Leasing a car means paying to use a vehicle for a set time, usually 2-4 years, with lower monthly payments than buying. It’s ideal if you like driving new models and want predictable costs, but it comes with mileage limits and no ownership at the end.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Is a Lease on a Car?

- 4 How Does a Car Lease Work?

- 5 Pros and Cons of Leasing a Car

- 6 Lease vs. Buy: Which Is Right for You?

- 7 Understanding Lease Costs and Fees

- 8 Tips for Getting the Best Car Lease Deal

- 9 Is Leasing a Car Right for You?

- 10 Frequently Asked Questions

Key Takeaways

- Lower monthly payments: Lease payments are typically 30-50% lower than loan payments for the same car, making it easier on your budget.

- Drive a new car more often: Most leases last 24 to 36 months, so you can upgrade to a newer model every few years.

- Mileage and wear restrictions: Leases limit how many miles you can drive (usually 10,000–15,000 per year) and charge fees for excess wear.

- No equity buildup: You don’t own the car at the end of the lease, so you won’t build any asset value like you would with a purchase.

- Maintenance and warranty coverage: Most leased cars are under warranty during the lease term, reducing repair costs.

- Early termination fees: Ending a lease early can be expensive, so it’s best to commit for the full term.

- Customization limits: You usually can’t modify a leased car, as it must be returned in original condition.

📑 Table of Contents

What Is a Lease on a Car?

So, what is a lease on a car, exactly? Think of it like renting a vehicle for an extended period—usually two to four years. Instead of buying the car outright, you’re essentially paying for the portion of its value that you use during that time. At the end of the lease, you return the car to the dealership unless you choose to buy it.

This arrangement has become increasingly popular among drivers who want to drive newer, more reliable vehicles without the long-term commitment of ownership. With a lease, you get lower monthly payments, often better warranty coverage, and the chance to upgrade every few years. But it’s not for everyone. Leasing comes with rules—like mileage limits and care requirements—that can add up if you’re not careful.

In this guide, we’ll walk you through everything you need to know about car leasing: how it works, the pros and cons, costs involved, and whether it’s the right choice for your lifestyle. Whether you’re a first-time lessee or just comparing options, this article will help you make a smart, informed decision.

How Does a Car Lease Work?

Leasing a car is simpler than it sounds, but it helps to understand the key steps and terms involved. When you lease, you’re entering into a contract with a leasing company (often the car manufacturer’s finance arm) to use a vehicle for a fixed period. Here’s how it typically unfolds:

Visual guide about What Is a Lease on a Car

Image source: investopedia.com

The Lease Agreement

First, you’ll sign a lease agreement that outlines the terms. This includes the lease duration (usually 24, 36, or 48 months), the monthly payment amount, the total mileage allowance, and any fees. You’ll also agree on the “residual value”—the estimated worth of the car at the end of the lease. This number is crucial because your monthly payment is based on the difference between the car’s current price and its residual value.

For example, if you lease a $30,000 car with a 60% residual value after three years, the car is expected to be worth $18,000 at the end of the lease. You’ll pay for the $12,000 depreciation, plus interest and fees, over 36 months. That’s why lease payments are lower than loan payments—you’re only paying for the car’s use, not its full value.

Down Payment and Fees

Many leases require an upfront payment, often called a “cap cost reduction” or “down payment.” This can range from a few hundred to several thousand dollars and lowers your monthly payments. However, some leases advertise “$0 down,” which means you pay nothing upfront—but your monthly cost will be higher.

You’ll also pay other fees at signing, such as the acquisition fee (a processing charge from the leasing company), title and registration fees, and possibly a security deposit. These can add up, so it’s important to ask for a full breakdown before signing.

Monthly Payments and Usage

Once the lease begins, you make fixed monthly payments for the duration of the contract. During this time, you’re responsible for regular maintenance, insurance, and staying within the mileage limit. Most leases include a maintenance schedule, and skipping oil changes or tire rotations could result in penalties.

At the end of the lease, you return the car to the dealership. The leasing company will inspect it for excess wear and tear and check the odometer. If you’ve stayed within the mileage limit and kept the car in good condition, you walk away with no further obligations—unless you decide to buy the car or lease a new one.

Pros and Cons of Leasing a Car

Like any financial decision, leasing has its advantages and drawbacks. Whether it’s right for you depends on your driving habits, budget, and long-term goals. Let’s break down the key pros and cons.

Visual guide about What Is a Lease on a Car

Image source: images.template.net

Advantages of Leasing

One of the biggest benefits of leasing is lower monthly payments. Because you’re only paying for the car’s depreciation during the lease term, your payments are often significantly less than what you’d pay with a car loan. For example, leasing a $40,000 SUV might cost $450 per month, while buying it could run $700 or more.

Another advantage is driving a new car more often. Most leases last 24 to 36 months, so you can upgrade to the latest model every few years with the newest safety features, tech, and design. This is great if you enjoy having a modern vehicle and don’t want to deal with long-term ownership.

Leased cars are typically under the manufacturer’s warranty for the entire lease period, which means most repairs are covered. This reduces unexpected out-of-pocket costs and gives you peace of mind. Plus, many leases include roadside assistance and maintenance packages, adding extra value.

Disadvantages of Leasing

The biggest downside? You don’t own the car. At the end of the lease, you have nothing to show for your payments—no equity, no asset. If you drive a lot or plan to keep a car for many years, buying might be more cost-effective in the long run.

Leases also come with strict rules. Most contracts limit you to 10,000 to 15,000 miles per year. If you exceed that, you’ll pay a per-mile fee—often $0.10 to $0.25—which can add up quickly. For example, driving 20,000 miles in a year on a 12,000-mile lease could cost you $800 in overage fees.

You’re also responsible for keeping the car in good condition. Normal wear and tear is expected, but dents, scratches, or stained upholstery may result in charges at the end of the lease. And forget about customizing your ride—most leases prohibit modifications like aftermarket wheels or paint jobs.

Finally, ending a lease early can be expensive. If your circumstances change and you need to get out of the contract, you may face early termination fees that can cost thousands of dollars. That’s why it’s important to be confident in your decision before signing.

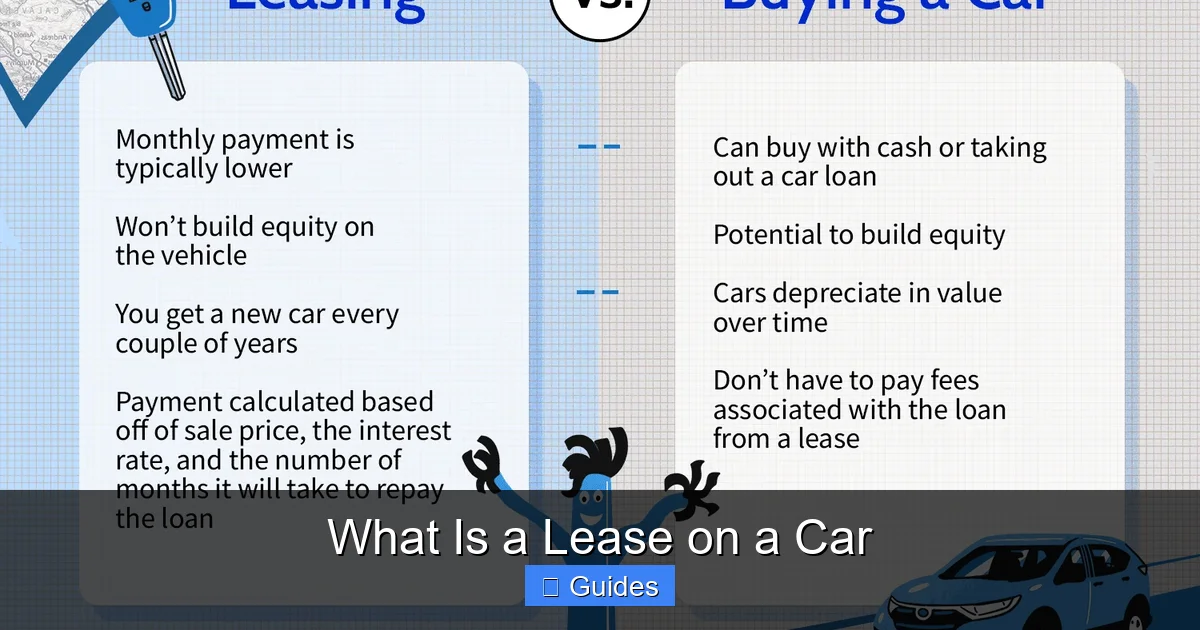

Lease vs. Buy: Which Is Right for You?

Deciding between leasing and buying comes down to your personal needs and financial situation. Both options have their place, and the right choice depends on how you use your car and what you value most.

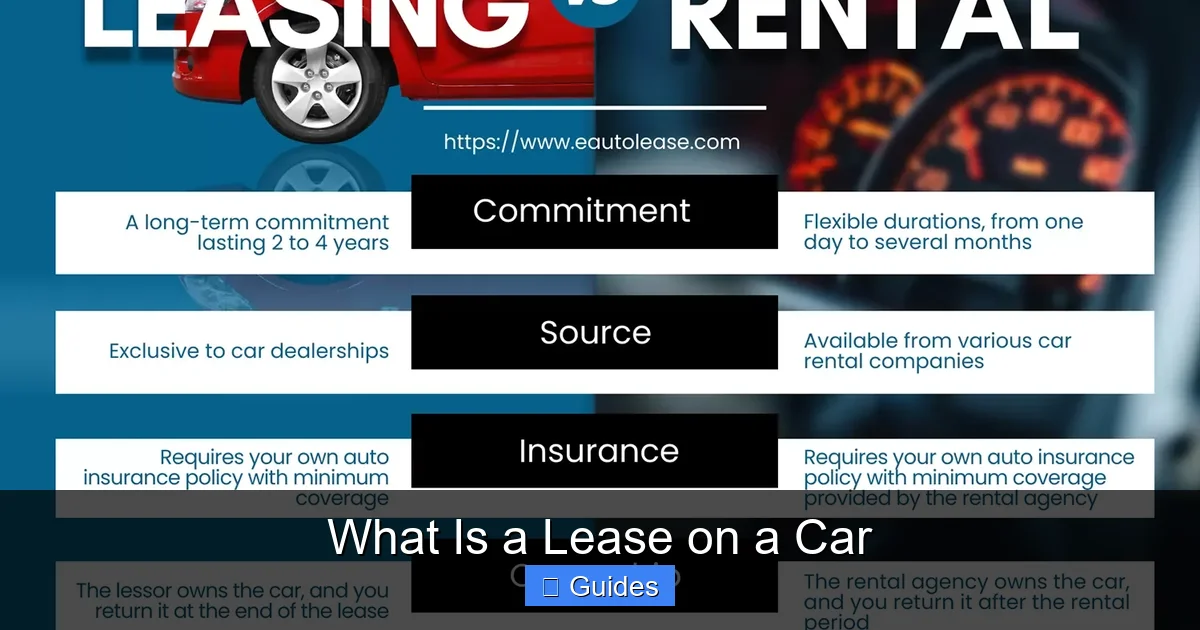

Visual guide about What Is a Lease on a Car

Image source: eautolease.com

When Leasing Makes Sense

Leasing is a great fit if you:

- Want lower monthly payments and a smaller down payment

- Enjoy driving a new car every few years

- Don’t drive more than 12,000–15,000 miles per year

- Prefer having warranty coverage for the entire time you use the car

- Don’t want the hassle of selling or trading in a car later

For example, a young professional who commutes 30 miles a day and likes having the latest tech in their vehicle might find leasing ideal. They get a new car with advanced safety features, pay less each month, and can upgrade in three years without worrying about resale value.

When Buying Is Better

Buying a car (with cash or a loan) is usually better if you:

- Plan to keep the car for five years or more

- Drive a lot—over 15,000 miles per year

- Want to customize or modify your vehicle

- Prefer building equity and owning an asset

- Want to avoid mileage and wear restrictions

For instance, a family with a long daily commute or someone who enjoys road trips might save money in the long run by buying. After paying off the loan, they own the car outright and can drive it for years with minimal expenses—just insurance, gas, and maintenance.

It’s also worth noting that used cars can be a smart buy. A three-year-old vehicle has already taken the biggest depreciation hit, so you get more value for your money. Plus, you avoid the high upfront costs of a new car.

Understanding Lease Costs and Fees

Leasing isn’t free—even though the monthly payments are lower. To make an informed decision, you need to understand all the costs involved. Let’s break them down.

Monthly Payment Breakdown

Your monthly lease payment is based on three main factors:

- Depreciation: The difference between the car’s current price and its residual value

- Interest (rent charge): The cost of financing the lease, similar to an interest rate on a loan

- Taxes and fees: Sales tax, registration, and other charges

For example, leasing a $35,000 car with a 55% residual value after three years means you’re paying for $15,750 in depreciation. Add in interest and taxes, and your monthly payment might be around $400. That’s still less than a loan payment for the same car, which could be $600 or more.

Upfront Costs

At signing, you’ll typically pay:

- Down payment (cap cost reduction): Optional, but lowers monthly payments

- Acquisition fee: $500–$1,000, charged by the leasing company

- Security deposit: Sometimes required, refundable if no damage

- First month’s payment: Usually due at signing

- Title, registration, and taxes: Vary by state

Some dealers advertise “sign and drive” deals where you only pay the first month and fees—no down payment. These can be tempting, but remember: you’re financing more of the car, so your monthly cost will be higher.

End-of-Lease Fees

When you return the car, you may face charges for:

- Excess mileage: Typically $0.10–$0.25 per mile over the limit

- Excess wear and tear: Dents, scratches, tire wear, or interior damage beyond normal use

- Disposition fee: $300–$500, charged by the leasing company for processing the return

To avoid surprises, take photos of the car before you drive it off the lot and keep records of maintenance. At the end of the lease, consider getting a pre-inspection to identify any issues early.

Tips for Getting the Best Car Lease Deal

Leasing can be a smart financial move—if you do it right. Here are some practical tips to help you get the best deal and avoid common pitfalls.

Negotiate the Capitalized Cost

Just like when buying a car, you can (and should) negotiate the price of a leased vehicle. The “capitalized cost” is the amount the lease is based on, so lowering it reduces your monthly payments. Aim to get the price as close to invoice as possible—or even below.

Research the car’s invoice price using resources like Edmunds or Kelley Blue Book. Then, use competing offers from other dealers to strengthen your position. Remember: the lower the cap cost, the lower your payments.

Watch the Money Factor

The money factor is the lease equivalent of an interest rate. It’s usually a small decimal like 0.00250. To convert it to an approximate APR, multiply by 2,400. So 0.00250 × 2,400 = 6% APR.

A lower money factor means lower financing costs. If the dealer won’t lower it, ask if you can improve your credit score before leasing or consider a different lender. Some manufacturers offer special lease rates for qualified customers.

Choose the Right Mileage Limit

Most leases come with a standard mileage limit—10,000, 12,000, or 15,000 miles per year. If you know you’ll drive more, consider paying for a higher limit upfront. It’s often cheaper than paying overage fees later.

For example, increasing your limit from 10,000 to 15,000 miles might cost $1,000 upfront. But if you drive 18,000 miles in a year, overage fees at $0.20 per mile would cost $1,600—so paying upfront saves you $600.

Consider a Closed-End Lease

Most consumer leases are “closed-end,” meaning you’re only responsible for the agreed-upon terms. As long as you return the car in good condition and within the mileage limit, you owe nothing more. This protects you from market fluctuations—if the car is worth less than the residual value at the end, the leasing company absorbs the loss.

Avoid “open-end” leases, which are riskier and typically used for commercial vehicles. They leave you liable if the car’s resale value drops below the residual.

Read the Fine Print

Before signing, read the entire lease agreement. Pay attention to early termination clauses, wear-and-tear guidelines, and insurance requirements. Ask questions if anything is unclear. A good dealer will explain everything in plain language.

Also, check if the lease includes gap insurance. This covers the difference between what you owe and the car’s value if it’s totaled or stolen. Most leases include it, but it’s worth confirming.

Is Leasing a Car Right for You?

So, after all this, is leasing the right choice? There’s no one-size-fits-all answer. It depends on your lifestyle, driving habits, and financial goals.

If you value driving a new car every few years, want lower monthly payments, and don’t mind not owning the vehicle, leasing could be a great fit. It’s especially appealing if you have a stable income and predictable mileage.

But if you drive a lot, plan to keep a car long-term, or want the freedom to customize and build equity, buying might be the better path. And if you’re unsure, consider a short-term lease (24 months) to test the waters without a long commitment.

Ultimately, the key is to do your homework, compare offers, and choose the option that aligns with your needs. Whether you lease or buy, the goal is the same: get reliable transportation that fits your budget and lifestyle.

Frequently Asked Questions

Can you negotiate a car lease?

Yes, you can negotiate several aspects of a car lease, including the capitalized cost (price of the car), money factor (interest rate), and mileage allowance. The more you negotiate, the lower your monthly payments will be.

What happens at the end of a car lease?

At the end of the lease, you return the car to the dealership. The leasing company inspects it for excess wear and mileage. If everything is in order, you owe nothing more—unless you choose to buy the car or lease a new one.

Can you lease a used car?

Yes, some dealerships and leasing companies offer certified pre-owned vehicles for lease. These often come with warranties and lower prices, making them a budget-friendly option.

Is it better to lease or buy a car?

It depends on your needs. Leasing offers lower payments and newer cars but no ownership. Buying builds equity and allows unlimited mileage, but costs more upfront and monthly.

What is a lease buyout?

A lease buyout is when you purchase the car at the end of the lease for its residual value. You can pay in cash or finance it with a loan. It’s a good option if you love the car and want to keep it.

Can you terminate a car lease early?

Yes, but it usually comes with steep fees. Early termination costs can include remaining payments, a penalty, and reconditioning fees. It’s best to avoid ending a lease early unless absolutely necessary.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.