Insuring a Nissan Maxima costs more than average due to its high-performance engine, expensive repairs, and higher theft risk. Insurance companies view it as a sports sedan, leading to elevated premiums despite its luxury features and safety ratings.

If you’ve ever shopped for car insurance for a Nissan Maxima, you might have done a double-take at the quote. It’s not uncommon for owners to feel sticker shock when they see how much it costs to insure this sleek, powerful sedan. The Maxima looks like a luxury car, drives like a sports car, and feels like a premium ride—but that premium experience comes with a premium price tag, especially when it comes to insurance.

So why is a Nissan Maxima so expensive to insure? It’s not just about the car’s sticker price. Insurance companies look at a wide range of factors when calculating your premium, including the vehicle’s performance, repair costs, theft rates, safety features, and even who tends to drive it. The Maxima checks several boxes that signal “higher risk” to insurers, even if you’re a safe, responsible driver. Understanding these factors can help you make smarter decisions when buying or insuring your Maxima—and maybe even save you money in the long run.

In this guide, we’ll break down the key reasons behind the high insurance costs for the Nissan Maxima. We’ll explore everything from its powerful engine and luxury features to theft trends and driver demographics. You’ll also get practical tips on how to lower your premiums without sacrificing coverage. Whether you already own a Maxima or are considering buying one, this article will give you the insight you need to navigate the world of car insurance with confidence.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 1. The Maxima’s High-Performance Engine Increases Risk

- 4 2. Expensive Repair and Replacement Costs

- 5 3. Higher Theft Rates Increase Comprehensive Coverage Costs

- 6 4. Classification as a Sports/Luxury Sedan

- 7 5. Advanced Safety Features Can Increase Costs

- 8 6. Driver Demographics and Risk Perception

- 9 How to Lower Your Nissan Maxima Insurance Costs

- 10 Conclusion

- 11 Frequently Asked Questions

- 11.1 Why is a Nissan Maxima more expensive to insure than a Toyota Camry?

- 11.2 Does the Maxima’s safety rating lower insurance costs?

- 11.3 Can I reduce my Maxima insurance by driving less?

- 11.4 Is it cheaper to insure an older Nissan Maxima?

- 11.5 Do insurance companies consider the Maxima a sports car?

- 11.6 Will installing an anti-theft device lower my Maxima insurance?

Key Takeaways

- High-performance engine increases risk: The Maxima’s 3.5L V6 engine delivers 300 horsepower, making it attractive to aggressive drivers and raising accident risk in insurers’ eyes.

- Expensive repair and replacement parts: Luxury components and advanced tech mean higher repair bills, which insurers factor into premium calculations.

- Higher theft rates than average sedans: The Maxima’s popularity and resale value make it a target for theft, increasing comprehensive coverage costs.

- Classified as a sports/luxury sedan: Despite being a four-door, its performance specs place it in a higher-risk category, leading to steeper insurance rates.

- Advanced safety tech can raise costs: While safety features reduce accident risk, the complexity of systems like ProPILOT Assist increases repair expenses after collisions.

- Driver demographics influence pricing: Younger drivers or those with poor records face even higher premiums due to perceived risk when driving a powerful vehicle.

- You can reduce costs with smart choices: Bundling policies, maintaining a clean record, and choosing higher deductibles can help lower your Maxima insurance bill.

📑 Table of Contents

- 1. The Maxima’s High-Performance Engine Increases Risk

- 2. Expensive Repair and Replacement Costs

- 3. Higher Theft Rates Increase Comprehensive Coverage Costs

- 4. Classification as a Sports/Luxury Sedan

- 5. Advanced Safety Features Can Increase Costs

- 6. Driver Demographics and Risk Perception

- How to Lower Your Nissan Maxima Insurance Costs

- Conclusion

1. The Maxima’s High-Performance Engine Increases Risk

One of the biggest reasons the Nissan Maxima is expensive to insure is its powerful engine. Under the hood, the Maxima packs a 3.5-liter V6 engine that delivers 300 horsepower and 261 lb-ft of torque. That’s more than enough to launch you from 0 to 60 mph in under six seconds—performance that rivals many entry-level sports cars.

Insurance companies see high horsepower as a red flag. Why? Because vehicles with more power are statistically more likely to be involved in speeding-related accidents. Even if you’re a cautious driver, the temptation to use that power—especially in younger or less experienced hands—can increase the likelihood of a claim. Insurers use actuarial data to assess risk, and cars with 300+ horsepower consistently show higher accident and injury rates.

For example, a study by the Insurance Institute for Highway Safety (IIHS) found that vehicles with high horsepower-to-weight ratios are more likely to be involved in fatal crashes. The Maxima, while not a full-blown sports car, sits in a gray area—it’s a family sedan with sports car tendencies. This duality makes it a higher-risk proposition for insurers.

How Performance Affects Premiums

When you apply for insurance, companies use your vehicle identification number (VIN) to pull detailed specs, including engine size and horsepower. These numbers directly influence your rate. A Maxima with 300 horsepower will almost always cost more to insure than a similarly sized sedan with a 200-horsepower engine, like a Toyota Camry or Honda Accord.

Even if you never push the Maxima to its limits, the potential for high-speed driving is enough to raise your premium. Insurers assume that a car capable of fast acceleration is more likely to be driven aggressively, especially in urban areas or on highways where speed limits are higher.

Real-World Example

Imagine two drivers: one with a 2023 Nissan Maxima and another with a 2023 Toyota Camry XLE. Both are 35 years old, have clean driving records, and live in the same ZIP code. The Maxima owner might pay $200–$400 more per year in insurance simply because of the engine’s power. That difference can add up to thousands over the life of the vehicle.

2. Expensive Repair and Replacement Costs

Visual guide about Why Is a Nissan Maxima So Expensive to Insure

Image source: autozonic.com

Another major factor driving up Maxima insurance costs is the price of repairs. The Maxima isn’t just a fast car—it’s a technologically advanced one, packed with luxury features and high-end components. While that makes for a comfortable and enjoyable ride, it also means that fixing the car after an accident can be costly.

From its LED headlights and panoramic sunroof to its premium Bose audio system and advanced driver-assistance tech, the Maxima uses parts that are more expensive to replace than those in mainstream sedans. Even minor collisions can result in thousands of dollars in repair bills, especially if sensors, cameras, or electronic systems are damaged.

Advanced Technology = Higher Repair Bills

Modern cars like the Maxima are loaded with sensors and cameras for features like automatic emergency braking, blind-spot monitoring, and adaptive cruise control. While these systems improve safety, they also increase repair complexity. For instance, if a fender bender damages the front radar sensor used for ProPILOT Assist, the repair might require recalibration—a process that can cost $500 or more at a certified shop.

Insurance companies know this. They factor in the average cost of repairs for each make and model when setting rates. Vehicles with higher repair costs lead to higher claim payouts, which translates to higher premiums for all owners.

Parts Availability and Labor Costs

Nissan parts, especially for newer models, can be more expensive and harder to find than those for more common brands like Toyota or Honda. Additionally, labor rates at Nissan dealerships or certified repair centers tend to be higher than at independent shops. This means even a simple repair—like replacing a bumper or fixing a dent—can cost significantly more than it would on a less complex vehicle.

For example, replacing a damaged front bumper on a Maxima might cost $1,200–$1,800, compared to $800–$1,200 for a similar repair on a Honda Accord. Over time, these differences add up, and insurers pass those costs on to consumers through higher premiums.

3. Higher Theft Rates Increase Comprehensive Coverage Costs

Visual guide about Why Is a Nissan Maxima So Expensive to Insure

Image source: nissankaengine.com

Theft is another reason why insuring a Nissan Maxima can be pricey. While the Maxima isn’t the most stolen car in America, it does have a higher theft rate than many other midsize sedans. According to the National Insurance Crime Bureau (NICB), the Maxima has appeared on lists of frequently stolen vehicles, particularly in urban areas.

Why is the Maxima a target? Several factors come into play. First, it’s a popular car with strong resale value. Thieves know they can sell parts or export the vehicle for profit. Second, older Maxima models (especially from the 2000s) have been known to have vulnerabilities in their anti-theft systems, making them easier to steal.

Even though newer models come with advanced security features like immobilizers and GPS tracking, the historical theft trend still affects insurance pricing. Insurers use historical data to predict future risk, and a car with a reputation for being stolen will cost more to insure—especially for comprehensive coverage, which protects against theft, vandalism, and natural disasters.

Geographic Impact on Theft Risk

Where you live plays a big role in how much you’ll pay for comprehensive coverage. If you live in a city with high auto theft rates—like Los Angeles, Chicago, or Atlanta—your Maxima insurance will be more expensive than if you lived in a rural area with low crime.

For instance, a Maxima owner in downtown Detroit might pay $300–$500 more per year for comprehensive coverage than someone in a small town in Nebraska. Insurers adjust rates based on ZIP code-level crime data, so your location can significantly impact your premium.

How to Reduce Theft Risk

While you can’t change your car’s theft history, you can take steps to reduce your risk—and potentially lower your insurance costs. Installing a steering wheel lock, using a GPS tracker, or parking in a secure garage can make your Maxima less appealing to thieves. Some insurers even offer discounts for anti-theft devices, so it’s worth asking your agent.

4. Classification as a Sports/Luxury Sedan

Visual guide about Why Is a Nissan Maxima So Expensive to Insure

Image source: slashgear.com

Despite being a four-door sedan, the Nissan Maxima is often classified by insurers as a sports or luxury vehicle. This categorization affects how it’s priced in insurance models. While it doesn’t have the flashy looks of a BMW or Mercedes, the Maxima’s performance, premium interior, and high-end features place it in a higher-risk category.

Insurance companies use vehicle class to assess risk. Sports and luxury cars are associated with higher speeds, more aggressive driving, and costlier repairs—all of which lead to higher premiums. Even if the Maxima is used as a daily commuter, its classification can bump up your rate.

The “Sports Sedan” Label

Nissan markets the Maxima as a “four-door sports car,” and that branding sticks in the minds of insurers. The car’s sport-tuned suspension, responsive steering, and powerful engine reinforce that image. As a result, it’s grouped with vehicles like the Audi A4, Lexus IS, and Acura TLX—cars that typically cost more to insure than mainstream sedans.

This classification means the Maxima is subject to higher base rates, even before factoring in driver history or location. It’s not just about what the car can do—it’s about how it’s perceived in the insurance industry.

Comparison to Similar Vehicles

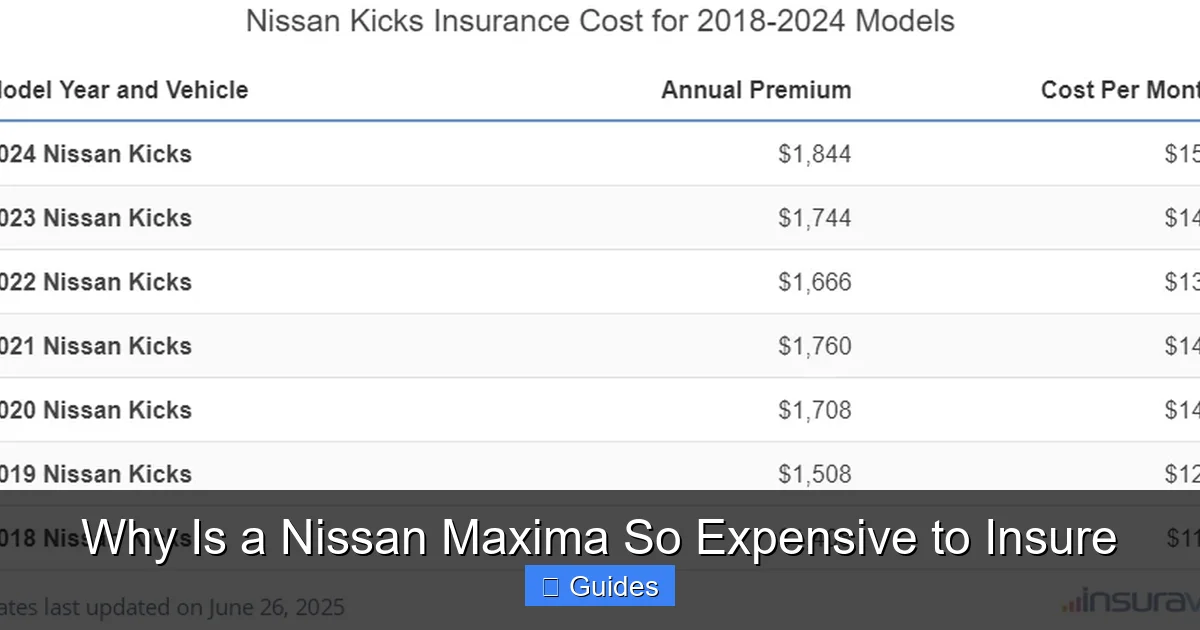

Let’s compare the Maxima to other midsize sedans. According to data from insurance comparison sites, the average annual premium for a Nissan Maxima is around $1,800–$2,400. In contrast, a Toyota Camry costs about $1,400–$1,800, and a Honda Accord runs $1,300–$1,700. That’s a difference of $400–$700 per year—just because of the Maxima’s performance and luxury positioning.

5. Advanced Safety Features Can Increase Costs

This might sound counterintuitive, but the Maxima’s advanced safety technology can actually contribute to higher insurance costs. While features like automatic emergency braking, lane departure warning, and adaptive cruise control reduce the likelihood of accidents, they also make repairs more expensive when collisions do occur.

For example, if a Maxima is rear-ended and the rear bumper sensor is damaged, the repair might require recalibrating the blind-spot monitoring system. This process often needs specialized equipment and certified technicians, driving up the cost.

The Repair Cost Paradox

Insurers face a paradox: safer cars have fewer accidents, but when they do crash, the repairs are more expensive. The Maxima’s suite of safety tech—Nissan’s Safety Shield 360—includes cameras, radars, and sensors that are integrated into the body and bumper. Damaging these systems means more than just replacing a part; it often requires software updates and system recalibration.

As a result, even minor accidents can lead to claims that cost $3,000–$5,000 or more. Insurers account for this by charging higher premiums to offset the potential for large payouts.

Do Safety Features Ever Lower Rates?

Yes—some insurers offer discounts for vehicles with advanced safety features. However, these discounts are often small (5–10%) and may not fully offset the higher base rate caused by repair costs. It’s a trade-off: you get better protection on the road, but you pay more when something goes wrong.

6. Driver Demographics and Risk Perception

Finally, who drives the Maxima matters to insurers. While the car appeals to a wide range of buyers—from professionals to empty nesters—its performance specs make it popular among younger drivers and car enthusiasts. Unfortunately, younger drivers (under 25) are statistically more likely to be involved in accidents, and insurers charge them higher rates accordingly.

Even if you’re over 30 with a clean record, driving a Maxima can still signal higher risk if you fit certain demographic profiles. For example, a 22-year-old male driving a Maxima will pay significantly more than a 45-year-old female driving the same car—even if they live in the same area and have identical driving histories.

The Role of Gender and Age

Insurance companies use age and gender as risk indicators. Young male drivers are considered the highest risk group, and pairing that with a high-performance vehicle like the Maxima can lead to very high premiums. A 20-year-old male might pay $3,000–$4,000 per year to insure a Maxima, while a 50-year-old female with the same car might pay half that.

Credit Score and Driving History

In most states, insurers also consider your credit score and driving history. A poor credit score or a history of tickets and accidents will increase your rate—especially on a car like the Maxima, which is already expensive to insure. Maintaining a clean record and good credit can help mitigate some of these costs.

How to Lower Your Nissan Maxima Insurance Costs

Now that you know why the Maxima is expensive to insure, let’s talk about what you can do about it. While you can’t change the car’s engine or theft history, there are several strategies to reduce your premiums.

1. Shop Around and Compare Quotes

Insurance rates vary widely between companies. What one insurer charges $2,200 for, another might offer for $1,600. Get quotes from at least three different insurers—including national brands like GEICO, State Farm, and Progressive, as well as regional companies.

2. Bundle Your Policies

Many insurers offer discounts if you bundle your auto insurance with home, renters, or life insurance. You could save 10–25% by combining policies with the same provider.

3. Increase Your Deductible

Raising your deductible from $500 to $1,000 can lower your premium by 15–30%. Just make sure you have enough savings to cover the higher out-of-pocket cost if you need to file a claim.

4. Maintain a Clean Driving Record

Safe driving is the best way to keep your rates low. Avoid speeding tickets, accidents, and DUIs. Some insurers offer safe driver discounts or usage-based programs that reward good behavior.

5. Take Advantage of Discounts

Ask your insurer about available discounts. Common ones include:

- Good student discount (for young drivers)

- Defensive driving course completion

- Low mileage discount

- Anti-theft device discount

- Pay-in-full discount

6. Consider Usage-Based Insurance

Programs like Progressive’s Snapshot or Allstate’s Drivewise monitor your driving habits through a mobile app or device. If you drive safely, you could earn significant discounts—sometimes up to 30%.

7. Park in a Garage or Secure Location

Reducing theft and vandalism risk can lower your comprehensive coverage cost. If you park in a locked garage or well-lit area, mention it to your insurer—they may offer a discount.

Conclusion

The Nissan Maxima is a fantastic car—powerful, stylish, and packed with features. But its combination of performance, luxury, and advanced technology makes it expensive to insure. From its 300-horsepower engine to its high repair costs and theft risk, the Maxima checks several boxes that insurers associate with higher risk.

That doesn’t mean you should avoid the car—or overpay for insurance. By understanding the factors that drive up costs, you can take proactive steps to reduce your premiums. Shop around, maintain a clean record, and take advantage of discounts. With the right strategy, you can enjoy your Maxima without breaking the bank on insurance.

Remember, the goal isn’t to find the cheapest policy—it’s to find the best value for your needs. A slightly higher premium might be worth it for better coverage, superior customer service, or faster claims processing. Do your research, ask questions, and make an informed decision. Your Maxima—and your wallet—will thank you.

Frequently Asked Questions

Why is a Nissan Maxima more expensive to insure than a Toyota Camry?

The Maxima has a more powerful engine, higher repair costs, and is classified as a sports/luxury sedan, all of which increase insurance risk. The Camry, while reliable and safe, lacks the performance specs that drive up premiums.

Does the Maxima’s safety rating lower insurance costs?

While the Maxima has excellent safety ratings, its advanced safety tech increases repair costs after accidents. Insurers may offer small discounts, but these often don’t offset the higher base rate.

Can I reduce my Maxima insurance by driving less?

Yes. Many insurers offer low-mileage discounts if you drive under a certain number of miles per year. Enrolling in a usage-based program can also reward you for driving less and more safely.

Is it cheaper to insure an older Nissan Maxima?

Not necessarily. Older models may have lower base values, but they can have higher theft rates and fewer safety features, which may increase certain types of coverage costs.

Do insurance companies consider the Maxima a sports car?

Yes, many insurers classify the Maxima as a sports or performance sedan due to its 300-horsepower engine and sport-tuned handling, which leads to higher premiums.

Will installing an anti-theft device lower my Maxima insurance?

Possibly. Some insurers offer discounts for devices like steering wheel locks, GPS trackers, or alarms. Contact your provider to see if you qualify for a discount.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.