and Final Advice

So, is it smarter to lease or finance a car? The answer depends on your priorities.

Ask Yourself These Questions

– How many miles do I drive per year?

– Do I want to own the car long-term?

– Can I afford higher monthly payments?

– Do I prefer driving new cars every few years?

– Am I okay with restrictions on mileage and modifications?

Negotiate Like a Pro

Whether leasing or financing, always negotiate. Dealers often mark up interest rates or add unnecessary fees. Get quotes from multiple lenders or dealers. Use online tools to check fair market values.

For leases, negotiate the capitalized cost (the price of the car) and the money factor. For financing, shop around for the best loan rates—banks, credit unions, and online lenders often beat dealer financing.

Consider Certified Pre-Owned (CPO)

A CPO car can be a smart middle ground. It’s cheaper than new, comes with a warranty, and depreciates slower. You can finance it with lower payments and still build equity.

Think Long-Term

Don’t just focus on monthly payments. Calculate total cost of ownership—including insurance, maintenance, fuel, and depreciation. A cheaper monthly payment today could cost more over time.

Final Recommendation

If you value ownership, drive a lot, or plan to keep a car for many years, financing is usually the smarter choice. If you prefer lower payments, enjoy new technology, and drive modestly, leasing can be a great fit.

There’s no universal “right” answer—only the one that works best for you.

Frequently Asked Questions

Is it cheaper to lease or finance a car?

Leasing usually has lower monthly payments, but financing is often cheaper in the long run. While leasing costs less upfront, you never own the car and keep making payments. Financing costs more per month but leads to ownership and long-term savings.

Can I buy a car at the end of a lease?

Yes, most leases allow you to purchase the car at the end of the term for its residual value—the pre-set price in your contract. This can be a good deal if the car is in great shape and the price is fair compared to market value.

What happens if I go over my lease mileage?

If you exceed your annual mileage limit, you’ll be charged a per-mile fee—typically $0.10 to $0.25. For example, going 3,000 miles over a 12,000-mile lease could cost $300 to $750. Some leases offer mileage buyouts upfront to avoid surprises.

Can I pay off a car loan early?

Yes, most auto loans allow early payoff without penalty. Paying off your loan early saves you interest and frees up your cash flow. Just check your loan agreement for any prepayment penalties.

Is leasing a good idea for someone with bad credit?

Leasing can be harder with bad credit, as lenders view it as riskier. You may face higher money factors or require a larger down payment. Financing might offer more flexibility, but both options will cost more with poor credit.

Should I lease or finance an electric car?

Leasing an electric car can be smart—you get the latest tech, lower payments, and often qualify for tax credits. But financing lets you keep the car long-term and benefit from lower fuel and maintenance costs. Consider your driving needs and how long you plan to keep the vehicle.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.