Choosing a good 6 month premium car insurance policy means balancing cost, coverage, and flexibility. It’s ideal for drivers who need short-term protection without long-term commitments, especially during life transitions or while shopping for better rates.

[FEATURED_IMAGE_PLACEOLDER]

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Is a Good 6 Month Premium Car Insurance?

- 4 Why Choose a 6 Month Car Insurance Policy?

- 5 What Makes a 6 Month Policy “Premium”?

- 6 How to Find the Best 6 Month Premium Car Insurance

- 7 Top Providers Offering 6 Month Premium Car Insurance

- 8 Tips to Lower Your 6 Month Premium

- 9 Common Mistakes to Avoid

- 10 Conclusion

- 11 Frequently Asked Questions

Key Takeaways

- Affordable premiums with solid coverage: A good 6-month policy offers competitive rates without sacrificing essential protection like liability, collision, and comprehensive coverage.

- Flexibility for changing needs: Short-term policies are perfect for students, seasonal drivers, or those between vehicles who don’t want to lock into a full-year plan.

- No long-term commitment: You can reassess your insurance needs every six months, making it easier to switch providers or adjust coverage as your situation changes.

- Discounts and savings opportunities: Many insurers offer multi-car, safe driver, or pay-in-full discounts even on short-term plans.

- Transparent terms and no hidden fees: A quality policy clearly outlines deductibles, coverage limits, and renewal options without surprise charges.

- Easy online management: Top providers offer digital tools to view policies, make payments, and file claims quickly and securely.

- Customer support matters: Reliable 24/7 support ensures help is available when accidents or questions arise.

📑 Table of Contents

- What Is a Good 6 Month Premium Car Insurance?

- Why Choose a 6 Month Car Insurance Policy?

- What Makes a 6 Month Policy “Premium”?

- How to Find the Best 6 Month Premium Car Insurance

- Top Providers Offering 6 Month Premium Car Insurance

- Tips to Lower Your 6 Month Premium

- Common Mistakes to Avoid

- Conclusion

What Is a Good 6 Month Premium Car Insurance?

If you’re shopping for car insurance, you’ve probably noticed that most standard policies last 12 months. But what if you only need coverage for six months? Maybe you’re in between jobs, driving a rental temporarily, or just want more control over your insurance choices. That’s where a 6 month premium car insurance policy comes in.

A good 6-month premium car insurance plan gives you the same level of protection as a yearly policy—but with more flexibility and often better pricing. It’s designed for drivers who want quality coverage without the long-term commitment. Whether you’re a student heading back to school, someone waiting for a new vehicle to arrive, or simply testing out a new insurer, a short-term policy can be a smart move.

But not all 6-month plans are created equal. The key is knowing what makes one “good.” It’s not just about the lowest price. A truly good policy balances affordability with strong coverage, clear terms, and excellent customer service. In this guide, we’ll walk you through everything you need to know to find the right 6-month premium car insurance for your needs.

Why Choose a 6 Month Car Insurance Policy?

Visual guide about What Is a Good 6 Month Premium Car Insurance

Image source: wallstreetmojo.com

You might be wondering—why go for six months instead of a full year? After all, most people just renew their annual policy and forget about it. But there are several smart reasons to consider a shorter-term plan.

First, life is unpredictable. You might be between cars, traveling for work, or sharing a vehicle with a family member. In these cases, committing to a full year of insurance can feel unnecessary. A 6-month policy lets you pay only for the time you actually need coverage.

Second, short-term policies give you more control. Every six months, you can reassess your needs. Did your driving habits change? Did you move to a safer neighborhood? Did you install anti-theft devices? These factors can lower your risk profile and potentially reduce your premium. With a 6-month plan, you can shop around and switch insurers more easily to take advantage of better rates.

Third, some drivers use 6-month policies as a trial period. Maybe you’re considering a new insurance company but aren’t sure about their service quality. A short-term plan lets you test the waters without locking in for a full year.

And let’s not forget cost. While monthly premiums might seem similar to annual plans, paying for six months upfront often comes with discounts. Many insurers reward customers who pay in full with lower rates. Plus, you avoid the hassle of monthly billing and potential late fees.

Who Benefits Most from 6 Month Policies?

Not everyone needs a 6-month policy, but certain drivers find them especially useful:

– **Students**: College students who drive home during breaks or only use a car part-time can save money with a short-term plan.

– **Seasonal drivers**: If you only drive in the summer or during holidays, a 6-month policy avoids paying for unused coverage.

– **New drivers**: Young or inexperienced drivers often face high premiums. A 6-month plan lets them build a clean record and reapply at a lower rate.

– **People between vehicles**: Waiting for a new car delivery? A short-term policy keeps you legal on the road without overpaying.

– **Military personnel**: Service members on temporary duty or deployment may only need coverage for part of the year.

What Makes a 6 Month Policy “Premium”?

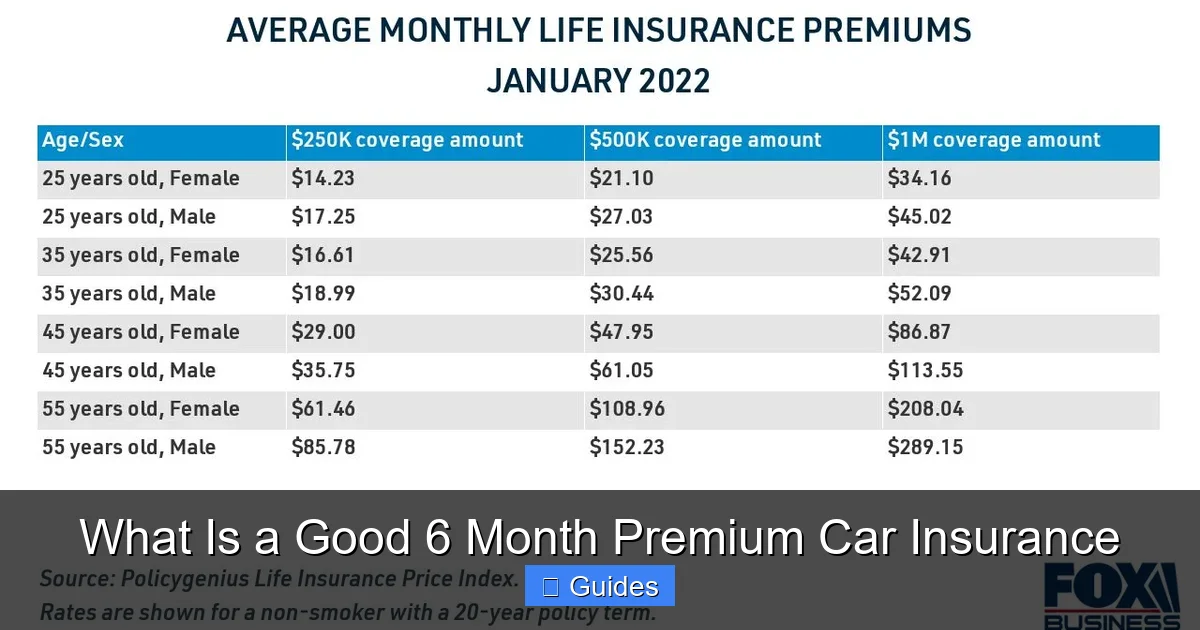

Visual guide about What Is a Good 6 Month Premium Car Insurance

Image source: static.foxbusiness.com

Now that we know who benefits from a 6-month plan, let’s talk about what makes one “premium.” The word “premium” here doesn’t just refer to the price—it refers to the quality of the policy.

A premium 6-month car insurance policy offers more than basic state minimum coverage. It includes robust protection, reliable customer service, and transparent terms. Think of it as getting the best value for your money—not just the cheapest option.

So, what should you look for?

Comprehensive Coverage Options

A good 6-month premium policy includes more than just liability insurance. While liability (which covers damage or injuries you cause to others) is required by law, a premium plan goes further.

Look for policies that include:

– **Collision coverage**: Pays for damage to your car after an accident, regardless of fault.

– **Comprehensive coverage**: Covers non-collision events like theft, vandalism, fire, or weather damage.

– **Uninsured/underinsured motorist protection**: Helps pay your bills if you’re hit by a driver with no or insufficient insurance.

– **Medical payments or PIP (Personal Injury Protection)**: Covers your medical expenses after an accident, no matter who’s at fault.

These extras might increase your premium slightly, but they provide peace of mind and financial protection in real-world scenarios.

For example, imagine you park your car overnight and wake up to a broken window and a missing stereo. Without comprehensive coverage, you’d pay out of pocket. But with it, your insurer handles the repair or replacement—minus your deductible.

Competitive Pricing and Discounts

Price matters, but it shouldn’t be the only factor. A good 6-month premium policy offers fair, competitive rates based on your risk profile.

Insurers consider many factors when setting your premium, including:

– Your driving record

– Age and gender

– Vehicle type and age

– Credit score (in most states)

– Location

– Annual mileage

But here’s the good news: many of these factors can work in your favor. For instance, if you have a clean driving record, drive a safe car, and live in a low-crime area, you’ll likely qualify for lower rates.

And don’t forget discounts. A premium insurer offers multiple ways to save, such as:

– **Safe driver discount**: For accident-free driving.

– **Multi-car discount**: If you insure more than one vehicle.

– **Pay-in-full discount**: For paying the entire 6-month premium upfront.

– **Good student discount**: For students with strong grades.

– **Anti-theft device discount**: For vehicles equipped with alarms or tracking systems.

Some companies even offer usage-based discounts through telematics programs. These track your driving habits (like speed, braking, and mileage) via a smartphone app or device. Safe drivers can earn significant savings.

Flexible Deductibles and Payment Options

A premium policy gives you control over your deductible—the amount you pay out of pocket before insurance kicks in.

Higher deductibles mean lower premiums, but more risk if you file a claim. Lower deductibles cost more upfront but reduce your financial burden after an accident.

A good 6-month plan lets you choose a deductible that fits your budget. For example, you might opt for a $500 deductible to keep premiums low, or $250 if you prefer more protection.

Payment flexibility is also key. Look for insurers that offer:

– Monthly payments (with minimal fees)

– Quarterly or semi-annual billing

– Online and automatic payment options

– Grace periods for late payments

This flexibility helps you manage cash flow, especially if you’re on a tight budget.

How to Find the Best 6 Month Premium Car Insurance

Visual guide about What Is a Good 6 Month Premium Car Insurance

Image source: sparkgist.com

Now that you know what to look for, how do you actually find the best policy? It’s not as hard as it seems—if you follow a few smart steps.

Compare Quotes from Multiple Insurers

The first step is shopping around. Don’t just go with your current insurer or the first ad you see. Get quotes from at least three to five reputable companies.

Use online comparison tools or visit insurer websites directly. Most allow you to enter your information once and receive instant quotes. Be honest about your driving history, vehicle, and coverage needs—this ensures accurate pricing.

When comparing, look beyond the monthly premium. Consider:

– Total 6-month cost

– Coverage limits

– Deductibles

– Available discounts

– Customer reviews

For example, Insurer A might offer a lower monthly rate, but Insurer B includes roadside assistance and a lower deductible for just a few dollars more. Over six months, the difference might be negligible—but the added benefits could be worth it.

Check Financial Strength and Customer Reviews

Price and coverage matter, but so does reliability. You want an insurer that will be there when you need them—especially after an accident.

Check the company’s financial strength rating from agencies like A.M. Best, Moody’s, or Standard & Poor’s. A rating of “A” or higher means the insurer is financially stable and likely to pay claims.

Also, read customer reviews on sites like Trustpilot, the Better Business Bureau, or Google. Look for patterns: Are complaints about slow claims processing? Poor communication? High renewal rates?

A premium insurer should have responsive customer service, easy claims filing, and transparent communication.

Read the Fine Print

Never skip the policy details. A good 6-month premium plan will have clear, easy-to-understand terms.

Pay attention to:

– Coverage exclusions (what’s not covered)

– Renewal terms (will your rate go up after six months?)

– Cancellation policies (can you cancel early without a fee?)

– Claim filing procedures

For example, some policies require you to report an accident within 24 hours. Others may not cover rental cars unless you add extra coverage.

If anything is unclear, ask. A reputable insurer will explain your policy in plain language.

Top Providers Offering 6 Month Premium Car Insurance

While most major insurers offer 6-month policies, some stand out for their combination of coverage, pricing, and service.

State Farm

State Farm is one of the largest auto insurers in the U.S. and offers flexible 6-month policies. They’re known for excellent customer service, a wide range of discounts, and a user-friendly mobile app. Their agents provide personalized support, which can be helpful if you’re new to insurance shopping.

Geico

Geico is famous for low rates and fast online quotes. They offer 6-month policies with competitive pricing, especially for safe drivers. Their mobile app allows you to manage your policy, file claims, and access digital ID cards instantly.

Progressive

Progressive stands out for its Name Your Price® tool, which helps you find a policy within your budget. They also offer Snapshot®, a usage-based program that can lower your premium based on your driving. Their 6-month plans include strong coverage options and 24/7 support.

Allstate

Allstate offers 6-month policies with perks like accident forgiveness and new car replacement. Their Drivewise® program rewards safe driving with discounts. Allstate also has a strong network of agents for in-person support.

USAA (for military members and families)

If you’re in the military or a family member, USAA often provides the best value. They offer low rates, excellent claims service, and special benefits for service members. Their 6-month policies are highly rated for coverage and customer satisfaction.

Tips to Lower Your 6 Month Premium

Even with a premium policy, you can take steps to reduce your cost. Here are some proven strategies:

Improve Your Driving Record

Accidents and tickets can spike your premium. Drive safely, obey speed limits, and avoid distractions. Many insurers offer accident forgiveness after a few years of clean driving.

Increase Your Deductible

Raising your deductible from $250 to $500 can lower your premium by 10–20%. Just make sure you can afford the higher out-of-pocket cost if you file a claim.

Bundle Policies

If you have home, renters, or life insurance, ask about bundling. Many insurers offer discounts for multiple policies.

Maintain Good Credit

In most states, insurers use credit-based insurance scores to set rates. Pay bills on time, reduce debt, and check your credit report for errors.

Drive Less

Lower annual mileage can qualify you for a low-mileage discount. Consider carpooling, working from home, or using public transit when possible.

Take a Defensive Driving Course

Some insurers offer discounts for completing an approved course. It’s also a great way to refresh your skills.

Common Mistakes to Avoid

Even savvy shoppers can make errors when choosing a 6-month policy. Avoid these common pitfalls:

Choosing the Cheapest Policy Without Checking Coverage

A low premium might hide high deductibles or weak coverage. Always compare what’s included—not just the price.

Not Updating Your Information

If you move, change jobs, or buy a new car, update your insurer. Outdated info can lead to incorrect rates or denied claims.

Ignoring Renewal Notices

After six months, your policy will renew—often at a higher rate. Review your renewal notice and shop around before自动续订.

Assuming All Insurers Offer 6-Month Plans

Some companies only offer annual policies. Always confirm the term length before applying.

Conclusion

A good 6 month premium car insurance policy is more than just a short-term fix—it’s a smart, flexible solution for drivers who value control, quality, and value. Whether you’re between cars, a student, or just want to test a new insurer, a 6-month plan gives you the freedom to adapt as your life changes.

The key is knowing what to look for: strong coverage, fair pricing, transparent terms, and reliable service. By comparing quotes, reading the fine print, and taking advantage of discounts, you can find a policy that protects you without breaking the bank.

Remember, insurance isn’t just a legal requirement—it’s your financial safety net. A premium 6-month policy ensures that net is strong, reliable, and tailored to your needs. So take the time to shop smart, ask questions, and choose a plan that gives you peace of mind on the road.

Frequently Asked Questions

Is 6 month car insurance cheaper than annual?

Not always, but it can be. Some insurers offer discounts for paying a 6-month premium in full, which may lower the overall cost. However, monthly payments over six months might cost more than a single annual payment due to fees or interest.

Can I cancel a 6 month car insurance policy early?

Yes, most insurers allow early cancellation, but you may face a fee or lose your pay-in-full discount. Always check the cancellation policy before signing up.

Do I need full coverage for a 6 month policy?

It depends on your vehicle and financial situation. If you drive a newer or financed car, full coverage (collision and comprehensive) is usually recommended. For older cars, liability-only may suffice.

Will my rate increase after 6 months?

Possibly. Insurers often adjust rates at renewal based on claims, driving record, or market changes. Always review your renewal notice and shop around before自动续订.

Can I switch insurers mid-policy?

Yes, but you’ll need to cancel your current policy (check for fees) and start a new one. Make sure there’s no gap in coverage to stay legal and protected.

Are 6 month policies available for all drivers?

Most insurers offer 6-month plans, but availability may vary by state and driver profile. High-risk drivers or those with poor credit might face limited options or higher rates.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.