Owning a JDM (Japanese Domestic Market) car is thrilling, but insuring it can be tricky. This guide breaks down the best types of car insurance for JDM vehicles, from classic imports to high-performance tuners, helping you find the right coverage without overpaying.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Introduction: Why JDM Cars Need Special Insurance

- 4 Understanding JDM Cars and Insurance Challenges

- 5 Types of Car Insurance for JDM Vehicles

- 6 Factors That Affect JDM Insurance Rates

- 7 How to Choose the Right Insurance for Your JDM Car

- 8 Real-World Examples: JDM Insurance in Action

- 9 Tips to Save Money on JDM Car Insurance

- 10 Conclusion: Protect Your Passion the Right Way

- 11 Frequently Asked Questions

- 11.1 Can I insure a right-hand drive JDM car in the U.S.?

- 11.2 Do I need special insurance if my JDM car is modified?

- 11.3 Is classic car insurance cheaper for JDM vehicles?

- 11.4 What happens if my JDM car is totaled?

- 11.5 Can I use my JDM car for track days?

- 11.6 How do I prove my JDM car’s value for insurance?

Key Takeaways

- Specialty insurers are your best bet: Most standard insurers don’t understand JDM cars, but specialty providers offer tailored policies for imports, classics, and modified vehicles.

- Agreed value coverage is essential: Unlike standard policies that pay market value, agreed value ensures you’re paid what you and the insurer agree your JDM car is worth—critical for rare or modified models.

- Consider usage-based policies: If you drive your JDM car sparingly (e.g., weekends or car shows), pay-per-mile or classic car insurance can save you money.

- Modifications affect coverage: Tuned engines, suspension upgrades, or aftermarket parts may require additional coverage or a specialty policy to be fully protected.

- Garage and storage matter: Keeping your JDM car in a secure, locked garage can lower premiums and may be required by some insurers.

- Document everything: Photos, receipts, and appraisals help prove your car’s value and condition, especially after an accident or theft.

- Compare quotes annually: The JDM insurance market changes fast—shopping around each year ensures you’re getting the best rate and coverage.

📑 Table of Contents

- Introduction: Why JDM Cars Need Special Insurance

- Understanding JDM Cars and Insurance Challenges

- Types of Car Insurance for JDM Vehicles

- Factors That Affect JDM Insurance Rates

- How to Choose the Right Insurance for Your JDM Car

- Real-World Examples: JDM Insurance in Action

- Tips to Save Money on JDM Car Insurance

- Conclusion: Protect Your Passion the Right Way

Introduction: Why JDM Cars Need Special Insurance

So, you’ve got your hands on a sleek Nissan Skyline R34, a nimble Mazda RX-7, or maybe even a rare Honda NSX. Congratulations—you’re part of a passionate community that values engineering, style, and performance. But now comes a less glamorous part of ownership: insurance. And let’s be honest, insuring a JDM car isn’t as simple as calling up your regular auto insurer and getting a quote.

Unlike mainstream vehicles, JDM imports often fall into gray areas for standard insurance companies. They might not recognize the model, question its safety standards, or assume it’s a high-risk vehicle due to performance modifications. That’s why knowing what type of car insurance to get for JDM vehicles is crucial. You don’t just need coverage—you need the *right kind* of coverage that respects your car’s uniqueness and value.

In this guide, we’ll walk you through everything you need to know about insuring your JDM car. Whether you’re driving a vintage 1990s import or a modern JDM-inspired build, we’ll help you navigate the insurance landscape, avoid common pitfalls, and find a policy that fits your needs—and your budget.

Understanding JDM Cars and Insurance Challenges

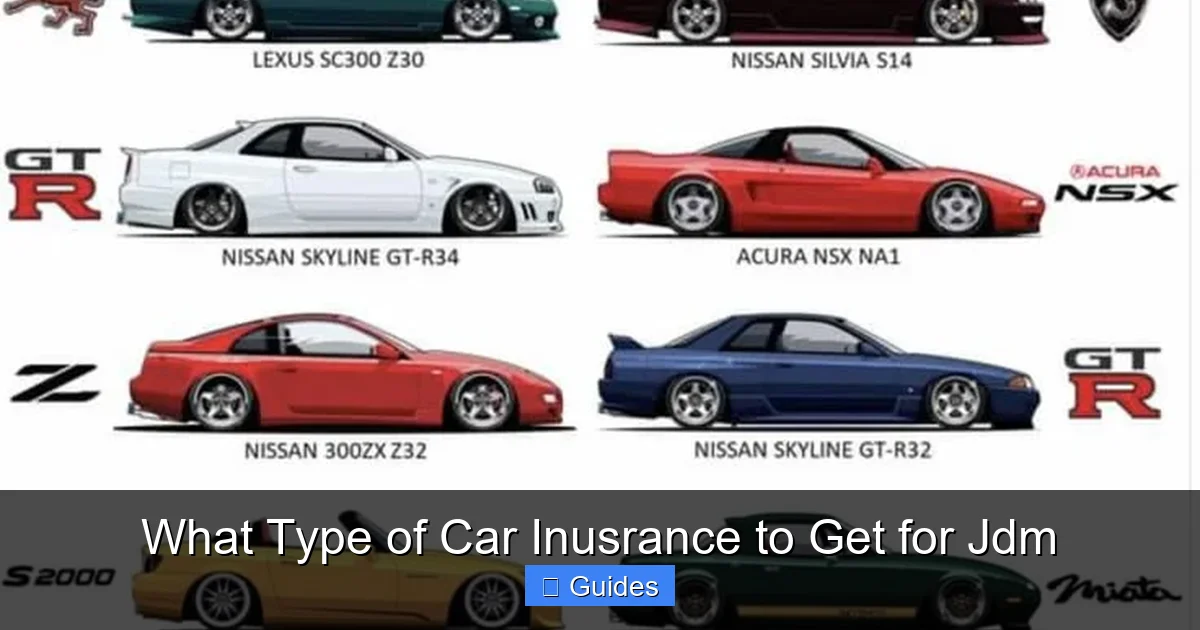

Visual guide about What Type of Car Inusrance to Get for Jdm

Image source: i.pinimg.com

What Makes JDM Cars Different?

JDM stands for Japanese Domestic Market, meaning these vehicles were originally designed and sold in Japan. They often feature unique specifications, right-hand drive configurations, and engineering tailored to Japanese roads and regulations. While many JDM cars are now legal to import and drive in the U.S. and other countries (thanks to the 25-year rule), they still present challenges for insurers.

One major issue is that standard insurance companies often lack data on JDM models. They may not have actuarial tables for a 1998 Subaru Impreza WRX STI or a 2002 Mitsubishi Lancer Evolution VII. This makes it hard for them to assess risk accurately, leading to higher premiums or outright denials.

Additionally, many JDM cars are performance-oriented. High horsepower, lightweight bodies, and advanced handling systems make them exciting to drive—but also riskier in the eyes of insurers. Even if your car is stock, its reputation as a “tuner” or “track car” can affect your rates.

Common Insurance Hurdles for JDM Owners

Let’s say you walk into a mainstream insurer and say, “I want to insure my 1995 Toyota Supra Twin Turbo.” You might get a blank stare. Or worse, they might quote you a sky-high premium based on assumptions about theft, accidents, or repair costs.

Here are some common challenges JDM owners face:

– **Limited insurer knowledge:** Most agents aren’t familiar with JDM models, leading to inaccurate risk assessments.

– **Right-hand drive complications:** Some insurers see RHD as a safety concern, even though it’s perfectly legal in many regions.

– **Parts availability:** Repairing a JDM car can be expensive and time-consuming, which insurers factor into premiums.

– **Modification risks:** If your car has aftermarket parts—common in the JDM scene—standard policies may not cover them unless declared.

These hurdles mean you can’t just go with the cheapest option. You need a policy that understands your car’s value, usage, and quirks.

Types of Car Insurance for JDM Vehicles

Visual guide about What Type of Car Inusrance to Get for Jdm

Image source: motorbiscuit.com

Liability-Only Coverage: The Bare Minimum

Liability insurance covers damage or injury you cause to others in an accident. It’s the legal minimum in most places, but it won’t protect your JDM car if it’s damaged or stolen.

For JDM owners, liability-only might seem tempting to save money—especially if you drive your car infrequently. But here’s the catch: if your rare $30,000 Nissan Skyline is totaled in an accident, liability won’t pay a dime toward replacing it. You’d be out of luck.

This type of coverage is only advisable if you’re on a tight budget and your car has low market value. But for most JDM enthusiasts, it’s not enough.

Comprehensive and Collision Coverage: Full Protection

This is where things get more interesting. Comprehensive and collision coverage protects your car from damage, whether it’s from an accident, theft, vandalism, or natural disaster.

For JDM cars, this is often essential. These vehicles can be expensive to repair or replace, especially if they’re rare or modified. Comprehensive coverage also includes theft protection—important since JDM cars are often targeted by thieves due to their high resale value and parts demand.

But here’s the key: make sure your policy includes **agreed value** coverage, not just market value. We’ll dive deeper into that next.

Agreed Value vs. Market Value: Why It Matters

Most standard policies pay out based on **actual cash value (ACV)**, which factors in depreciation. So if your 1999 Honda Civic Type R is worth $20,000 today but was worth $30,000 five years ago, you might only get $20,000 after a total loss—even if you’ve invested heavily in it.

**Agreed value** policies solve this. You and the insurer agree on the car’s worth upfront. If your JDM car is totaled, you get that agreed amount—no depreciation deductions.

For example, let’s say you and your insurer agree your modified Mazda RX-8 is worth $25,000. Even if market prices drop, you’ll still receive $25,000 if it’s totaled. This is especially important for modified or rare JDM cars, where market value doesn’t reflect true worth.

Classic and Collector Car Insurance

If your JDM car is over 25 years old, it may qualify as a classic or collector vehicle. These policies are designed for cars that are driven sparingly and well-maintained—perfect for weekend cruisers or show cars.

Classic car insurance often includes:

– Agreed value coverage

– Lower premiums due to limited mileage

– Coverage for car shows and events

– Flexible usage (e.g., pleasure driving, parades)

For example, Hagerty and Grundy are well-known insurers that specialize in classic and collector cars. They understand the JDM scene and offer policies tailored to enthusiasts.

But be aware: classic car insurance usually requires you to drive fewer than 5,000 miles per year and store the car in a secure garage. If you use your JDM car as a daily driver, this might not be the right fit.

Specialty and Enthusiast Insurance

For modern or modified JDM cars that don’t qualify as classics, **specialty insurance** is your best option. These providers cater to car enthusiasts and understand the unique needs of JDM owners.

Companies like **American Collectors Insurance**, **Heacock Classic**, and **J.D. Power-endorsed specialty insurers** offer policies that cover:

– Aftermarket parts and modifications

– Track day use (with proper endorsements)

– Agreed value for tuned vehicles

– Flexible usage for weekend and event driving

For instance, if you’ve installed a turbo kit, coilovers, and a custom ECU tune on your Subaru WRX, a specialty insurer can cover those upgrades—something most standard policies won’t do.

Factors That Affect JDM Insurance Rates

Visual guide about What Type of Car Inusrance to Get for Jdm

Image source: wallup.net

Vehicle Age and Rarity

Older JDM cars (especially those over 25 years) often qualify for classic car insurance, which can be cheaper. But rarity plays a role too. A mass-produced Toyota Corolla might be inexpensive to insure, but a limited-run Nissan Skyline GT-R NISMO could cost more due to high repair and replacement costs.

Modifications and Upgrades

This is a big one. If your JDM car has performance mods—bigger turbos, racing suspension, custom exhaust—you’ll need to declare them. Some insurers may charge more, while others (like specialty providers) include modification coverage in their base rates.

Always keep receipts and photos of your mods. This helps prove their value and ensures they’re covered in case of damage.

Usage and Mileage

How you use your JDM car affects your premium. If it’s a daily driver, expect higher rates. But if you only drive it on weekends or to car meets, you can save with low-mileage or usage-based policies.

Some insurers offer **pay-per-mile** plans, where you pay based on how much you drive. This is great for JDM owners who treat their car like a hobby, not a necessity.

Storage and Security

Where you keep your car matters. Insurers love it when JDM cars are stored in locked garages, especially if they’re equipped with alarms, GPS trackers, or immobilizers. These reduce theft risk and can lower your premium.

For example, a 1993 Mazda RX-7 kept in a secure garage with a kill switch and tracker might qualify for a 10–15% discount.

Your Driving Record and Location

Just like with any car, your personal driving history and where you live impact your rates. A clean record helps, but if you live in an area with high theft or accident rates, expect higher premiums—especially for high-value JDM cars.

How to Choose the Right Insurance for Your JDM Car

Step 1: Assess Your Car’s Value and Use

Start by determining how much your JDM car is worth. Get an appraisal if it’s rare or heavily modified. Then, think about how you use it:

– Daily driver?

– Weekend cruiser?

– Track day car?

– Show car?

Your usage will determine whether you need full coverage, classic insurance, or a specialty policy.

Step 2: Shop with Specialty Insurers

Don’t rely on your regular auto insurer. Instead, contact companies that specialize in JDM, classic, or enthusiast vehicles. They’ll understand your car’s value and offer better terms.

Ask questions like:

– Do you offer agreed value coverage?

– Are modifications covered?

– Can I use the car at track events?

– What’s the mileage limit?

Step 3: Compare Quotes and Coverage

Get at least three quotes from different providers. Compare not just the price, but what’s included:

– Agreed value amount

– Deductible options

– Coverage for mods

– Roadside assistance

– Spare parts coverage

For example, one insurer might offer $25,000 agreed value with a $500 deductible, while another offers $20,000 with a $250 deductible. The cheaper premium might not be the best deal if coverage is limited.

Step 4: Read the Fine Print

Insurance policies are full of details. Make sure you understand:

– What’s excluded (e.g., track use without endorsement)

– How claims are handled

– Whether you need to notify the insurer before making mods

– Storage requirements

A policy that looks great on paper might have hidden restrictions that could leave you underinsured.

Step 5: Review Annually

The JDM market changes. Your car’s value might go up (or down), and new insurers may enter the space. Review your policy every year and shop around to ensure you’re still getting the best deal.

Real-World Examples: JDM Insurance in Action

Case Study 1: The Weekend Skyline

Mike owns a 1998 Nissan Skyline GT-R R33. He drives it only on weekends and to car shows—about 3,000 miles a year. He stores it in a locked garage with an alarm.

He went with a classic car insurer and got an agreed value policy for $35,000. His premium is $800/year—much lower than a standard policy would have been. He also added coverage for his aftermarket wheels and turbo timer.

Case Study 2: The Daily-Driven RX-7

Sarah drives her 1995 Mazda RX-7 every day to work. It’s modified with a rebuilt 13B engine and custom suspension. She needed full coverage but didn’t want to overpay.

She found a specialty insurer that covers modified JDM cars. Her agreed value is $28,000, and her premium is $1,200/year. The policy includes roadside assistance and covers her mods.

Case Study 3: The Track-Day Supra

Jake uses his 1993 Toyota Supra MKIV for weekend drives and occasional track days. He needed a policy that allowed track use.

He chose a specialty insurer that offers track day endorsements. For an extra $200/year, he can drive at approved events without voiding his coverage. His agreed value is $40,000.

Tips to Save Money on JDM Car Insurance

– **Join a car club:** Some insurers offer discounts to members of recognized JDM or enthusiast clubs.

– **Bundle policies:** If you have home or life insurance, bundling can save you 10–15%.

– **Increase your deductible:** A higher deductible lowers your premium, but make sure you can afford it if you need to file a claim.

– **Install security features:** Alarms, GPS trackers, and immobilizers can reduce theft risk and lower rates.

– **Drive safely:** A clean driving record keeps your premiums down over time.

Conclusion: Protect Your Passion the Right Way

Owning a JDM car is more than just driving—it’s a lifestyle. These machines represent engineering excellence, cultural history, and personal passion. But to truly enjoy your JDM experience, you need the right insurance.

Standard policies often fall short, leaving you underinsured or overpaying. Instead, look for specialty insurers that offer agreed value coverage, understand modifications, and respect how you use your car. Whether you’re cruising a classic Skyline or tuning a modern WRX, the right policy will protect your investment and give you peace of mind.

Remember: the cheapest option isn’t always the best. Take the time to assess your needs, compare quotes, and choose a policy that matches your JDM journey. After all, your car deserves more than just basic coverage—it deserves protection that matches its spirit.

Frequently Asked Questions

Can I insure a right-hand drive JDM car in the U.S.?

Yes, you can insure a right-hand drive JDM car in the U.S., especially if it’s over 25 years old and meets federal import rules. Many specialty insurers understand RHD vehicles and offer coverage without issues.

Do I need special insurance if my JDM car is modified?

Yes, modifications can affect your coverage. Standard insurers may not cover aftermarket parts, but specialty providers often include modification coverage—just make sure to declare all upgrades.

Is classic car insurance cheaper for JDM vehicles?

Often, yes—especially if your JDM car is over 25 years old and driven sparingly. Classic car insurance typically offers lower premiums and agreed value coverage, making it a smart choice for collectors.

What happens if my JDM car is totaled?

If you have agreed value coverage, you’ll receive the amount you and the insurer agreed upon. With standard market value policies, you’ll get the depreciated value, which may be far less than your car’s true worth.

Can I use my JDM car for track days?

Some specialty insurers allow track day use with an endorsement or rider. Check with your provider—driving on a track without proper coverage could void your policy.

How do I prove my JDM car’s value for insurance?

Keep detailed records: photos, receipts for parts and labor, appraisals, and maintenance logs. These help establish your car’s value, especially for rare or modified models.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.