Leasing a car offers lower monthly payments and access to newer models, but comes with mileage limits and no ownership. Understanding the pros and cons to leasing a car helps you make a smart, informed decision based on your driving habits and financial goals.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Introduction: Is Leasing a Car Right for You?

- 4 What Is Car Leasing? A Simple Breakdown

- 5 Top Pros to Leasing a Car

- 6 Top Cons to Leasing a Car

- 7 Who Should Lease a Car? Ideal Candidates

- 8 Tips for Getting the Best Lease Deal

- 9 Conclusion: Weighing the Pros and Cons to Leasing a Car

- 10 Frequently Asked Questions

Key Takeaways

- Lower monthly payments: Lease payments are typically 30-50% less than loan payments for the same vehicle, freeing up cash for other expenses.

- Drive a new car every few years: Most leases last 24 to 36 months, letting you upgrade to the latest tech, safety, and design features regularly.

- Warranty coverage included: Most leased cars are under manufacturer warranty, reducing repair costs during the lease term.

- Mileage restrictions apply: Standard leases allow 10,000–15,000 miles per year; exceeding this incurs costly per-mile fees.

- No equity or ownership: You don’t build equity, and must return the car (or buy it) at lease end—no long-term asset value.

- Fees and penalties for wear and tear: Excessive damage or modifications can result in end-of-lease charges, so maintenance matters.

- Ideal for predictable drivers: Leasing works best for those with stable commutes and no plans to customize or keep a car long-term.

📑 Table of Contents

Introduction: Is Leasing a Car Right for You?

Thinking about getting a new car? You’ve probably heard the word “lease” thrown around—maybe a friend bragged about driving a luxury SUV for half the price of buying, or a dealership offered you a “low monthly payment” deal. But what does leasing really mean, and is it the right move for you?

At its core, leasing a car is like renting it for a long period—typically two to three years. Instead of buying the vehicle outright, you pay for its depreciation during the lease term, plus fees and interest. At the end, you return the car (unless you choose to buy it). It’s not ownership, but it can feel close—especially when you’re behind the wheel of a shiny new ride with the latest tech.

But here’s the catch: leasing isn’t for everyone. While it offers some serious perks—like lower payments and the thrill of driving something new—it also comes with strings attached. Mileage limits, wear-and-tear rules, and the fact that you’ll never actually own the car are real drawbacks. So before you sign on the dotted line, it’s crucial to weigh the pros and cons to leasing a car carefully.

In this guide, we’ll walk you through everything you need to know. From cost savings and convenience to hidden fees and long-term value, we’ll break down the leasing experience in plain English. Whether you’re a first-time lessee or just comparing options, this article will help you decide if leasing fits your lifestyle, budget, and driving habits.

What Is Car Leasing? A Simple Breakdown

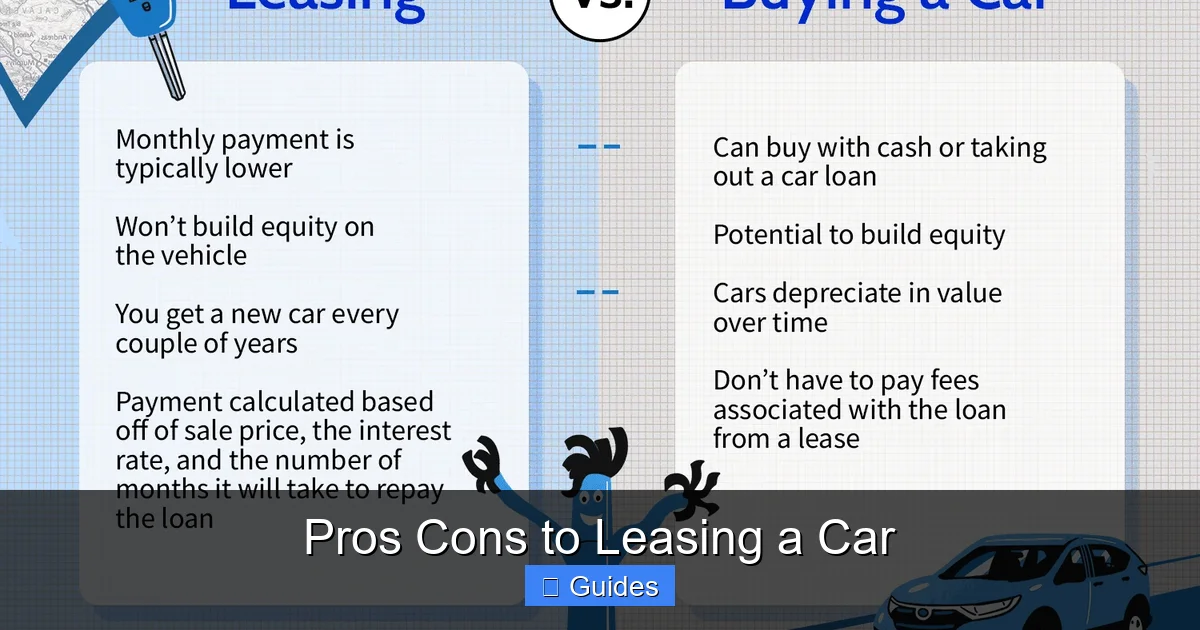

Visual guide about Pros Cons to Leasing a Car

Image source: i.pinimg.com

Before diving into the pros and cons to leasing a car, let’s make sure we’re on the same page about what leasing actually means.

When you lease a car, you’re essentially entering into a contract with a leasing company (often the car manufacturer’s finance arm) to use a vehicle for a set period—usually 24, 36, or 48 months. You make monthly payments based on the car’s expected depreciation during that time, plus interest (called the “money factor”) and fees. At the end of the lease, you return the car, though you may have the option to buy it at a pre-set price (the “residual value”).

Think of it like leasing an apartment: you pay to live there for a while, but you don’t own it. You follow rules (no pets, no painting the walls), and when the lease ends, you move out—unless you negotiate to stay or buy the place.

How Leasing Differs from Buying

The biggest difference between leasing and buying is ownership. When you buy a car—with cash or a loan—you own it once the loan is paid off. You can drive it as much as you want, modify it, sell it, or keep it for 10+ years. With leasing, you’re only paying for the car’s value loss during the lease term. You don’t own it, and you must return it in good condition.

Another key difference? Upfront costs. Leases often require a “down payment” (called a capitalized cost reduction), but it’s usually smaller than a traditional car down payment. You might also pay first month’s rent, security deposit, acquisition fee, and other charges—but overall, initial costs are typically lower than buying.

Common Lease Terms You Should Know

To understand the pros and cons to leasing a car, you need to know the lingo:

– Lease Term: How long you’ll have the car (e.g., 36 months).

– Monthly Payment: Based on depreciation, interest, and fees.

– Mileage Allowance: How many miles you can drive per year (usually 10,000–15,000).

– Residual Value: The car’s estimated worth at lease end.

– Capitalized Cost: The negotiated price of the car (like the purchase price).

– Money Factor: The lease’s interest rate (multiply by 2,400 to get an approximate APR).

– Disposition Fee: Charged when you return the car (often $300–$500).

Knowing these terms helps you compare lease offers and avoid surprises.

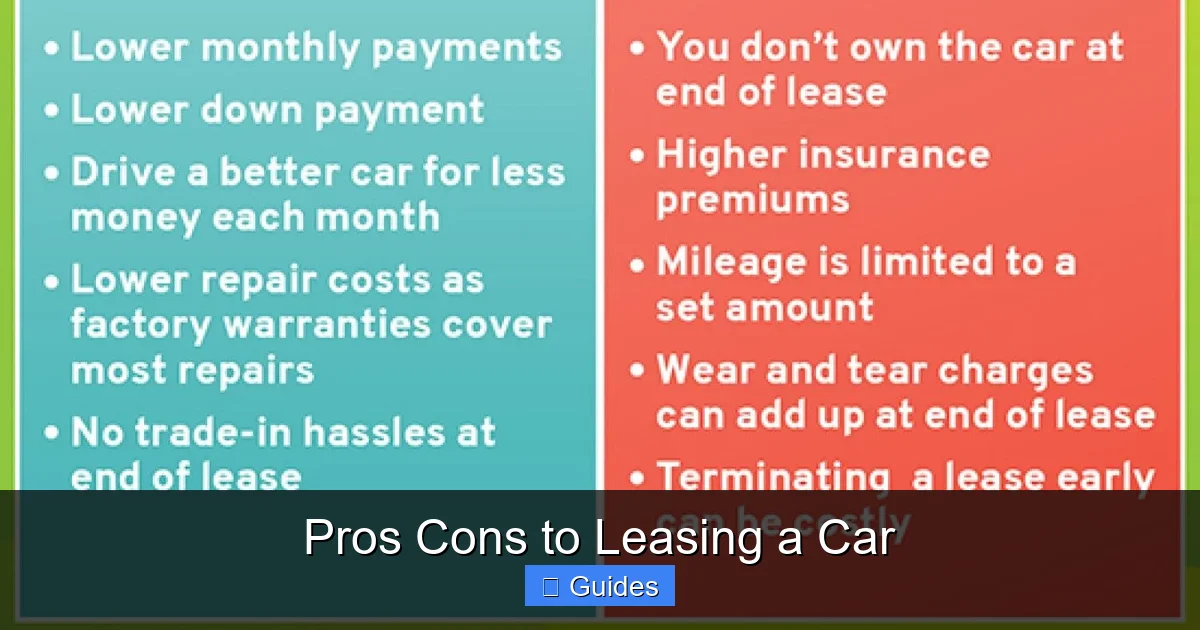

Top Pros to Leasing a Car

Now that you understand the basics, let’s explore the advantages. For many drivers, leasing offers a smart, flexible way to enjoy a new car without the long-term commitment of ownership.

1. Lower Monthly Payments

One of the biggest draws of leasing is affordability. Because you’re only paying for the car’s depreciation during the lease term—not the full value—your monthly payments are significantly lower than if you financed the same car.

For example, a $40,000 SUV might cost $600/month to finance over 60 months. But lease the same SUV for 36 months, and your payment could drop to $350–$400/month. That’s a savings of $200+ per month—money you can put toward savings, travel, or other goals.

This lower payment also means you can afford a higher-end model or trim level. Want leather seats, a sunroof, and advanced safety features? Leasing makes luxury more accessible.

2. Drive a New Car Every Few Years

Love having the latest tech, safety features, and design? Leasing lets you upgrade every 2–4 years. Most leases run 24 to 36 months, so you’re always driving something fresh.

Imagine getting a new infotainment system with Apple CarPlay and Android Auto, adaptive cruise control, or a hybrid powertrain—without waiting a decade. For tech-savvy drivers or those who simply enjoy change, this is a major perk.

Plus, you avoid the hassle of selling or trading in an old car. Just return the leased vehicle and walk away (or lease a new one).

3. Lower Repair Costs and Warranty Coverage

Most leased cars are under the manufacturer’s warranty for the entire lease term. That means if something breaks—like the transmission, engine, or electrical system—you’re covered. No surprise repair bills.

This is a huge advantage over buying a used car or keeping a vehicle past its warranty. With leasing, you’re protected against major mechanical issues, giving you peace of mind.

Some leases even include maintenance packages (like Toyota Care or Honda Care), covering oil changes, tire rotations, and inspections. While not standard, these can save you time and money.

4. Minimal Down Payment and Tax Benefits

Leases often require little or no down payment. Some deals advertise “$0 down,” though you’ll still pay fees and the first month’s payment. This makes leasing attractive if you want to preserve cash or invest elsewhere.

Also, in some states, you only pay sales tax on the monthly lease payments—not the full car price. For example, if you lease a $50,000 car in a state with 6% sales tax, you pay tax on $400/month, not $50,000. That can save hundreds or even thousands over the lease term.

Business owners may also deduct lease payments as a business expense, further reducing costs.

5. No Resale Hassle

Selling a car privately is time-consuming. You have to clean it, take photos, list it online, meet buyers, and handle paperwork. With leasing, you skip all that. At the end of the term, you return the car to the dealership—no haggling, no waiting.

Even if the car is worth less than expected (a risk when buying), you’re not on the hook. The leasing company absorbs the depreciation risk.

Top Cons to Leasing a Car

While leasing has clear benefits, it’s not a perfect solution. Several drawbacks can make it a poor fit for certain drivers. Let’s look at the downsides.

1. No Ownership or Equity

The biggest con? You don’t own the car. After 36 months of payments, you return it—no asset to show for your investment. Unlike buying, where you build equity and can sell the car later, leasing gives you nothing tangible.

This can feel like “throwing money away,” especially if you keep leasing forever. Over 10 years, you might pay $30,000 in lease payments with zero ownership. That’s a hard pill to swallow for some.

2. Mileage Restrictions and Fees

Most leases limit you to 10,000–15,000 miles per year. Drive more? You’ll pay 10–25 cents per extra mile. For example, if you drive 18,000 miles in a year on a 12,000-mile lease, that’s 6,000 extra miles at 15 cents each—$900 in fees.

This makes leasing risky for frequent travelers, road-trippers, or those with long commutes. If your driving habits change mid-lease (e.g., a new job across town), you could face steep penalties.

Some leases offer higher mileage limits (e.g., 20,000 miles/year), but they cost more upfront. Still, it’s hard to predict future needs.

3. Wear and Tear Charges

Leased cars must be returned in “normal” condition. That means no excessive dents, scratches, stains, or modifications. The leasing company will inspect the car and charge for any damage beyond “wear and tear.”

For example, a large dent might cost $500 to repair, while a torn seat could be $300. Even small things—like a cracked windshield or faded paint—can add up.

This encourages careful driving and maintenance, but it also means you can’t personalize the car (e.g., custom paint, aftermarket wheels). And if you have kids or pets, keeping the interior pristine can be a challenge.

4. Early Termination Fees

Need to get out of your lease early? It’s possible, but costly. Most leases charge an early termination fee—often thousands of dollars—plus any remaining payments.

Some companies offer lease transfer programs (letting someone else take over your payments), but they’re not always available. And the new lessee must qualify financially.

This lack of flexibility is a major downside if your life changes—like moving, job loss, or family growth.

5. Higher Long-Term Costs

While monthly payments are lower, leasing can cost more over time—especially if you lease repeatedly. You’re always making payments, never owning. In contrast, buying a car and keeping it for 8–10 years means no payments after the loan ends.

For example:

– Lease a car for 3 years: $400/month = $14,400

– Buy the same car: $500/month for 5 years = $30,000, then own it outright

After 8 years, the buyer has no payments; the lessee has paid $38,400 and owns nothing.

If you prefer long-term savings, buying may be better.

Who Should Lease a Car? Ideal Candidates

Leasing isn’t for everyone—but for the right person, it’s a great fit. Here’s who benefits most:

Business Professionals and Executives

If you drive a company car or use your vehicle for work, leasing offers tax advantages and image benefits. You can drive a luxury sedan or SUV without the high cost of ownership, and deduct payments as a business expense (consult a tax pro).

Tech Enthusiasts and Early Adopters

Love new features? Leasing lets you enjoy the latest infotainment, safety, and performance tech every few years. No waiting for a car to depreciate before upgrading.

Low-Mileage Drivers

If you drive under 12,000 miles per year and have a predictable commute, leasing avoids mileage penalties. City dwellers, remote workers, and retirees often fit this profile.

Those Who Prefer Lower Monthly Payments

If cash flow is tight or you want to preserve savings, leasing frees up money for investments, emergencies, or lifestyle expenses.

People Who Don’t Want to Sell Cars

If the idea of listing, showing, and negotiating a car sale sounds stressful, leasing eliminates that hassle.

Tips for Getting the Best Lease Deal

If you decide leasing is right for you, follow these tips to maximize value and avoid pitfalls.

Negotiate the Capitalized Cost

Just like buying, the car’s price (capitalized cost) is negotiable. Research the invoice price and aim to lease at or below it. A lower cost means lower payments.

Watch the Money Factor

The money factor is the lease’s interest rate. Ask for it in APR form (multiply by 2,400). Compare it to current auto loan rates. If it’s high, consider a different lender.

Choose the Right Mileage Limit

Estimate your annual mileage honestly. If you’re close to the limit, pay for extra miles upfront—it’s cheaper than per-mile fees later.

Skip Unnecessary Add-Ons

Dealers may push gap insurance, maintenance packages, or tire protection. Some are useful (gap insurance covers lease payoff if the car is totaled), but others are overpriced. Read the fine print.

Inspect the Car at Return

Before returning the car, do a walk-around with the dealer. Take photos. Dispute any unfair wear-and-tear charges.

Conclusion: Weighing the Pros and Cons to Leasing a Car

So, should you lease a car? The answer depends on your priorities.

If you value lower payments, new technology, and hassle-free upgrades—and you drive responsibly within mileage limits—leasing can be a smart, convenient choice. It’s ideal for professionals, low-mileage drivers, and anyone who enjoys driving something fresh every few years.

But if you drive a lot, want to customize your car, or prefer building equity over time, buying might be better. Leasing doesn’t offer ownership, and long-term costs can add up.

Ultimately, the pros and cons to leasing a car come down to lifestyle and financial goals. Take time to assess your driving habits, budget, and long-term plans. Run the numbers. Compare lease offers. And don’t rush the decision.

When done right, leasing can be a win-win: you get a great car with minimal stress, and you keep more cash in your pocket. Just remember—every mile, every scratch, and every payment counts. Make sure leasing aligns with your life, not just your lifestyle.

Frequently Asked Questions

Can I lease a used car?

Yes, some dealerships and leasing companies offer certified pre-owned (CPO) vehicles for lease. These are typically 1–3 years old with low mileage and full warranty coverage. Leasing a used car can offer even lower payments, but availability is limited.

What happens if I go over my mileage limit?

If you exceed your annual mileage allowance, you’ll be charged a per-mile fee—usually 10–25 cents—at lease end. For example, driving 18,000 miles on a 12,000-mile lease could cost $900 in penalties. Some leases allow you to buy extra miles upfront at a lower rate.

Can I buy my leased car at the end of the lease?

Yes, most leases include a purchase option. You can buy the car at its residual value (pre-set in the contract). This is a good idea if the car is in great condition and the price is fair compared to market value.

Is leasing cheaper than buying in the long run?

Not necessarily. While monthly payments are lower, you never build equity. If you lease repeatedly, you’ll always have car payments. Buying and keeping a car for 8–10 years often costs less over time, especially after the loan is paid off.

Do I need gap insurance when leasing?

Most lease contracts include gap coverage automatically. This pays the difference between the car’s value and the lease balance if it’s totaled or stolen. Check your lease agreement—gap insurance is usually included, but confirm to avoid surprises.

Can I transfer my lease to someone else?

Some leasing companies allow lease transfers, where another qualified person takes over your payments. This can help you exit early, but fees and approval are required. Not all leases permit transfers, so check your contract.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.