Featured image for Car Insurance For 17 Year Old

Image source: forbes.com

Car insurance for a 17-year-old is notoriously expensive, often costing several hundred dollars monthly due to their perceived high risk. Rates vary significantly based on factors like the vehicle driven, geographic location, chosen coverage levels, and the teen’s driving record. To potentially lower these substantial premiums, consider good student discounts, driver’s education completion, and adding the teen to a family policy.

In This Article

- 1 Unlock How Much Is Car Insurance For A 17 Year Old Per Month

- 1.1 Key Takeaways

- 1.2 📑 Table of Contents

- 1.3 The Harsh Reality: Why Is Car Insurance So Expensive for a 17-Year-Old?

- 1.4 Factors That Directly Impact How Much Is Car Insurance For A 17 Year Old Per Month

- 1.5 Average Costs: What to Expect for Car Insurance for a 17-Year-Old

- 1.6 Proven Strategies to Significantly Reduce Car Insurance Costs for a 17-Year-Old

- 1.7 Navigating the Application Process: Tips for Parents and Teens

- 1.8 Data Table: Estimated Monthly Car Insurance Costs for a 17-Year-Old (Illustrative)

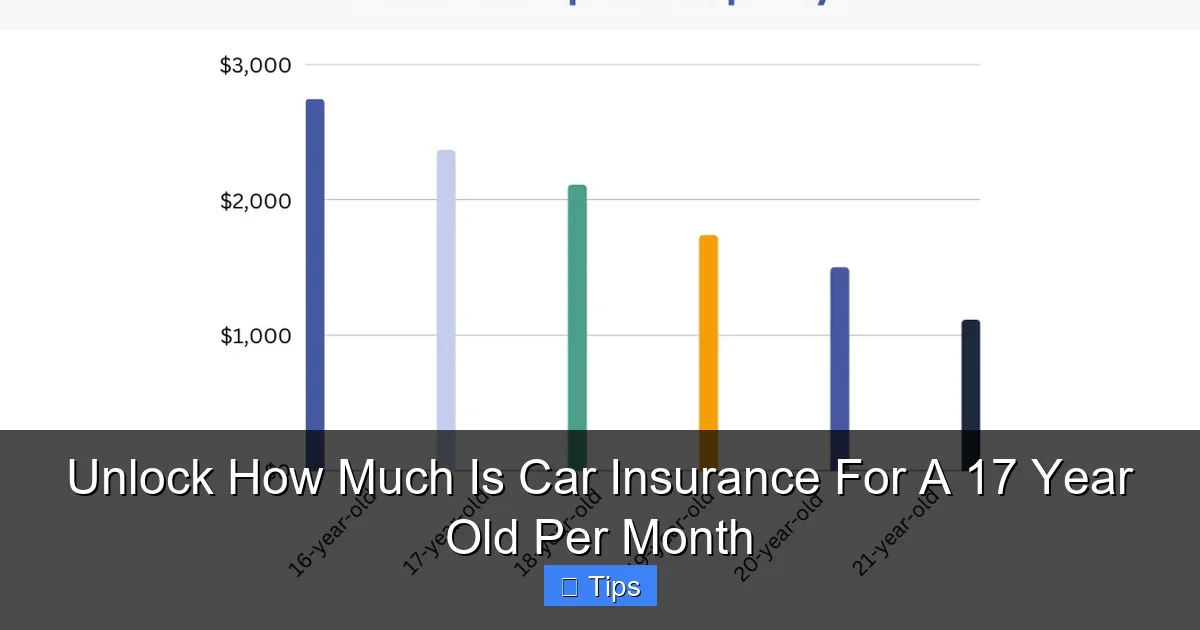

- 1.9 Understanding the Evolution of Car Insurance Costs Over Time

- 1.10 Conclusion

- 1.11 Frequently Asked Questions

- 1.11.1 What is the average cost of car insurance for a 17-year-old per month?

- 1.11.2 Why is car insurance for a 17-year-old so expensive?

- 1.11.3 How can a 17-year-old reduce their car insurance premiums?

- 1.11.4 Is it cheaper to add a 17-year-old to a parent’s existing car insurance policy?

- 1.11.5 Does the type of car affect how much car insurance for a 17-year-old costs?

- 1.11.6 Are there any other discounts available for car insurance for a 17-year-old?

Unlock How Much Is Car Insurance For A 17 Year Old Per Month

The exhilarating moment of turning 16 or 17 and finally getting behind the wheel is a rite of passage for many teenagers. It signifies newfound freedom, independence, and the open road beckoning with possibilities. However, for both teens and their parents, this excitement often comes hand-in-hand with a significant financial reality check: the cost of car insurance. Specifically, understanding how much is car insurance for a 17 year old per month can be a daunting and often eye-opening experience.

It’s no secret that insuring a young driver, especially a 17-year-old, is notoriously expensive. Insurers view this age group as high-risk, leading to substantially higher premiums compared to more experienced drivers. This comprehensive guide aims to demystify the complexities of car insurance for a 17 year old, breaking down the factors that influence costs, providing average figures, and most importantly, offering actionable strategies to help reduce those daunting monthly payments. Whether you’re a teen eager to drive or a parent bracing for the financial impact, this post will equip you with the knowledge to navigate the world of car insurance effectively.

Key Takeaways

- Expect high costs: 17-year-olds face significantly higher premiums due to risk.

- Leverage discounts: Good student and driver’s ed significantly cut costs.

- Choose wisely: Safer, older, cheaper cars mean lower premiums.

- Join family plan: Adding to a parent’s policy is often most affordable.

- Compare quotes: Always shop multiple insurers for the best rates.

- Consider telematics: Usage-based insurance can reward safe driving.

- Increase deductible: Higher deductibles significantly reduce monthly payments.

📑 Table of Contents

- The Harsh Reality: Why Is Car Insurance So Expensive for a 17-Year-Old?

- Factors That Directly Impact How Much Is Car Insurance For A 17 Year Old Per Month

- Average Costs: What to Expect for Car Insurance for a 17-Year-Old

- Proven Strategies to Significantly Reduce Car Insurance Costs for a 17-Year-Old

- Navigating the Application Process: Tips for Parents and Teens

- Data Table: Estimated Monthly Car Insurance Costs for a 17-Year-Old (Illustrative)

- Understanding the Evolution of Car Insurance Costs Over Time

- Conclusion

The Harsh Reality: Why Is Car Insurance So Expensive for a 17-Year-Old?

Before diving into specific numbers, it’s crucial to understand the fundamental reasons behind the high cost of car insurance for a 17 year old. Insurers operate on risk assessment, and unfortunately, 17-year-olds fall into a category that statistically presents a significantly higher risk profile. This isn’t a judgment on individual driving skills, but rather a reflection of aggregated data that guides premium calculations.

Lack of Driving Experience

This is perhaps the most significant factor. A 17-year-old driver, by definition, has limited experience navigating various road conditions, traffic situations, and emergency scenarios. Unlike seasoned drivers who have years of practice, a new driver is still developing their judgment, reaction times, and spatial awareness on the road. Insurers factor in this inexperience, as it correlates with a higher likelihood of minor fender-benders and more serious accidents.

Higher Accident Rates

Statistics consistently show that teenage drivers, particularly those aged 16-19, have the highest crash rates per mile driven compared to any other age group. The Centers for Disease Control and Prevention (CDC) reports that motor vehicle crashes are a leading cause of death for U.S. teens. This elevated risk is due to a combination of factors, including inexperience, risk-taking behavior, and susceptibility to distractions. For an insurance company, these statistics translate directly into a higher probability of paying out claims, thus driving up the cost of car insurance for a a 17 year old.

Risk Perception by Insurers

Insurance companies view young drivers through the lens of data. They see that 17-year-olds are more prone to speeding, driving under the influence (even if they personally do not), driving distracted (texting, passengers), and not wearing seatbelts. While not every 17-year-old exhibits these behaviors, the aggregated data for the age group as a whole paints a picture of higher risk. This perception is built into their actuarial tables, which determine premiums. Therefore, when you ask how much is car insurance for a 17 year old per month, you’re essentially asking what premium covers this higher statistical risk.

Driving Habits and Statistics

- Distracted Driving: Teens are more likely to be distracted by cell phones or passengers.

- Night Driving: They often drive at night, which is statistically more dangerous.

- Seatbelt Use: Lower rates of seatbelt use compared to older drivers.

- Risk-Taking: A developing brain contributes to a higher propensity for risk-taking behavior.

Understanding these underlying reasons helps explain why car insurance for a 17 year old comes with a premium sticker shock. It’s not personal; it’s purely statistical risk assessment.

Factors That Directly Impact How Much Is Car Insurance For A 17 Year Old Per Month

While the baseline cost of car insurance for a 17 year old is high, several specific factors can significantly increase or decrease the final premium you pay each month. Being aware of these elements allows you to make informed decisions that can help manage costs.

Visual guide about Car Insurance For 17 Year Old

Image source: thumbor.forbes.com

Driver-Specific Factors

- Gender: Historically, young male drivers pay more for car insurance than young female drivers due to higher accident rates and claims, though some states prohibit gender as a rating factor.

- Academic Performance (Good Student Discount): Many insurers offer discounts for students who maintain a B average or better. This indicates responsibility and can make a noticeable difference in how much is car insurance for a 17 year old per month.

- Driving Record: Any accidents, tickets, or moving violations will drastically increase premiums. A clean driving record is paramount for keeping costs down.

- Driver’s Education: Completing an approved driver’s education course often qualifies for a discount, demonstrating a commitment to safe driving.

Vehicle-Specific Factors

- Make and Model: Sports cars or high-performance vehicles are more expensive to insure due to higher repair costs, theft rates, and the perception that they encourage risky driving. Opting for a safer, more practical sedan or SUV can significantly lower costs.

- Age and Value of the Car: Newer, more expensive cars cost more to repair or replace, thus increasing collision and comprehensive coverage costs. An older, less valuable car might be cheaper to insure.

- Safety Features: Cars equipped with advanced safety features like anti-lock brakes, airbags, anti-theft devices, and advanced driver-assistance systems (ADAS) can qualify for discounts.

- Vehicle Usage: Is the car used for daily commuting, or just occasional leisure? Lower mileage can sometimes lead to lower premiums.

Policy-Specific Factors

- Coverage Limits: The more coverage you opt for (e.g., higher liability limits, comprehensive, collision), the higher your premiums will be. While higher coverage offers better protection, it directly impacts how much is car insurance for a 17 year old per month.

- Deductibles: Your deductible is the amount you pay out-of-pocket before your insurance kicks in. Choosing a higher deductible typically results in lower monthly premiums, but means you’ll pay more upfront in case of a claim.

- Bundling Policies: Combining car insurance with other policies, like homeowners or renters insurance, often leads to multi-policy discounts.

- Adding to a Parent’s Policy vs. Individual Policy: This is a crucial decision. Almost always, adding a 17-year-old to a parent’s existing family policy is substantially cheaper than them obtaining their own individual policy.

Location-Specific Factors

- Zip Code: Urban areas with higher traffic density, theft rates, and accident statistics generally have higher insurance premiums than rural areas.

- State Regulations: Each state has different minimum coverage requirements and regulatory environments, which influence the overall cost of car insurance.

Considering all these variables, it becomes clear that there isn’t a single, universal answer to how much is car insurance for a 17 year old per month. It’s a complex calculation tailored to individual circumstances.

Average Costs: What to Expect for Car Insurance for a 17-Year-Old

While precise figures depend on the factors mentioned above, we can provide some general estimates to help set expectations for car insurance for a 17 year old. It’s important to remember these are averages and your actual costs could be higher or lower.

Visual guide about Car Insurance For 17 Year Old

Image source: autoinsurance.org

National Averages (Monthly/Yearly)

On average, adding a 17-year-old male driver to a parent’s full coverage policy can increase the annual premium by anywhere from $2,000 to $4,000. For a 17-year-old female driver, this increase might be slightly lower, perhaps $1,800 to $3,500 annually. When broken down, this means how much is car insurance for a 17 year old per month could range from approximately $150 to $350 or more, simply for adding them to an existing policy. If a 17-year-old were to seek an individual policy (which is rare and extremely expensive), the costs could skyrocket to $400-$700+ per month, making it largely unaffordable for most.

- Average for a 17-year-old on a parent’s policy (Full Coverage):

- Male: ~$170 – $330 per month ($2,040 – $3,960 annually)

- Female: ~$150 – $290 per month ($1,800 – $3,480 annually)

- Average for an individual 17-year-old policy (Full Coverage):

- Male: ~$400 – $700+ per month ($4,800 – $8,400+ annually)

- Female: ~$350 – $600+ per month ($4,200 – $7,200+ annually)

These figures can vary dramatically based on the type of car, location, and specific discounts applied.

Cost Variations by State

Insurance premiums are heavily influenced by state-specific regulations, population density, accident rates within the state, and weather conditions. For instance, states like Michigan often have higher car insurance costs due to no-fault laws and higher minimum coverage requirements. Conversely, states with lower population densities and fewer accidents might see slightly lower average premiums. This means how much is car insurance for a 17 year old per month will differ significantly if you live in New York versus North Dakota.

Impact of Adding to a Parent’s Policy vs. Individual Policy

This is arguably the most impactful decision regarding cost.

When a 17-year-old is added to a parent’s existing multi-car, multi-driver policy, the risk is spread across more drivers and vehicles. The insurer sees a more diversified portfolio, and the teen benefits from the parents’ longer driving history, good credit score (if used in pricing), and any loyalty discounts.

An individual policy for a 17-year-old, however, isolates all the high-risk factors onto a single, inexperienced driver. There’s no buffering from older, experienced drivers or established policy history, making the premiums astronomically high. This is why it’s almost universally recommended to add a 17-year-old to an existing family plan.

Examples of Cost Ranges (with Conditions)

- Scenario 1: 17-year-old male, B student, drives a 10-year-old sedan, added to parent’s policy in a suburban area with good discounts. Monthly cost increase: ~$180-$220.

- Scenario 2: 17-year-old female, A student, drives a 5-year-old SUV with safety features, added to parent’s policy in a rural area with maximum discounts. Monthly cost increase: ~$140-$180.

- Scenario 3: 17-year-old male, average grades, drives a new sports car, added to parent’s policy in an urban area with minimal discounts. Monthly cost increase: ~$280-$350+.

These examples illustrate the wide range of possibilities when assessing how much is car insurance for a 17 year old per month, emphasizing the importance of considering all contributing factors.

Proven Strategies to Significantly Reduce Car Insurance Costs for a 17-Year-Old

While the initial quotes for car insurance for a 17 year old can be shocking, there are numerous proactive steps both teens and parents can take to mitigate these high costs. Implementing these strategies requires a bit of effort but can lead to substantial savings.

Visual guide about Car Insurance For 17 Year Old

Image source: insuraviz.com

Academic Excellence Discounts

Many insurance companies recognize that responsible students tend to be responsible drivers. If your 17-year-old maintains a B average (3.0 GPA) or higher, they may qualify for a “good student discount.” This discount can reduce premiums by 10-25% and is one of the easiest ways to lower the cost of car insurance for a 17 year old. Parents should ensure they provide proof of academic achievement to their insurer regularly.

Driver Education Programs

Completing a state-approved driver’s education course isn’t just about learning to drive; it often comes with a discount. These courses teach safe driving practices, defensive driving techniques, and the rules of the road. Insurers view this as a positive step towards responsible driving, leading to reduced premiums. Some companies may offer additional discounts for advanced driving courses after the initial licensing period.

Choosing the Right Vehicle

The type of car your 17-year-old drives makes a huge difference.

Avoid sports cars, luxury vehicles, or highly modified cars. These vehicles are generally more expensive to insure due to higher repair costs, increased theft risk, and the perception of encouraging aggressive driving.

Instead, opt for older, reliable, mid-sized sedans or SUVs with strong safety ratings. Look for vehicles with advanced safety features like anti-lock brakes (ABS), electronic stability control (ESC), multiple airbags, and anti-theft devices. These features not only keep your teen safer but also qualify for safety discounts, directly impacting how much is car insurance for a 17 year old per month.

Telematics and Usage-Based Insurance

Many insurers offer telematics programs (often called “pay-as-you-drive” or “usage-based insurance”). These programs use a device plugged into the car’s diagnostic port or a smartphone app to monitor driving habits such as speed, braking, acceleration, and mileage. Good driving behavior can lead to significant discounts. While it might feel like being monitored, it’s a powerful tool to demonstrate responsible driving and lower car insurance costs for a 17 year old. Encourage your teen to drive safely, and watch the savings add up.

Increasing Deductibles (with Caution)

A higher deductible means you pay more out-of-pocket if you file a claim, but it typically results in lower monthly premiums. This strategy should be approached with caution. Ensure you have enough savings to cover the higher deductible amount if an accident occurs. While it can reduce how much is car insurance for a 17 year old per month, it shifts more financial responsibility to you in the event of a minor incident.

Bundling Policies

If you already have other insurance policies with the same provider (e.g., homeowners, renters, life insurance), inquire about bundling discounts. Many companies offer significant savings (often 10-25% or more) for customers who hold multiple policies with them. Adding your 17-year-old to an already bundled family policy can compound these savings.

Shopping Around for Quotes

Never settle for the first quote you receive. Insurance rates vary widely between companies for the same coverage. Obtain quotes from at least three to five different insurers. Use online comparison tools or work with an independent insurance agent who can shop multiple carriers for you. This competitive shopping is one of the most effective ways to find the best rate for car insurance for a 17 year old.

By combining several of these strategies, you can significantly reduce the financial burden of insuring a young driver, making their journey to independence a little more affordable.

The process of getting car insurance for a 17 year old can seem overwhelming, but with the right approach and clear communication, it can be managed effectively. Here are some essential tips for both parents and teens.

Communication is Key

For Parents: Have an open and honest conversation with your 17-year-old about the costs and responsibilities associated with driving and insurance. Discuss the financial implications and how their driving habits directly impact premiums. Consider having them contribute to the insurance cost, even a small amount, to instill financial responsibility.

For Teens: Understand that driving is a privilege that comes with significant costs. Be transparent with your parents and insurer about your driving history (even minor incidents), academic performance, and vehicle usage. Show commitment to safe driving and maintaining a clean record.

Understanding Coverage Types

Before obtaining quotes, understand the different types of car insurance coverage:

- Liability Coverage: Required by law in most states, this covers damages and injuries you cause to others.

- Collision Coverage: Pays for damage to your own car if you hit another vehicle or object.

- Comprehensive Coverage: Covers damage to your car from non-collision events like theft, vandalism, fire, or natural disasters.

- Personal Injury Protection (PIP) / Medical Payments: Covers medical expenses for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist: Protects you if you’re hit by a driver without enough (or any) insurance.

For a 17-year-old, especially when added to a parent’s policy, full coverage (liability, collision, and comprehensive) is usually recommended to protect the significant investment in the vehicle and provide adequate financial security. Be clear on what each covers and how much is car insurance for a 17 year old per month based on these choices.

The Importance of a Clean Driving Record

For a 17-year-old, even a single speeding ticket or minor accident can lead to a dramatic increase in insurance premiums, potentially for several years. This reinforces the need for defensive driving and strict adherence to traffic laws. A clean record is the single most powerful factor under a teen’s control to keep insurance costs manageable over time. Emphasize that every decision behind the wheel has financial consequences regarding car insurance for a 17 year old.

Reviewing the Policy Annually

Insurance needs and rates can change. Once your 17-year-old turns 18, 19, and enters their early twenties, their risk profile gradually improves, leading to lower rates. Additionally, life changes (e.g., getting better grades, moving, buying a safer car) can affect premiums. Make it a habit to review your policy annually with your insurer. Ask about new discounts, compare quotes from other companies, and adjust coverage as needed to ensure you’re always getting the best possible rate for how much is car insurance for a 17 year old per month.

Being proactive and informed during the application and review process can make a significant difference in managing the costs of insuring a young driver.

Data Table: Estimated Monthly Car Insurance Costs for a 17-Year-Old (Illustrative)

To provide a clearer picture of the potential costs, the following table offers illustrative estimates for how much is car insurance for a 17 year old per month under various common scenarios. These figures are hypothetical averages and will vary widely based on your specific location, chosen vehicle, driving history, and insurer.

| Scenario | Driver Gender | Policy Type | Vehicle Type | Key Factors | Estimated Monthly Cost (Range) |

|---|---|---|---|---|---|

| Base Case: Parent’s Policy | Male | Full Coverage (Parent’s Policy) | Older Sedan (e.g., 2010 Honda Civic) | Average grades, suburban, basic discounts | $180 – $250 |

| Base Case: Parent’s Policy | Female | Full Coverage (Parent’s Policy) | Older Sedan (e.g., 2010 Toyota Corolla) | Good grades, suburban, basic discounts | $150 – $220 |

| Optimized Case | Female | Full Coverage (Parent’s Policy) | Safe SUV (e.g., 2015 Subaru Forester) | Excellent grades, rural, driver’s ed, telematics opt-in, bundling | $120 – $180 |

| High-Risk Case | Male | Full Coverage (Parent’s Policy) | Sports Car (e.g., 2020 Ford Mustang) | Average grades, urban, minimal discounts, 1 minor ticket | $280 – $380+ |

| Individual Policy (Illustrative) | Male | Full Coverage (Individual Policy) | Standard Sedan (e.g., 2015 Chevy Malibu) | Clean record, no established credit/history | $450 – $750+ |

| Individual Policy (Illustrative) | Female | Full Coverage (Individual Policy) | Standard Sedan (e.g., 2015 Nissan Altima) | Clean record, no established credit/history | $400 – $650+ |

Note: These figures are purely illustrative and intended to show potential ranges. Your actual cost of car insurance for a 17 year old per month will depend on specific details and quotes from insurance providers.

Understanding the Evolution of Car Insurance Costs Over Time

The high cost of car insurance for a 17 year old is not a permanent fixture. As drivers gain experience and mature, their risk profile generally improves, leading to a gradual decrease in premiums. Understanding this trajectory can help set realistic expectations and encourage safe driving habits from the outset.

Age as a Primary Factor

Age is one of the most significant factors in insurance pricing. Once a driver moves out of the teen age bracket (16-19), particularly as they turn 20 and then 25, premiums typically begin to drop more noticeably. Insurers statistically see a reduction in accident rates and risky behavior in these older age groups. The cost of car insurance for a 17 year old is at its peak; it gradually decreases with each year of safe driving. For example, a 20-year-old might pay 15-25% less than a 17-year-old, and a 25-year-old could pay 30-50% less.

Impact of Driving History

A clean driving record is invaluable as a young driver ages. Every year that passes without an accident or a ticket builds a positive driving history, which directly translates into lower premiums. Conversely, even a minor infraction can keep rates elevated for several years. This emphasizes the long-term financial benefit of driving responsibly from day one when you first get car insurance for a 17 year old.

Building Credit and Financial Responsibility

While a 17-year-old may not have a credit history, as they get older and begin establishing credit, this can also influence insurance rates. Insurers in many states use credit scores as a factor, believing it correlates with financial responsibility and, by extension, driving responsibility. Maintaining good credit and financial habits over time can indirectly contribute to lower insurance costs.

Continuing Discounts and Re-evaluation

Many of the discounts available for a 17-year-old, such as good student discounts and driver’s education discounts, may continue to apply or evolve as they age. Additionally, as their risk profile changes, it becomes even more crucial to re-evaluate policies annually. Insurers introduce new discounts, and your eligibility for existing ones might change. Proactively shopping around and asking for discounts, even as your driver gets older, ensures you’re always getting the most competitive rates for how much is car insurance for a 17 year old per month and beyond.

Understanding this progression helps young drivers and their families appreciate that the initial high costs are not permanent and that responsible choices today will yield financial benefits tomorrow.

Conclusion

Navigating the world of car insurance for a 17 year old can indeed be an expensive endeavor, with premiums often representing a significant financial hurdle for families. The reality is that insurers view this age group as the riskiest, leading to substantially higher costs. Understanding how much is car insurance for a 17 year old per month requires factoring in a complex array of variables, from the driver’s academic record and gender to the type of vehicle driven and even the family’s geographical location.

However, as this comprehensive guide has detailed, there are numerous proactive and effective strategies to mitigate these high costs. From leveraging good student discounts and opting for safe, practical vehicles to enrolling in driver education courses and utilizing telematics programs, families can significantly reduce the financial burden. The single most impactful decision is often adding the 17-year-old to a parent’s existing multi-car policy rather than seeking an independent plan. Furthermore, maintaining a spotless driving record is paramount, as every accident or ticket can lead to increased premiums for years to come.

Ultimately, while the initial cost of car insurance for a 17 year old may seem daunting, it’s an investment in independence and a critical step towards adulthood. By being informed, communicating openly, and diligently applying the cost-saving tips outlined here, both teens and parents can unlock more manageable monthly premiums and pave the way for a safer, more affordable driving future.

Frequently Asked Questions

What is the average cost of car insurance for a 17-year-old per month?

The cost of car insurance for a 17-year-old per month is typically quite high, often ranging from $200 to $600 or more, though this can vary significantly. Factors like location, the specific car, coverage limits, and the insurer all play a major role in determining the exact premium.

Why is car insurance for a 17-year-old so expensive?

Insurance companies view 17-year-olds as high-risk drivers due to their limited driving experience and statistical data showing they are more prone to accidents. Their lack of a long driving history and higher likelihood of risky behaviors contribute to the elevated premiums.

Several strategies can help lower costs, such as maintaining good grades to qualify for a “good student” discount and completing a defensive driving course. Choosing a safer, older, and less powerful car can also significantly impact the price of car insurance for a 17-year-old.

Is it cheaper to add a 17-year-old to a parent’s existing car insurance policy?

Yes, almost always. Adding a 17-year-old to a family policy is generally much more affordable than them purchasing their own standalone policy. This leverages the parent’s established driving history and potential multi-car or multi-policy discounts.

Does the type of car affect how much car insurance for a 17-year-old costs?

Absolutely. Cars that are more expensive to repair, have high theft rates, or are considered high-performance vehicles will result in significantly higher car insurance costs. Opting for an older, safer, and less powerful vehicle can lead to considerable savings on car insurance for a 17-year-old.

Are there any other discounts available for car insurance for a 17-year-old?

Beyond good student and defensive driving discounts, some insurers offer telematics programs that monitor driving habits for potential savings. Maintaining a clean driving record from day one is also crucial, as any traffic violations or accidents will significantly increase future premiums.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.