Buying a car or house first depends on your financial situation, lifestyle, and long-term goals. While a home builds equity and offers stability, a car provides immediate mobility—especially if you live in an area with poor public transit. Weigh your priorities, budget, and future plans before making this big decision.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Should I Buy a Car or House First? A Smart Guide to Your Next Big Purchase

- 4 Understanding Your Financial Readiness

- 5 The Case for Buying a House First

- 6 The Case for Buying a Car First

- 7 Lifestyle and Location Matter

- 8 Financial Strategies to Prepare for Either Purchase

- 9 When to Consider Buying Both—or Neither

- 10 Conclusion: Make the Choice That Fits Your Life

- 11 Frequently Asked Questions

- 11.1 Should I buy a car or house first if I have bad credit?

- 11.2 Can I buy a house if I still have a car payment?

- 11.3 Is it better to buy a new or used car first?

- 11.4 How much should I save before buying a house?

- 11.5 Can I get a mortgage if I don’t have a car?

- 11.6 What if I move frequently for work?

Key Takeaways

- Assess your financial readiness: Before buying anything, ensure you have stable income, an emergency fund, and manageable debt.

- Housing builds long-term wealth: A home is typically a long-term investment that can appreciate in value and offer tax benefits.

- A car offers immediate utility: If you need reliable transportation for work or family, a car may be a practical first purchase.

- Consider location and lifestyle: Urban dwellers with good transit may prioritize a house, while rural residents often need a car first.

- Down payments matter: A house requires a larger down payment (usually 10–20%), while cars need less upfront but depreciate quickly.

- Credit score impacts both: A strong credit score helps you secure better interest rates on both auto and home loans.

- Timing and market conditions count: Research local housing and auto markets to avoid overpaying during peak seasons.

📑 Table of Contents

- Should I Buy a Car or House First? A Smart Guide to Your Next Big Purchase

- Understanding Your Financial Readiness

- The Case for Buying a House First

- The Case for Buying a Car First

- Lifestyle and Location Matter

- Financial Strategies to Prepare for Either Purchase

- When to Consider Buying Both—or Neither

- Conclusion: Make the Choice That Fits Your Life

Should I Buy a Car or House First? A Smart Guide to Your Next Big Purchase

So, you’ve saved up some money, and now you’re staring at two big-ticket items: a car and a house. Both are exciting, both are expensive, and both come with long-term commitments. But which one should you buy first?

It’s a question that stumps many young professionals, growing families, and first-time buyers. The truth is, there’s no one-size-fits-all answer. The right choice depends on your personal circumstances, financial health, lifestyle needs, and long-term goals. Some people swear by buying a house first to start building equity. Others argue that without reliable transportation, owning a home—especially in the suburbs—isn’t practical.

In this guide, we’ll walk you through the key factors to consider when deciding whether to buy a car or house first. We’ll break down the financial implications, lifestyle impacts, and strategic advantages of each option. By the end, you’ll have a clearer picture of what makes the most sense for you—and how to prepare for whichever path you choose.

Understanding Your Financial Readiness

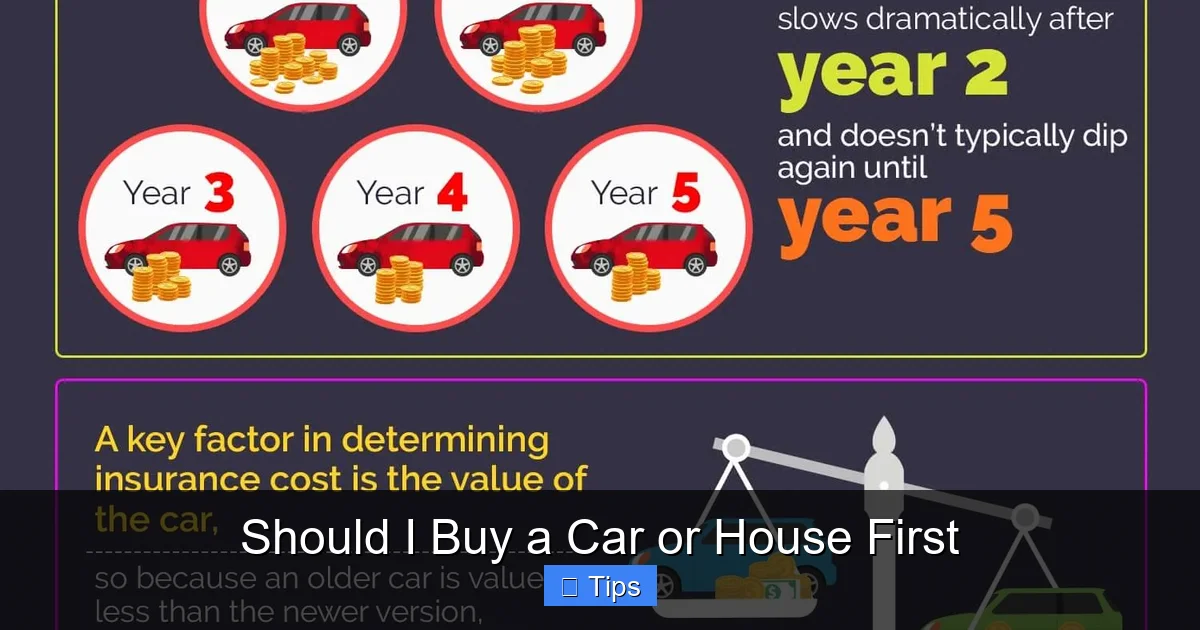

Visual guide about Should I Buy a Car or House First

Image source: infographicjournal.com

Before you even think about signing a contract or driving off in a new vehicle, take a hard look at your financial foundation. Buying a car or house is a major commitment, and rushing in without preparation can lead to stress, debt, and regret.

Do You Have Stable Income?

First and foremost, ask yourself: Is your income steady and reliable? Lenders want to see consistent earnings before approving a mortgage or auto loan. If you’re between jobs, freelancing without a track record, or relying on gig work, it might be wise to wait.

For a house, most lenders prefer at least two years of stable employment in the same field. For a car loan, one year of steady income is often enough—but the higher the loan amount, the stricter the requirements.

Emergency Fund: Are You Covered?

Life happens. Cars break down. Roofs leak. Medical bills pop up. That’s why having an emergency fund is non-negotiable before making a big purchase.

Aim to save three to six months’ worth of living expenses in a high-yield savings account. This cushion protects you from dipping into your down payment or missing loan payments if unexpected costs arise.

For example, if your monthly expenses are $3,000, you’ll want $9,000 to $18,000 saved. Without this safety net, buying a house or car could leave you financially vulnerable.

Debt-to-Income Ratio: Are You Overextended?

Your debt-to-income (DTI) ratio is a key metric lenders use to assess your ability to manage payments. It’s calculated by dividing your total monthly debt payments by your gross monthly income.

Most mortgage lenders prefer a DTI below 43%, though some may accept up to 50% with strong credit. Auto lenders are a bit more lenient, but high DTI can still lead to higher interest rates or loan denial.

Let’s say you earn $5,000 per month and pay $1,500 in rent, $300 for student loans, and $200 for credit cards. Your DTI is 40% ($2,000 ÷ $5,000). That’s manageable. But if you add a $400 car payment, it jumps to 48%—pushing the limit for a mortgage.

Before buying a car or house, pay down high-interest debt and avoid taking on new obligations.

The Case for Buying a House First

Visual guide about Should I Buy a Car or House First

Image source: c8.alamy.com

For many people, buying a home is the ultimate financial milestone. It’s more than just a place to live—it’s an investment, a tax advantage, and a symbol of stability. But is it the right first step?

Homes Build Equity Over Time

Unlike cars, which lose value the moment you drive them off the lot, homes typically appreciate in value over time. While there are no guarantees—especially in volatile markets—real estate has historically outperformed inflation.

Let’s say you buy a $300,000 home with a 10% down payment ($30,000). If the home appreciates at 3% annually, it could be worth over $400,000 in 10 years. Even after accounting for maintenance, taxes, and interest, you’ve built significant equity.

In contrast, a $30,000 car might be worth just $15,000 after five years—a 50% loss. That’s why financial advisors often recommend prioritizing assets that grow in value.

Tax Benefits and Long-Term Savings

Homeownership comes with tax perks that can save you thousands. In the U.S., you can deduct mortgage interest and property taxes from your taxable income, which lowers your overall tax bill.

For example, if you pay $15,000 in mortgage interest in a year and are in the 24% tax bracket, you save $3,600 in taxes. Over 30 years, that adds up.

Additionally, owning a home can protect you from rising rent costs. Rent increases 3–5% annually in many cities. With a fixed-rate mortgage, your principal and interest stay the same, giving you predictable housing costs.

Stability and Personal Freedom

There’s something deeply satisfying about putting down roots. Owning a home means you can paint the walls, plant a garden, or adopt a pet without asking a landlord.

It also offers stability for families. Kids can attend the same school, and you’re not at risk of sudden rent hikes or eviction. For many, this sense of security is worth the financial commitment.

But What If You Need a Car?

Of course, buying a house first only makes sense if you already have reliable transportation. If you’re relying on public transit, rideshares, or borrowing a friend’s car, a home purchase might not be practical—especially if you live in a car-dependent area.

In that case, consider a used car or a modest new vehicle to get by while you save for a down payment. Some buyers even rent a car short-term while they house hunt.

The Case for Buying a Car First

Visual guide about Should I Buy a Car or House First

Image source: img.freepik.com

While homes are long-term investments, cars serve an immediate, practical purpose. For many people, especially those in rural or suburban areas, a car isn’t a luxury—it’s a necessity.

Mobility Opens Doors

Imagine you’ve saved $20,000 and are ready to buy a home. But you live in a city with limited public transit, and your job requires you to drive to clients or work sites. Without a car, your housing options shrink dramatically.

You might be stuck looking at homes far from work, increasing your commute time and stress. Or you could end up in a neighborhood with poor schools or safety concerns—just because it’s walkable.

A reliable car gives you freedom. It expands your job opportunities, lets you visit family, and makes daily errands manageable. For single parents, remote workers, or healthcare professionals with irregular hours, this mobility is invaluable.

Lower Upfront Cost

One of the biggest advantages of buying a car first is the lower barrier to entry. While a house typically requires a 10–20% down payment (that’s $30,000–$60,000 on a $300,000 home), a car might need just $2,000–$5,000 down.

Even a brand-new car can be financed with a small down payment and a 5- to 7-year loan. Used cars are even more affordable, with many reliable models available under $15,000.

This lower upfront cost means you can make progress toward your financial goals without draining your savings. You can buy a car, keep working, and continue saving for a home—all at the same time.

Credit Building Opportunity

Taking out an auto loan and making consistent payments can help build your credit score—especially if you don’t have much credit history. A strong credit score is essential for getting a good mortgage rate later.

For example, someone with a 650 credit score might qualify for a 7% mortgage rate, while a 750 score could get 5.5%. On a $300,000 loan, that’s a difference of over $100,000 in interest over 30 years.

By responsibly managing a car loan, you’re setting yourself up for better terms when you’re ready to buy a home.

But What About Depreciation?

Yes, cars lose value fast. A new car can drop 20% in the first year and 50% in five years. That’s why financial experts often recommend buying a used car that’s 2–3 years old. It’s already taken the biggest depreciation hit, but still has plenty of life left.

For example, a 2021 Honda Civic might cost $18,000 used instead of $25,000 new—and still have a clean title, low mileage, and a warranty.

Lifestyle and Location Matter

Your decision to buy a car or house first isn’t just about money—it’s about how you live and where you live.

Urban vs. Rural Living

If you live in a major city like New York, Chicago, or San Francisco, public transit, biking, and walking might cover most of your needs. In that case, buying a house first makes sense—especially if parking is expensive or hard to find.

But if you’re in a rural area or a suburb with limited buses and trains, a car is essential. You’ll need it to get to work, buy groceries, and visit the doctor. In these areas, buying a car first isn’t just practical—it’s necessary.

Job Flexibility and Commute

Consider your job. Do you work remotely? If so, you might not need a car at all—making a home purchase the smarter first step.

But if your job requires driving, or if you’re considering a career change that might involve relocation, a car gives you flexibility. It lets you commute to interviews, attend networking events, or take a job in a different town.

Also, think about your commute. A 30-minute drive each way adds up to 2.5 hours a day. If you buy a home far from work without a reliable car, you’re signing up for a long, stressful daily grind.

Family and Future Plans

Are you planning to start a family? Kids change everything. You’ll need a safe car for school runs, doctor visits, and weekend activities. You’ll also want a home with good schools and a yard.

In this case, buying a car first might make sense—especially if you’re still renting. Once you have reliable transportation, you can start house hunting in family-friendly neighborhoods.

On the other hand, if you’re single or child-free and value stability, a home might be the better first purchase.

Financial Strategies to Prepare for Either Purchase

No matter which path you choose, preparation is key. Here are some smart strategies to get ready for your next big buy.

Save Aggressively

Set a clear savings goal and automate your contributions. Use a separate high-yield savings account for your down payment or car fund. Even $200 a week adds up to over $10,000 in a year.

Cut unnecessary expenses—like dining out, subscriptions, or impulse buys—and redirect that money to your goal.

Improve Your Credit Score

Check your credit report for errors and pay down credit card balances. Keep your credit utilization below 30%, and avoid opening new accounts before applying for a loan.

Even a 20-point increase in your credit score can save you thousands in interest.

Get Pre-Approved

Whether you’re looking at cars or homes, get pre-approved for a loan. This tells you how much you can afford and shows sellers you’re serious.

For a car, pre-approval helps you avoid dealer financing traps. For a house, it strengthens your offer in competitive markets.

Research the Market

Timing matters. Car prices spike during holidays and model-year transitions. Home prices rise in spring and fall. Watch trends and buy when demand is lower.

For example, buying a car in August—when dealers are clearing out old models—can save you thousands.

Consider Alternatives

You don’t always have to buy new. A certified pre-owned car offers warranty protection at a lower price. A fixer-upper home might need work, but it could be a great investment.

Also, explore first-time buyer programs, down payment assistance, and low-down-payment mortgage options like FHA loans.

When to Consider Buying Both—or Neither

Sometimes, the best move is to wait. Other times, you might be ready for both.

Buying Both at Once

If you have strong income, excellent credit, and a large down payment, you might qualify for both a car loan and a mortgage. But be cautious—taking on two big debts at once increases your financial risk.

Lenders will look at your total debt load. If your DTI is already high, adding a car payment could disqualify you from a mortgage.

Buying Neither (Yet)

If you’re not financially ready, it’s okay to wait. Renting a home and leasing or sharing a car can give you time to save, build credit, and gain stability.

Use this time to invest in yourself—get a promotion, switch careers, or pay off debt. The stronger your foundation, the better your purchase will be.

Conclusion: Make the Choice That Fits Your Life

So, should you buy a car or house first? The answer depends on your unique situation.

If you need reliable transportation to work, live in a car-dependent area, or want to build credit, buying a car first might be the smart move. Choose a reliable, affordable vehicle—preferably used—and keep payments manageable.

If you already have transportation, value long-term wealth building, and are ready for the commitment, buying a house first could set you up for financial success. Focus on affordability, location, and future growth.

Remember, this isn’t a race. The best purchase is the one that aligns with your goals, budget, and lifestyle. Take your time, do your research, and make a decision you can feel confident about.

Whether you’re driving off in a new car or unlocking the door to your first home, you’re taking a big step forward. Make it count.

Frequently Asked Questions

Should I buy a car or house first if I have bad credit?

If your credit score is low, focus on improving it before making a major purchase. Consider buying a used car with cash or a small loan to build credit, then work toward a home purchase once your score improves.

Can I buy a house if I still have a car payment?

Yes, but your car payment will count toward your debt-to-income ratio. Lenders may approve you, but you’ll need a higher income or larger down payment to qualify for a mortgage.

Is it better to buy a new or used car first?

A used car is often the smarter choice. It costs less upfront, depreciates slower, and still offers reliability. Look for certified pre-owned models with warranties.

How much should I save before buying a house?

Aim for at least 10–20% of the home’s price as a down payment, plus 3–6 months of living expenses in an emergency fund. This reduces your loan amount and protects you from financial shocks.

Can I get a mortgage if I don’t have a car?

Yes, as long as you have stable income, good credit, and meet lender requirements. Some rural or suburban areas may require proof of transportation, but it’s not a standard mortgage condition.

What if I move frequently for work?

If you relocate often, renting may be better than buying a home. In that case, a reliable car could be your best first purchase—giving you mobility without long-term housing commitments.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.