Winning a Maserati sounds like a dream—but don’t forget the taxes. Depending on where you live, you could owe federal and state income taxes, plus sales and registration fees. Understanding these costs upfront helps you plan and avoid surprises.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Introduction: The Dream of Winning a Maserati

- 4 Understanding How Prize Winnings Are Taxed

- 5 Sales Tax on a Won Maserati: Who Pays?

- 6 Registration, Title, and Other Fees

- 7 Tax Withholding and Estimated Payments

- 8 Planning Ahead: Tips for Winners

- 9 Real-Life Example: John’s Maserati Win

- 10 Conclusion: Enjoy the Ride—But Plan for the Costs

- 11 Frequently Asked Questions

- 11.1 Do I have to pay taxes on a won Maserati?

- 11.2 How much federal tax will I owe on a won Maserati?

- 11.3 Do I pay sales tax on a won car?

- 11.4 What fees are involved in registering a won Maserati?

- 11.5 Can I avoid taxes by selling the Maserati right away?

- 11.6 What happens if I don’t pay the taxes on my won Maserati?

Key Takeaways

- Federal income tax applies: The IRS treats prize winnings, including cars, as taxable income. A won Maserati is valued at its fair market value and reported on your tax return.

- State income tax may apply: Most states tax prize winnings, though a few (like Florida and Texas) do not. Check your state’s rules to estimate your liability.

- Sales tax is often your responsibility: Even though the car is “free,” you may still need to pay sales tax when registering it, based on the car’s value in your state.

- Registration and title fees add up: These vary by state but typically include charges for titling, registration, and emissions or safety inspections.

- Withholding may occur at the time of prize: Some sweepstakes or contests withhold 24% for federal taxes upfront, but this may not cover your full tax bill.

- Consult a tax professional: Tax laws are complex and vary by location. A CPA or tax advisor can help you plan and avoid underpayment penalties.

- Keep detailed records: Save all documentation related to the prize, including the fair market value, tax forms (like a 1099-MISC), and receipts for fees paid.

📑 Table of Contents

- Introduction: The Dream of Winning a Maserati

- Understanding How Prize Winnings Are Taxed

- Sales Tax on a Won Maserati: Who Pays?

- Registration, Title, and Other Fees

- Tax Withholding and Estimated Payments

- Planning Ahead: Tips for Winners

- Real-Life Example: John’s Maserati Win

- Conclusion: Enjoy the Ride—But Plan for the Costs

Introduction: The Dream of Winning a Maserati

Imagine getting a phone call or an email saying you’ve won a brand-new Maserati. Your heart races. You picture yourself cruising down the highway in a sleek, Italian luxury car—engine purring, heads turning. It’s the kind of moment people dream about. But while the excitement is real, it’s important to remember that winning a high-value prize like a Maserati comes with financial responsibilities—especially taxes.

Many people assume that because the car is a “prize,” it’s free and clear. But the reality is more complicated. The Internal Revenue Service (IRS) and most state tax agencies treat prize winnings as taxable income. That means the value of your Maserati will likely be added to your taxable income for the year, potentially pushing you into a higher tax bracket. And that’s just the beginning. Depending on where you live, you may also owe sales tax, registration fees, and other charges when you take possession of the vehicle.

Understanding How Prize Winnings Are Taxed

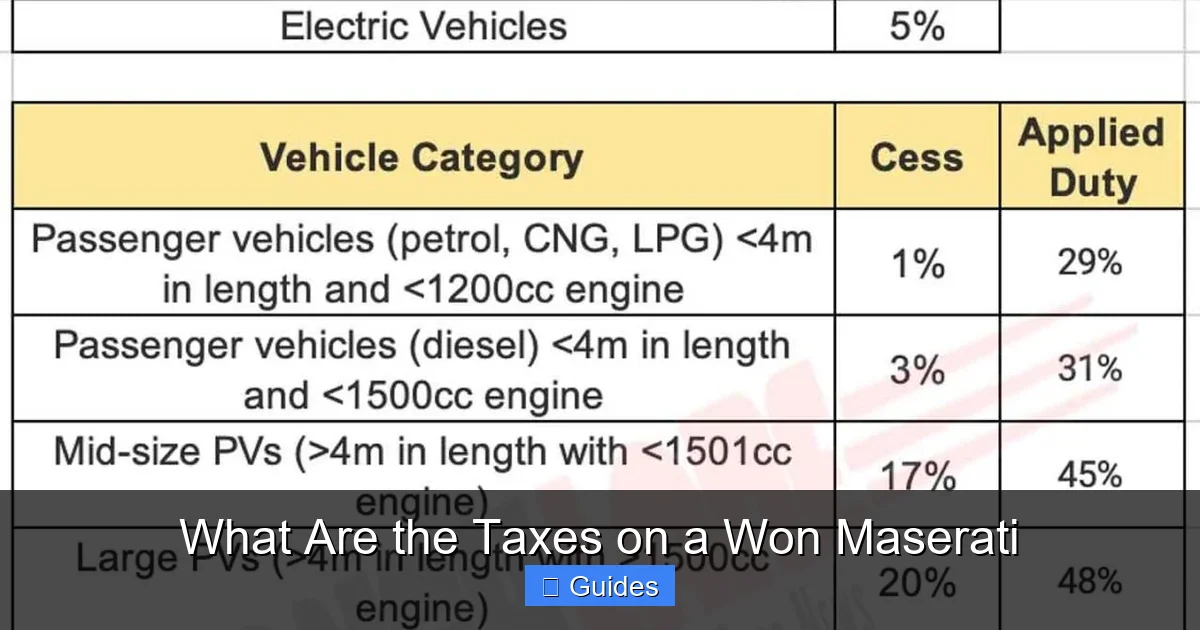

Visual guide about What Are the Taxes on a Won Maserati

Image source: i.postimg.cc

When you win a Maserati—whether through a contest, sweepstakes, or lottery—the IRS considers it taxable income. This rule applies regardless of how you won the car. The key factor is the fair market value (FMV) of the vehicle at the time you receive it. FMV is essentially what the car would sell for on the open market in your area.

For example, if you win a 2024 Maserati Ghibli, which has a starting price of around $78,000, the IRS will treat that $78,000 as income. That amount will be reported to you and the IRS on a Form 1099-MISC (or similar form), and you’ll need to include it when filing your federal tax return.

Federal Income Tax on Prize Winnings

The federal government taxes prize winnings at your ordinary income tax rate. This means the value of the Maserati is added to your other income—like wages, interest, or investment gains—and taxed accordingly. If you’re in the 22% tax bracket, for instance, you could owe around $17,160 in federal taxes on a $78,000 car. But if your total income (including the prize) pushes you into the 32% bracket, your tax liability could be significantly higher.

It’s also important to note that the IRS requires organizations awarding prizes over $600 to report them. If the prize is valued at $5,000 or more, the organization may also be required to withhold 24% for federal income taxes at the time of award. This withholding is an advance payment toward your tax bill, but it may not cover the full amount you owe.

State Income Tax Considerations

While federal tax rules are consistent across the U.S., state tax treatment of prize winnings varies. Most states follow the federal approach and tax prize winnings as income. However, a few states—including Florida, Texas, Washington, and Nevada—do not impose a state income tax, so residents of these states may not owe additional state taxes on the prize.

Other states have different rules. For example, California taxes prize winnings at the same rate as regular income, which can be as high as 13.3%. New York also taxes prizes, with rates ranging from 4% to 10.9%. Even if your state doesn’t tax income, you may still be subject to local taxes or fees.

How the Fair Market Value Is Determined

The fair market value of your Maserati is crucial because it determines how much income you must report. The contest organizer is responsible for providing this value, usually based on the manufacturer’s suggested retail price (MSRP) or a valuation from a third-party source like Kelley Blue Book.

However, if the car is used or has been driven before delivery, the value may be lower. For example, if the Maserati has 5,000 miles on it, the FMV might be closer to $70,000. Always ask for documentation of the valuation, as you’ll need it for your tax return.

Sales Tax on a Won Maserati: Who Pays?

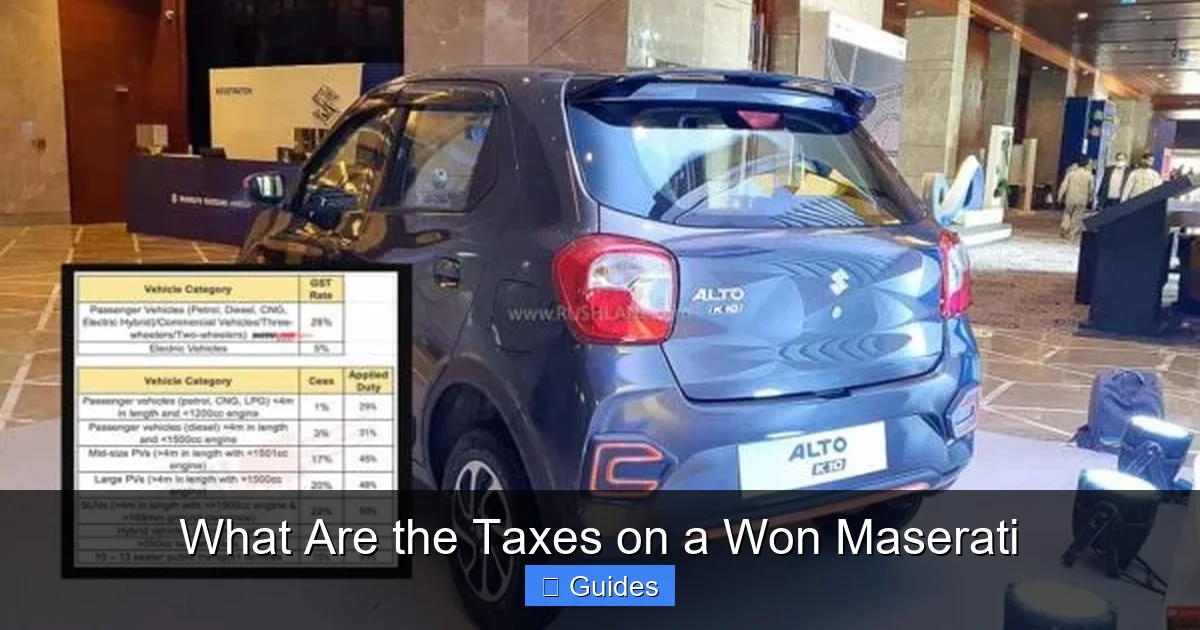

Visual guide about What Are the Taxes on a Won Maserati

Image source: rushlane.com

One of the most common questions people have is whether they need to pay sales tax on a won Maserati. The short answer is: it depends on your state.

In most states, sales tax is based on the purchase price of a vehicle. But when you win a car, there’s no purchase—so who pays the tax? In many cases, the winner is still responsible for paying sales tax when they register the vehicle.

States That Require Sales Tax on Prize Vehicles

Several states require winners to pay sales tax on the full value of a prize vehicle. For example:

– In California, you must pay sales tax (currently around 7.25% to 10.25%, depending on the county) on the fair market value of the car when you register it.

– In New York, sales tax is based on the vehicle’s value and can range from 4% to 8.875%.

– In Illinois, the sales tax rate is 6.25%, but local taxes can push the total above 10%.

So, if you win a $78,000 Maserati in California and your local sales tax rate is 9%, you could owe around $7,020 in sales tax alone.

States That Exempt Prize Vehicles from Sales Tax

A few states do not require sales tax on prize vehicles. These include:

– Texas: No sales tax on prize vehicles.

– Florida: No sales tax on prizes, though registration fees still apply.

– New Hampshire: No sales tax, but registration fees are required.

Even in these states, you should confirm the rules with your local Department of Motor Vehicles (DMV), as policies can change.

How to Calculate Your Sales Tax Liability

To estimate your sales tax, follow these steps:

1. Determine the fair market value of the Maserati (provided by the contest organizer).

2. Find your state and local sales tax rate (check your state’s DMV or revenue department website).

3. Multiply the car’s value by the tax rate.

For example:

$78,000 (car value) × 0.09 (9% tax rate) = $7,020 in sales tax.

Keep in mind that some states allow you to deduct the federal tax withholding from the sales tax base, but this is rare. Always verify with your state’s rules.

Registration, Title, and Other Fees

Visual guide about What Are the Taxes on a Won Maserati

Image source: rushlane.com

Beyond income and sales tax, you’ll likely face additional costs when registering your Maserati. These fees vary widely by state but typically include:

– Title fee: To legally transfer ownership of the vehicle.

– Registration fee: To license the car for road use.

– Plate fee: For new license plates.

– Emissions or safety inspection fee: Required in some states.

– Luxury or weight-based fees: Some states charge extra for high-value or heavy vehicles.

Typical Registration Costs by State

Here’s a breakdown of what you might expect in different states:

– California: Title fee ($20), registration fee ($62), plus a $24 smog check fee and potential local taxes. Total: ~$150–$300, not including sales tax.

– New York: Title fee ($50), registration fee ($50–$200 depending on weight), plus possible emissions testing. Total: ~$150–$300.

– Texas: Title fee ($33), registration fee ($50.75), plus optional inspection ($7). Total: ~$90.

– Florida: Title fee ($75.25), registration fee ($225 for a new vehicle), plus possible local fees. Total: ~$300.

These fees may seem small compared to the car’s value, but they add up—especially when combined with taxes.

Special Fees for Luxury Vehicles

Some states impose additional charges on high-value vehicles. For example:

– California has a “smog impact fee” based on the car’s value. For a $78,000 Maserati, this could be $78.

– New York charges a “vehicle use tax” on luxury cars, which can be several hundred dollars.

– Illinois has a “title service fee” that can add $50–$100.

Always check with your state’s DMV to understand all applicable fees.

Tax Withholding and Estimated Payments

When you win a Maserati, the contest organizer may withhold taxes upfront. This is common for prizes valued at $5,000 or more. The standard federal withholding rate is 24%, which is applied to the fair market value of the prize.

For example, if your Maserati is worth $78,000, the organizer might withhold $18,720 (24% of $78,000) and send it to the IRS on your behalf. This amount will appear on your Form 1099-MISC.

Is Withholding Enough?

While 24% withholding helps, it may not cover your full tax liability. If your total income (including the prize) pushes you into a higher tax bracket, you could owe more. For instance, if your marginal tax rate is 32%, you’d owe an additional 8% on the prize value—about $6,240 on a $78,000 car.

To avoid underpayment penalties, you may need to make estimated tax payments throughout the year. The IRS requires taxpayers to pay at least 90% of their current year’s tax liability or 100% of the prior year’s liability (110% if your income is over $150,000).

How to Make Estimated Tax Payments

If you expect to owe more than $1,000 in taxes after withholding, you should consider making quarterly estimated tax payments. You can do this using IRS Form 1040-ES. Payments are typically due in April, June, September, and January of the following year.

For example, if you win the Maserati in March, you’d need to make your first estimated payment by April 15. Missing a payment could result in penalties and interest.

Planning Ahead: Tips for Winners

Winning a Maserati is exciting, but it’s smart to plan for the financial impact. Here are some practical tips to help you manage the taxes and fees:

Consult a Tax Professional

Tax laws are complex and vary by state. A certified public accountant (CPA) or tax advisor can help you understand your obligations, estimate your tax bill, and plan for payments. They can also help you determine if you’re eligible for any deductions or credits.

For example, if you use the Maserati for business purposes (e.g., client meetings or promotional events), you may be able to deduct a portion of the operating costs. However, personal use of the car is not deductible.

Set Aside Funds for Taxes and Fees

Don’t wait until tax season to think about the costs. As soon as you win the car, estimate your total tax and fee liability and set aside that amount in a separate savings account. This will help you avoid financial stress and potential penalties.

For a $78,000 Maserati, you might need to set aside $25,000–$35,000 to cover federal and state income taxes, sales tax, and registration fees.

Keep Detailed Records

Save all documentation related to the prize, including:

– The official notification of the win.

– The fair market value statement.

– Form 1099-MISC (if issued).

– Receipts for registration, title, and inspection fees.

– Proof of any tax payments or withholding.

These records will be essential when filing your tax return and responding to any IRS inquiries.

Consider Selling the Car

If the tax burden is too high, you might consider selling the Maserati soon after winning it. This can help you recoup some of the value and reduce your taxable income. However, selling a prize vehicle may trigger additional tax rules, such as capital gains tax if the car appreciates in value.

For example, if you win the car and sell it for $80,000, you’d report $78,000 as prize income and $2,000 as capital gain. Consult a tax professional before making this decision.

Real-Life Example: John’s Maserati Win

Let’s look at a real-world scenario to illustrate how taxes on a won Maserati work.

John, a resident of California, wins a 2024 Maserati Ghibli valued at $78,000 in a national sweepstakes. Here’s how his costs break down:

– Federal income tax: 24% withholding = $18,720 (paid upfront).

– Additional federal tax: His total income pushes him into the 32% bracket, so he owes an extra 8% = $6,240.

– California state income tax: 9.3% on the prize = $7,254.

– Sales tax: 9% on $78,000 = $7,020.

– Registration and title fees: $250.

Total estimated cost: $39,484.

John sets aside $40,000 to cover these expenses and consults a CPA to ensure he files correctly. He also keeps all receipts and forms for his records.

Conclusion: Enjoy the Ride—But Plan for the Costs

Winning a Maserati is a once-in-a-lifetime experience, but it’s not entirely free. The taxes and fees can add up quickly, especially if you live in a high-tax state. By understanding your obligations upfront—federal and state income taxes, sales tax, registration fees, and possible withholding—you can avoid surprises and enjoy your new car without financial stress.

The key is to plan ahead. Consult a tax professional, set aside funds, and keep detailed records. With the right preparation, you can turn your dream win into a smooth, stress-free reality.

Remember: the IRS doesn’t care how you got the car—only that you report its value correctly. So while the Maserati may be a prize, the taxes are very real. But with smart planning, you can handle them like a pro and still enjoy every mile.

Frequently Asked Questions

Do I have to pay taxes on a won Maserati?

Yes, the IRS treats prize winnings, including cars, as taxable income. You must report the fair market value of the Maserati on your federal tax return, and most states also tax prize winnings.

How much federal tax will I owe on a won Maserati?

Federal tax is based on your income tax bracket. The prize value is added to your total income and taxed at your marginal rate. If the prize is over $5,000, 24% may be withheld upfront, but you could owe more when you file.

Do I pay sales tax on a won car?

It depends on your state. Most states require you to pay sales tax on the fair market value when you register the vehicle, even if you didn’t buy it. A few states, like Texas and Florida, do not charge sales tax on prizes.

What fees are involved in registering a won Maserati?

You’ll likely pay title fees, registration fees, plate fees, and possibly emissions or safety inspection fees. These vary by state but typically range from $100 to $300, not including taxes.

Can I avoid taxes by selling the Maserati right away?

Selling the car may reduce your net gain, but you’ll still owe taxes on the prize value. You may also owe capital gains tax if the car increases in value. Consult a tax professional before selling.

What happens if I don’t pay the taxes on my won Maserati?

Failing to report prize income can result in IRS penalties, interest, and even audits. It’s important to report the value accurately and pay any taxes owed to avoid legal and financial consequences.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.