Choosing between leasing or buying a car depends on your financial goals, driving habits, and lifestyle needs. This guide breaks down the pros and cons of each option, helping you decide whether to drive off with ownership or enjoy lower monthly payments with a lease.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Leasing or Buying a Car: Which Is Right for You?

- 4 Understanding Car Leasing

- 5 Understanding Car Buying

- 6 Cost Comparison: Leasing vs. Buying

- 7 Lifestyle and Driving Habits Matter

- 8 Tips for Making the Right Choice

- 9 Conclusion: Leasing or Buying a Car?

- 10 Frequently Asked Questions

Key Takeaways

- Leasing offers lower monthly payments: You pay only for the vehicle’s depreciation during the lease term, not the full price, resulting in smaller monthly costs.

- Buying builds equity over time: Once you pay off your loan, you own the car outright and can sell it or keep it without monthly payments.

- Leases come with mileage and wear restrictions: Exceeding limits can result in hefty fees, so leasing suits predictable, lower-mileage drivers.

- Buying allows full customization and long-term use: You can modify your vehicle, drive as much as you want, and keep it for years after the loan ends.

- Maintenance costs differ significantly: Leased cars are typically under warranty, while owned vehicles may require out-of-pocket repairs as they age.

- Down payments and credit matter for both: A strong credit score and larger down payment can lower monthly costs whether you lease or buy.

- Your lifestyle should guide your decision: Frequent upgraders may prefer leasing; those seeking long-term value often choose to buy.

📑 Table of Contents

Leasing or Buying a Car: Which Is Right for You?

So you’re in the market for a new car. Congratulations! But before you start test-driving your dream ride, there’s a big decision to make: should you lease or buy? It’s not just about what looks good in the driveway—it’s about what fits your budget, lifestyle, and long-term goals.

Leasing and buying each come with their own set of advantages and trade-offs. Leasing often means lower monthly payments and the thrill of driving a new car every few years. Buying, on the other hand, gives you ownership, freedom, and the satisfaction of paying off a major asset. But which path is smarter for your situation? The answer isn’t one-size-fits-all. It depends on how you drive, how long you plan to keep a car, and how you handle money.

In this guide, we’ll walk you through everything you need to know about leasing or buying a car. We’ll compare costs, explore the fine print, and help you weigh the pros and cons so you can make a confident, informed decision. Whether you’re a first-time buyer or a seasoned car owner, this breakdown will give you the clarity you need to choose wisely.

Understanding Car Leasing

Let’s start with leasing—what it is, how it works, and who it’s best for. Simply put, leasing a car is like renting it for a long period, usually two to four years. You don’t own the vehicle, but you get to drive it as if it were yours. At the end of the lease term, you return the car to the dealership (or sometimes have the option to buy it).

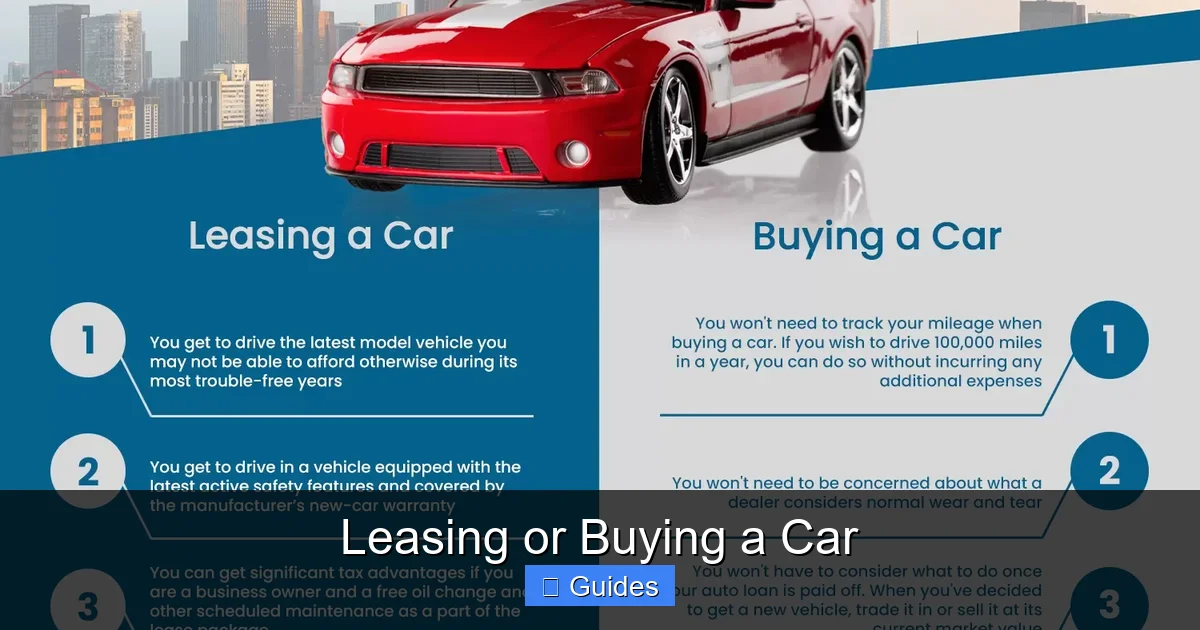

Visual guide about Leasing or Buying a Car

Image source: workinghomeguide.com

How Leasing Works

When you lease, you’re essentially paying for the car’s depreciation during your lease period, plus interest and fees. For example, if a $30,000 car is expected to be worth $18,000 after three years, you’ll pay for that $12,000 drop in value, spread out over 36 monthly payments. Add in a money factor (similar to an interest rate), acquisition fees, and other charges, and you’ve got your monthly lease payment.

Most leases also require a down payment, often called a “cap cost reduction,” though some dealers offer $0-down leases. You’ll also agree to a set number of miles per year—typically 10,000, 12,000, or 15,000. Drive more than that, and you’ll pay extra per mile. And yes, there are rules about how you treat the car: excessive wear and tear can lead to additional charges at return time.

Pros of Leasing

One of the biggest draws of leasing is lower monthly payments. Since you’re not paying off the entire value of the car, your payments are usually 20% to 40% lower than a loan payment for the same vehicle. That means you could drive a more expensive or higher-trim model for the same monthly cost as a cheaper car you’d buy.

Leasing also means you’re almost always driving a car under warranty. Most leases last three years, and new cars typically come with three years of bumper-to-bumper coverage. That means if something breaks, the manufacturer covers it—no surprise repair bills. Plus, you get to drive a new car every few years, which some people love for the latest tech, safety features, and style.

Cons of Leasing

But leasing isn’t all smooth driving. For starters, you never own the car. You’re essentially making payments forever if you keep leasing. And those mileage limits? They can be a real pain if your job changes or you suddenly start road-tripping more. Go over by even a few thousand miles, and you could owe hundreds or even thousands in excess mileage fees.

There’s also the issue of wear and tear. While normal use is expected, anything beyond that—like deep scratches, stained upholstery, or dented bumpers—can cost you at the end of the lease. And if you want to get out of your lease early, it can be expensive. Early termination fees, payoff amounts, and potential penalties can add up fast.

Understanding Car Buying

Now let’s flip the script and talk about buying. When you buy a car—whether with cash or a loan—you’re purchasing it outright (or financing the purchase with the goal of owning it). Once the loan is paid off, the car is 100% yours. No mileage limits, no return inspections, no monthly payments.

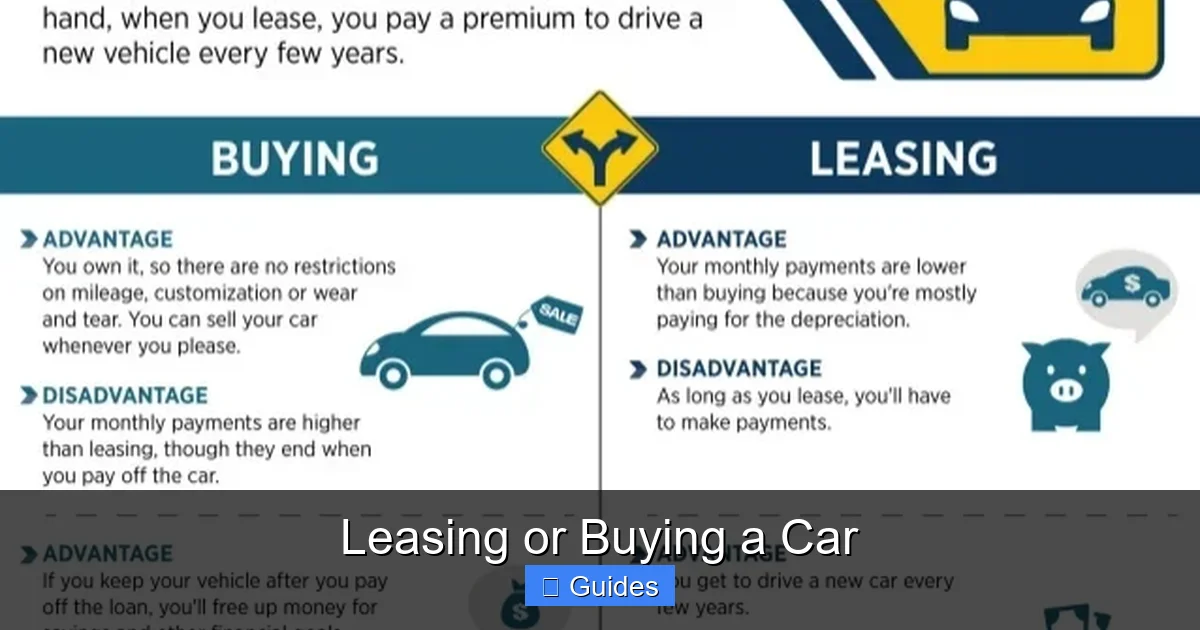

Visual guide about Leasing or Buying a Car

Image source: eautolease.com

How Buying Works

Buying a car usually involves a down payment, a loan, and monthly payments that cover the full cost of the vehicle plus interest. Let’s say you buy that same $30,000 car with a $6,000 down payment and a 5-year loan at 5% interest. Your monthly payment might be around $450. After 60 months, you own the car free and clear.

You can buy new or used. New cars come with the latest features and full warranties, but they depreciate quickly—losing up to 20% of their value the moment you drive them off the lot. Used cars cost less upfront and depreciate more slowly, but may come with higher maintenance costs and shorter warranties.

Pros of Buying

The biggest advantage of buying is ownership. Once your loan is paid off, you have a valuable asset with no monthly payments. You can keep the car for 10 years, 15 years, or even longer—many modern cars are built to last well beyond 200,000 miles with proper care.

Buying also gives you complete freedom. Want to paint your car purple? Go for it. Need to drive 25,000 miles a year for work? No problem. You can modify it, use it for rideshare, or even sell it privately for cash. There are no restrictions on how you use or treat your vehicle.

Cons of Buying

Of course, buying isn’t perfect. Monthly payments are higher than leasing, especially for new cars. And once the warranty expires, you’re on the hook for all repairs. A transmission failure or engine issue in year six could cost thousands—money you’ll have to pay out of pocket.

There’s also the matter of depreciation. That $30,000 car might be worth only $18,000 after three years, and $10,000 after six. If you sell it, you might not get back what you paid. And if you finance, you could end up “upside down” on your loan—owing more than the car is worth—especially in the early years.

Cost Comparison: Leasing vs. Buying

Now let’s get into the numbers. Which option is cheaper in the long run? The answer depends on how long you plan to keep the car and how much you drive.

Visual guide about Leasing or Buying a Car

Image source: image.slidesharecdn.com

Short-Term Costs (1–4 Years)

In the short term, leasing usually wins on affordability. Monthly payments are lower, and you’re often driving a newer, more reliable car under warranty. For example, leasing a $35,000 SUV might cost $350/month, while buying the same vehicle could cost $550/month. That’s a $200 difference each month—$2,400 per year.

But remember: with leasing, you’re not building equity. You’re paying to use the car, not own it. So after three years, you have nothing to show for your $12,600 in payments except great memories and a shiny new ride.

Long-Term Costs (5+ Years)

Over five years or more, buying often becomes the better financial choice. Yes, your monthly payments are higher, but once the loan is paid off, you own the car. No more payments. No more interest. Just free transportation.

Let’s say you buy that $30,000 car with a $6,000 down payment and a 5-year loan. After 60 months, you’ve paid $33,000 total (including interest). But now you own a car that might still be worth $12,000–$15,000. If you keep it for another five years, your cost per mile drops dramatically.

In contrast, if you lease the same car for three years, return it, and lease another, you’re back to square one—paying $350/month with no equity. Over 10 years, that’s $42,000 in lease payments with zero ownership.

Hidden Costs to Consider

Both leasing and buying come with hidden fees. Leases often include acquisition fees ($500–$1,000), disposition fees ($300–$500 at return), and potential excess wear charges. Buying may involve higher interest rates if your credit isn’t perfect, plus registration, taxes, and insurance costs.

And don’t forget maintenance. Leased cars are usually under warranty, so repairs are covered. But owned cars—especially older ones—can require costly fixes. A $2,000 transmission repair in year seven can really sting if you’re not prepared.

Lifestyle and Driving Habits Matter

Your personal situation plays a huge role in whether leasing or buying makes more sense. Let’s look at a few real-world examples.

Example 1: The Commuter

Sarah drives 12,000 miles a year for her job. She likes having a reliable, safe car with the latest tech. She plans to upgrade every three or four years. For Sarah, leasing is a great fit. She gets low monthly payments, stays under warranty, and can drive a new car every few years without the hassle of selling.

Example 2: The Road Warrior

Mike is a sales rep who drives 25,000 miles a year. He needs a dependable car but doesn’t care about having the latest model. For Mike, buying a used car with good fuel economy makes more sense. He can drive as much as he wants, avoid mileage penalties, and keep the car long after the loan is paid off.

Example 3: The Budget-Conscious Family

The Johnsons have two kids and a tight budget. They want a safe, spacious SUV but can’t afford high monthly payments. They’re considering leasing a new model with low payments and full warranty coverage. But they’re also looking at certified pre-owned SUVs that cost less upfront and could be paid off in four years. If they plan to keep the car long-term, buying used might save them thousands.

Example 4: The Tech Enthusiast

Alex loves new gadgets and wants the latest infotainment system, driver-assist features, and electric vehicle tech. He doesn’t mind making payments forever as long as he’s always driving something cutting-edge. For Alex, leasing is ideal—he can upgrade every three years and enjoy the newest innovations without the risk of rapid depreciation.

Tips for Making the Right Choice

Still unsure? Here are some practical tips to help you decide between leasing or buying a car.

1. Know Your Driving Habits

How many miles do you drive per year? If it’s under 12,000, leasing might work. If it’s over 15,000, buying is usually better. Also consider job stability—will your commute change?

2. Check Your Credit Score

A good credit score (670 or higher) can get you lower interest rates on loans and better lease terms. If your score is low, you might face higher payments either way—so consider improving it before you shop.

3. Compare Total Costs Over 5–7 Years

Don’t just look at monthly payments. Calculate the total cost of leasing (including fees and potential excess charges) versus buying (including depreciation, repairs, and resale value). Use online calculators to help.

4. Consider Resale Value

Some cars hold their value better than others. Brands like Toyota, Honda, and Subaru depreciate slowly, making them great buys. Luxury brands like BMW and Mercedes lose value fast—better for leasing.

5. Negotiate the Price

Whether you lease or buy, always negotiate the vehicle’s price. A lower price means lower monthly payments and less depreciation. Don’t focus only on the monthly payment—dealers can stretch out terms to hide a high price.

6. Read the Fine Print

Lease agreements are full of details. Understand the mileage limits, wear-and-tear guidelines, early termination fees, and purchase option at the end. For loans, check the interest rate, prepayment penalties, and total cost.

Conclusion: Leasing or Buying a Car?

So, should you lease or buy? There’s no universal answer—only the one that fits your life. If you value lower payments, enjoy driving new cars, and don’t mind never owning, leasing could be your best bet. But if you want to build equity, drive a lot, or keep your car for the long haul, buying is likely the smarter move.

The key is to look beyond the monthly payment and think about your long-term financial picture. Consider your driving habits, budget, and goals. Do the math. Talk to a financial advisor if needed. And remember: the best car decision isn’t the flashiest one—it’s the one that keeps you happy, safe, and financially sound for years to come.

Frequently Asked Questions

Is it better to lease or buy a car?

It depends on your financial situation and lifestyle. Leasing offers lower monthly payments and the chance to drive a new car every few years, while buying builds equity and saves money in the long run if you keep the car for many years.

Can you negotiate a car lease?

Yes, you can negotiate the price of the car, the money factor (interest rate), and other terms just like when buying. A lower price means lower monthly payments and less depreciation cost.

What happens at the end of a car lease?

At the end of the lease, you return the car to the dealership. You may be charged for excess mileage or wear and tear. Some leases offer the option to buy the car at its residual value.

Is it cheaper to lease or buy a used car?

Buying a used car is often cheaper in the long run because you avoid the steep depreciation of new cars and can keep it long after the loan is paid off. Leasing used cars is less common and may not offer the same benefits as leasing new.

Can you get out of a car lease early?

Yes, but it usually involves paying an early termination fee and possibly the remaining payments. Some dealers allow lease transfers, where another person takes over your payments.

Do you pay sales tax when leasing a car?

Yes, but how it’s applied varies by state. Some states charge sales tax on the full price of the car, while others tax only the monthly payments. Check your local laws to understand the cost.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.