Buying a new car is a big decision, and timing matters. With shifting market conditions, interest rates, and inventory levels, knowing when to act can save you thousands. This guide helps you weigh the pros and cons so you can decide confidently.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Should I Buy a New Car Now or Wait?

- 4 Current Market Conditions: Is Now a Good Time to Buy?

- 5 Financing and Interest Rates: The Real Cost of Waiting

- 6 Incentives, Rebates, and Government Programs

- 7 Electric Vehicles: Should You Wait for Better Tech?

- 8 Your Personal Situation: When Waiting Isn’t an Option

- 9 Depreciation and Long-Term Value

- 10 Final Decision: Should You Buy Now or Wait?

- 11 Conclusion

- 12 Frequently Asked Questions

Key Takeaways

- Market conditions are improving: New car inventory has rebounded after pandemic shortages, giving buyers more choices and better negotiating power.

- Interest rates remain high: Auto loan rates are near 7%, so financing costs are a major factor in your total spending.

- Electric vehicles (EVs) are evolving fast: New models, better range, and expanding charging networks may make waiting worthwhile if you’re considering an EV.

- Incentives and rebates are available: Manufacturers and governments are offering strong deals, especially on hybrids and EVs, which can offset higher prices.

- Your personal situation matters most: If your current car is unreliable or unsafe, waiting may cost you more in repairs and stress.

- Depreciation starts immediately: New cars lose value fast—typically 20% in the first year—so consider how long you plan to keep it.

- Test drive and compare: Don’t rush. Take time to research, compare models, and test drive to ensure you’re making the right choice.

📑 Table of Contents

- Should I Buy a New Car Now or Wait?

- Current Market Conditions: Is Now a Good Time to Buy?

- Financing and Interest Rates: The Real Cost of Waiting

- Incentives, Rebates, and Government Programs

- Electric Vehicles: Should You Wait for Better Tech?

- Your Personal Situation: When Waiting Isn’t an Option

- Depreciation and Long-Term Value

- Final Decision: Should You Buy Now or Wait?

- Conclusion

Should I Buy a New Car Now or Wait?

Buying a new car is one of the biggest financial decisions most people make—second only to purchasing a home. It’s not just about picking a color or a brand. It’s about timing, budget, and long-term value. With so many moving parts in today’s auto market, it’s easy to feel overwhelmed. Should you jump in now and take advantage of growing inventory? Or is it smarter to wait for lower interest rates or better technology?

The truth is, there’s no one-size-fits-all answer. But by understanding the current market, your personal needs, and the financial implications, you can make a confident choice. This guide will walk you through everything you need to know to decide whether now is the right time to buy—or if patience might pay off.

We’ll look at inventory levels, financing costs, incentives, vehicle trends, and your own life situation. Whether you’re eyeing a fuel-efficient sedan, a rugged SUV, or a cutting-edge electric vehicle, this guide will help you cut through the noise and focus on what matters most: getting the best value for your money.

Current Market Conditions: Is Now a Good Time to Buy?

Visual guide about Should I Buy a New Car Now or Wait

Image source: innovatecar.com

The auto market has changed dramatically over the past few years. During the pandemic, supply chain disruptions caused a severe shortage of new vehicles. Dealerships had empty lots, and buyers faced long wait times and inflated prices. But things have shifted. As of 2024, new car inventory has rebounded significantly. According to industry reports, dealerships now have nearly twice as many vehicles on hand compared to 2021.

This increase in supply has given buyers more power. You’re no longer competing with dozens of other shoppers for the same model. Instead, you can take your time, compare options, and negotiate better deals. Some manufacturers are even offering discounts and incentives to move inventory, especially on slower-selling models.

However, while supply is up, demand remains strong. Many people delayed car purchases during the pandemic and are now ready to buy. Plus, aging vehicles and rising maintenance costs are pushing others to upgrade. So while the market is more balanced than it was, it’s not a total buyer’s market—yet.

Inventory Levels Are Rising

One of the biggest changes in the auto market is the return of inventory. In 2023 and early 2024, automakers ramped up production to meet pent-up demand. This means more choices for you. Whether you want a compact car, a luxury SUV, or a pickup truck, you’re likely to find several options at local dealerships.

For example, brands like Toyota, Honda, and Ford have increased their stock of popular models like the RAV4, CR-V, and F-150. Even luxury brands like BMW and Mercedes-Benz are seeing better availability. This gives you the freedom to shop around and avoid settling for a vehicle that doesn’t meet your needs.

Prices Are Stabilizing—But Still High

While inventory is up, prices haven’t dropped as much as some hoped. New car prices remain near record highs, with the average transaction price hovering around $48,000 in early 2024. This is partly due to inflation, higher material costs, and the inclusion of advanced technology in most new vehicles.

That said, prices are no longer climbing at the rapid pace seen in 2021 and 2022. In fact, some models have seen slight price reductions or increased incentives. For instance, Hyundai and Kia have introduced cash rebates on certain SUVs, and GM is offering 0% financing on select trucks.

So while you won’t find fire-sale prices, the market is moving in a more favorable direction for buyers. If you’re flexible on trim levels or colors, you may be able to find a good deal.

Dealer Markups Are Less Common

One of the most frustrating aspects of buying a car during the shortage was dealer markups—also known as “market adjustments.” Some dealers added thousands of dollars to the sticker price, especially on high-demand vehicles like the Toyota Tacoma or Ford Bronco.

Thankfully, these markups are becoming less common. With more vehicles available, dealers are less likely to inflate prices. However, it’s still smart to research the fair market value of any car you’re interested in. Tools like Kelley Blue Book (KBB) and Edmunds can help you determine what a vehicle should cost in your area.

Financing and Interest Rates: The Real Cost of Waiting

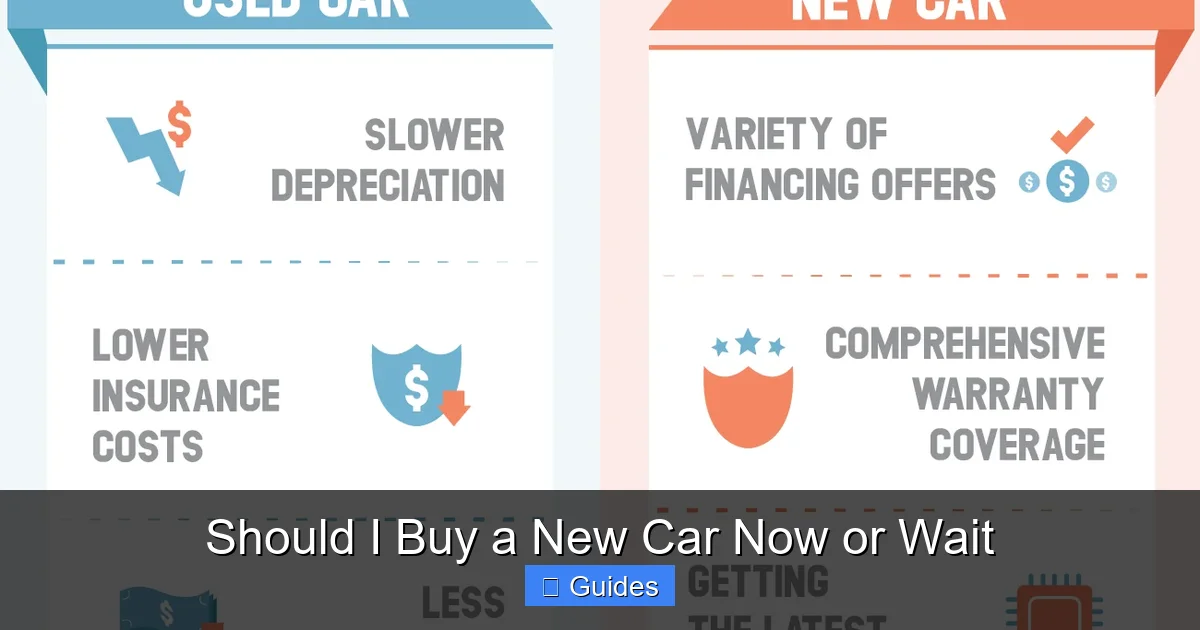

Visual guide about Should I Buy a New Car Now or Wait

Image source: thumbs.dreamstime.com

Even if you find the perfect car at a fair price, the cost of financing can make a big difference in your monthly budget. Auto loan interest rates have risen significantly over the past two years, driven by the Federal Reserve’s efforts to combat inflation.

As of mid-2024, the average interest rate for a new car loan is around 6.8%, according to Experian. That’s up from about 4.5% in 2021. For a $40,000 loan over 60 months, that difference translates to nearly $3,000 in extra interest over the life of the loan.

How Interest Rates Affect Your Monthly Payment

Let’s look at a real example. Suppose you’re financing a $45,000 vehicle with a $5,000 down payment, leaving a loan amount of $40,000.

– At 4.5% interest over 60 months, your monthly payment would be about $746.

– At 6.8% interest over the same term, your payment jumps to $793.

That’s an extra $47 per month—or $2,820 over five years. Over time, that adds up. And if you stretch the loan to 72 or 84 months to lower the monthly payment, the total interest paid increases even more.

Should You Wait for Lower Rates?

Many buyers are holding off, hoping interest rates will drop in the near future. While the Fed has signaled it may cut rates later in 2024 or 2025, there’s no guarantee. Economic conditions can change quickly, and waiting could mean missing out on a good deal on a vehicle you need now.

Plus, if you wait too long, your current car might break down or require expensive repairs. That could force you into a rushed purchase at an even higher price.

A better strategy might be to lock in a rate now and refinance later if rates drop. Many lenders allow you to refinance your auto loan after six to 12 months, potentially saving you money without delaying your purchase.

Improving Your Loan Terms

Even with high rates, you can take steps to reduce your financing costs:

– **Boost your credit score:** A higher credit score can qualify you for lower interest rates. Pay down credit card balances and avoid new debt before applying for a loan.

– **Make a larger down payment:** Putting down 20% or more reduces the amount you need to finance and can lower your monthly payment.

– **Shop around for loans:** Don’t just accept the dealer’s financing offer. Compare rates from banks, credit unions, and online lenders.

– **Consider a shorter loan term:** While monthly payments are higher, you’ll pay less in interest overall.

For example, a 48-month loan at 6.8% on $40,000 would cost about $921 per month but save you over $2,000 in interest compared to a 72-month loan.

Incentives, Rebates, and Government Programs

Visual guide about Should I Buy a New Car Now or Wait

Image source: global-uploads.webflow.com

One bright spot in today’s car market is the availability of incentives and rebates. Manufacturers are offering cash back, low APR financing, and lease deals to attract buyers. Additionally, government programs are providing significant savings—especially for electric and hybrid vehicles.

Manufacturer Incentives

Many automakers are running promotions to clear inventory and boost sales. These can include:

– **Cash rebates:** Direct discounts off the purchase price, often $1,000 to $3,000.

– **Low or 0% APR financing:** Special financing rates for qualified buyers.

– **Lease deals:** Lower monthly payments and reduced down payments for leasing.

– **Loyalty bonuses:** Extra savings for returning customers of the same brand.

For example, Ford is offering $2,500 cash back on the 2024 Escape, and Toyota has 0% APR for 36 months on the Camry. These deals can significantly reduce your total cost.

Federal and State EV Incentives

If you’re considering an electric vehicle, government incentives can make a big difference. The federal government offers a tax credit of up to $7,500 for new EVs that meet certain requirements, such as battery size and manufacturing location.

As of 2024, eligible vehicles include models from Tesla, Ford, GM, Hyundai, and others. However, not all EVs qualify, and the credit phases out after a manufacturer sells 200,000 units. It’s important to check the latest list on the IRS website.

Many states also offer additional rebates. For example:

– California: Up to $7,000 rebate for low- and middle-income buyers.

– New York: $2,000 rebate for new EVs.

– Colorado: $5,000 tax credit for EV purchases.

These incentives can stack with manufacturer deals, making EVs more affordable than ever.

How to Find the Best Deals

To take advantage of incentives, do your homework:

– Visit manufacturer websites for current promotions.

– Check the U.S. Department of Energy’s EV incentive database.

– Ask dealers about available rebates—some may not advertise them.

– Use online tools like Cars.com or Edmunds to compare deals in your area.

For instance, a $50,000 EV with a $7,500 federal credit and a $2,000 state rebate effectively costs $40,500—before any dealer discounts.

Electric Vehicles: Should You Wait for Better Tech?

Electric vehicles are advancing rapidly. New models offer longer range, faster charging, and more features than ever before. If you’re considering an EV, you might wonder: Should I buy now or wait for the next generation?

Current EV Advancements

Today’s EVs are more practical than ever. Many offer 250 to 350 miles of range on a single charge—enough for most daily commutes and weekend trips. Charging infrastructure is also improving, with more public stations and faster chargers being installed nationwide.

For example, the 2024 Hyundai Ioniq 6 offers up to 361 miles of range, while the Ford F-150 Lightning can power your home during an outage. These aren’t just concept cars—they’re available now.

What’s Coming Next?

The EV market is evolving quickly. In the next few years, we can expect:

– **Solid-state batteries:** These promise even longer range, faster charging, and lower costs—but they’re not widely available yet.

– **More affordable models:** Brands like Chevrolet and Nissan are working on EVs under $30,000.

– **Improved charging networks:** Companies like Tesla and Electrify America are expanding fast-charging stations across the U.S.

If you can wait a year or two, you might get a better vehicle for less money. But if you need a car now, today’s EVs are already a great option—especially with current incentives.

Weighing the Pros and Cons

Buying an EV now means you can start saving on fuel and maintenance immediately. Electricity is cheaper than gas, and EVs have fewer moving parts, so they cost less to maintain.

However, if you have range anxiety or limited access to charging, waiting might make sense. Also, if you plan to keep the car for only a few years, rapid depreciation could be a concern.

Ultimately, the decision depends on your driving habits, budget, and access to charging. For many, the benefits of going electric today outweigh the risks.

Your Personal Situation: When Waiting Isn’t an Option

While market trends and financing matter, your personal circumstances should be the biggest factor in your decision. If your current car is on its last legs, waiting could cost you more in the long run.

Signs You Need a New Car Now

Consider buying now if:

– Your car requires frequent repairs.

– Safety features are outdated (e.g., no automatic emergency braking or blind-spot monitoring).

– You’re spending more on gas than a new car payment would cost.

– Your vehicle no longer meets your needs (e.g., growing family, job change).

For example, if your 12-year-old sedan needs a $2,000 transmission repair, it might be smarter to put that money toward a down payment on a reliable new car.

The Cost of Waiting

Delaying a purchase can lead to:

– **Higher repair bills:** Older cars often need costly fixes.

– **Safety risks:** Older vehicles may not perform well in crashes.

– **Lost time:** Breakdowns can disrupt your work and family life.

– **Missed incentives:** Rebates and low-rate financing may not last.

If your car is unreliable, the peace of mind from a new vehicle could be worth the cost—even with higher interest rates.

Leasing vs. Buying

If you’re unsure about committing to a purchase, leasing might be a good middle ground. Leases typically have lower monthly payments and let you drive a new car every few years. However, you don’t build equity, and there are mileage limits.

For some, leasing offers the best of both worlds: a new car now with the option to upgrade later.

Depreciation and Long-Term Value

One of the biggest downsides of buying new is depreciation. A new car loses about 20% of its value the moment you drive it off the lot. After one year, it’s worth roughly 80% of its original price. After three years, that drops to around 50%.

How to Minimize Depreciation

While you can’t stop depreciation, you can reduce its impact:

– **Buy a car that holds its value:** Brands like Toyota, Honda, and Subaru tend to depreciate slower.

– **Choose popular models:** High-demand vehicles retain value better.

– **Keep it well-maintained:** Regular service and clean records help when reselling.

– **Drive it longer:** The longer you keep the car, the less depreciation matters per year.

For example, a Toyota Camry might lose 15% in the first year, while a luxury SUV could lose 25% or more.

Is Buying Used a Better Option?

Used cars depreciate slower and often cost less upfront. A three-year-old vehicle has already taken the biggest hit in value, so you get more car for your money.

However, used cars may have higher maintenance costs and fewer warranties. Certified pre-owned (CPO) programs can offer peace of mind with extended coverage and inspections.

If you’re on a tight budget, a high-quality used car might be the smarter choice—even if it’s not brand new.

Final Decision: Should You Buy Now or Wait?

So, should you buy a new car now or wait? The answer depends on your unique situation.

If your current car is unreliable, you find a great deal with incentives, and you can afford the payments, buying now makes sense. The market is more favorable than it has been in years, and waiting too long could cost you in repairs and stress.

On the other hand, if your car is still running well, interest rates are a major concern, and you’re considering an EV with rapidly improving technology, waiting a few months might pay off.

Questions to Ask Yourself

Before making a decision, ask:

– How reliable is my current car?

– Can I afford the monthly payment, insurance, and maintenance?

– Are there strong incentives on the models I want?

– Do I need a car right now, or can I wait?

– How long do I plan to keep the vehicle?

Answering these honestly will guide you to the right choice.

Tips for a Smart Purchase

– **Research thoroughly:** Compare models, read reviews, and check reliability ratings.

– **Negotiate confidently:** Use pricing guides to know what’s fair.

– **Test drive multiple vehicles:** Don’t settle for the first one you like.

– **Get pre-approved for a loan:** This gives you leverage at the dealership.

– **Read the fine print:** Understand all fees, warranties, and terms.

Buying a car doesn’t have to be stressful. With the right information and preparation, you can drive away with a vehicle that fits your needs and budget.

Conclusion

Deciding whether to buy a new car now or wait isn’t easy. The market is more balanced than it’s been in years, with better inventory and growing incentives. But high interest rates and rapid depreciation are real concerns.

The best approach is to weigh the current market conditions against your personal needs and financial situation. If you need a reliable vehicle now and find a good deal, buying could be the right move. But if you can wait and want to take advantage of falling rates or better EV technology, patience might pay off.

Ultimately, there’s no perfect time to buy a car—only the time that’s right for you. By doing your homework, comparing options, and staying flexible, you can make a confident decision and enjoy your new ride for years to come.

Frequently Asked Questions

Is it better to buy a car now or wait until 2025?

It depends on your needs and the market. If your current car is failing or you find a strong deal with incentives, buying now may be wise. However, if you can wait and want lower interest rates or newer EV technology, 2025 could offer better options.

Are car prices expected to drop in 2024?

Prices are stabilizing but not dropping significantly. While inventory has improved, high demand and inflation are keeping prices elevated. Some models may see small discounts, but a major price drop is unlikely.

Should I buy an electric car now or wait?

If you have access to charging and want to save on fuel, today’s EVs are excellent choices—especially with federal and state incentives. But if you’re waiting for longer range or lower prices, holding off a year or two could be beneficial.

How much should I put down on a new car?

Aim for at least 20% down to reduce your loan amount and avoid being upside-down on your loan. This also helps lower your monthly payment and total interest paid.

Can I negotiate the price of a new car in 2024?

Yes. With more inventory available, dealers are more willing to negotiate. Use pricing guides like Kelley Blue Book to know the fair market value and don’t be afraid to walk away if the deal isn’t right.

Is it smarter to lease or buy a new car?

Buying builds equity and is better if you plan to keep the car long-term. Leasing offers lower payments and the chance to drive new models every few years, but you don’t own the vehicle. Choose based on your budget and lifestyle.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.