There is no single universal minimum credit score to buy a car, but some subprime lenders may approve applicants with scores as low as 500. While a higher score secures better loan terms, specialized lenders focus on your entire financial picture, including income and down payment. To improve your chances, it’s critical to shop around and get pre-qualified with multiple lenders.

In This Article

- 1 What Is The Lowest Credit Score To Buy A Car Find Out Now

- 1.1 Key Takeaways

- 1.2 📑 Table of Contents

- 1.3 Understanding Credit Scores and Car Loans

- 1.4 What Is The Lowest Credit Score To Buy A Car?

- 1.5 How Credit Scores Affect Your Loan Terms and Interest Rates

- 1.6 Steps to Buy a Car When You Have a Low Credit Score

- 1.7 Improving Your Credit Score for a Better Car Deal

- 1.8 Alternatives If Your Credit Score Is Too Low

- 1.9 Conclusion: Your Path to Car Ownership Starts Here

- 1.10 Frequently Asked Questions

- 1.10.1 What is the lowest credit score to buy a car?

- 1.10.2 Can I buy a car with bad credit?

- 1.10.3 How does my credit score affect my car loan?

- 1.10.4 Are there lenders for the lowest credit score to buy a car?

- 1.10.5 What can I do to improve my chances if my score is low?

- 1.10.6 Is it possible to get a car loan with no credit history?

What Is The Lowest Credit Score To Buy A Car Find Out Now

So, you’re thinking about buying a car. Maybe your old one finally gave up, or you need something more reliable for the daily commute. Whatever the reason, it’s exciting! But then, that little voice in your head whispers, “What about my credit score?” If you’ve ever worried about that, you’re not alone. I remember when my friend Sam was in the same boat. He needed a car for his new job, but his credit history had a few bumps. He spent nights wondering, “What is the lowest credit score to buy a car?” It felt like a huge mystery.

Let’s clear that up right now. Buying a car with less-than-perfect credit is absolutely possible. But knowing the score—literally—can save you time, stress, and money. This isn’t about scary financial jargon; it’s about giving you the straight talk you need to navigate the process confidently. Think of this as a chat with a friend who’s been there, sharing what works and what to watch out for.

In this post, we’ll dive deep into credit scores and car buying. We’ll explore the magic number, how it affects your loan, and practical steps you can take, no matter where your credit stands. By the end, you’ll have a clear roadmap. So, grab a coffee, get comfortable, and let’s find out what is the lowest credit score to buy a car.

Key Takeaways

- No universal minimum score: Lenders set their own criteria, so shop around.

- Scores below 580 are subprime: Expect higher interest rates and stricter terms.

- Improve your credit before applying: Pay down debts and check for errors.

- Save for a larger down payment: This can help offset a low score.

- Consider a co-signer: Someone with good credit boosts approval odds.

- Shop multiple lenders: Specialized subprime lenders offer better bad credit options.

- Prepare for higher costs: Low scores mean higher APRs and fees.

📑 Table of Contents

- Understanding Credit Scores and Car Loans

- What Is The Lowest Credit Score To Buy A Car?

- How Credit Scores Affect Your Loan Terms and Interest Rates

- Steps to Buy a Car When You Have a Low Credit Score

- Improving Your Credit Score for a Better Car Deal

- Alternatives If Your Credit Score Is Too Low

- Conclusion: Your Path to Car Ownership Starts Here

Understanding Credit Scores and Car Loans

Before we get to the lowest number, let’s talk about what a credit score really is. Imagine it as a report card for how you handle borrowed money. Lenders use it to guess how likely you are to pay back a loan. It’s based on your payment history, how much debt you have, the length of your credit history, new credit, and the types of credit you use.

When you walk into a dealership or apply online for a car loan, lenders peek at this score. It helps them decide two big things: if they’ll approve you and what interest rate they’ll offer. A higher score usually means smoother sailing and lower costs. A lower score? Well, that’s where things get interesting, but not impossible.

Why Your Credit Score Matters for Auto Financing

Your credit score directly impacts your monthly payment. Let’s say you want a $20,000 car loan. With an excellent score, you might get a 4% APR. Your monthly payment could be around $368 for 60 months. But with a poor score, the APR might jump to 15%. Suddenly, that same loan costs about $476 per month. That’s over $100 more each month—just because of your score!

It’s not just about approval; it’s about the cost of borrowing. Lenders see a lower score as higher risk, so they charge more to cover that risk. Knowing this helps you understand why improving your score, even a little, can save you thousands over the life of the loan.

What Is The Lowest Credit Score To Buy A Car?

Here’s the moment you’ve been waiting for. Drumroll, please… The absolute lowest credit score to buy a car typically falls around 500 to 550. Yes, you read that right. Some subprime lenders specialize in working with borrowers who have scores in this range. But, and this is a big but, it comes with major caveats.

Visual guide about What Is The Lowest Credit Score To Buy A Car

Image source: thumbor.forbes.com

Just because you can get a loan with a 500 score doesn’t mean you should. The terms are often harsh—think sky-high interest rates, strict loan conditions, and possibly requiring a large down payment. It’s like being offered a lifeline that’s also very heavy to hold onto.

The Realities of Buying a Car with a Very Low Credit Score

Let me share a story. My cousin had a credit score of 510 after some medical bills piled up. He found a dealership that approved him for a used car loan. The catch? The APR was 22%, and he needed a $2,000 down payment. He took the deal because he needed wheels for work. Two years later, he realized he’d paid almost the car’s value in interest alone. It was a tough lesson.

So, while 500 might be the technical floor, a more practical and safer threshold is often 580 to 620. In this range, you’ll find more lenders willing to work with you, and the terms start to become more manageable. Always aim for the best score you can before applying.

How Credit Scores Affect Your Loan Terms and Interest Rates

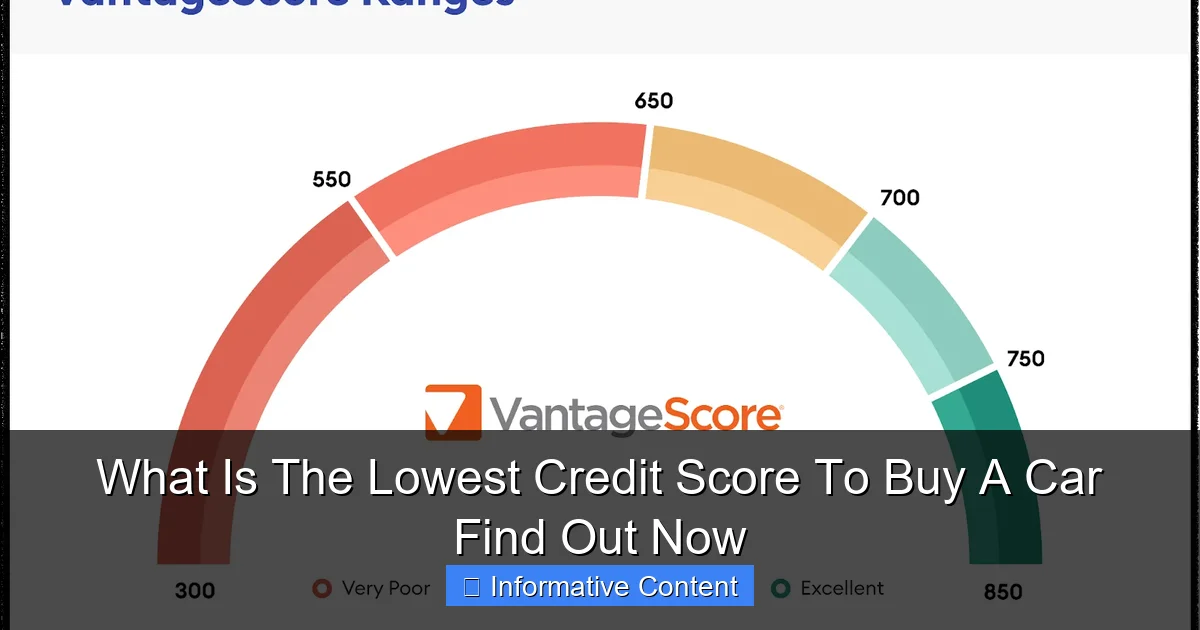

Your credit score doesn’t just open or close doors; it shapes the entire path of your loan. Lenders use score ranges to categorize borrowers. Here’s a breakdown of how these ranges typically influence auto loan offers.

Visual guide about What Is The Lowest Credit Score To Buy A Car

Image source: i.pinimg.com

Credit Score Ranges and What They Mean for Car Buyers

Lenders generally see scores in tiers. While exact ranges can vary, here’s a common way to look at it:

- Poor (300-579): This is where finding financing gets tough. You might need a subprime lender, a co-signer, or a very large down payment. Interest rates are often the highest.

- Fair (580-669): You’re in the game! Many mainstream lenders will consider you, but rates won’t be the best. You have negotiating power if you shop around.

- Good (670-739): Now we’re talking. You’ll likely qualify for standard rates from most lenders. The process is smoother.

- Very Good (740-799): You’re in a strong position. Expect competitive, low-interest rates and favorable terms.

- Excellent (800-850): The golden zone. You’ll get the lowest possible interest rates and the pick of the litter when it comes to loan offers.

Understanding where you fit helps set realistic expectations. It’s not just about the lowest credit score to buy a car; it’s about what kind of deal you can secure.

A Look at Interest Rates by Credit Tier

To make this real, let’s look at some numbers. The table below shows estimated average APRs for a 60-month new car loan based on credit score ranges. Remember, these are examples—your actual rate depends on many factors.

| Credit Score Range | Rating Tier | Estimated APR Range |

|---|---|---|

| 300 – 579 | Poor | 14% – 20%+ |

| 580 – 669 | Fair | 8% – 14% |

| 670 – 739 | Good | 5% – 8% |

| 740 – 799 | Very Good | 4% – 5% |

| 800 – 850 | Excellent | 3% – 4% |

See the difference? Moving from a “Fair” to a “Good” score could cut your interest rate nearly in half. That’s why knowing what is the lowest credit score to buy a car is just the start. The goal is to get out of the highest-cost tiers as fast as you can.

Steps to Buy a Car When You Have a Low Credit Score

If your score is on the lower end, don’t panic. A structured approach can make all the difference. Here’s a step-by-step plan to help you secure wheels without breaking the bank.

Visual guide about What Is The Lowest Credit Score To Buy A Car

Image source: thumbor.forbes.com

1. Check Your Credit Report for Errors

First things first: get your free credit reports from AnnualCreditReport.com. Look for mistakes—like old debts still listed or payments marked late that you made on time. Disputing errors can sometimes give your score a quick boost. It’s like finding money in your couch cushions!

2. Save for a Substantial Down Payment

The more money you can put down, the better. A larger down payment reduces the amount you need to borrow, which makes lenders see you as less risky. Aim for at least 10-20% of the car’s price. If you can save more, do it. This is one of the most powerful tools when you’re asking what is the lowest credit score to buy a car.

3. Get Pre-Approved from Multiple Lenders

Don’t just rely on the dealership’s financing. Shop around! Credit unions, online lenders, and banks often have better rates for people with fair or poor credit. Get pre-approval offers so you know what you qualify for. This gives you bargaining power at the dealership. It’s like walking in with a shield.

4. Consider a Co-Signer

If you have a trusted friend or family member with good credit, asking them to co-sign can work wonders. Their credit strength backs your loan, which can help you qualify for a much lower rate. But be careful—this is a big ask. If you miss payments, their credit suffers too. Always have a clear agreement.

5. Choose a Practical, Affordable Car

This isn’t the time for your dream sports car. Focus on reliable, used cars with a good reputation for longevity. Think Honda Civic, Toyota Corolla, or Ford Fusion. A less expensive car means a smaller loan, which is easier to get approved for and pay off. Keep your total monthly car payment (including insurance) below 15% of your take-home pay if possible.

Improving Your Credit Score for a Better Car Deal

Maybe you’re not in a rush. If you have a few months, working on your score can transform your car-buying experience. Here’s how to give it a lift.

Pay Your Bills on Time, Every Time

Your payment history is the biggest factor in your score. Set up automatic payments or calendar reminders. Even one missed payment can hurt. Consistency here is key.

Reduce Your Credit Card Balances

Try to keep your credit card balances below 30% of your credit limit. If you have a $1,000 limit, aim to owe less than $300. Paying down debt lowers your credit utilization ratio, which can boost your score quickly.

Avoid New Credit Applications

Every time you apply for credit, a hard inquiry shows on your report, which can ding your score a few points. In the months before you apply for a car loan, avoid opening new credit cards or store accounts.

Improving your score takes patience, but even moving from 580 to 650 can save you a fortune. Remember, the quest to find out what is the lowest credit score to buy a car is about more than just approval—it’s about getting a deal you can live with happily.

Alternatives If Your Credit Score Is Too Low

What if your score is below 500, or you just can’t get approved? Don’t lose hope. There are other paths to car ownership.

Buy-Here-Pay-Here Dealerships

These dealerships finance the car themselves. They often don’t check your credit score, but they charge very high interest rates and may require weekly payments. The cars might also be older or have higher mileage. Use this only as a last resort, and read every line of the contract.

Save Up and Pay in Cash

It might sound old-fashioned, but saving to buy a cheaper car outright avoids loans entirely. No interest, no credit check. Look for a reliable used car in the $3,000 to $5,000 range. It might not be fancy, but it gets you from A to B while you rebuild your credit.

Lease Takeover or Sublease

Sometimes, you can take over someone else’s car lease through sites like LeaseTrader or Swapalease. Requirements vary, but some may be more lenient on credit. Just make sure you understand all the terms and fees.

Exploring these options shows that knowing what is the lowest credit score to buy a car isn’t the only answer. Sometimes, the best move is to sidestep the traditional loan process altogether.

Conclusion: Your Path to Car Ownership Starts Here

We’ve covered a lot of ground together. From the technical lowest credit score to buy a car around 500, to the smarter target of 580 or higher, and all the steps in between. The big takeaway? Your credit score is a tool, not a life sentence. Even if it’s low right now, you have choices and power.

Start by checking your credit report. Save what you can for a down payment. Shop around for loans. And if possible, take a little time to boost your score. Every point up puts money back in your pocket. Remember my friend Sam? He waited six months, paid down a credit card, and bought a car with a score of 610. His rate wasn’t perfect, but it was manageable, and he’s now building credit with every payment.

Buying a car is a big step, but it doesn’t have to be scary. Arm yourself with knowledge, plan ahead, and make the decision that’s right for your wallet and your peace of mind. You’ve got this!

Frequently Asked Questions

What is the lowest credit score to buy a car?

The absolute lowest credit score to buy a car is generally around 500, but this can vary by lender. Scores below 600 are considered subprime and often come with significantly higher interest rates. It’s crucial to research lenders who specialize in high-risk auto loans.

Can I buy a car with bad credit?

Yes, buying a car with bad credit is possible, though it may require more effort. You might need a larger down payment or face higher monthly payments due to increased interest rates. Exploring options like subprime lenders or in-house financing dealerships can help.

How does my credit score affect my car loan?

Your credit score heavily influences the interest rate and loan terms you’re offered. A higher score typically secures lower rates and better conditions, while a lower score can lead to costlier loans over time. This makes it a key factor in your overall auto financing cost.

Are there lenders for the lowest credit score to buy a car?

Yes, some lenders focus on borrowers with the lowest credit score to buy a car, including subprime auto lenders and certain credit unions. These institutions often assess other factors like income stability, but be prepared for stricter terms and higher fees.

What can I do to improve my chances if my score is low?

To boost your approval odds, save for a substantial down payment to lower the loan amount. Consider adding a co-signer with good credit to strengthen your application. Also, review your credit report for errors and pay down existing debt to improve your score.

Is it possible to get a car loan with no credit history?

Yes, getting a car loan with no credit is feasible, as lenders may use alternative data like employment and income. Providing proof of stable employment and a down payment can enhance your application. Building credit through a secured loan or credit-builder account might also help.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.