Deciding whether to lease or buy a car? A lease vs buy car calculator helps you compare total costs, monthly payments, and long-term value. By plugging in your budget, loan terms, and expected mileage, you can make a data-driven decision that fits your lifestyle and finances.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Lease vs Buy Car Calculator: The Ultimate Guide to Making the Right Choice

- 4 How a Lease vs Buy Car Calculator Works

- 5 Leasing vs Buying: What’s the Real Difference?

- 6 Real-Life Example: Using a Lease vs Buy Car Calculator

- 7 Tips for Getting the Most Accurate Results

- 8 Common Mistakes to Avoid When Using a Calculator

- 9 When to Lease, When to Buy: A Decision Framework

- 10 Conclusion: Let the Numbers Guide You

- 11 Frequently Asked Questions

- 11.1 What is a lease vs buy car calculator?

- 11.2 Is it better to lease or buy a car?

- 11.3 Can I use a lease vs buy calculator for used cars?

- 11.4 Do lease vs buy calculators include taxes and fees?

- 11.5 What happens if I exceed the mileage limit on a lease?

- 11.6 Can I negotiate lease terms like I do with a car purchase?

Key Takeaways

- Understand the core difference: Leasing means paying for depreciation and use, while buying means owning the car outright after payments.

- Use a lease vs buy car calculator: These tools factor in interest rates, down payments, mileage, and resale value to show real cost comparisons.

- Consider your driving habits: High-mileage drivers often save more by buying, while low-mileage drivers may benefit from leasing.

- Watch for hidden fees: Leases often include excess mileage charges, wear-and-tear fees, and early termination penalties.

- Think long-term: Buying builds equity and offers freedom after the loan ends; leasing offers lower monthly payments but no ownership.

- Factor in maintenance and insurance: New leased cars may have lower repair costs, but insurance can be higher due to required coverage levels.

- Run multiple scenarios: Try different down payments, loan terms, and mileage limits to see how they impact your total cost.

📑 Table of Contents

- Lease vs Buy Car Calculator: The Ultimate Guide to Making the Right Choice

- How a Lease vs Buy Car Calculator Works

- Leasing vs Buying: What’s the Real Difference?

- Real-Life Example: Using a Lease vs Buy Car Calculator

- Tips for Getting the Most Accurate Results

- Common Mistakes to Avoid When Using a Calculator

- When to Lease, When to Buy: A Decision Framework

- Conclusion: Let the Numbers Guide You

Lease vs Buy Car Calculator: The Ultimate Guide to Making the Right Choice

So, you’re in the market for a new car. You’ve narrowed down your options, taken a few test drives, and now you’re staring at two paths: lease or buy. It’s a big decision—one that can impact your budget for years to come. And while emotions and preferences play a role, the smart move is to let the numbers guide you. That’s where a lease vs buy car calculator comes in.

These handy online tools do more than just crunch numbers—they help you visualize the real cost of each option. Whether you’re leaning toward lower monthly payments or long-term ownership, a calculator gives you a side-by-side comparison based on your personal financial situation. No guesswork. No sales pressure. Just clear, actionable data.

In this guide, we’ll walk you through everything you need to know about using a lease vs buy car calculator. We’ll explain how they work, what inputs matter most, and how to interpret the results. By the end, you’ll have the confidence to choose the option that truly fits your lifestyle and wallet.

How a Lease vs Buy Car Calculator Works

A lease vs buy car calculator is a digital tool designed to compare the total cost of leasing a vehicle versus purchasing it over time. It takes into account a variety of financial factors and presents them in an easy-to-understand format—usually a breakdown of monthly payments, total interest paid, and overall cost of ownership.

Visual guide about Lease Vs Buy Car Calculator

Image source: inchcalculator.com

These calculators are typically available for free on automotive websites, financial institutions, and car manufacturer portals. You simply input details like the car’s price, down payment, loan or lease term, interest rate, expected mileage, and estimated resale value. The calculator then runs the numbers and shows you which option is more cost-effective over a set period—commonly three to five years.

Key Inputs the Calculator Needs

To get accurate results, you’ll need to provide several pieces of information. Here’s what most calculators ask for:

- Vehicle Price: The sticker price or negotiated sale price of the car.

- Down Payment: The amount you plan to pay upfront. This reduces the amount financed or leased.

- Loan or Lease Term: How long you’ll be making payments—typically 36, 48, or 60 months.

- Interest Rate (APR): The annual percentage rate for a loan or the money factor for a lease.

- Estimated Resale Value: For buying, this is how much the car might be worth at the end of the term.

- Mileage Limit: For leasing, most contracts include an annual mileage cap (e.g., 10,000 or 15,000 miles).

- Taxes and Fees: Sales tax, registration, documentation fees, and other charges.

Some advanced calculators also let you factor in maintenance costs, insurance differences, and even fuel efficiency. The more detailed your inputs, the more accurate your comparison will be.

How the Calculator Crunches the Numbers

Once you’ve entered your data, the calculator performs two separate calculations—one for leasing and one for buying—and then compares them.

For leasing, it calculates:

- Monthly lease payment based on depreciation, interest (money factor), and fees.

- Total amount paid over the lease term.

- Potential penalties for excess mileage or wear and tear.

For buying, it calculates:

- Monthly loan payment using the loan amount, interest rate, and term.

- Total interest paid over the life of the loan.

- Estimated equity or resale value at the end of the term.

The calculator then shows you the net cost of each option—often highlighting which one saves you more money over time. Some tools even include a “break-even” point, showing when buying becomes cheaper than leasing.

Leasing vs Buying: What’s the Real Difference?

Before diving deeper into the calculator, it’s important to understand the fundamental differences between leasing and buying. This context will help you interpret the results more effectively.

Visual guide about Lease Vs Buy Car Calculator

Image source: lease.io

What Does It Mean to Lease a Car?

Leasing a car is like renting it for a long period—typically two to four years. You make monthly payments to use the vehicle, but you don’t own it. At the end of the lease, you return the car to the dealership, often with the option to buy it at a predetermined price (the residual value).

Leasing is attractive for several reasons:

- Lower monthly payments: Since you’re only paying for the car’s depreciation during the lease term, payments are usually lower than loan payments.

- Drive a new car more often: Most leases last 2–3 years, so you can upgrade to a newer model frequently.

- Lower maintenance costs: Leased vehicles are typically under warranty, so major repairs are covered.

- Little or no down payment: Some leases require minimal upfront costs.

However, leasing comes with restrictions:

- Mileage limits: Exceeding the annual mileage cap (e.g., 12,000 miles) results in per-mile charges.

- Wear and tear fees: You may be charged for excessive damage beyond “normal” use.

- No equity: You don’t build ownership, so you’re always making payments.

- Early termination penalties: Ending the lease early can be expensive.

What Does It Mean to Buy a Car?

Buying a car means you’re purchasing it outright—either with cash or through a loan. Once the loan is paid off, you own the vehicle free and clear. You can drive it as much as you want, modify it, sell it, or keep it for years.

Buying offers long-term benefits:

- Ownership and equity: After paying off the loan, the car is yours. You can sell it or trade it in for value.

- No mileage restrictions: Drive as much as you need without penalties.

- Freedom to customize: You can modify the car (within legal limits) without approval.

- Lower long-term cost: Once the loan is paid, you have no more payments—just maintenance and insurance.

But buying also has downsides:

- Higher monthly payments: Loan payments are typically higher than lease payments.

- Depreciation: Cars lose value quickly, especially in the first few years.

- Maintenance costs: As the car ages, repair bills may increase.

- Longer commitment: Loans often last 5–7 years, so you’re tied to the vehicle longer.

Which Option Is Right for You?

The best choice depends on your financial goals, driving habits, and lifestyle. A lease vs buy car calculator helps you see which path aligns with your needs.

For example, if you:

- Drive less than 12,000 miles per year,

- Prefer driving a new car every few years,

- Want lower monthly payments,

- Don’t mind not owning the car,

Then leasing might be the better fit.

On the other hand, if you:

- Drive a lot or plan long road trips,

- Want to own your car outright,

- Plan to keep the vehicle for many years,

- Want to avoid endless payments,

Then buying is likely the smarter move.

Real-Life Example: Using a Lease vs Buy Car Calculator

Let’s walk through a practical example to show how a calculator works in real life. Imagine you’re considering a 2024 Honda Accord with a sticker price of $32,000.

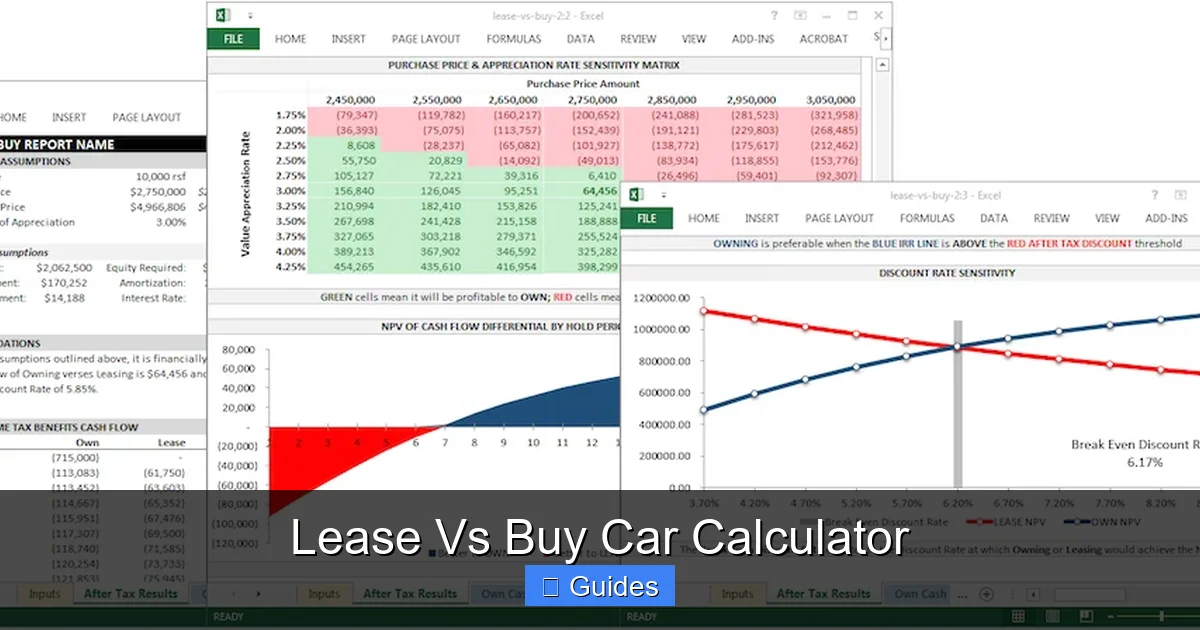

Visual guide about Lease Vs Buy Car Calculator

Image source: alfacalculator.com

Scenario: Leasing the Honda Accord

You find a 36-month lease with the following terms:

- Down payment: $3,000

- Monthly payment: $350

- Mileage limit: 12,000 miles per year

- Residual value: 58% ($18,560)

- Money factor: 0.0025 (equivalent to 6% APR)

Using a lease vs buy car calculator, you input these details. The tool calculates that over three years, you’ll pay:

- Total lease payments: $12,600 ($350 x 36 months)

- Plus down payment: $3,000

- Total cost: $15,600

At the end of the lease, you return the car. No equity. But you’ve driven a new car with lower payments.

Scenario: Buying the Honda Accord

Now, let’s say you decide to buy the same car with a 60-month loan:

- Down payment: $5,000

- Loan amount: $27,000

- Interest rate: 5.5% APR

- Monthly payment: $515

The calculator shows:

- Total loan payments: $30,900 ($515 x 60 months)

- Total interest paid: $3,900

- Total cost: $35,900

But here’s the key: after five years, you own the car. If the car is worth $15,000 at that point, your net cost is $20,900 ($35,900 – $15,000 resale value).

Comparing the Two

Over three years:

- Lease cost: $15,600

- Buy cost (first 3 years): ~$20,550 (36 payments of $515 + down payment)

At first glance, leasing seems cheaper. But remember—after year three, the lease ends, and you’ll need another car. If you lease again, you’ll start another $350/month payment.

With buying, after year five, you have no more payments. You can drive the car for free (aside from maintenance) or sell it.

The calculator helps you see that while leasing has lower short-term costs, buying may save you money in the long run—especially if you keep the car beyond the loan term.

Tips for Getting the Most Accurate Results

Not all lease vs buy car calculators are created equal. To get reliable results, follow these best practices:

Use Real-World Numbers

Don’t guess. Use actual quotes from dealerships or lenders. Get a firm lease offer or loan pre-approval to input accurate interest rates, down payments, and terms.

Factor in All Costs

Include taxes, registration, documentation fees, and any dealer add-ons. These can significantly impact the total cost.

Estimate Resale Value Realistically

Use resources like Kelley Blue Book or Edmunds to estimate how much your car might be worth in 3–5 years. Be conservative—cars depreciate faster than many people expect.

Consider Your Driving Habits

If you drive more than 15,000 miles a year, leasing could cost you extra in mileage fees. Input your actual annual mileage to see the real impact.

Run Multiple Scenarios

Try different down payments, loan terms, and mileage limits. See how a $2,000 vs. $5,000 down payment changes your monthly payment and total cost.

Don’t Ignore Maintenance and Insurance

While most calculators focus on payments and interest, remember that insurance and repairs differ between new and used cars. Leased cars often require higher coverage, which can increase insurance costs.

Use Reputable Tools

Stick to calculators from trusted sources like Bankrate, Edmunds, NerdWallet, or your bank’s website. Avoid tools with ads or unclear methodology.

Common Mistakes to Avoid When Using a Calculator

Even with the best tools, it’s easy to make errors that skew your results. Here are some common pitfalls:

Ignoring the Residual Value

The residual value—the car’s estimated worth at the end of the lease—is critical. A higher residual means lower lease payments. Make sure you’re using the correct number from the lease quote.

Overestimating Resale Value When Buying

It’s tempting to assume your car will hold its value, but most vehicles lose 20–30% of their value in the first year. Use realistic estimates to avoid overestimating your equity.

Forgetting About Taxes and Fees

Some calculators let you toggle taxes on or off. Always include them—they can add thousands to your total cost.

Comparing Different Timeframes

Don’t compare a 3-year lease to a 5-year loan without adjusting for time. Use the same period (e.g., 36 months) for both options to make a fair comparison.

Not Considering Opportunity Cost

If you put $5,000 down on a car, that money isn’t earning interest in a savings account or investment. Some advanced calculators let you factor in opportunity cost—consider using one if you’re financially savvy.

When to Lease, When to Buy: A Decision Framework

Now that you understand how the calculator works, here’s a simple framework to help you decide:

Lease If:

- You want lower monthly payments.

- You drive less than 12,000 miles per year.

- You enjoy driving a new car every 2–3 years.

- You don’t want to deal with long-term maintenance.

- You can afford the potential fees for excess mileage or wear.

Buy If:

- You plan to keep the car for 5+ years.

- You drive a lot or take frequent road trips.

- You want to build equity and own the vehicle.

- You prefer no mileage restrictions.

- You want to customize or modify the car.

Remember, there’s no one-size-fits-all answer. The lease vs buy car calculator is your best tool for making a personalized, data-driven decision.

Conclusion: Let the Numbers Guide You

Choosing between leasing and buying a car doesn’t have to be overwhelming. With the right information and tools, you can make a confident decision that aligns with your financial goals and lifestyle.

A lease vs buy car calculator removes the guesswork. It shows you the real cost of each option, factoring in payments, interest, fees, and resale value. Whether you’re looking to minimize monthly expenses or build long-term equity, the calculator gives you the clarity you need.

So before you sign any paperwork, take 10 minutes to run the numbers. Try different scenarios. Ask questions. And remember—the cheapest option today isn’t always the best choice tomorrow. Use the calculator to look ahead, not just at your next payment.

Your dream car is out there. Make sure you’re getting it the smart way.

Frequently Asked Questions

What is a lease vs buy car calculator?

A lease vs buy car calculator is an online tool that compares the total cost of leasing a vehicle versus purchasing it over time. It factors in payments, interest, fees, and resale value to help you decide which option is more affordable.

Is it better to lease or buy a car?

It depends on your financial situation and driving habits. Leasing offers lower monthly payments and newer cars, while buying builds equity and offers long-term savings. Use a calculator to compare based on your personal numbers.

Can I use a lease vs buy calculator for used cars?

Most calculators are designed for new cars, but some allow used car inputs. Be sure to adjust the depreciation rate and warranty status for accurate results.

Do lease vs buy calculators include taxes and fees?

Many do, but you may need to enable them in the settings. Always include taxes, registration, and documentation fees for the most accurate comparison.

What happens if I exceed the mileage limit on a lease?

You’ll be charged a per-mile fee, typically $0.10 to $0.25. If you expect to drive more than the limit, buying or choosing a higher-mileage lease may save money.

Can I negotiate lease terms like I do with a car purchase?

Yes. You can negotiate the capitalized cost (price), money factor (interest), and residual value. A lower cap cost and money factor mean lower monthly payments.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.