Missing a car insurance payment can trigger serious consequences, including policy cancellation, late fees, and even legal penalties. Act quickly to reinstate coverage and avoid long-term damage to your driving record and finances.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Happens If You Miss a Car Insurance Payment

- 4 Immediate Consequences of Missing a Payment

- 5 What Happens After Your Policy Is Canceled

- 6 Long-Term Consequences of a Lapse in Coverage

- 7 How to Avoid Missing a Car Insurance Payment

- 8 What to Do If You’ve Already Missed a Payment

- 9 Conclusion

- 10 Frequently Asked Questions

- 10.1 How long do I have to pay after missing a car insurance payment?

- 10.2 Can I reinstate my car insurance after it’s been canceled?

- 10.3 Will missing a payment affect my credit score?

- 10.4 What happens if I drive without insurance after a missed payment?

- 10.5 Can I avoid late fees if I pay within the grace period?

- 10.6 Will my insurance rates go up after a lapse in coverage?

Key Takeaways

- Your policy may be canceled: Most insurers cancel policies after 10–30 days of non-payment, leaving you uninsured.

- Late fees and interest apply: Insurers often charge late fees and may increase your premium due to the lapse.

- Reinstatement isn’t automatic: You may need to pay back premiums, fees, and even undergo a new underwriting process to get coverage back.

- Legal and financial risks increase: Driving without insurance can result in fines, license suspension, or vehicle impoundment.

- Your credit score could suffer: Unpaid premiums may be sent to collections, damaging your credit history.

- Future insurance costs may rise: A lapse in coverage signals risk to insurers, leading to higher premiums when you reapply.

- Act fast to minimize damage: Contact your insurer immediately, explore grace periods, and consider payment plans or assistance programs.

📑 Table of Contents

What Happens If You Miss a Car Insurance Payment

We’ve all been there—life gets busy, bills pile up, and sometimes a payment slips through the cracks. But when it comes to car insurance, missing a payment isn’t just a minor oversight. It can set off a chain reaction of problems that affect your wallet, your driving privileges, and even your future ability to get affordable coverage.

Car insurance isn’t optional in most states—it’s the law. Whether you’re financing a vehicle or driving your own car, having active coverage is non-negotiable. When you miss a payment, your insurer doesn’t just shrug and wait. They follow strict procedures that can quickly escalate from a simple reminder to full policy cancellation. And once you’re uninsured, the risks multiply fast.

The good news? Most of these consequences can be avoided or reversed—if you act quickly. Understanding what happens when you miss a car insurance payment, and knowing your options, can help you get back on track without lasting damage. In this guide, we’ll walk you through the immediate effects, long-term risks, and practical steps you can take to fix the situation.

Immediate Consequences of Missing a Payment

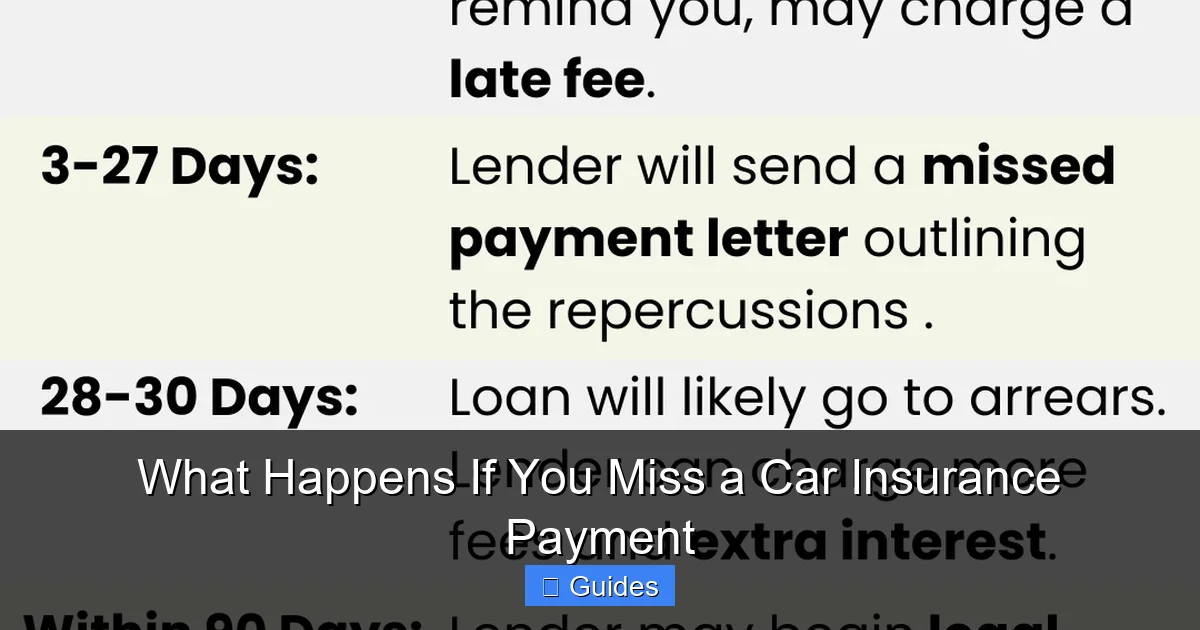

Visual guide about What Happens If You Miss a Car Insurance Payment

Image source: thebig.ca

The moment your car insurance payment is late, your insurer takes notice. While they won’t cancel your policy right away, they will start the process of addressing the missed payment. Here’s what typically happens in the first few days and weeks.

Grace Period: Your First Line of Defense

Most insurance companies offer a grace period—usually between 7 and 30 days—after your due date. During this time, your policy remains active, and you can make the payment without penalty. Think of it as a safety net. For example, if your premium is due on the 1st of the month and you pay on the 10th, you’re likely still covered.

But don’t assume every insurer offers the same grace period. Some may give you only 10 days, while others extend it to 30. Check your policy documents or call your agent to confirm. If you pay within the grace period, you’ll avoid most negative consequences. However, some insurers may still charge a small late fee, so it’s best to pay as soon as possible.

Late Fees and Penalty Charges

If you miss the grace period, your insurer will likely charge a late fee. This fee varies by company but typically ranges from $10 to $50. It’s added to your next bill, increasing the amount you owe. In some cases, especially with monthly payment plans, the insurer may also apply interest on the overdue balance.

For example, imagine your monthly premium is $150, and you miss the due date by two weeks. If your insurer charges a $25 late fee, your next payment could jump to $175. If you continue to delay, these fees can add up quickly, making it harder to catch up.

Policy Cancellation Notice

If you don’t pay within the grace period, your insurer will send a cancellation notice. This is a formal letter stating that your policy will be terminated on a specific date—usually 10 to 15 days after the notice is sent. The notice will include instructions on how to avoid cancellation, such as paying the overdue amount plus any fees.

It’s important to act immediately when you receive this notice. Once the cancellation date passes, your coverage ends. At that point, you’re driving uninsured—even if you’re just going to the grocery store.

What Happens After Your Policy Is Canceled

Visual guide about What Happens If You Miss a Car Insurance Payment

Image source: motorbiscuit.com

Once your car insurance policy is officially canceled, the real problems begin. You’re now uninsured, and that comes with serious legal, financial, and practical consequences.

Driving Without Insurance: Legal Risks

In nearly every state, driving without insurance is illegal. If you’re pulled over or involved in an accident, law enforcement will check your insurance status. If you’re uninsured, you could face:

– Fines ranging from $100 to over $1,000, depending on the state

– License suspension for a set period (often 30 to 90 days)

– Vehicle impoundment or immobilization

– Requirement to file an SR-22 form (proof of financial responsibility) to reinstate your license

For example, in California, a first offense for driving uninsured can result in a fine of up to $500 and a 30-day license suspension. In Texas, the fine can exceed $1,000, and you may have to pay reinstatement fees on top of that.

Even if you weren’t driving when your policy lapsed, simply owning a registered vehicle without insurance can lead to penalties in some states. So, if you’re not driving the car, consider non-owner insurance or suspending coverage (if allowed) to avoid fines.

Financial Liability in an Accident

One of the biggest risks of being uninsured is financial exposure. If you cause an accident while uninsured, you’re personally responsible for all damages—medical bills, vehicle repairs, lost wages, and more. Insurance is designed to protect you from these costs, but without it, you could face lawsuits, wage garnishment, or even bankruptcy.

Let’s say you rear-end another driver and cause $20,000 in damages. Without insurance, you’d have to pay that out of pocket. If the other driver sues for additional damages, the amount could skyrocket. And if you can’t pay, your wages or assets could be at risk.

Even if you’re not at fault, being uninsured can complicate things. Some states allow uninsured drivers to sue for damages, but the process is often more difficult and time-consuming.

Reinstatement: Getting Your Coverage Back

If your policy is canceled, you’ll need to reinstate it to regain coverage. But reinstatement isn’t as simple as paying the missed payment. Here’s what’s typically involved:

– Paying all overdue premiums, late fees, and reinstatement fees

– Providing proof of insurance (like an SR-22) in some cases

– Undergoing a new underwriting review, especially if the lapse was long

Some insurers may reinstate your policy quickly if you pay within a short window—say, 10 days after cancellation. Others may treat you as a new customer, requiring a new application and possibly higher rates.

For example, if your policy was canceled on June 1st and you pay on June 5th, your insurer might reinstate it with no questions asked. But if you wait until June 20th, they may require a new application, a higher deductible, or even deny coverage altogether.

Long-Term Consequences of a Lapse in Coverage

Visual guide about What Happens If You Miss a Car Insurance Payment

Image source: tadvantagealpha-com.cdn-convertus.com

Even after you get your insurance back, the effects of a missed payment can linger. A lapse in coverage signals to insurers that you’re a higher risk, which can impact your premiums and options for years.

Higher Premiums and Renewal Rates

Insurance companies use your coverage history to determine your risk level. A lapse—even a short one—can lead to higher premiums when you renew or apply for new coverage. This is because insurers see you as more likely to miss payments or file claims in the future.

For example, if your monthly premium was $150 before the lapse, it might jump to $180 or $200 after reinstatement. In high-risk states or for drivers with poor credit or driving records, the increase could be even steeper.

Some insurers may also classify you as a “high-risk” driver, which limits your options and increases costs. You might be forced to shop with specialty insurers that charge significantly more than standard companies.

Difficulty Finding Affordable Coverage

A lapse in coverage can make it harder to find affordable insurance. Many standard insurers won’t accept drivers with recent lapses, especially if they were due to non-payment. This pushes you toward non-standard or high-risk insurers, which often have higher premiums and fewer discounts.

Additionally, some insurers may require you to maintain continuous coverage for a set period (like six months) before offering competitive rates. This means you could be stuck paying high premiums for months or even years.

Impact on Your Credit Score

If your missed payment leads to an unpaid balance, your insurer may send the debt to a collections agency. Once that happens, it can appear on your credit report and lower your credit score. A lower credit score affects more than just insurance—it can impact your ability to get loans, credit cards, or even rent an apartment.

For example, if your insurer sends a $300 unpaid balance to collections, it could drop your credit score by 50 to 100 points, depending on your overall credit profile. And it can stay on your report for up to seven years.

Even if you eventually pay the debt, the collections account will remain on your credit history, though it will be marked as “paid.” This can still affect your creditworthiness, especially for major financial decisions like buying a home or car.

How to Avoid Missing a Car Insurance Payment

The best way to handle a missed payment is to prevent it from happening in the first place. Here are some practical tips to keep your coverage active and your finances on track.

Set Up Automatic Payments

One of the easiest ways to avoid missing a payment is to set up automatic payments through your bank or insurer. With auto-pay, your premium is deducted from your account on the due date, so you never have to remember it.

Most insurers offer this option online or through their mobile app. You can choose to pay the full amount monthly or set up a payment plan. Just make sure your account has enough funds to cover the deduction—otherwise, you could face overdraft fees or a failed payment.

Use Calendar Reminders

If you prefer to pay manually, set up reminders on your phone or calendar. Schedule alerts a few days before your due date so you have time to make the payment. You can also sign up for email or text alerts from your insurer, which will notify you when a payment is due.

For example, if your premium is due on the 15th of each month, set a reminder for the 12th. That gives you three days to log in, check your balance, and make the payment without stress.

Choose a Payment Plan That Fits Your Budget

If you’re struggling to afford your premium, talk to your insurer about payment options. Many companies offer monthly, quarterly, or semi-annual plans. Some even allow you to split payments or defer a portion of the premium.

For instance, instead of paying $600 every six months, you might pay $100 per month. This makes the cost more manageable and reduces the risk of missing a large lump-sum payment.

You can also look into discounts—like safe driver, multi-car, or bundling with home insurance—to lower your overall cost. Even a small discount can make a big difference over time.

Communicate with Your Insurer

If you’re facing financial hardship, don’t ignore the problem. Contact your insurer as soon as possible. Many companies have hardship programs or can offer temporary relief, such as a payment extension or reduced premium.

For example, if you’ve lost your job or had a medical emergency, your insurer may allow you to defer a payment for 30 days. They might also connect you with financial assistance programs or nonprofit organizations that help with insurance costs.

The key is to be proactive. The longer you wait, the harder it becomes to resolve the issue.

What to Do If You’ve Already Missed a Payment

If you’ve already missed a payment, don’t panic. There are still steps you can take to minimize the damage and get back on track.

Contact Your Insurer Immediately

Call your insurance agent or customer service line as soon as you realize the payment is late. Explain the situation and ask about your options. If you’re within the grace period, you may be able to pay without penalty.

Even if your policy is already canceled, your insurer may still be willing to reinstate it—especially if you act quickly. Be honest about why the payment was missed and show that you’re committed to staying covered.

Pay the Full Amount Owed

To reinstate your policy, you’ll need to pay all overdue premiums, late fees, and any reinstatement charges. Use a secure method like online payment, bank transfer, or certified check to ensure the payment is processed quickly.

If you can’t afford the full amount, ask if your insurer offers a payment plan. Some companies allow you to pay in installments, though interest or fees may apply.

Consider Switching Insurers

If your current insurer won’t reinstate your policy or is charging high fees, it may be time to shop around. Compare quotes from multiple companies to find one that offers better rates and more flexible terms.

Keep in mind that a lapse in coverage will still affect your rates, but some insurers are more lenient than others. Look for companies that specialize in high-risk drivers or offer “forgiveness” programs for first-time lapses.

File an SR-22 if Required

In some states, you’ll need to file an SR-22 form after a lapse in coverage. This is a certificate of financial responsibility that proves you have the minimum required insurance. It’s often required for drivers with DUIs, at-fault accidents, or repeated violations.

Your insurer can file the SR-22 on your behalf, but there’s usually a fee—around $25 to $50. The form must be maintained for a set period, typically one to three years, depending on the state.

Conclusion

Missing a car insurance payment is more than just a financial slip-up—it’s a risk that can lead to policy cancellation, legal trouble, and long-term financial consequences. From late fees and higher premiums to license suspension and credit damage, the effects can be far-reaching.

But the situation isn’t hopeless. By acting quickly, communicating with your insurer, and taking steps to prevent future lapses, you can get back on track and protect yourself from further harm. Whether it’s setting up auto-pay, exploring payment plans, or shopping for a new insurer, there are always options.

Remember, car insurance isn’t just a legal requirement—it’s a critical safety net that protects you, your passengers, and others on the road. Don’t let a missed payment put that protection at risk. Stay informed, stay proactive, and keep your coverage active.

Frequently Asked Questions

How long do I have to pay after missing a car insurance payment?

Most insurers offer a grace period of 7 to 30 days after the due date. During this time, your policy remains active, and you can pay without penalty. Check your policy or contact your insurer to confirm the exact timeframe.

Can I reinstate my car insurance after it’s been canceled?

Yes, in most cases you can reinstate your policy by paying all overdue premiums, late fees, and reinstatement charges. However, some insurers may require a new application or higher rates, especially if the lapse was long.

Will missing a payment affect my credit score?

Only if the unpaid balance is sent to collections. If your insurer reports the debt to a collections agency, it can appear on your credit report and lower your score. Paying promptly can prevent this.

What happens if I drive without insurance after a missed payment?

Driving uninsured is illegal in most states and can result in fines, license suspension, vehicle impoundment, and legal liability for damages in an accident. Always reinstate coverage before driving.

Can I avoid late fees if I pay within the grace period?

Most insurers waive late fees if you pay within the grace period, but some may still charge a small administrative fee. Confirm with your insurer to understand their policy.

Will my insurance rates go up after a lapse in coverage?

Yes, a lapse in coverage can lead to higher premiums because insurers view you as a higher risk. The increase depends on your state, driving history, and the insurer’s underwriting policies.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.