Leasing a car vs financing comes down to your driving habits, budget, and long-term goals. Leasing offers lower monthly payments and new vehicles every few years, while financing builds equity and gives you ownership. Choose wisely based on your needs.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Leasing a Car vs Financing: Which Is Right for You?

- 4 What Is Leasing a Car?

- 5 What Is Financing a Car?

- 6 Cost Comparison: Leasing vs Financing

- 7 Lifestyle and Usage: Which Option Fits You?

- 8 Hidden Fees and Fine Print

- 9 Making the Right Choice for Your Situation

- 10 Conclusion: Leasing a Car vs Financing—The Final Verdict

- 11 Frequently Asked Questions

Key Takeaways

- Leasing means lower monthly payments: You pay only for the car’s depreciation during the lease term, not the full value.

- Financing builds ownership: Monthly payments go toward owning the car outright, giving you equity and no mileage limits.

- Leasing includes strict mileage limits: Exceeding the limit (usually 10,000–15,000 miles/year) results in hefty per-mile fees.

- Financing has higher monthly costs: You’re paying for the entire vehicle, so payments are typically 20–30% higher than lease payments.

- Leasing offers warranty coverage: Most leases last 2–3 years, so repairs are usually covered under the manufacturer’s warranty.

- Financing allows customization: Once you own the car, you can modify it, sell it, or drive it as much as you want.

- Early termination fees apply to both: Ending a lease or loan early can trigger penalties, so plan carefully.

📑 Table of Contents

- Leasing a Car vs Financing: Which Is Right for You?

- What Is Leasing a Car?

- What Is Financing a Car?

- Cost Comparison: Leasing vs Financing

- Lifestyle and Usage: Which Option Fits You?

- Hidden Fees and Fine Print

- Making the Right Choice for Your Situation

- Conclusion: Leasing a Car vs Financing—The Final Verdict

Leasing a Car vs Financing: Which Is Right for You?

So, you’re in the market for a new car. You’ve narrowed down your choices, taken a few test drives, and now you’re staring at the final decision: should you lease or finance? It’s a question millions of drivers face every year, and the answer isn’t always clear-cut.

At first glance, leasing might seem like the smarter move—lower monthly payments, driving a brand-new car every few years, and minimal repair worries. But financing offers long-term value, ownership, and freedom from restrictions. The truth is, neither option is universally better. It all depends on your lifestyle, financial situation, and how you plan to use your vehicle.

This guide will walk you through the ins and outs of leasing a car vs financing. We’ll break down the costs, benefits, and hidden pitfalls of each path so you can make a confident, informed decision. Whether you’re a daily commuter, a weekend adventurer, or someone who just wants reliable transportation, we’ve got you covered.

What Is Leasing a Car?

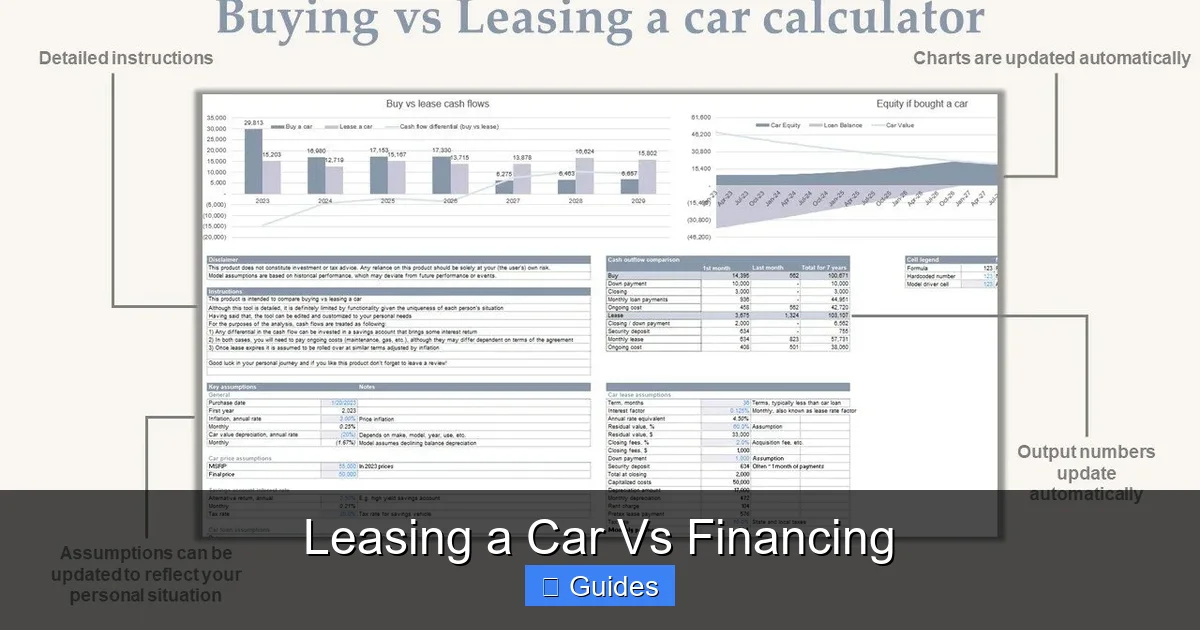

Visual guide about Leasing a Car Vs Financing

Image source: johnleemazda.com

Leasing a car is like renting it for an extended period—typically 24 to 36 months. Instead of buying the vehicle, you pay for its depreciation (the drop in value) during the lease term, plus interest and fees. At the end of the lease, you return the car to the dealership, though some leases offer the option to buy it.

How Leasing Works

When you lease, you agree to a set number of miles per year (usually 10,000 to 15,000), a monthly payment amount, and the condition the car must be in when returned. You’ll also pay an upfront cost, often called a “drive-off fee,” which includes the first month’s payment, taxes, registration, and a security deposit.

For example, let’s say you lease a $35,000 SUV with a 36-month term. The car is expected to lose $15,000 in value over those three years. Your monthly payment will cover that $15,000 depreciation, plus interest (called the “money factor” in leasing terms) and fees. If the money factor is equivalent to a 4% interest rate, your monthly payment might be around $350.

Pros of Leasing

One of the biggest advantages of leasing is affordability. Monthly payments are significantly lower than financing because you’re not paying off the entire car—just the portion that loses value during your lease. This means you can drive a more expensive vehicle for less money.

Leasing also means you’re almost always under warranty. Most new cars come with a 3-year/36,000-mile bumper-to-bumper warranty, so repairs are rarely your problem. Plus, you get to drive a new car every few years with the latest tech, safety features, and styling.

Cons of Leasing

But leasing isn’t perfect. You don’t own the car, so you’re essentially paying to use it—without building any equity. If you drive more than the allowed miles, you’ll face steep penalties (often $0.15 to $0.25 per mile). And if you return the car with excessive wear and tear, you could be charged hundreds or even thousands of dollars.

Another downside? You’re locked into a contract. If your financial situation changes or you need a different type of vehicle, ending the lease early can be costly. And unlike financing, you can’t customize your leased car—no aftermarket parts, no paint jobs, no major modifications.

What Is Financing a Car?

Visual guide about Leasing a Car Vs Financing

Image source: i.etsystatic.com

Financing a car means taking out a loan to purchase it. You make monthly payments over a set period (usually 36 to 72 months), and once the loan is paid off, you own the vehicle outright. This is the traditional path most people think of when buying a car.

How Financing Works

When you finance, the lender (a bank, credit union, or dealership) pays the dealer for the car, and you repay the loan with interest. Your monthly payment includes principal (the amount borrowed) and interest. The longer the loan term, the lower the monthly payment—but the more interest you’ll pay overall.

Let’s use the same $35,000 SUV. If you finance it with a 5-year loan at 5% interest and a $5,000 down payment, your monthly payment would be around $560. Over 60 months, you’d pay about $33,600—meaning you’d pay $3,600 in interest.

Pros of Financing

The biggest benefit of financing is ownership. Once the loan is paid off, the car is yours—no monthly payments, no mileage limits, no return inspections. You can drive it as much as you want, modify it, sell it, or keep it for years.

Financing also builds equity. Unlike leasing, where your money disappears into depreciation, your payments go toward owning an asset. After a few years, you may even have positive equity—meaning the car is worth more than what you owe.

Cons of Financing

But financing has its downsides. Monthly payments are higher than leasing because you’re paying for the entire vehicle. And if you choose a long loan term (like 72 or 84 months), you risk being “upside down”—owing more than the car is worth—especially in the early years.

Maintenance and repairs can also become your responsibility once the warranty expires. And if you sell the car before the loan is paid off, you may not get enough to cover the remaining balance.

Cost Comparison: Leasing vs Financing

Let’s put leasing a car vs financing side by side with real numbers. We’ll compare a $35,000 SUV over three years under both scenarios.

Leasing Costs

– Monthly payment: $350

– Lease term: 36 months

– Total payments: $12,600

– Upfront cost (drive-off fee): $2,500

– Total cost over 3 years: $15,100

– You return the car—no ownership

Financing Costs

– Monthly payment: $560

– Loan term: 60 months (but we’ll look at first 3 years)

– Total payments over 3 years: $20,160

– Down payment: $5,000

– Total cost over 3 years: $25,160

– You own the car after 5 years

At first glance, leasing seems cheaper—$15,100 vs $25,160 over three years. But remember: with leasing, you have nothing to show for it. With financing, you’re building equity. After three years, the car might be worth $20,000, and you’d owe about $15,000 on the loan—giving you $5,000 in equity.

Long-Term Financial Impact

Over time, financing usually costs less. After five years, you own the car outright. If you keep it for another five years (a total of 10), your only costs are maintenance and insurance. With leasing, you’d have paid for three different cars and still own nothing.

But if you prefer driving new cars every few years and can stay within mileage limits, leasing might save you money in the short term. It really depends on your priorities.

Lifestyle and Usage: Which Option Fits You?

Your driving habits and lifestyle play a huge role in deciding between leasing a car vs financing. Let’s look at a few common scenarios.

You Drive a Lot—Financing Is Better

If you commute long distances, road-trip often, or use your car for work, leasing could cost you dearly. Most leases allow only 10,000 to 15,000 miles per year. Exceeding that by just 5,000 miles could add $750 to $1,250 in fees. Financing has no mileage limits—you can drive as much as you want.

You Want a New Car Every Few Years—Leasing Wins

Love having the latest tech, safety features, and styling? Leasing lets you upgrade every 2–3 years without the hassle of selling or trading in. You walk away at the end of the lease and drive off in a new model.

You Plan to Keep the Car Long-Term—Finance It

If you’re the type who keeps cars for 10+ years, financing is the clear winner. You’ll pay more upfront, but you’ll save thousands in the long run by avoiding endless lease payments.

You Want to Customize Your Ride—Finance Only

Want to add a spoiler, upgrade the sound system, or lift your truck? You can’t do that with a leased car. Leasing companies require the vehicle to be returned in near-original condition. Financing gives you full ownership and freedom to modify.

You’re on a Tight Budget—Leasing Might Help

If cash flow is tight, leasing offers lower monthly payments and smaller down payments. This can free up money for other expenses. Just be sure you can stick to the mileage and condition rules.

Hidden Fees and Fine Print

Both leasing and financing come with hidden costs that can catch you off guard. Here’s what to watch for.

Leasing Fees

– **Acquisition fee:** $500–$1,000, charged by the leasing company to set up the contract.

– **Disposition fee:** $300–$500, charged when you return the car.

– **Excess wear and tear:** Scratches, dents, stained upholstery—anything beyond “normal” use can cost you.

– **Early termination fee:** Ending the lease early can cost thousands.

Financing Fees

– **Origination fee:** Some lenders charge a fee to process the loan.

– **Prepayment penalty:** Rare, but some loans charge if you pay off the loan early.

– **Negative equity:** If you trade in a car you still owe on, the remaining balance may be rolled into your new loan, increasing your debt.

Always read the fine print. Ask for a breakdown of all fees before signing. And don’t be afraid to negotiate—especially on the acquisition fee or money factor in a lease.

Making the Right Choice for Your Situation

So, how do you decide between leasing a car vs financing? Start by asking yourself these questions:

– How many miles do I drive per year?

– Do I want to own the car long-term?

– Can I afford higher monthly payments?

– Do I care about driving a new car every few years?

– Am I comfortable with mileage and condition restrictions?

If you answered “yes” to wanting ownership, driving a lot, or keeping the car long-term, financing is likely the better choice. If you prefer lower payments, enjoy new models, and can stay within limits, leasing might be right for you.

Tips for Getting the Best Deal

– **Shop around:** Compare offers from multiple dealerships and lenders.

– **Negotiate the capitalized cost:** In leasing, this is like the purchase price. Lowering it reduces your monthly payment.

– **Put money down:** A larger down payment lowers monthly costs for both leasing and financing.

– **Check your credit:** Better credit means lower interest rates.

– **Read the contract carefully:** Make sure you understand all terms, fees, and penalties.

Conclusion: Leasing a Car vs Financing—The Final Verdict

There’s no one-size-fits-all answer to leasing a car vs financing. Both options have their place, depending on your financial goals, driving habits, and lifestyle.

Leasing is ideal if you want lower monthly payments, enjoy driving new cars, and can stick to mileage and condition rules. It’s a great way to experience luxury vehicles without the high price tag—but remember, you’re not building any equity.

Financing is better if you plan to keep the car long-term, drive a lot, or want the freedom to customize and sell it. Yes, payments are higher, but you’ll own the car outright after the loan is paid off—and that’s a powerful financial advantage.

The key is to be honest about your needs and do the math. Crunch the numbers for both options over 3, 5, and 10 years. Consider your budget, your driving patterns, and your long-term goals.

And don’t forget: you can always change your mind later. Many people start with a lease and switch to financing when they’re ready to own. Or they finance a car and lease the next one. The choice is yours—just make sure it’s an informed one.

Whichever path you choose, drive smart, drive safe, and enjoy the ride.

Frequently Asked Questions

Is it better to lease or finance a car?

It depends on your needs. Leasing offers lower payments and new cars every few years, while financing builds ownership and is cheaper long-term. Choose based on your budget, mileage, and goals.

Can you negotiate a lease?

Yes! You can negotiate the capitalized cost (similar to the purchase price), money factor (interest rate), and fees. Always ask for a breakdown and compare offers.

What happens at the end of a lease?

You return the car to the dealership. They’ll inspect it for excess wear and mileage. If everything’s in order, you walk away—or you can buy the car at its residual value.

Can you pay off a lease early?

Yes, but it often comes with a penalty. The cost usually equals the remaining payments plus fees. Check your contract before making early payments.

Do you build equity when leasing?

No. Leasing means you’re paying to use the car, not own it. You don’t build equity—your money goes toward depreciation, interest, and fees.

Is it bad to finance a car for 72 months?

It can be. While lower monthly payments sound great, long loans mean more interest and a higher risk of being upside down (owing more than the car is worth). Aim for 60 months or less if possible.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.