With a $70,000 annual salary, you can comfortably afford a car priced between $25,000 and $35,000, depending on your monthly expenses and down payment. This guide breaks down how to calculate your car budget, factor in insurance and maintenance, and choose a vehicle that fits your lifestyle without straining your finances.

So, you’re earning $70,000 a year and wondering, “What car can I afford?” It’s a smart question—one that many people overlook until they’re stuck with high payments and surprise repair bills. The good news? With a $70k salary, you’re in a solid position to drive a reliable, stylish, and practical vehicle without breaking the bank. But the key is knowing how to stretch your dollars wisely.

Let’s be real: a $70,000 income sounds great on paper, but after taxes, rent, groceries, and student loans (if you have them), your take-home pay might be closer to $4,500–$5,000 per month. That’s why it’s crucial to approach car buying with a clear budget—not just for the monthly payment, but for all the hidden costs that come with owning a vehicle. From insurance premiums to oil changes, these expenses add up fast. The goal isn’t to buy the fanciest car on the lot, but to find one that fits your lifestyle, meets your needs, and doesn’t derail your financial goals.

In this guide, we’ll walk you through exactly how to determine what car you can afford on a $70k salary. We’ll cover budgeting rules, realistic price ranges, financing tips, and smart alternatives like certified pre-owned vehicles. Whether you’re eyeing a fuel-efficient sedan, a rugged SUV, or a sporty hatchback, we’ll help you make a confident, informed decision—without the buyer’s remorse.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 How to Calculate Your Real Car Budget

- 4 Realistic Car Price Range for a $70k Salary

- 5 Financing Tips to Keep Payments Low

- 6 Don’t Forget: Ongoing Costs Matter

- 7 Best Car Options for a $70k Salary

- 8 Smart Shopping Tips to Stay on Budget

- 9 Final Thoughts: Drive Smart, Live Well

- 10 Frequently Asked Questions

Key Takeaways

- Budget 10–15% of take-home pay for car expenses: This includes loan payments, insurance, fuel, and maintenance to avoid financial stress.

- Aim for a car price of $25,000–$35,000: Based on a $70k salary, this range keeps monthly payments manageable and leaves room for other financial goals.

- Make a 20% down payment: Putting down at least $5,000–$7,000 reduces loan amount, interest, and monthly payments.

- Choose a loan term of 48–60 months: Longer terms mean lower monthly payments but more interest paid over time—balance affordability with total cost.

- Factor in insurance, fuel, and maintenance: These ongoing costs can add $200–$400+ per month, so include them in your budget.

- Consider certified pre-owned (CPO) vehicles: You get reliability, warranty coverage, and lower depreciation than new cars at a fraction of the price.

- Use online calculators and pre-approval: Tools like auto loan calculators and lender pre-approval help you shop within your real budget.

📑 Table of Contents

How to Calculate Your Real Car Budget

Figuring out what you can afford starts with understanding your monthly cash flow. It’s not just about the car payment—it’s about everything that comes with owning a vehicle. The most common rule of thumb is the **10–15% rule**: your total car expenses (loan, insurance, fuel, maintenance) should not exceed 10–15% of your take-home pay.

Let’s do the math. If you earn $70,000 a year, your monthly gross income is about $5,833. After federal and state taxes, Social Security, and Medicare, your take-home pay is likely between $4,500 and $5,000, depending on where you live and your deductions. Taking 15% of $4,750 (a midpoint estimate), you’d have around $712 per month to spend on all car-related costs.

Now, let’s break that down:

– **Loan payment:** $350–$450

– **Insurance:** $120–$200

– **Fuel:** $100–$150

– **Maintenance & repairs:** $50–$100

That adds up to $620–$900, which is right in the 10–15% range. But if your insurance is high (common in cities or for younger drivers), or you drive a lot, you might need to adjust. The point is: don’t just focus on the loan payment. Look at the full picture.

Use the 20/4/10 Rule for Clarity

Another helpful guideline is the **20/4/10 rule**, widely recommended by financial experts:

– **20% down payment:** Put at least 20% of the car’s price down to reduce your loan amount and avoid being “upside down” (owing more than the car is worth).

– **4-year loan term:** Aim for a 48-month loan to minimize interest and pay off the car faster.

– **10% of income on total car costs:** Keep all vehicle expenses under 10% of your gross monthly income.

With a $70k salary, 10% of your gross income is $583 per month. That’s a tight but realistic target. If you follow this rule, you’ll avoid overextending yourself and keep your finances healthy.

Factor in Your Debt-to-Income Ratio

Lenders look at your **debt-to-income ratio (DTI)** when approving loans. This is your total monthly debt payments (car, student loans, credit cards, mortgage) divided by your gross monthly income. Most lenders prefer a DTI under 36%, with no more than 28% going toward housing.

If you already have student loans or credit card debt, that affects how much you can afford for a car. For example, if your monthly debts (excluding the car) are $1,200, and your gross income is $5,833, your DTI is already 20.6%. Adding a $400 car payment brings it to 27.4%—still acceptable, but cutting it close. If your DTI is already high, consider a less expensive car or a larger down payment.

Realistic Car Price Range for a $70k Salary

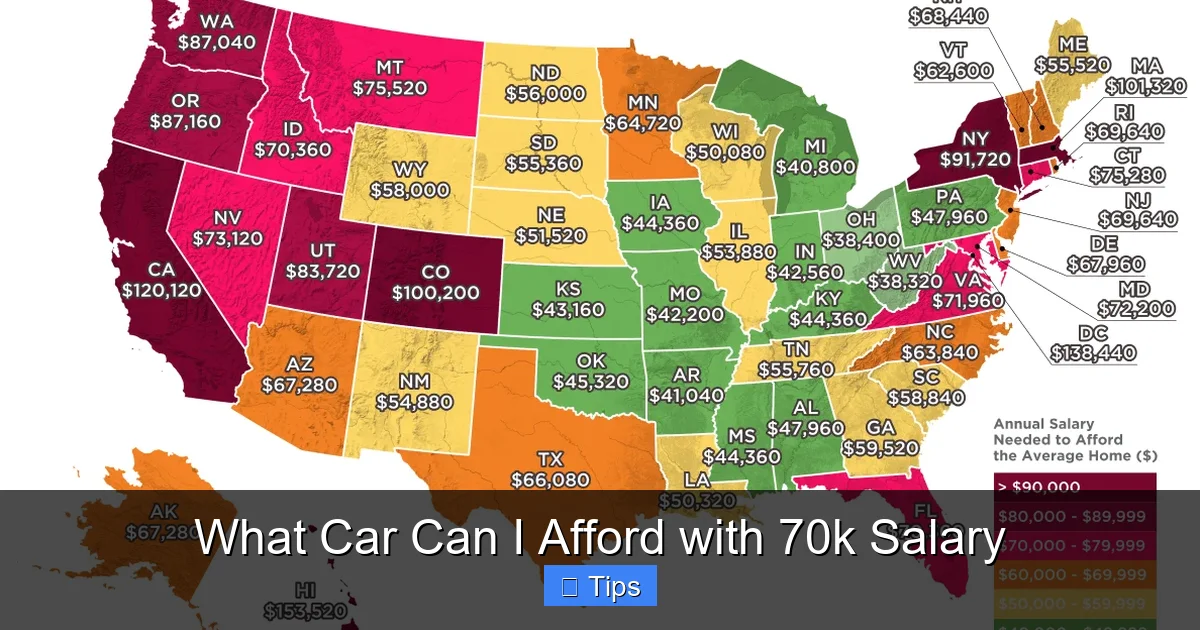

Visual guide about What Car Can I Afford with 70k Salary

Image source: autozonic.com

So, what does this mean in terms of actual car prices? Based on the guidelines above, you can comfortably afford a vehicle in the **$25,000 to $35,000 range**. This includes new, used, and certified pre-owned (CPO) models across a wide variety of categories.

Let’s look at a few examples:

– A **2024 Honda Civic LX** starts around $25,000. With a $5,000 down payment and a 5.5% interest rate on a 60-month loan, your monthly payment would be about $380.

– A **2024 Toyota RAV4 LE** starts at $29,000. With the same down payment and rate, your payment would be around $440.

– A **2022 certified pre-owned BMW 3 Series** might cost $32,000. With a $6,400 down payment (20%), your payment could be $520—but insurance and maintenance will be higher.

These prices keep your total monthly car costs within the 10–15% range, assuming average insurance and fuel expenses. Going above $35,000 starts to stretch your budget, especially if you have other financial obligations.

New vs. Used: What Makes Sense?

New cars offer the latest features, full warranties, and peace of mind—but they depreciate fast. A new car can lose 20–30% of its value in the first year. That’s a $7,000–$10,000 hit on a $35k vehicle.

Used cars, especially **certified pre-owned (CPO)** models, offer a sweet spot. CPO vehicles are typically 1–3 years old, have low mileage, and come with extended warranties and thorough inspections. You get most of the benefits of a new car at a much lower price. For example, a 2022 CPO Honda Accord might cost $24,000 instead of $32,000 for a new one—saving you $8,000 upfront.

If you’re open to it, a 3–5-year-old used car can be an even better deal. These models have already taken the biggest depreciation hit, so you’re paying for reliability, not brand-new status.

Financing Tips to Keep Payments Low

Visual guide about What Car Can I Afford with 70k Salary

Image source: acadlog.in

How you finance your car makes a big difference in affordability. Here are some smart strategies to keep your payments manageable.

Get Pre-Approved Before You Shop

Don’t wait until you’re at the dealership to figure out your financing. Get pre-approved through your bank, credit union, or online lender. This gives you a clear budget, strengthens your negotiating power, and helps you avoid high dealer interest rates.

For example, if you’re approved for a $30,000 loan at 5.5% over 60 months, you know your payment will be around $570. If the dealer offers 7%, you can push back or walk away. Pre-approval also speeds up the buying process.

Aim for a 20% Down Payment

Putting down 20% reduces your loan amount, lowers your monthly payment, and helps you avoid negative equity. On a $30,000 car, a $6,000 down payment means you’re only financing $24,000. That could drop your payment from $570 to $456—a savings of $114 per month.

If you can’t afford 20% right now, aim for at least 10%. But try to save a bit more before buying. Even an extra $2,000 down can make a noticeable difference.

Choose the Right Loan Term

Shorter loan terms (48–60 months) mean higher monthly payments but less interest over time. A 72- or 84-month loan lowers your payment but costs more in the long run.

For example:

– $24,000 loan at 5.5% over 60 months = $456/month, $3,360 total interest

– Same loan over 72 months = $386/month, $4,792 total interest

You save $70 per month but pay $1,432 more in interest. Only choose a longer term if you truly need the lower payment—and plan to pay it off early if possible.

Don’t Forget: Ongoing Costs Matter

Visual guide about What Car Can I Afford with 70k Salary

Image source: vividmaps.com

The sticker price and loan payment are just the beginning. Owning a car comes with recurring expenses that can sneak up on you.

Insurance: It’s Not All the Same

Insurance costs vary widely based on the car, your age, driving record, and location. A sporty coupe or luxury SUV will cost more to insure than a compact sedan or minivan.

For a $70k salary earner, expect to pay $100–$200 per month for full coverage. Use online tools like Progressive, Geico, or The Zebra to compare quotes before buying. Some insurers offer discounts for safe driving, bundling home and auto, or paying annually.

Fuel and Maintenance: Plan for the Long Haul

Fuel costs depend on your car’s efficiency and how much you drive. If you commute 30 miles round-trip in a car that gets 25 MPG, and gas is $3.50/gallon, you’ll spend about $150 per month on fuel.

Maintenance includes oil changes ($50–$80 every 5,000–7,500 miles), tire rotations, brake pads, and unexpected repairs. Budget $50–$100 per month for these. Newer cars under warranty will cost less, but even they need regular upkeep.

Depreciation: The Silent Cost

Depreciation is the loss in value over time. It’s not a direct expense, but it affects your net worth. A $35,000 new car might be worth $25,000 after three years—a $10,000 loss. That’s why buying used or choosing a car with strong resale value (like Toyota, Honda, or Subaru) can save you money in the long run.

Best Car Options for a $70k Salary

Now that you know your budget, let’s look at some great car options that fit within the $25,000–$35,000 range.

Compact Sedans: Reliable and Efficient

Perfect for city driving and commuters, these cars offer great fuel economy, low insurance, and affordable maintenance.

– **Honda Civic:** Starting at $25,000, known for reliability and resale value.

– **Toyota Corolla:** Starts around $23,000, excellent safety ratings and hybrid option.

– **Mazda3:** Stylish and fun to drive, starting at $24,000.

Compact SUVs: Space and Versatility

Ideal for families, outdoor enthusiasts, or anyone who wants extra cargo space.

– **Toyota RAV4:** Starts at $29,000, top safety pick, available hybrid.

– **Honda CR-V:** Starts at $28,000, spacious interior, great fuel economy.

– **Subaru Forester:** Starts at $27,000, standard all-wheel drive, excellent for snowy climates.

Certified Pre-Owned Luxury

Want a touch of luxury without the new-car price? CPO models offer premium features at a discount.

– **CPO BMW 3 Series:** $30,000–$35,000, sporty handling, luxury interior.

– **CPO Audi A4:** Similar price range, advanced tech, sleek design.

– **CPO Lexus ES:** $32,000+, known for reliability and comfort.

Hybrids and EVs: Save on Fuel

If you drive a lot or want to reduce your carbon footprint, consider a hybrid or electric vehicle.

– **Toyota Prius:** Starts at $28,000, 50+ MPG, low maintenance.

– **Hyundai Kona Electric:** Starts at $33,000, 258-mile range, federal tax credit available.

– **Chevrolet Bolt EV:** Starts at $27,000, 259-mile range, great value.

Smart Shopping Tips to Stay on Budget

Once you know what you can afford, it’s time to shop smart.

Use Online Tools and Calculators

Websites like Edmunds, Kelley Blue Book (KBB), and TrueCar help you compare prices, read reviews, and find fair market values. Auto loan calculators let you plug in different prices, down payments, and interest rates to see how they affect your monthly payment.

Negotiate the Price, Not Just the Payment

Dealers often focus on monthly payments to make a car seem affordable. But a lower payment could mean a longer loan or higher interest. Always negotiate the **total price** of the car first, then discuss financing.

Check for Incentives and Rebates

Manufacturers often offer cash rebates, low-interest financing, or loyalty discounts. For example, Toyota might offer $1,000 cash back on a RAV4, or Honda could offer 0.9% APR for qualified buyers. These can save you hundreds or thousands.

Get a Pre-Purchase Inspection

If you’re buying used, always have a trusted mechanic inspect the car before you buy. It costs $100–$150 but can save you from costly repairs down the road.

Final Thoughts: Drive Smart, Live Well

Buying a car on a $70,000 salary is absolutely doable—if you plan wisely. The key is to balance your desires with your financial reality. You don’t need the most expensive car to feel confident on the road. A well-chosen vehicle in the $25,000–$35,000 range can offer safety, reliability, and style without sacrificing your financial health.

Remember: your car is a tool, not a status symbol. Focus on value, not vanity. Stick to your budget, factor in all costs, and choose a vehicle that fits your lifestyle. Whether it’s a fuel-efficient sedan, a family-friendly SUV, or a certified pre-owned luxury ride, the right car is out there—and it won’t keep you up at night worrying about payments.

So go ahead, hit the road with confidence. You’ve got this.

Frequently Asked Questions

Can I afford a $40,000 car on a $70k salary?

It’s possible, but tight. A $40,000 car could push your monthly payments and total car costs above the recommended 15% of take-home pay, especially with insurance and maintenance. Consider a larger down payment or a longer loan term, but be cautious of higher interest and depreciation.

Is it better to lease or buy on a $70k salary?

Buying is usually better for long-term value, especially if you plan to keep the car for 5+ years. Leasing offers lower monthly payments but no ownership and mileage limits. With a $70k salary, buying a reliable used or CPO car often makes more financial sense.

How much should I save for a down payment?

Aim for at least 20% of the car’s price. On a $30,000 car, that’s $6,000. This reduces your loan amount, lowers monthly payments, and helps you avoid being upside down on the loan.

What if I have student loans or other debt?

Factor your existing debt into your budget. If your debt-to-income ratio is already high, consider a less expensive car or delay buying until you’ve paid down some debt. Your financial health comes first.

Are electric cars affordable on a $70k salary?

Yes, especially with federal and state incentives. Models like the Chevrolet Bolt EV or Hyundai Kona Electric start under $35,000 and offer low fuel and maintenance costs, making them great long-term value.

Should I buy new or used?

Used or certified pre-owned cars often offer better value. They depreciate slower and cost less upfront. A 2–3-year-old CPO vehicle can give you near-new reliability at a used-car price.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.