Understanding the three types of car insurance—liability, collision, and comprehensive—is essential for protecting yourself, your vehicle, and others on the road. Each type covers different risks, from damage to others’ property to theft and natural disasters, so choosing the right mix can save you money and stress in the long run.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Are the 3 Types of Car Insurance?

- 4 Liability Insurance: The Legal Foundation of Car Coverage

- 5 Collision Insurance: Protecting Your Vehicle After a Crash

- 6 Comprehensive Insurance: Coverage Beyond Collisions

- 7 Combining the Three: What Is Full Coverage?

- 8 Optional Add-Ons and Enhancements

- 9 How to Choose the Right Types of Car Insurance for You

- 10 Final Thoughts: Making Smart Insurance Decisions

- 11 Frequently Asked Questions

- 11.1 What are the three main types of car insurance?

- 11.2 Is liability insurance required by law?

- 11.3 Do I need collision insurance if I own my car outright?

- 11.4 What does comprehensive insurance cover that collision doesn’t?

- 11.5 What is full coverage car insurance?

- 11.6 Can I drop comprehensive and collision insurance on an older car?

Key Takeaways

- Liability insurance is legally required in most states and covers damage or injuries you cause to others in an accident.

- Collision insurance pays for repairs to your own vehicle after a crash, regardless of who is at fault.

- Comprehensive insurance protects against non-collision events like theft, vandalism, fire, and weather damage.

- Combining all three types creates full coverage, offering the most protection for your car and financial well-being.

- Your driving habits, car value, and budget should guide which types of car insurance you choose.

- Optional add-ons like roadside assistance and rental reimbursement can enhance your policy for added peace of mind.

- Always review your policy annually to ensure it still meets your needs as your life and vehicle change.

📑 Table of Contents

- What Are the 3 Types of Car Insurance?

- Liability Insurance: The Legal Foundation of Car Coverage

- Collision Insurance: Protecting Your Vehicle After a Crash

- Comprehensive Insurance: Coverage Beyond Collisions

- Combining the Three: What Is Full Coverage?

- Optional Add-Ons and Enhancements

- How to Choose the Right Types of Car Insurance for You

- Final Thoughts: Making Smart Insurance Decisions

What Are the 3 Types of Car Insurance?

When you get behind the wheel, you’re not just driving a car—you’re taking on responsibility. Whether you’re commuting to work, picking up the kids, or taking a weekend road trip, accidents can happen in the blink of an eye. That’s why car insurance isn’t just a good idea—it’s a necessity. But with so many options out there, it’s easy to feel overwhelmed. What do all those terms mean? What’s actually covered? And most importantly, which types of car insurance do you really need?

The good news? It doesn’t have to be complicated. At its core, car insurance breaks down into three main types: liability, collision, and comprehensive. Each one plays a unique role in protecting you, your passengers, and your vehicle. Think of them like layers of safety—each covering a different kind of risk. Liability protects others if you’re at fault. Collision covers your car when you hit something (or something hits you). Comprehensive steps in when things go wrong that have nothing to do with driving, like a tree falling on your car or someone breaking in.

Understanding these three types of car insurance is the first step toward making smart, confident decisions about your coverage. Whether you’re a new driver or have been on the road for decades, knowing what each policy does—and doesn’t—cover can save you thousands of dollars and a lot of headaches down the line. In this guide, we’ll break down each type in simple terms, explain when you need them, and help you figure out the right mix for your lifestyle and budget.

Liability Insurance: The Legal Foundation of Car Coverage

Visual guide about What Are the 3 Types of Car Insurance

Image source: thefinancetrend.com

Let’s start with the most basic—and most important—type of car insurance: liability coverage. If you live in the United States, chances are your state requires you to carry at least some form of liability insurance. Why? Because it protects other people when you’re at fault in an accident. Without it, you could be on the hook for massive medical bills or property damage out of your own pocket.

Liability insurance is split into two parts: bodily injury liability and property damage liability. Bodily injury coverage pays for medical expenses, lost wages, and even legal fees if someone is injured because of your actions behind the wheel. Property damage liability covers the cost of repairing or replacing someone else’s vehicle or other property—like a fence, mailbox, or building—that you damage in a crash.

For example, imagine you run a red light and hit another car. The other driver needs surgery, and their car is totaled. Your liability insurance would step in to cover their medical bills and the cost of a new vehicle (up to your policy limits). Without it, you’d be responsible for paying those costs yourself—which could easily run into the tens or even hundreds of thousands of dollars.

How Much Liability Coverage Do You Need?

Most states set minimum liability requirements, but these are often surprisingly low. For instance, in California, the minimum is $15,000 per person for bodily injury, $30,000 per accident, and $5,000 for property damage. That might sound like enough—until you realize a single ambulance ride can cost more than $15,000. If your coverage maxes out and the other party’s expenses exceed it, they can sue you for the difference.

That’s why experts recommend carrying more than the minimum. A common rule of thumb is the “100/300/100” rule: $100,000 per person for bodily injury, $300,000 per accident, and $100,000 for property damage. This gives you a much stronger safety net and reduces your risk of financial ruin after a serious accident.

Who Needs Liability Insurance?

Virtually every driver needs liability insurance. If you own a car and drive it on public roads, you’re legally required to have it in almost every state (except New Hampshire and Virginia, which have alternative options). Even if you don’t own a car but frequently drive someone else’s vehicle, you should still be covered—either under their policy or through a non-owner car insurance policy.

Liability insurance is especially important if you have assets to protect—like a home, savings, or investments. If you’re sued after an accident and don’t have enough coverage, a court could go after your personal belongings to pay the judgment. Liability insurance helps shield you from that kind of financial disaster.

Collision Insurance: Protecting Your Vehicle After a Crash

Visual guide about What Are the 3 Types of Car Insurance

Image source: insuredaily.co.uk

Now let’s talk about collision insurance—the type of coverage that pays to repair or replace your own car after an accident, no matter who’s at fault. While liability insurance protects others, collision insurance protects you. It’s one of the most valuable types of car insurance if you own a vehicle that’s worth more than a few thousand dollars.

Collision coverage kicks in when your car collides with another vehicle, a stationary object (like a tree or guardrail), or even if you flip your car. It doesn’t matter if the accident was your fault or not—your collision policy will cover the cost of repairs, minus your deductible. For example, if you skid on ice and hit a pole, damaging your front bumper and headlights, collision insurance would pay for the repairs (after you pay your deductible, say $500).

When Is Collision Insurance Worth It?

The decision to add collision coverage depends largely on the value of your car. If you drive a brand-new sedan or a luxury SUV, collision insurance is almost always worth it. The cost of repairs or replacement could easily exceed $10,000—far more than the annual premium you’d pay for coverage.

But if you drive an older car with low market value—say, under $4,000—you might consider dropping collision coverage. Why? Because the cost of the premium could be close to or even exceed the car’s actual cash value. In that case, if your car is totaled, the insurance payout might only be a few thousand dollars, but you’ve been paying hundreds per year for coverage. It’s a numbers game.

A good rule of thumb: if the annual cost of collision insurance is more than 10% of your car’s value, it might not be worth it. For example, if your car is worth $5,000 and collision costs $600 per year, that’s 12%—probably too high. But if your car is worth $20,000 and collision costs $800, that’s only 4%, which is reasonable.

Collision vs. Liability: What’s the Difference?

It’s easy to mix up collision and liability insurance, but they serve very different purposes. Liability covers damage you cause to others. Collision covers damage to your own vehicle. Think of it this way: if you rear-end another car, liability pays for their car repairs and medical bills. Collision pays for your car’s repairs.

Both are important, but they’re not interchangeable. You can’t use liability to fix your own car, and you can’t use collision to pay for someone else’s injuries. That’s why many drivers choose to carry both—especially if they want full protection.

Comprehensive Insurance: Coverage Beyond Collisions

Visual guide about What Are the 3 Types of Car Insurance

Image source: 25174313.fs1.hubspotusercontent-eu1.net

Now for the third major type of car insurance: comprehensive coverage. While collision handles accidents involving impacts, comprehensive insurance protects your vehicle from everything else. It’s the “everything else” policy that covers non-collision events like theft, vandalism, fire, flooding, hail, falling objects, and even animal collisions.

Imagine this: you park your car overnight, and in the morning, you find a huge dent in the door and spray paint across the hood. That’s vandalism—covered by comprehensive insurance. Or maybe a tree branch falls on your roof during a storm, cracking the windshield and denting the hood. Again, comprehensive has you covered. Even if a deer jumps out and you swerve to avoid it, damaging your car in the process, comprehensive may apply (depending on the circumstances).

What Does Comprehensive Insurance Cover?

Comprehensive coverage is broad, but it’s not unlimited. Here’s a breakdown of common covered events:

– Theft: If your car is stolen, comprehensive insurance can pay to replace it (up to the car’s actual cash value).

– Vandalism: Graffiti, broken windows, or slashed tires are typically covered.

– Natural disasters: Floods, hurricanes, earthquakes, and wildfires can damage your car—comprehensive steps in.

– Falling objects: Tree branches, debris from construction, or even a satellite falling from the sky (yes, it’s happened!) are covered.

– Animal collisions: Hitting a deer, moose, or even a large bird can cause serious damage. Comprehensive covers this, unlike collision, which usually only applies to vehicles or objects.

– Fire: Whether it’s a house fire that spreads to your garage or a spontaneous engine fire, comprehensive pays for repairs.

One thing comprehensive doesn’t cover? Mechanical breakdowns or normal wear and tear. If your transmission fails because it’s old, that’s not covered. But if a flood ruins your engine, that is.

Is Comprehensive Insurance Necessary?

Like collision insurance, comprehensive is optional unless you have a loan or lease. If you’re financing your car, the lender will almost always require both collision and comprehensive to protect their investment. But if you own your car outright, it’s up to you.

The same rule of thumb applies: if your car is worth more than $4,000–$5,000, comprehensive is usually a smart choice. The cost of replacing a stolen car or repairing storm damage can far exceed the annual premium. Plus, comprehensive often has a low deductible (like $250 or $500), making it affordable to file a claim.

Even if your car is older, comprehensive can still be valuable if you live in an area prone to theft, extreme weather, or wildlife. For example, drivers in Florida might want comprehensive for hurricane protection, while those in rural areas might need it for deer collisions.

Combining the Three: What Is Full Coverage?

So what happens when you combine all three types of car insurance? You get what’s commonly called “full coverage.” This isn’t a specific policy—it’s just a term used to describe a combination of liability, collision, and comprehensive insurance. It’s the most complete protection you can get for your vehicle and financial security.

Full coverage gives you peace of mind knowing that whether you cause an accident, hit a tree, or your car gets stolen, you’re protected. It covers damage to others (liability), damage to your car from collisions (collision), and damage from non-collision events (comprehensive). It’s the gold standard for car insurance.

Who Should Consider Full Coverage?

Full coverage is ideal for:

– New or relatively new cars

– Leased or financed vehicles

– Drivers with valuable assets to protect

– People who want maximum peace of mind

If you drive a car that’s still under warranty or has high resale value, full coverage is almost always worth it. The cost of repairs or replacement could easily exceed $20,000—far more than the annual premium for full coverage.

Even if your car is a few years old, full coverage can still make sense. For example, a 2019 Honda Accord might be worth $15,000. Paying $1,200 per year for full coverage (including liability, collision, and comprehensive) is a small price to pay for protection against a total loss.

Full Coverage vs. Minimum Coverage: A Cost Comparison

Let’s look at a real-world example. Say you’re a 35-year-old driver in Texas with a clean record. Here’s what you might pay annually:

– Minimum liability only: $600

– Full coverage (liability + collision + comprehensive): $1,400

That’s an $800 difference. But consider this: if your $18,000 car is totaled in a hailstorm, minimum coverage won’t pay a dime for your vehicle. Full coverage would pay $17,500 (minus your deductible). That’s a $17,500 benefit for an extra $800 per year. Over five years, you’d pay $4,000 more for full coverage—but you could receive $17,500 in a single claim.

The math is clear: full coverage offers far greater value when you need it most.

Optional Add-Ons and Enhancements

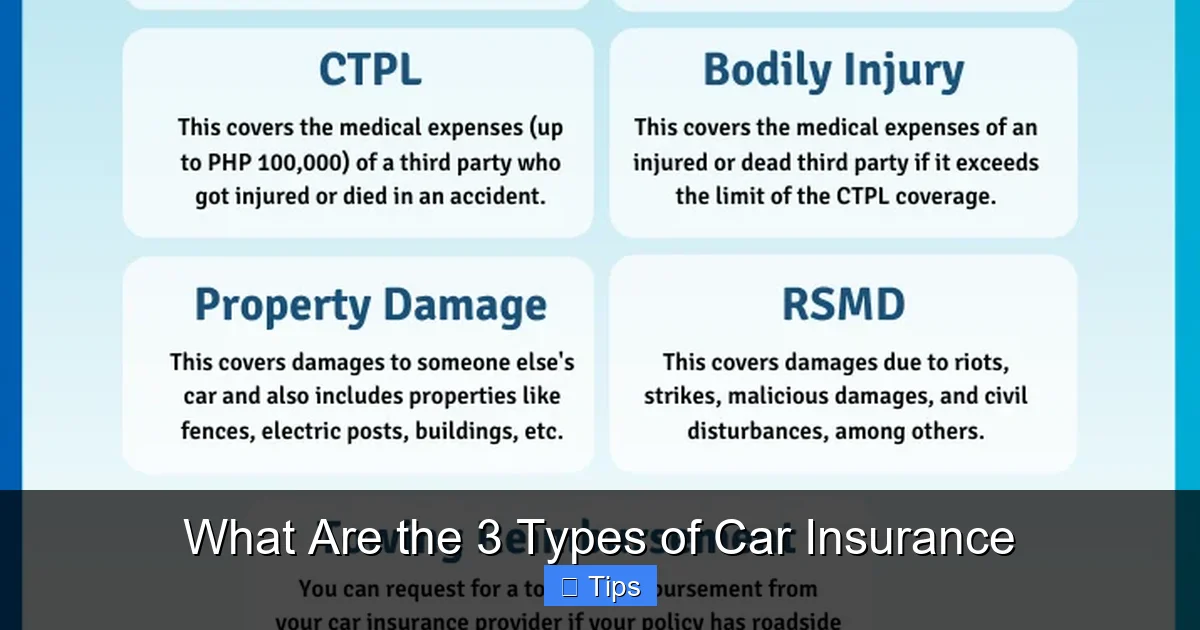

While the three main types of car insurance form the foundation of your policy, there are several optional add-ons that can enhance your coverage. These extras aren’t required, but they can provide valuable protection in specific situations.

Uninsured/Underinsured Motorist Coverage

This protects you if you’re hit by a driver who has no insurance or not enough to cover your damages. It pays for your medical bills, lost wages, and car repairs. Given that nearly 13% of drivers are uninsured (according to the Insurance Information Institute), this add-on is highly recommended.

Personal Injury Protection (PIP)

Also known as “no-fault” insurance, PIP covers medical expenses for you and your passengers, regardless of who caused the accident. It’s required in some states and optional in others. PIP can also cover lost wages and funeral expenses.

Roadside Assistance

This add-on covers towing, jump-starts, flat tire changes, and lockout services. It’s especially useful if you drive long distances or live in a rural area. Many insurers offer it for $5–$15 per month.

Rental Reimbursement

If your car is in the shop after an accident, rental reimbursement pays for a rental car while yours is being repaired. This can be a lifesaver if you rely on your vehicle for work or family responsibilities.

Gap Insurance

If you have a loan or lease, gap insurance covers the “gap” between what you owe on your car and its actual cash value if it’s totaled. For example, if you owe $25,000 but your car is only worth $20,000, gap insurance pays the $5,000 difference.

How to Choose the Right Types of Car Insurance for You

With so many options, how do you decide which types of car insurance to buy? The answer depends on your personal situation. Here are some key factors to consider:

Your Car’s Value

If your car is worth more than $5,000, collision and comprehensive are usually worth it. If it’s older and low-value, you might skip them to save money.

Your Driving Habits

Do you drive daily in heavy traffic? Do you park on the street in a high-crime area? High-risk drivers benefit more from comprehensive and collision coverage.

Your Financial Situation

Can you afford to pay $5,000 out of pocket if your car is totaled? If not, full coverage is a smart investment. If you have significant savings, you might opt for higher deductibles to lower your premium.

State Requirements

Always meet your state’s minimum liability requirements. But don’t stop there—consider increasing your limits for better protection.

Shop Around Annually

Insurance rates change. Comparing quotes from multiple insurers each year can save you hundreds. Use online tools or work with an independent agent to find the best deal.

Final Thoughts: Making Smart Insurance Decisions

Car insurance doesn’t have to be confusing. By understanding the three main types—liability, collision, and comprehensive—you can build a policy that fits your needs and budget. Liability protects others. Collision protects your car in crashes. Comprehensive protects against everything else.

Whether you choose minimum coverage or full coverage, the goal is the same: to drive with confidence, knowing you’re protected no matter what happens on the road. Take the time to review your policy, ask questions, and adjust your coverage as your life changes. A little knowledge today can prevent a lot of stress tomorrow.

Frequently Asked Questions

What are the three main types of car insurance?

The three main types of car insurance are liability, collision, and comprehensive. Liability covers damage or injuries you cause to others, collision covers damage to your own vehicle after a crash, and comprehensive covers non-collision events like theft, vandalism, and natural disasters.

Is liability insurance required by law?

Yes, liability insurance is legally required in most states. It covers bodily injury and property damage you cause to others in an accident. The minimum coverage varies by state, but it’s essential for all drivers.

Do I need collision insurance if I own my car outright?

Collision insurance is optional if you own your car outright, but it’s recommended if your vehicle is worth more than $4,000–$5,000. It pays for repairs to your car after a collision, regardless of fault.

What does comprehensive insurance cover that collision doesn’t?

Comprehensive insurance covers non-collision events like theft, vandalism, fire, flooding, hail, falling objects, and animal collisions. Collision only covers damage from crashes with vehicles or objects.

What is full coverage car insurance?

Full coverage refers to a combination of liability, collision, and comprehensive insurance. It provides the most complete protection for your vehicle and financial well-being, covering damage to others, your car in crashes, and non-collision losses.

Can I drop comprehensive and collision insurance on an older car?

Yes, you can drop comprehensive and collision on an older, low-value car if the cost of the premiums exceeds the car’s value. However, consider your risk tolerance and whether you can afford to replace the vehicle out of pocket if it’s damaged or stolen.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.